What if you didn’t have a mortgage payment on your next house? It may sound a little unrealistic. But for a number of homeowners, it’s actually doable.

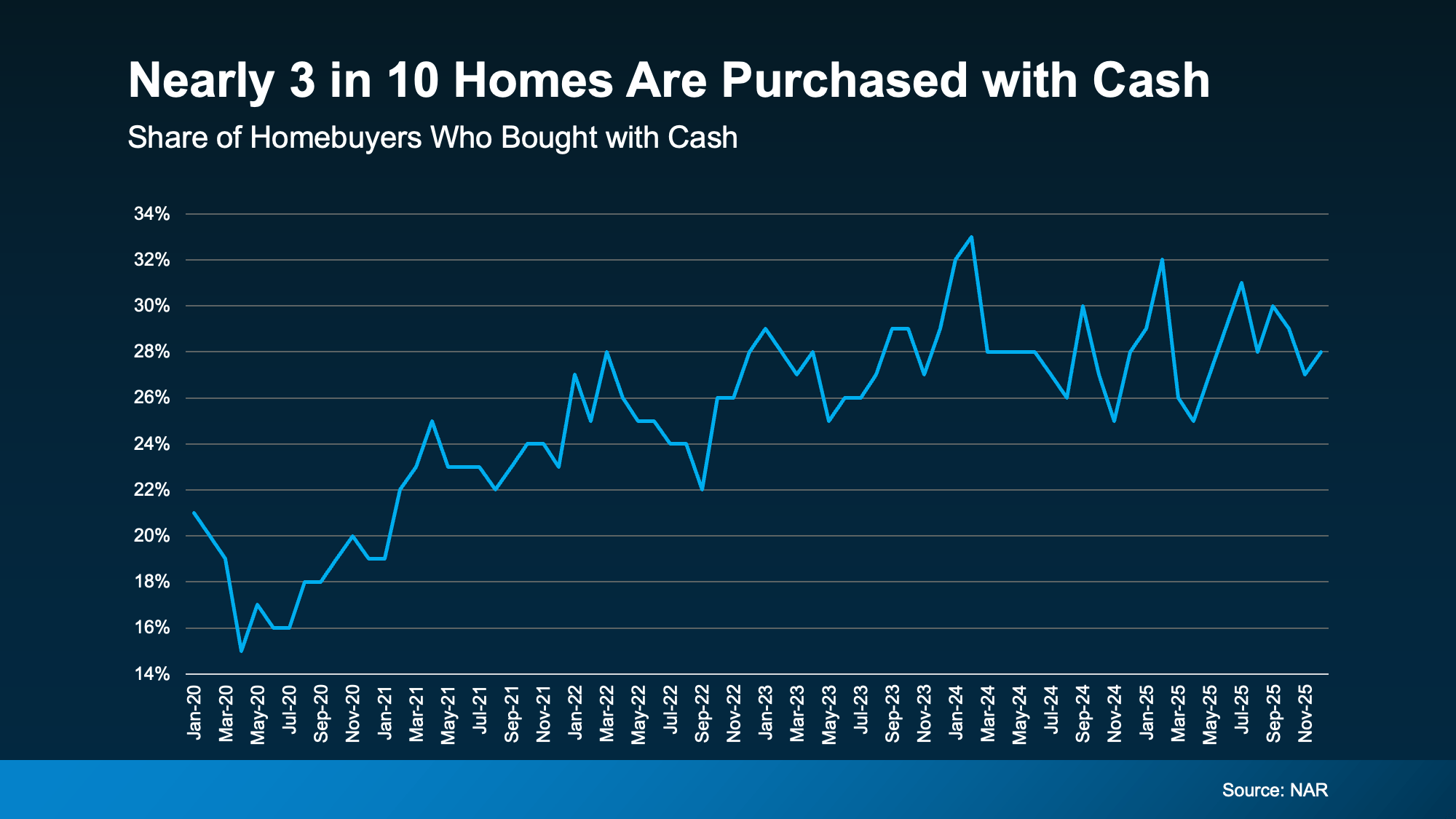

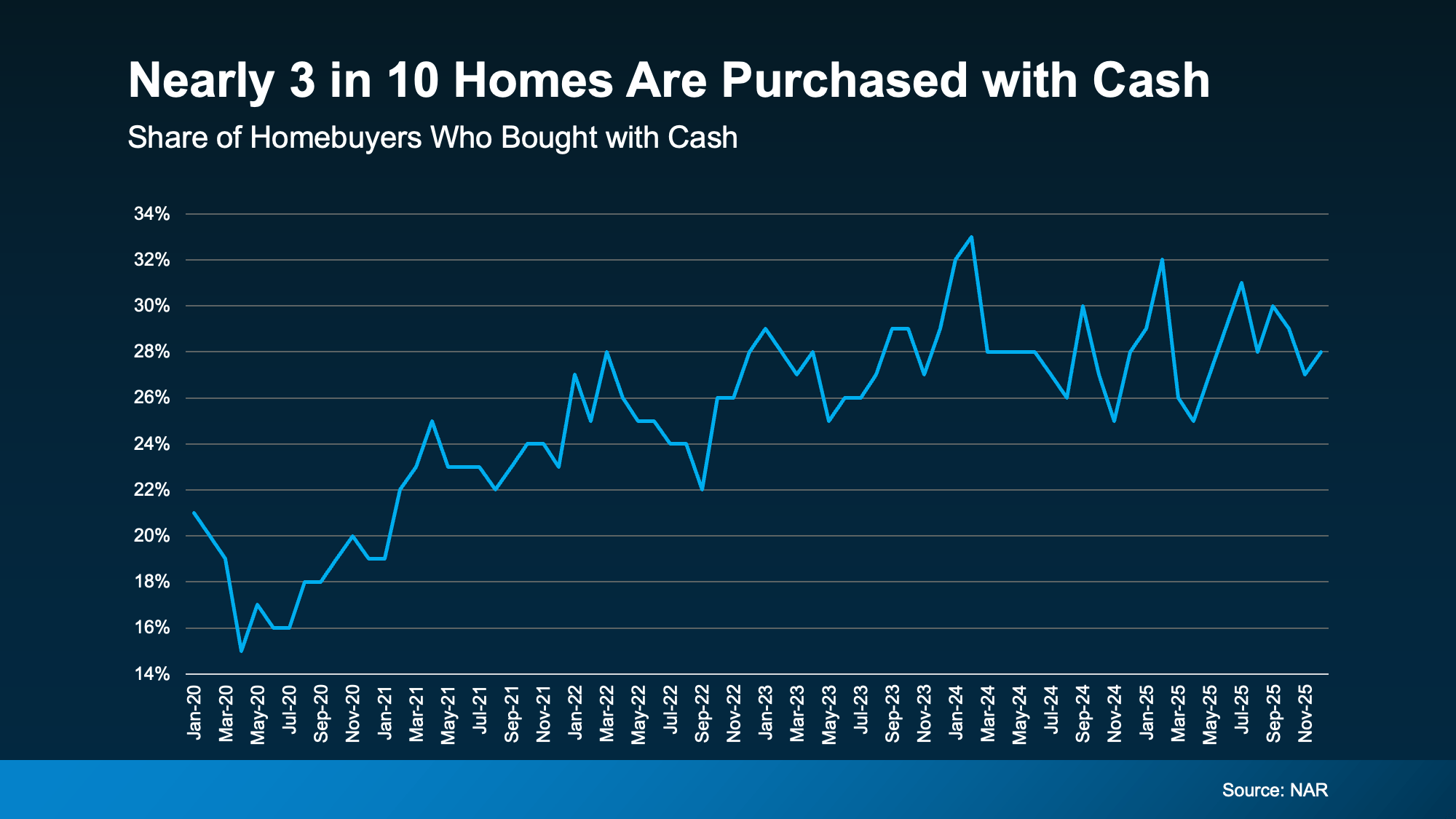

Nearly 3 in 10 homes purchased today are bought in cash, according to the National Association of Realtors (NAR). That’s far more than the pre-pandemic norm (see graph below):

So, how are so many buyers pulling that off? The answer is simple: home equity.

So, how are so many buyers pulling that off? The answer is simple: home equity.

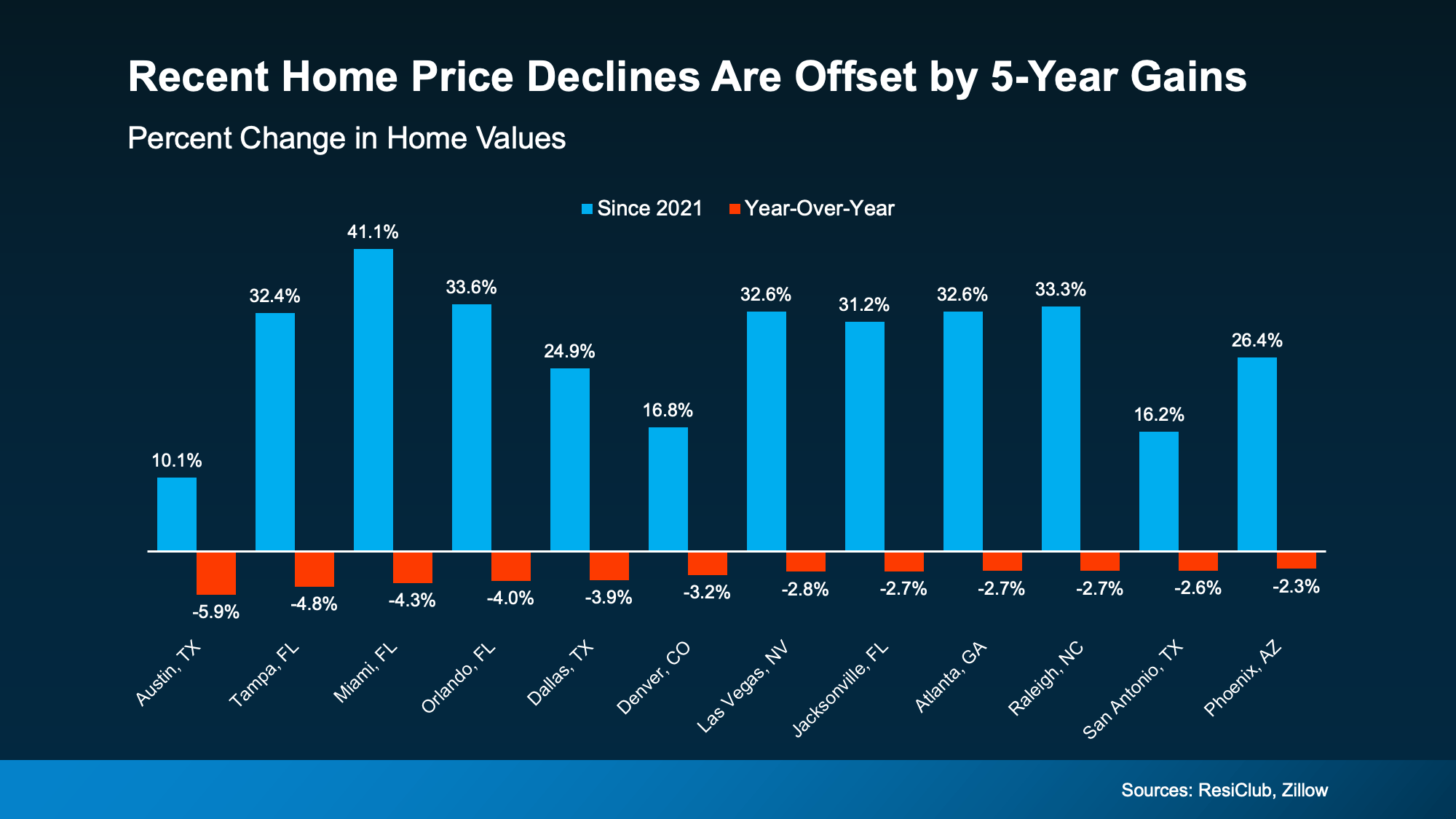

Back in 2020-2021, mortgage rates and the number of homes for sale were both at all-time lows. And that combination pushed home prices up, fast.

If you owned a home during that time, it likely gained significant value – maybe even enough to buy your next house in cash. NAR explains:

“. . . rising home equity has armed many existing homeowners with the financial leverage to make cash offers, allowing them to convert years of price appreciation into immediate purchasing power.”

Here’s why you may want to go that route yourself, if you have enough equity to do it.

1. Your Offer Becomes More Attractive

Sellers value certainty. And an all-cash offer removes one of the biggest unknowns in a transaction: financing. As Rocket Mortgage explains:

“Cash offers are attractive to sellers. Sellers often prefer to work with cash buyers if they can because they don’t have to worry about a buyer’s financing falling through at the last minute.”

In many markets, an all-cash offer can give you a serious edge.

2. You Can Close Faster

And since you don’t have to worry about underwriting, lender approvals, and loan processing, the time it takes to close shrinks. Cotality puts it this way:

“Cash buyers have always enjoyed an edge over borrowers. They remove financing risk, reduce delays, and often close in days rather than weeks.”

If the owner of the house you’re buying is already under contract on their next home or they just need to move fast (like for a new job), that speed is a real draw.

3. You Won’t Have Monthly Mortgage Payments

When you buy in cash, you don’t have to finance your purchase. That means you don’t have to worry about what today’s mortgage rates are and you own the house outright from the day you close. And that’s a big deal.

No mortgage.

No monthly payment.

Full ownership.

That financial freedom opens the door for other big lifestyle benefits. Zillow explains:

“Paying in cash means you own your home outright. This eliminates the need for monthly mortgage payments, freeing up your finances for other priorities like savings, travel, or home improvements.”

4. You May Get a Better Deal

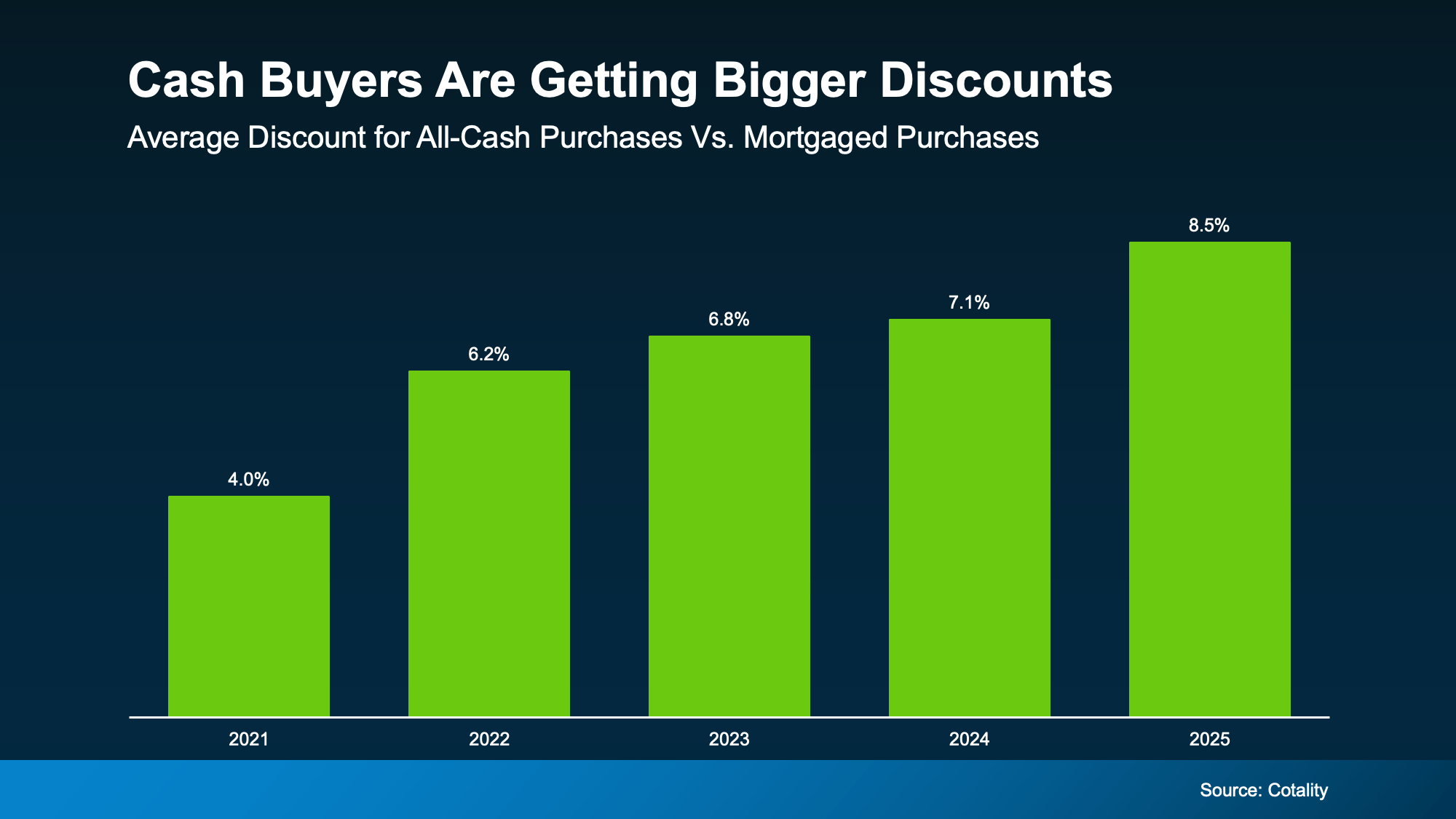

And here’s one more thing that surprises a lot of homeowners: cash buyers often pay less for the house.

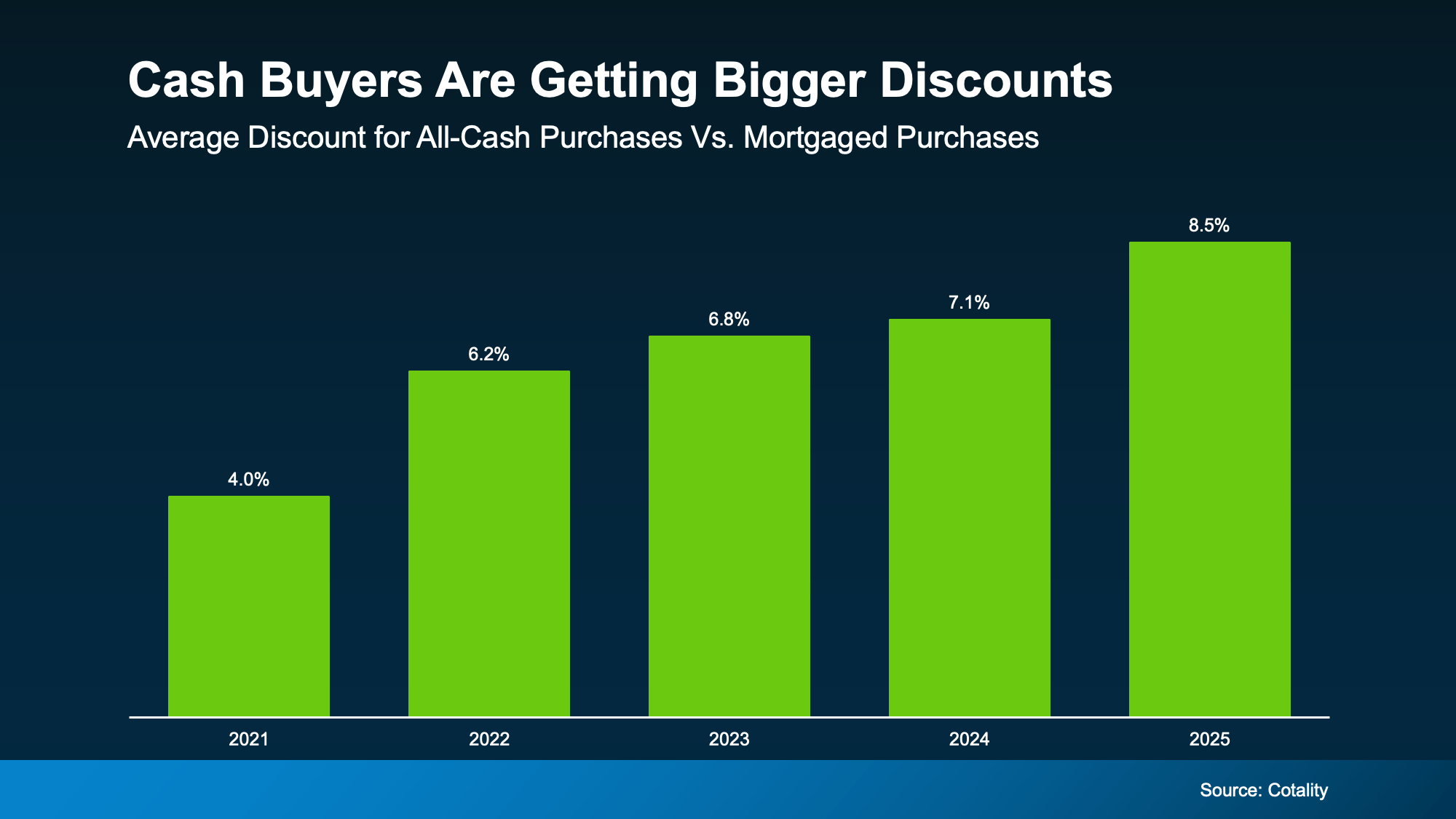

According to Cotality, all-cash buyers tend to spend roughly 9% less on the house than buyers who use a mortgage. That’s because some sellers are willing to accept lower offers to get a deal done quickly, with more certainty of closing, and fewer financing hoops to jump through. As Cotality explains:

“From a seller’s point of view, a lower but reliable offer can feel preferable to a higher one that may collapse weeks later.”

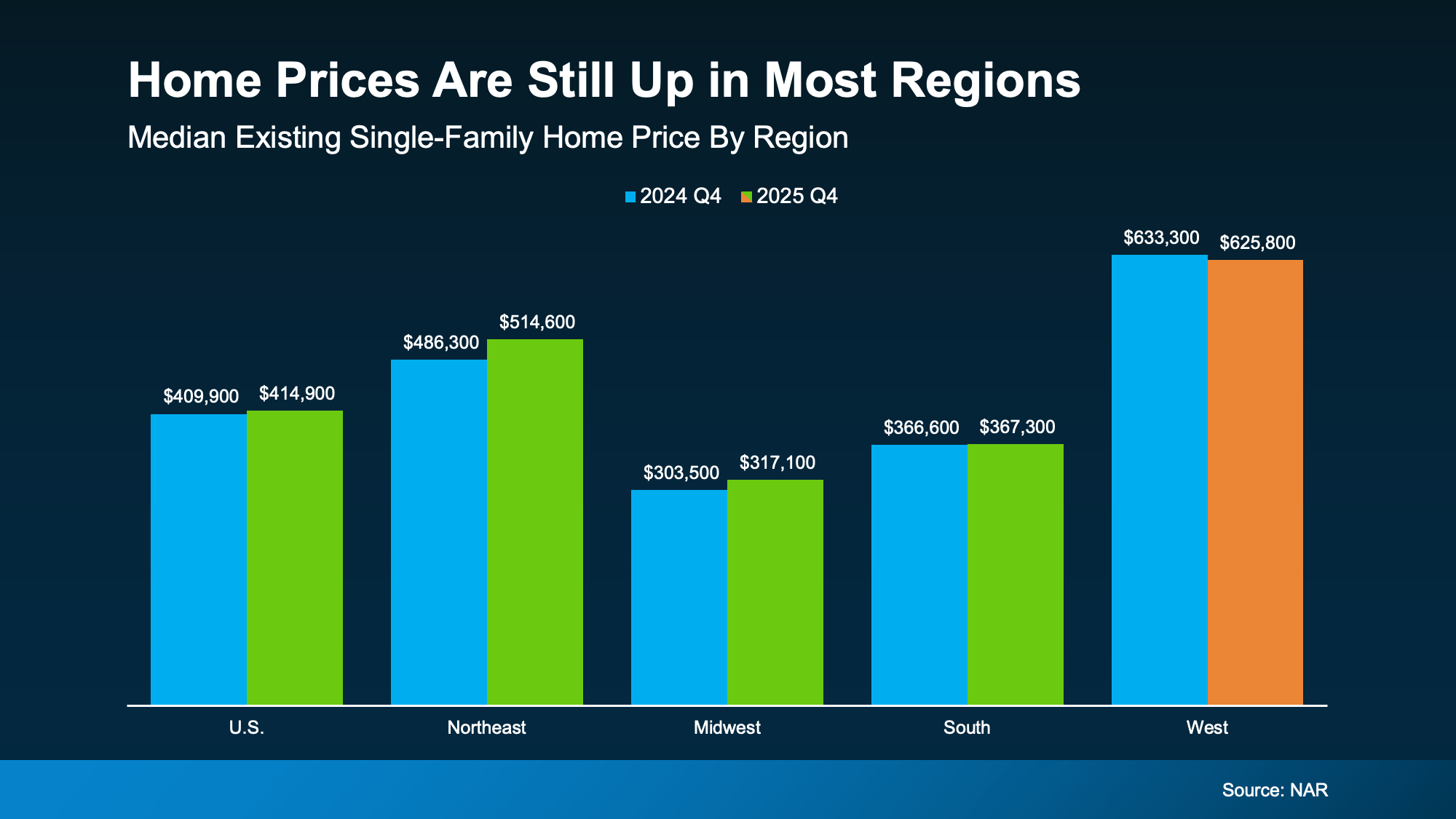

And that advantage grows with each passing year (see graph below):

Is an All-Cash Move Realistic for You?

Is an All-Cash Move Realistic for You?

Not every homeowner will buy their next house outright in cash. And that’s okay.

But the bigger takeaway is this: the equity you’ve built may give you more options than you think.

Whether that means downsizing and eliminating a mortgage entirely, or just relocating with stronger negotiating power, your current house may be what makes it possible.

Bottom Line

Before assuming you’ll need another traditional mortgage, it’s worth asking one simple question: How much equity do you really have? Because the answer might change what you thought your next move could look like.

Curious what your home equity could do for you? Ask a local real estate agent to run the numbers and see what kind of buying power you’re really sitting on.

Affordability4 weeks ago

Affordability4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Equity3 weeks ago

Equity3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Affordability1 week ago

Affordability1 week ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

So, how are so many buyers pulling that off? The answer is simple:

So, how are so many buyers pulling that off? The answer is simple:  Is an All-Cash Move Realistic for You?

Is an All-Cash Move Realistic for You?

You must be logged in to post a comment Login