Let’s be clear: selling your house is absolutely possible right now. According to the National Association of Realtors (NAR), roughly 11k homes sell every day in this country.

And the sellers who are making their moves happen all have one thing in common: they’ve adjusted their strategy to match today’s market. They’re realizing inventory has grown. Homebuyers are more selective. And buyer expectations are higher.

The sellers who struggle are usually approaching today’s market with yesterday’s expectations. Here are the three biggest mistakes they’re making – and how to avoid them.

1. Pricing Based on What Their Neighbor Got a Few Years Back

Setting your price is the most important decision you make when you sell – and the one that’s most often mishandled. Realtor.com data shows almost 1 out of 5 sellers in 2025 had to drop their price. Here’s what those sellers went wrong.

Buyers have more choice and more negotiating power now that inventory has grown. And house hunters will actively avoid your house is if feels like it’s priced too high. That’s why overpricing usually leads to:

- Fewer showings

- Less competitive (or lowball) offers

- Longer time on market

And all three of those side effects are things you don’t want to deal with.

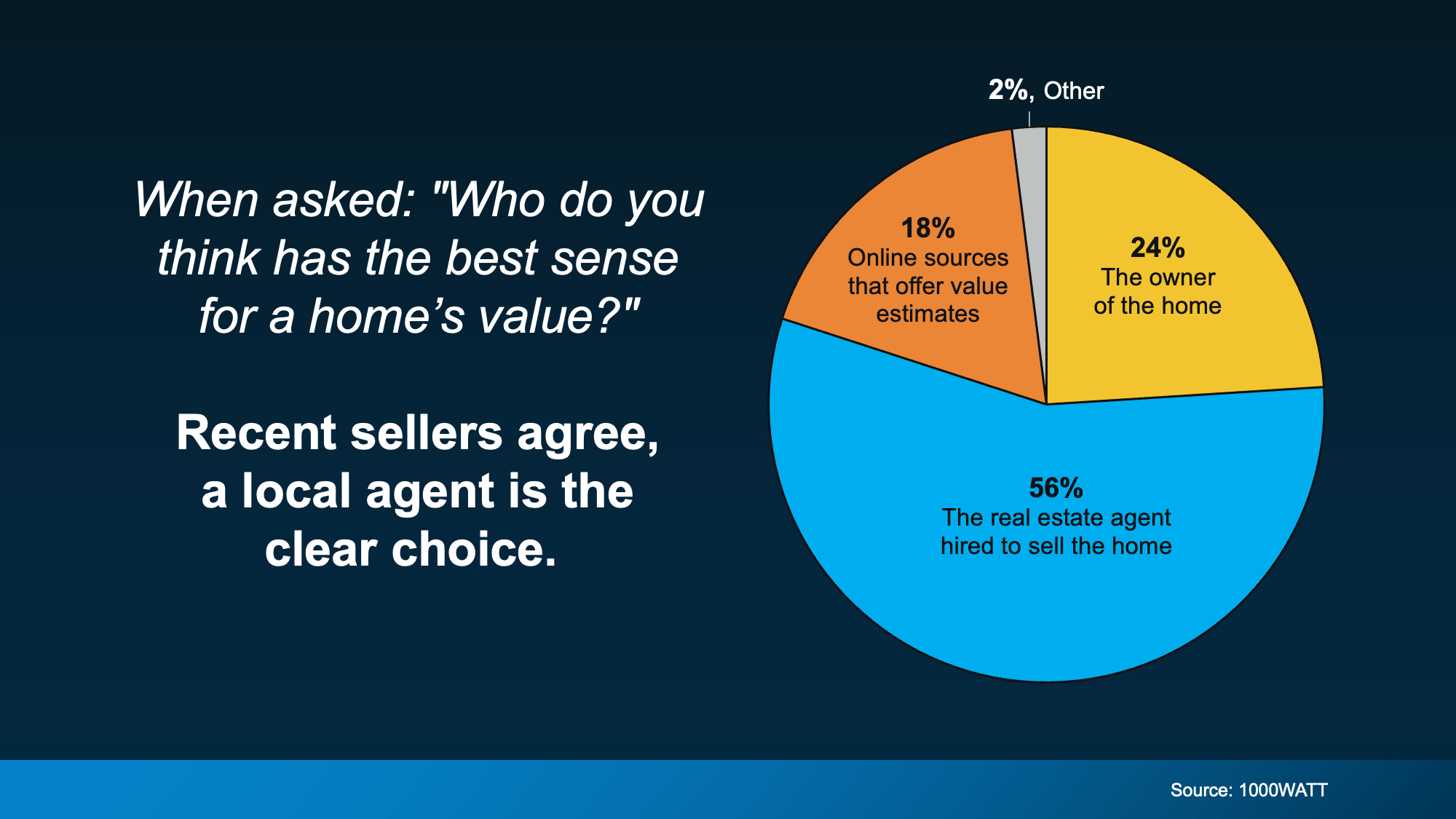

What To Do Instead: The good news is the cure is simple. Just price for today’s buyer, not yesterday’s headlines. Lean on your agent’s knowledge of recent comparable sales, current competition, and local buyer behavior to land in the value “sweet spot” that drives traffic and urgency from day one.

2. Trying To Skip Repairs That Buyers Now Expect

A few years ago, you could sell as-is and still get well above asking. Today? Not so much. Right now, NAR says two-thirds of sellers are making at least some repairs.

And the reason why is simple. In a market with more inventory, buyers compare homes side by side. Homes that don’t show well (or feel dated) are going to lose attention quickly, even if the issues are minor.

What To Do Instead: Ask your agent which high-impact, low-stress updates they’d recommend for your house. The goal isn’t perfection. It’s helping buyers see themselves moving in without a mental to-do list. Small investments in staging, repairs, and curb appeal can make a huge difference in how quickly offers come in – and how strong those offers are.

3. Playing Hardball When Buyers Try To Negotiate

Today’s buyers have housing affordability at the top of their minds. And since money is already tight, they’ll be pickier and will probably ask for some compromises from you. Whether that’s making repairs, giving them a credit at closing, or taking just a few thousand dollars off your asking price, negotiating is normal again.

So, if something pops up in the inspection, you’re going to need to be open to talking about it. If you’re not, you may very well see your buyer walk away. And some sellers are figuring this out the hard way. Redfin data shows one of the big reasons home sales fell thru in 2025 was inspection or repair issues. Odds are those homeowners weren’t willing to flex a bit to get the deal done.

What to Do Instead: Meet with your agent to make sure you understand what buyers in your area care the most about. Align your price with value, present the home clearly and confidently, and stay open to reasonable negotiations that keep deals moving forward.

Bottom Line

The sellers who succeed in this market aren’t doing anything extreme. They’re pricing their house right, making strategic repairs, getting local guidance, and making decisions based on how buyers actually behave today. Those small but mighty mindset shifts could make or break your sale.

Want a real plan tailored to your home and your neighborhood? Talk to a local agent.

Downsize4 weeks ago

Downsize4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Equity2 weeks ago

Equity2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

This Is About Opportunity, Not Obligation

This Is About Opportunity, Not Obligation

You must be logged in to post a comment Login