There’s one decision you’re going to make when you sell that determines whether your house sells quickly, or it sits. Whether buyers make an offer, or scroll past it. Whether you walk away with the maximum return, or you end up cutting the price later.

And that’s your asking price.

The #1 Mistake Sellers Make Today: Trusting the Wrong Number

If you’re thinking of moving and trying to figure out what your house may sell for, it’s tempting to start with an online home value tool. They’re fast, free, and easy. And you don’t have to talk to anyone. But here’s the problem: they don’t know your house.

And that can be a bigger drawback than you realize.

Where Online Estimates Fall Short

Online tools often lag behind the market. They look in the rearview mirror, relying on closed sales and delayed information. And in that sense, they’re using incomplete data.

That’s not a miss in how these systems are built. Some information just isn’t available online. Bankrate explains:

“While these tools can be a useful starting point, keep in mind that they typically do not provide the most accurate pricing. Algorithms can only rely on the information available; they can’t account for things like a home’s condition or renovations made since the last public information was updated.”

They can’t see:

- The unique features that make your house special

- All the work you’ve put in to keep it in good condition

- Or, how in-demand your specific neighborhood is right now

So, while they may do a good job in some cases, they can’t be as accurate as a local agent who has boots on the ground day in and day out.

In a market where buyers have more options, a seemingly small margin of error can cost you thousands if you price too low, or weeks of lost momentum and time if you price too high.

If you want to sell for the most money and in the least amount of time, you don’t want the fast answer on how to price your house. You want the right one.

That’s why the savviest homeowners today don’t rely on algorithms when it actually matters. They rely on people, specifically trusted local agents.

What an Expert Agent Brings to the Table

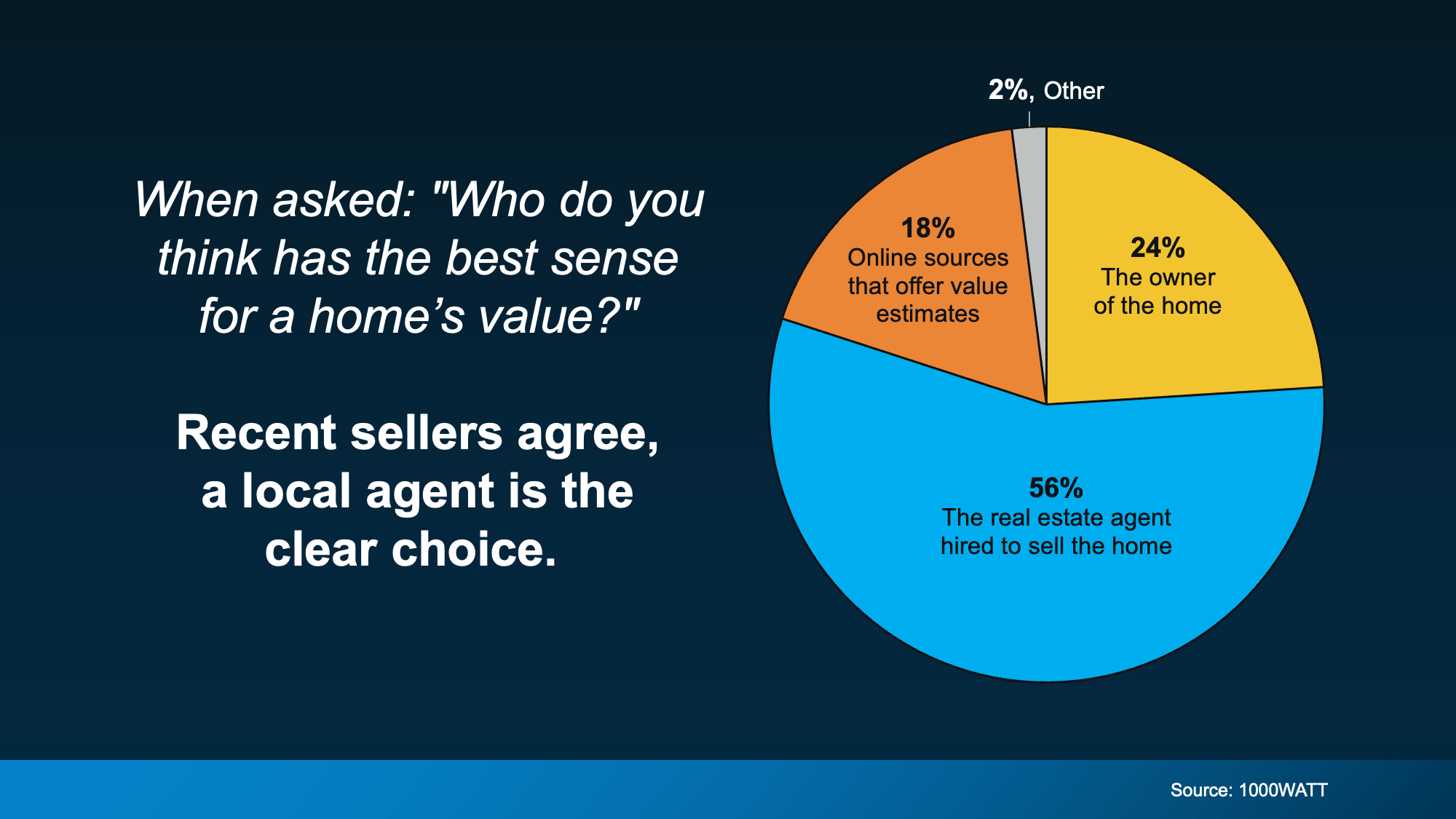

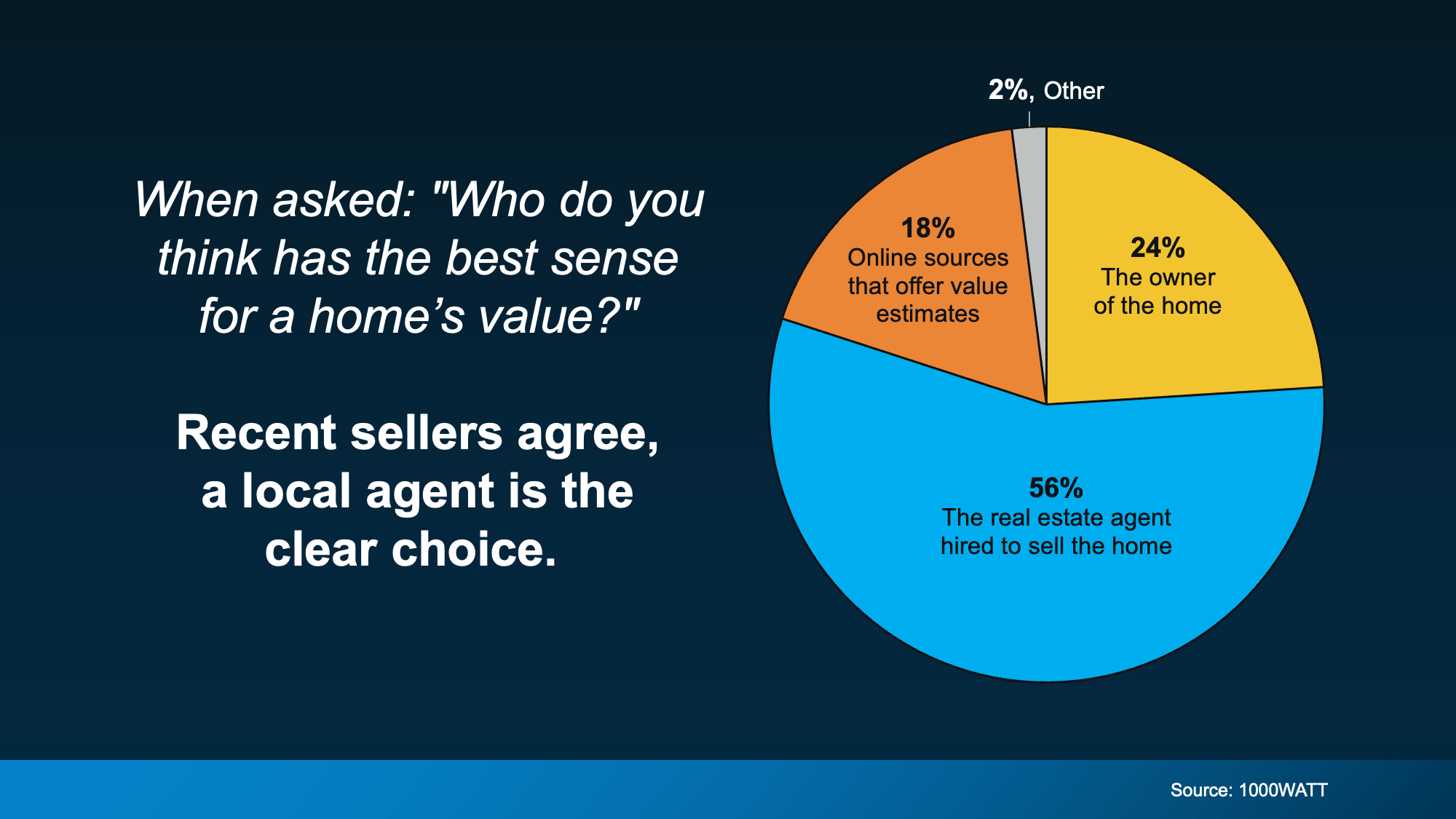

According to 1000WATT, sellers overwhelmingly believe real estate agents have the best sense of a home’s true value, far more than any automated tools.

That confidence isn’t accidental. As Bankrate puts it:

That confidence isn’t accidental. As Bankrate puts it:

“A professional appraiser or real estate agent can visit the home in person, assess the neighborhood as a whole as well as the individual property, perform more thorough market research, and consider subjective details.”

And those details matter. A skilled local agent doesn’t just pull reports. They know what’s happening right now:

- What buyers are paying this month, not last month, or even last year

- How your home compares to the current competition in your neighborhood

- Which features add value based on what buyers are willing to pay for today

- How to price your house to create urgency in this market

And once an agent steps foot in your house, they may even find your online estimate undershot your value. So, if you stuck with the estimate you got online, you’d actually be leaving money on the table. And no one wants that.

Bottom Line

While online tools can give you a rough starting point, only a local expert can give you a price that actually works.

If you want to know the right number for your house, not just the easiest one to find, connect with a local real estate agent.

Downsize4 weeks ago

Downsize4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Affordability2 weeks ago

Affordability2 weeks ago

Equity2 weeks ago

Equity2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

This Is About Opportunity, Not Obligation

This Is About Opportunity, Not Obligation

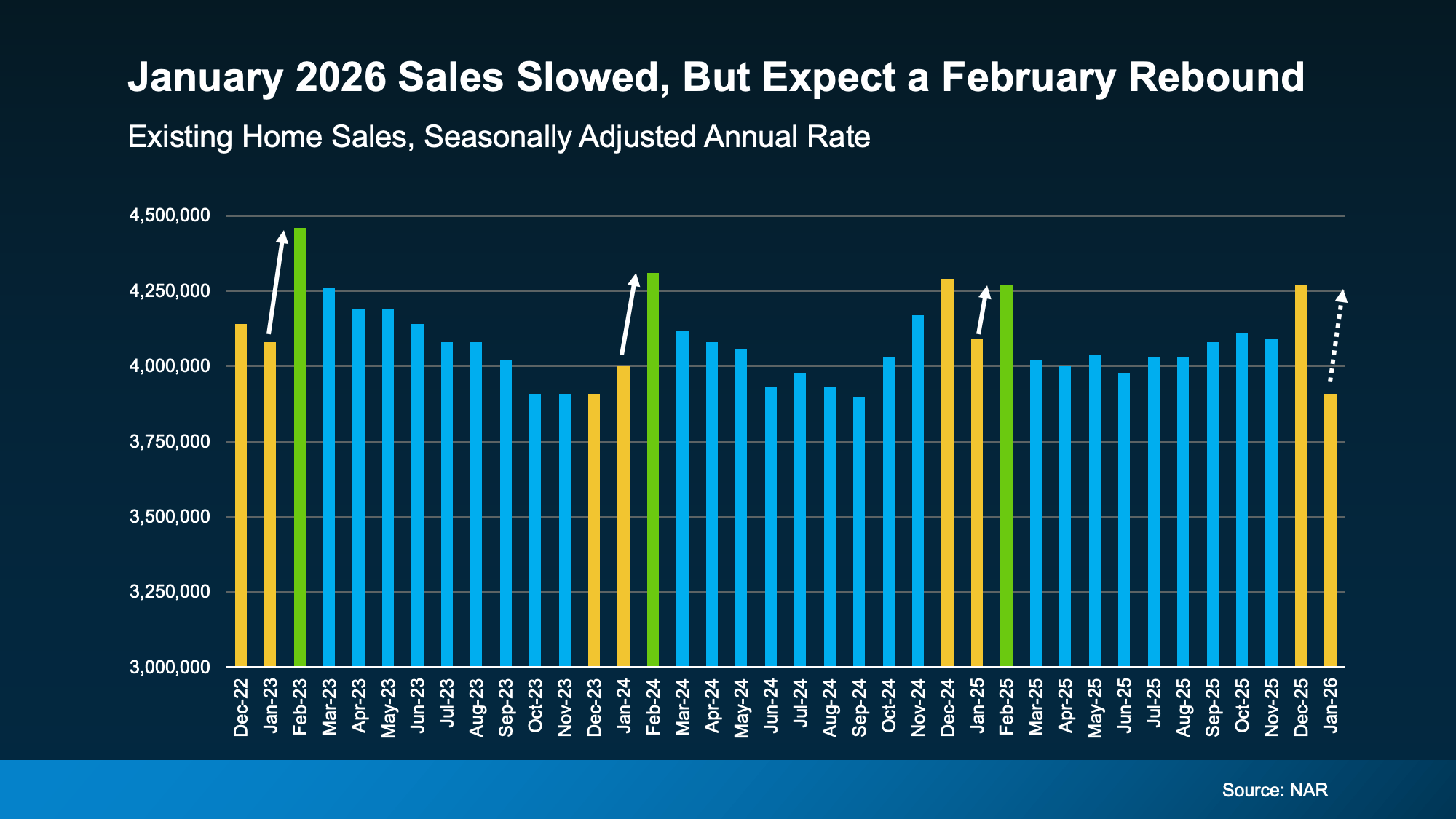

So even though the market slowed a bit momentarily, it should start to pick back up.

So even though the market slowed a bit momentarily, it should start to pick back up.

You must be logged in to post a comment Login