Infographics

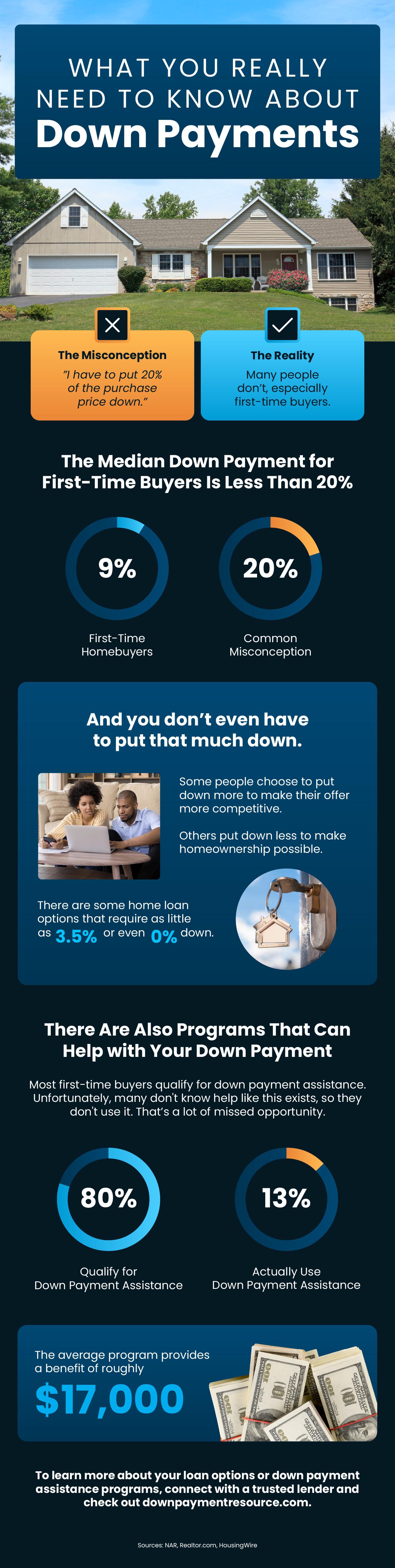

What You Really Need To Know About Down Payments

For Sellers

What You Need To Know About Concessions

Affordability

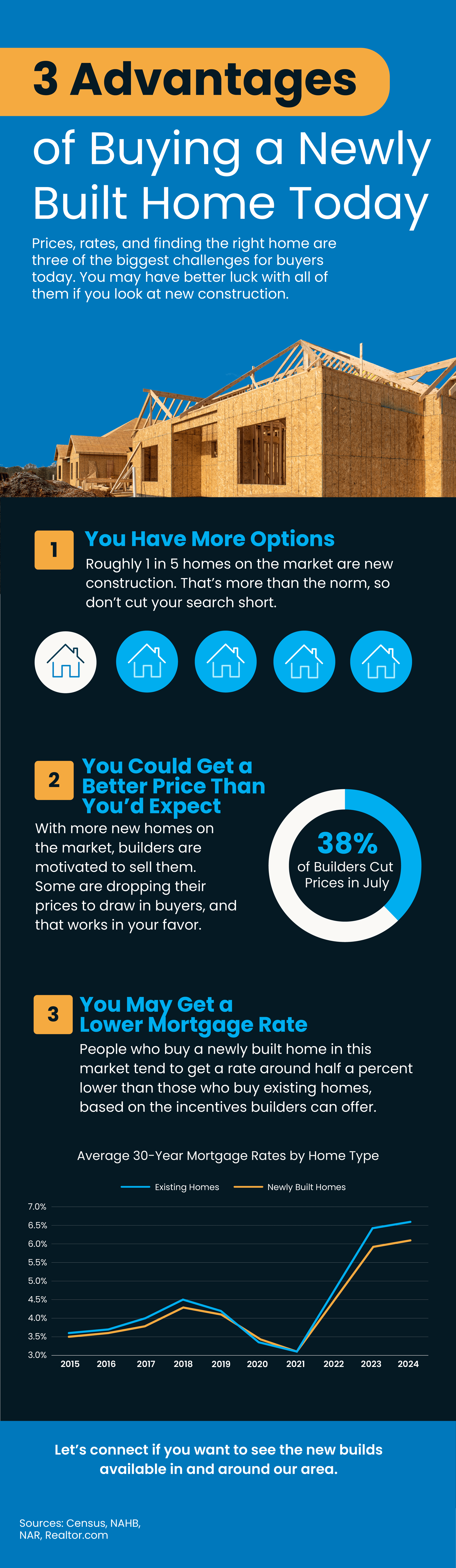

3 Advantages of Buying a Newly Built Home Today

For Buyers

Home Price Forecasts for the Second Half of 2025

-

Downsize4 weeks ago

Downsize4 weeks agoWhy So Many Homeowners Are Downsizing Right Now

-

Affordability3 weeks ago

Affordability3 weeks agoIt’s Getting More Affordable To Buy a Home

-

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks agoTop 2026 Housing Markets for Buyers and Sellers

-

Buying Tips3 weeks ago

Buying Tips3 weeks agoHome Insurance Costs Are Rising: What Buyers Should Plan For

-

Buying Tips3 weeks ago

Buying Tips3 weeks agoTop 3 Reasons To Buy a Home Before Spring

-

Affordability2 weeks ago

Affordability2 weeks agoWhy Townhomes Are Popular with Today’s First-Time Buyers

-

Equity2 weeks ago

Equity2 weeks agoFour Ways Your Home Equity Can Work for You

-

For Buyers2 weeks ago

For Buyers2 weeks agoInventory Is Making a Comeback in 2026

You must be logged in to post a comment Login