If you’re planning to buy a home this year, you may be focused on the spring market. And hoping that when spring does hit, you’ll see:

- Mortgage rates drop a little more.

- More homes hit the market.

But here’s what most buyers don’t realize. Buying just a few weeks earlier could mean paying less, dealing with less stress, and feeling less rushed.

Here are three reasons why accelerating your timeline over the next few weeks could actually be a better play.

1. Holding Out for Lower Rates May Pay Off

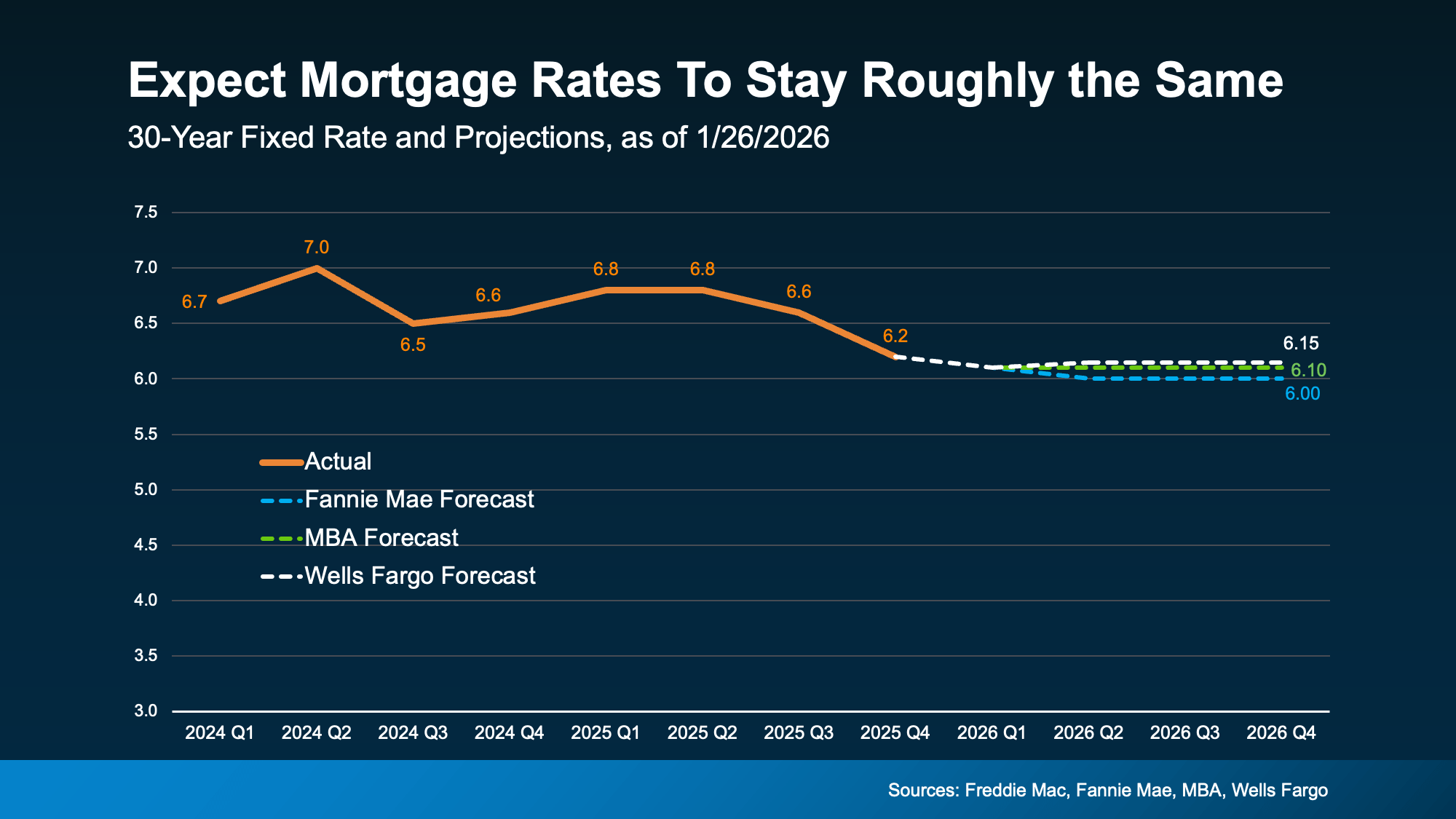

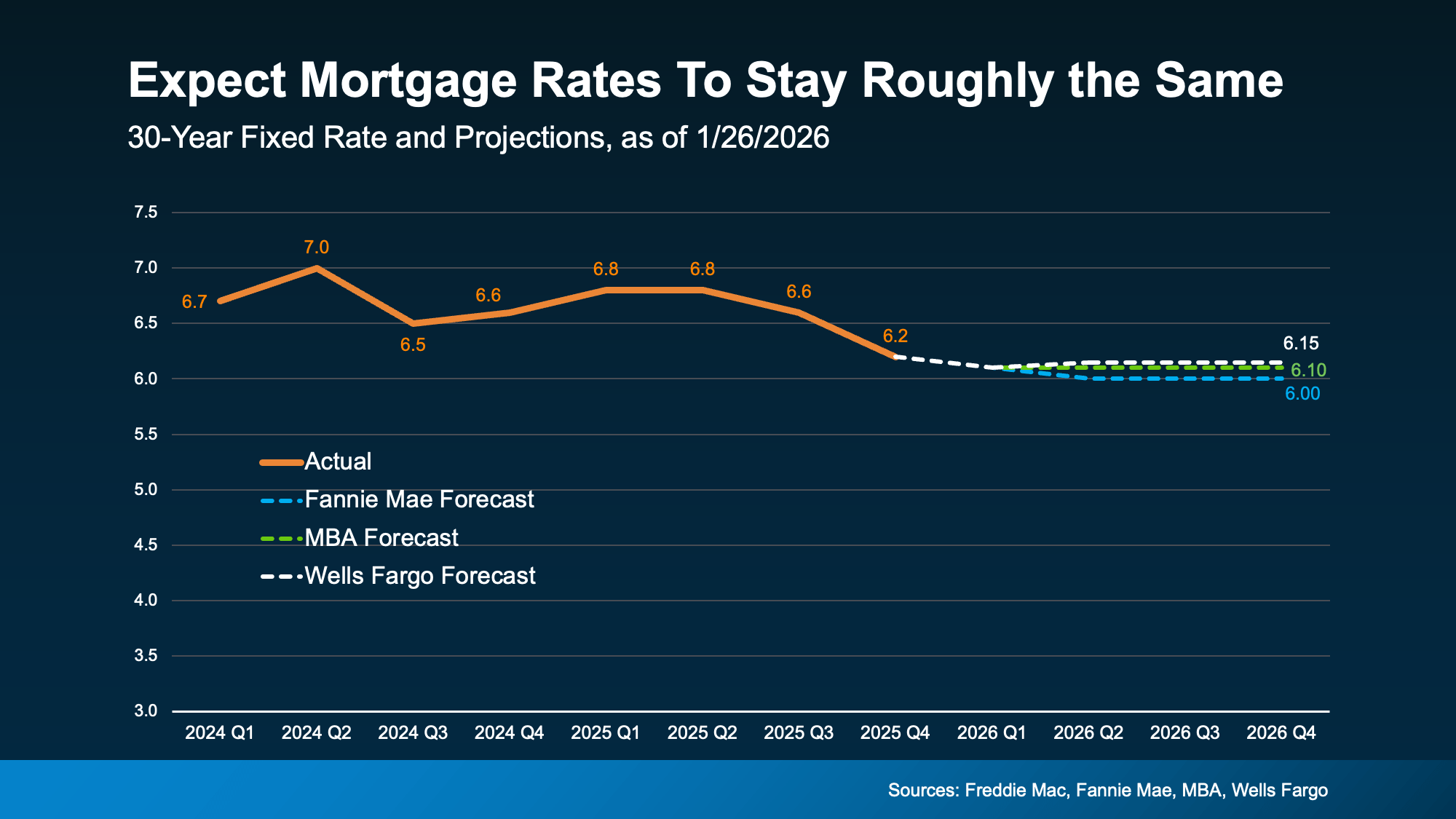

A lot of buyers are hoping mortgage rates will fall even further. But that’s not the best strategy. Here’s why. Experts are pretty aligned on this: rates are expected to stay roughly where they are.

Forecasts throughout the industry all point to the same thing: rates are projected to be in the low-6% range this year (see graph below):

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

That’s not a bad thing, especially if you consider how much rates have already come down. Over the past 12 months, they’ve dropped roughly a full percentage point. And for many buyers, that means affordability has already improved more than they may realize.

So why wait a few more weeks just for more buyers to jump in and act as your competition? You already have a window right now. As Chen Zhao, Head of Economics Research at Redfin, explains:

“House hunters should know that this may be near the lowest mortgage rates fall for the foreseeable future.”

2. Spring Means More Competition + More Stress

Speaking of competition, the spring market is popular for a reason, but with popularity comes pressure. With more buyers active at that time of year, you’ll have to move faster once you find a home you like. And no one likes feeling rushed.

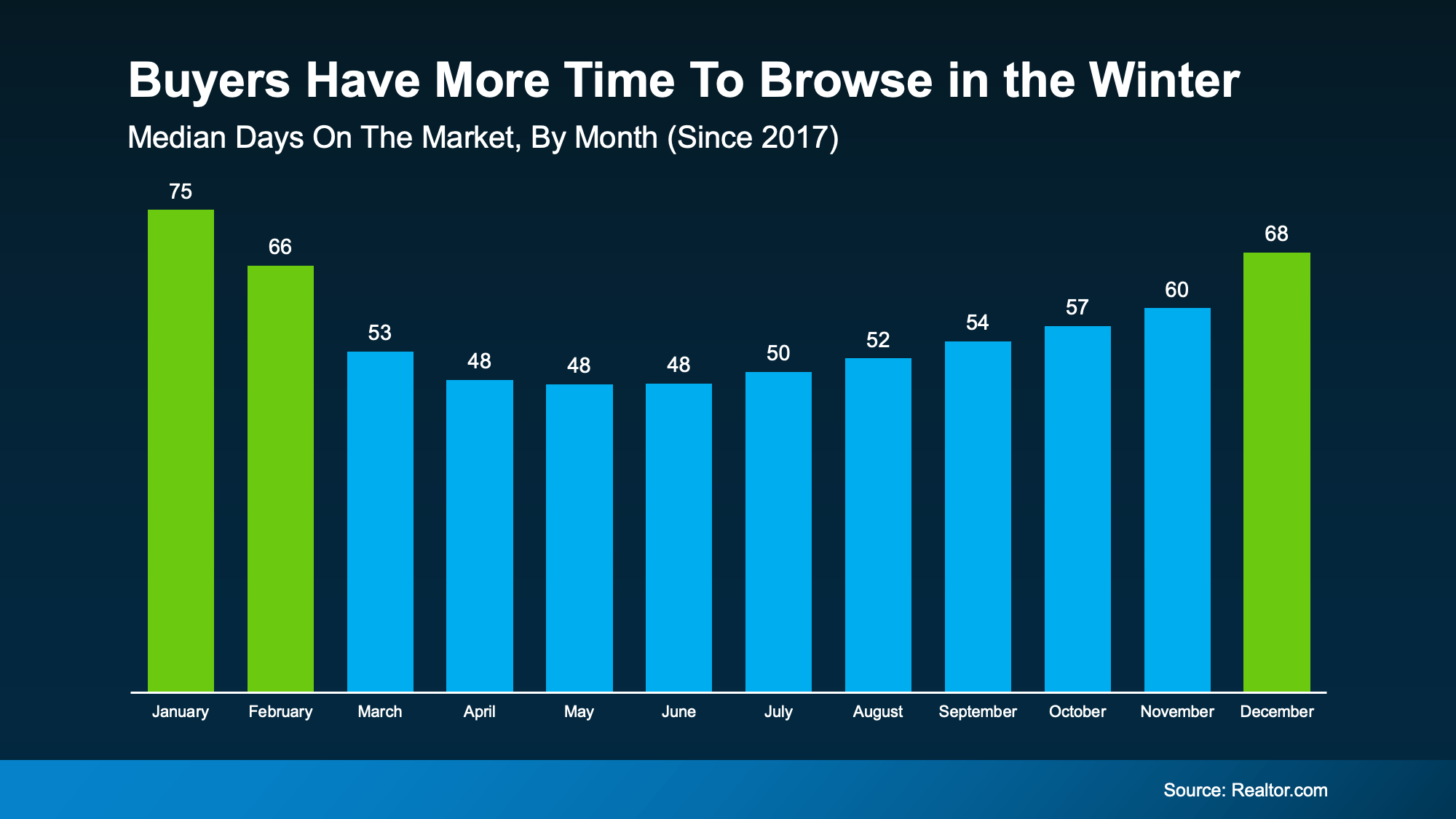

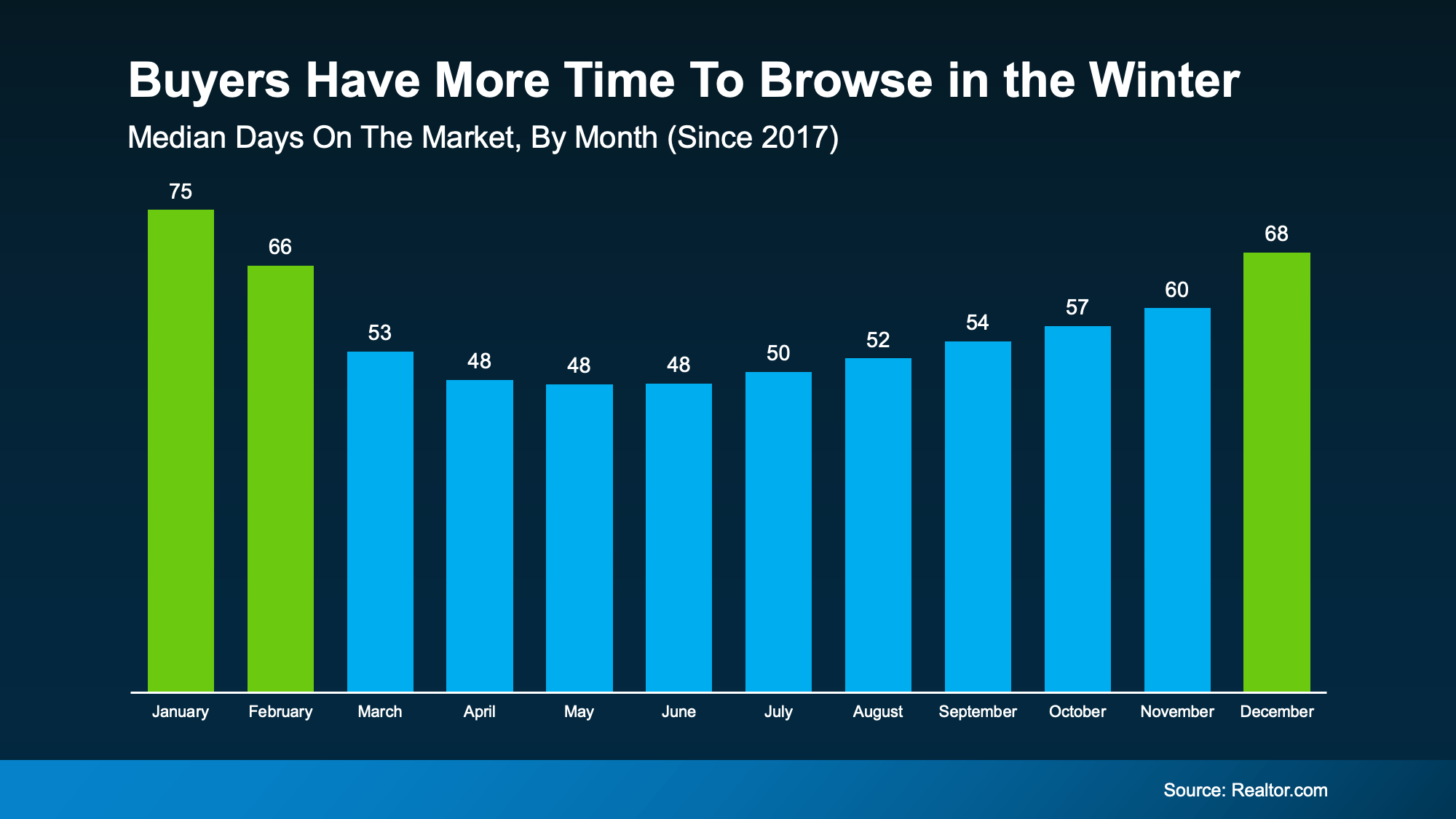

But buy now and you have more time to browse. Fewer people are looking, so homes sit longer.

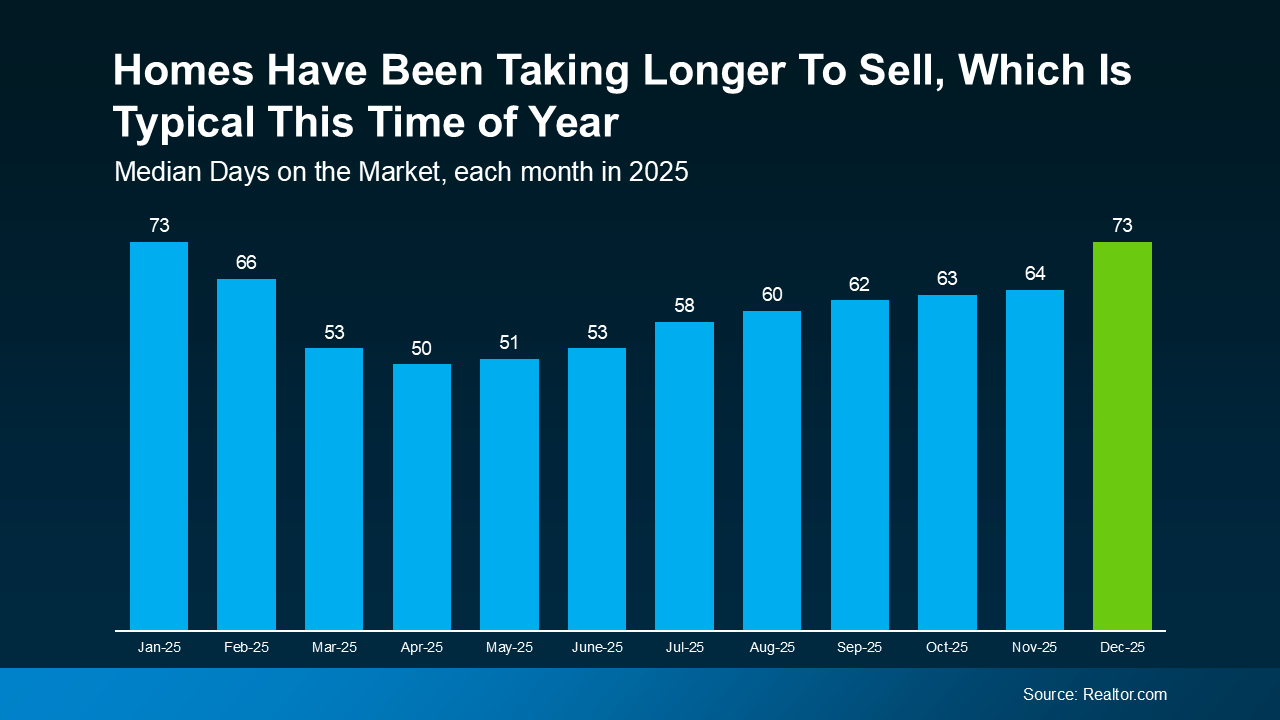

You can see this play out in the data from Realtor.com (see graph below). In winter months, it takes an average of about 70 days for a home to sell. In spring? That drops to about 50 days. That’s a 20-day swing – and that pace is going to be more stressful.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

3. Prices Tend To Rise When Competition Heats Up

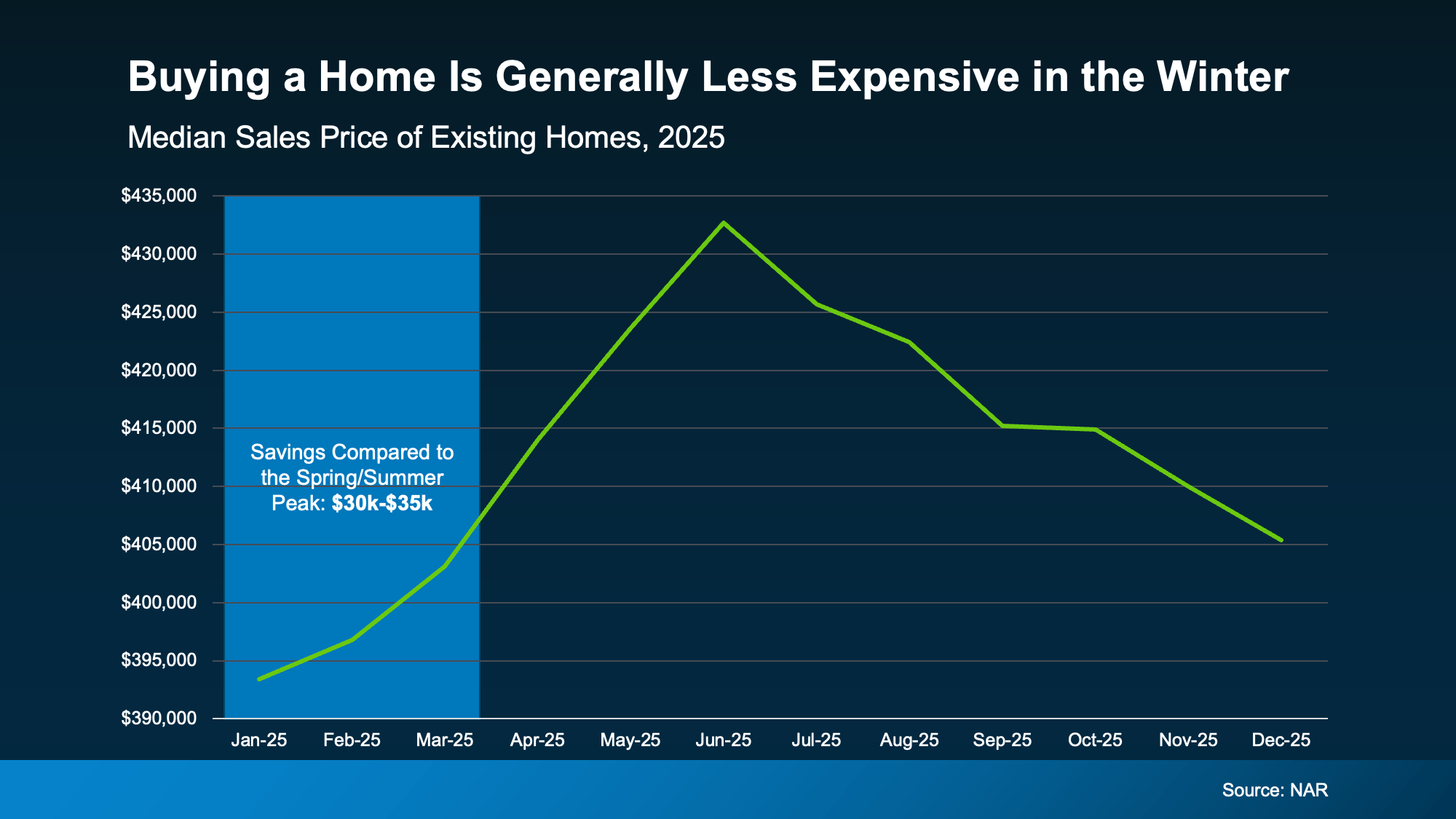

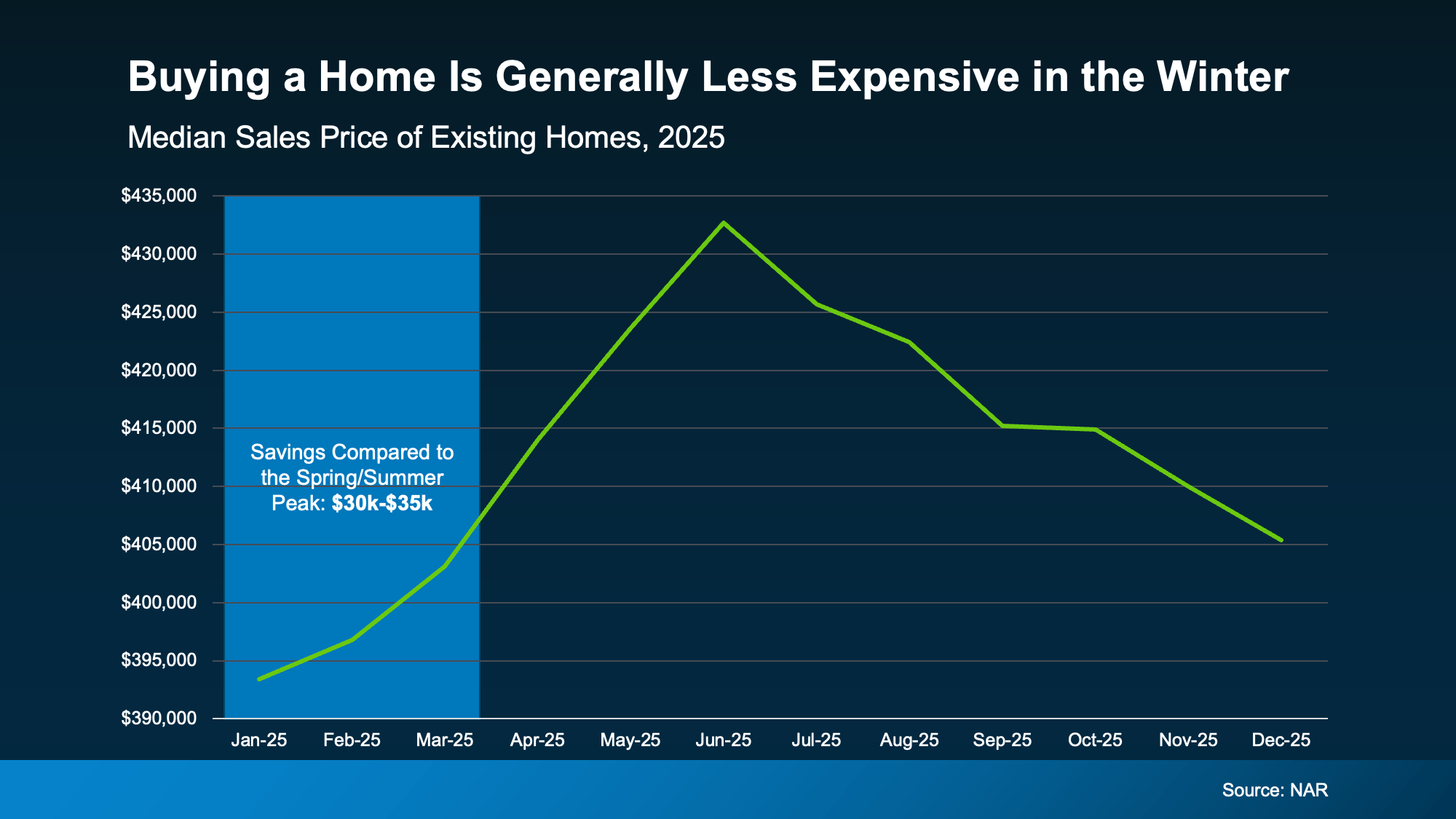

And here’s something most buyers forget to factor in. Prices usually respond to demand. So, when demand is higher, prices are too. Bankrate explains:

“Spring and early summer are the busiest and most competitive time of year for the real estate market . . . home prices tend to be steeper to reflect the increased demand.”

In fact, data from the National Association of Realtors (NAR) shows that in 2025, buyers who purchased in the beginning of the year saved roughly $30,000–$35,000 compared to those who bought when prices peaked in the spring or early summer.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

And let’s be honest, for a lot of buyers today, every little bit of savings helps. That’s why buying just a few weeks earlier, before prices ramp up, will be better for you and your wallet.

Bottom Line

Buying a few weeks before spring isn’t about rushing. It’s about choosing to be ahead of the curve and knowing you want more leverage, less stress, and meaningful savings.

If you’re ready and able to buy now and want to get the ball rolling, connect with a local agent.

Downsize4 weeks ago

Downsize4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Affordability2 weeks ago

Affordability2 weeks ago

Equity2 weeks ago

Equity2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

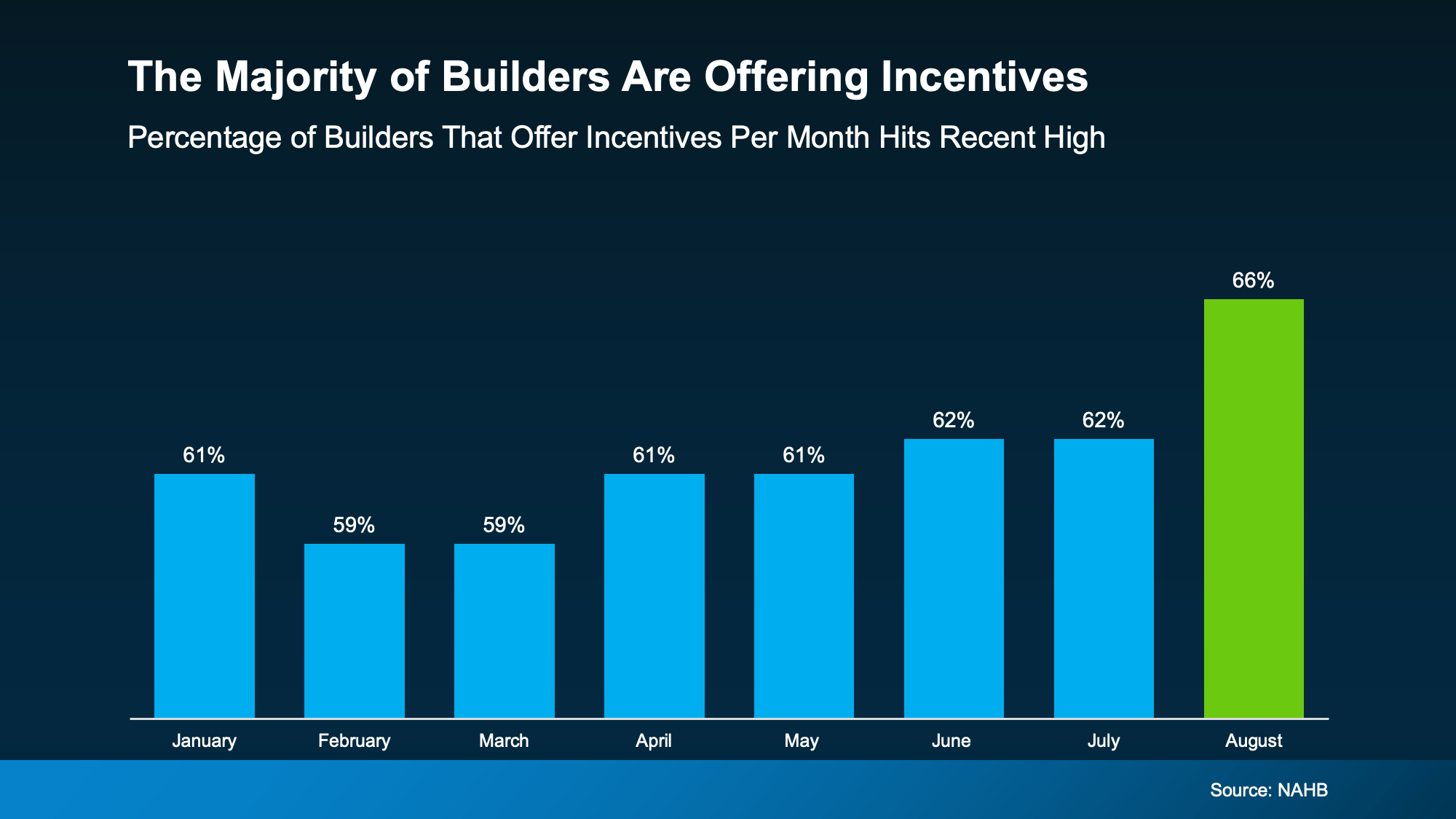

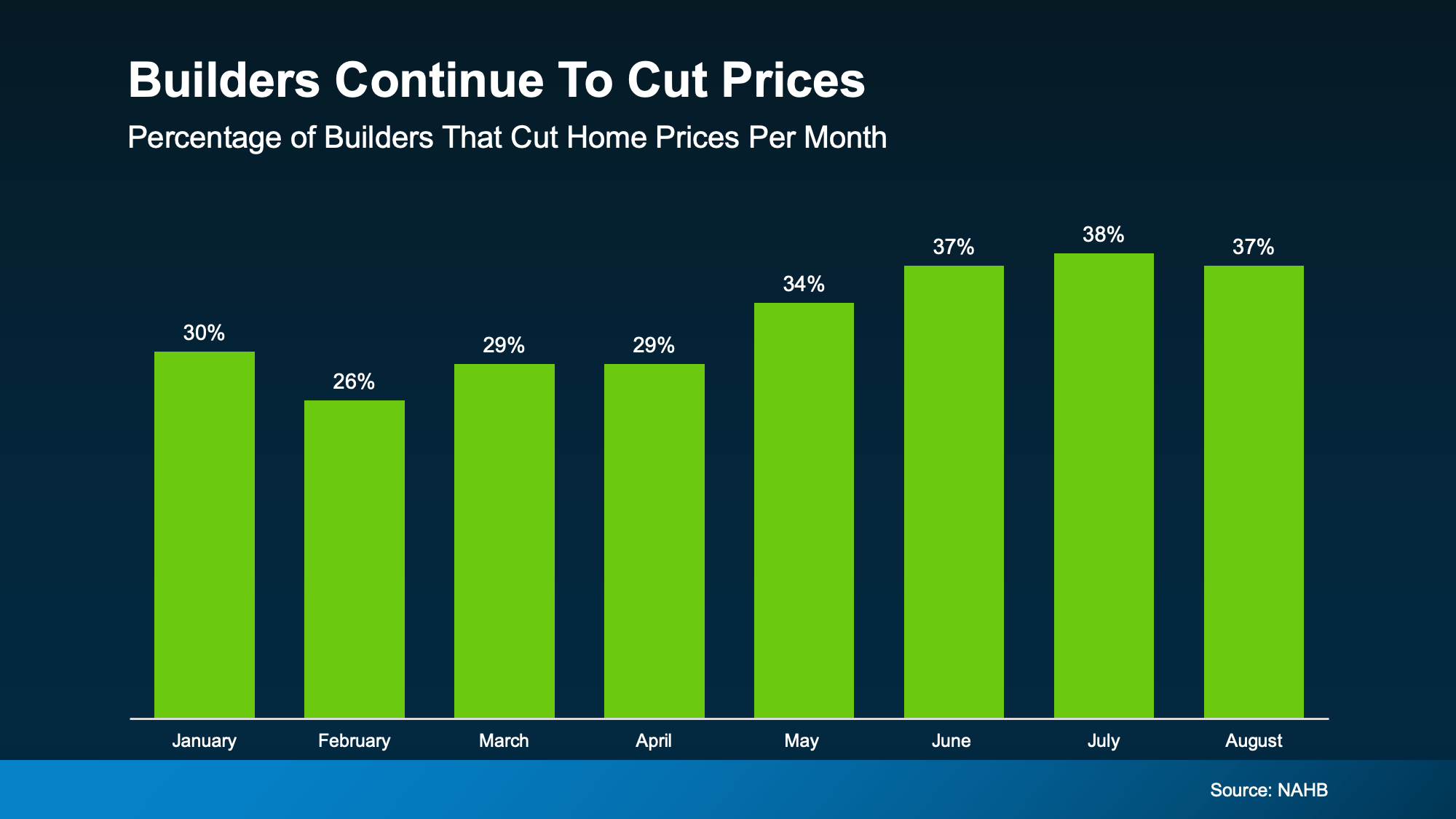

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.

On average they’re taking off about 5% off the purchase price of the house. For a buyer, 5% could be the difference between reluctantly settling and finally getting a home that works for you.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

So, What Can You Do About It?

So, What Can You Do About It?

You must be logged in to post a comment Login