When your house doesn’t sell, it doesn’t just feel frustrating – it feels personal. You put time, money, and emotional energy into this move. You told your friends and family it was happening. And now that your listing has expired without a buyer? You’re left feeling stuck, and maybe even a little embarrassed.

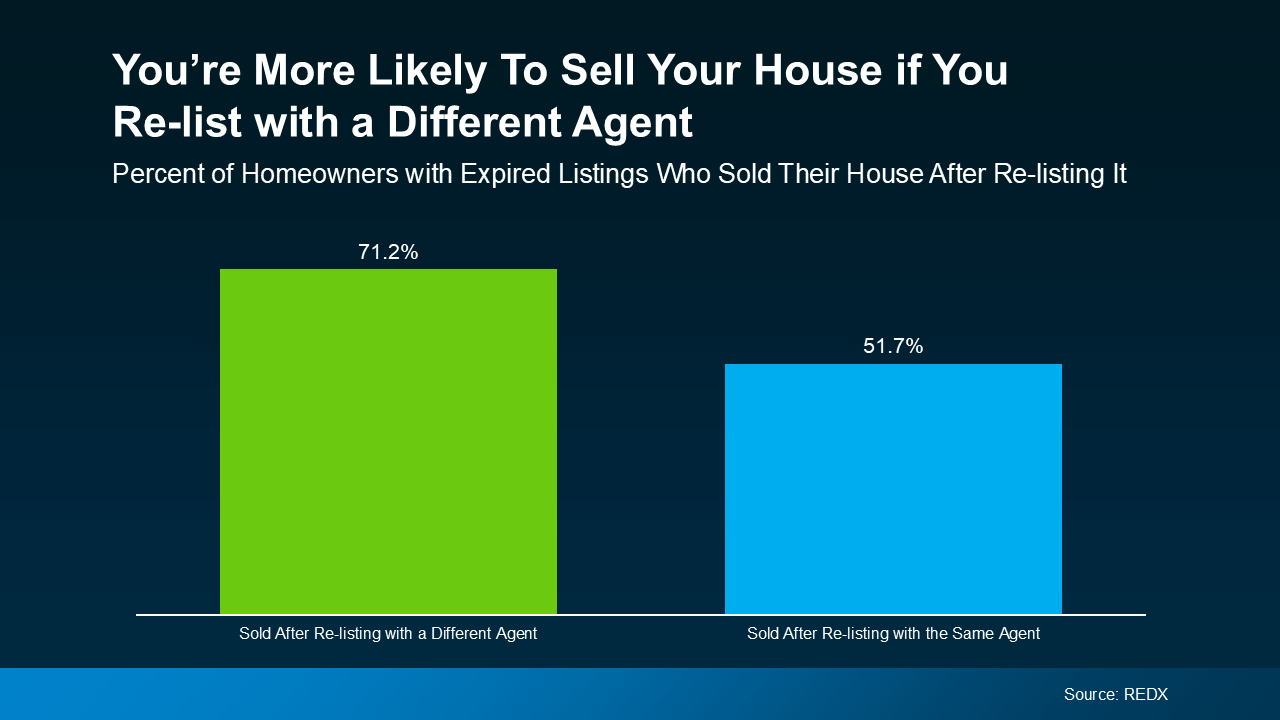

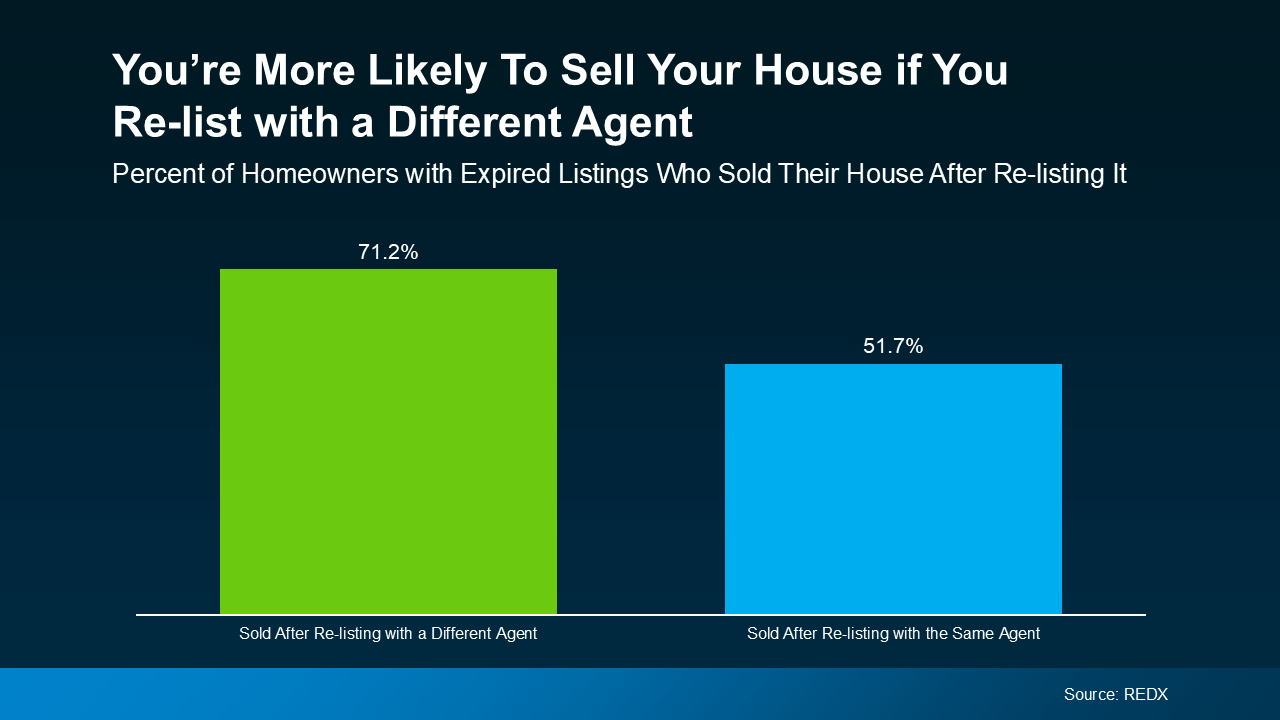

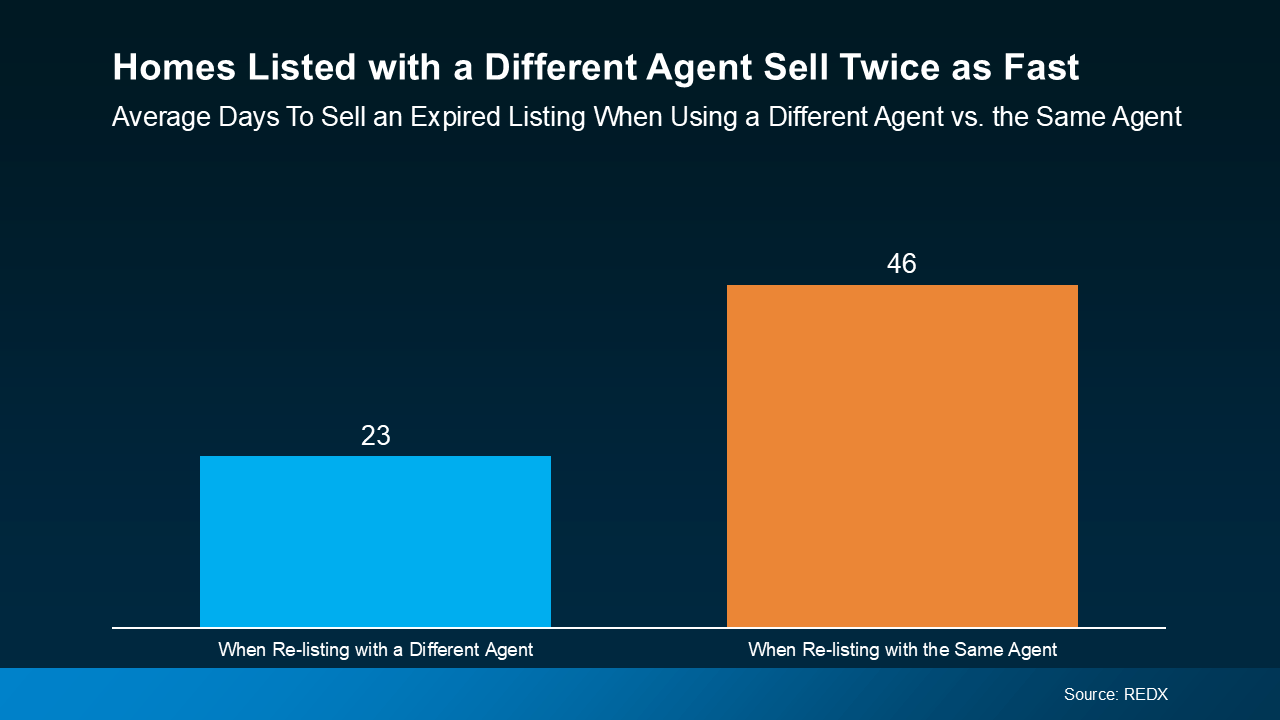

And here’s what most agents won’t tell you. Over 70% of homeowners who re-list with a different agent sell their house.

Re-list with the same agent? That stat drops to only 50%, according to the latest data from REDX. That’s like leaving the fate of your sale to a coin toss. And that’s not good enough.

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better.

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better.

Same house. Different strategy. Completely different results.

Let’s break down what might’ve gone wrong – and how a fresh perspective can help you have a winning strategy this time.

1. It Was Priced Too High

Today, homebuyers are feeling the squeeze of higher mortgage rates, so even a slightly overpriced home will get overlooked. And once your listing starts to go stale, it’s hard to regain momentum.

Missing the mark on pricing is a costly mistake – and too many homeowners are doing that very thing right now.

What we need to do now: We need to analyze the latest sales in your area to make sure you’re hitting the right number. This includes taking a hard look at real-time buyer behavior, and any feedback you got from open houses or showings your first time around. Pricing at, or even just below, current market value is a winning play because it drives more buyers to your listing – and that amps up the competition for your home.

2. It Didn’t Show Well

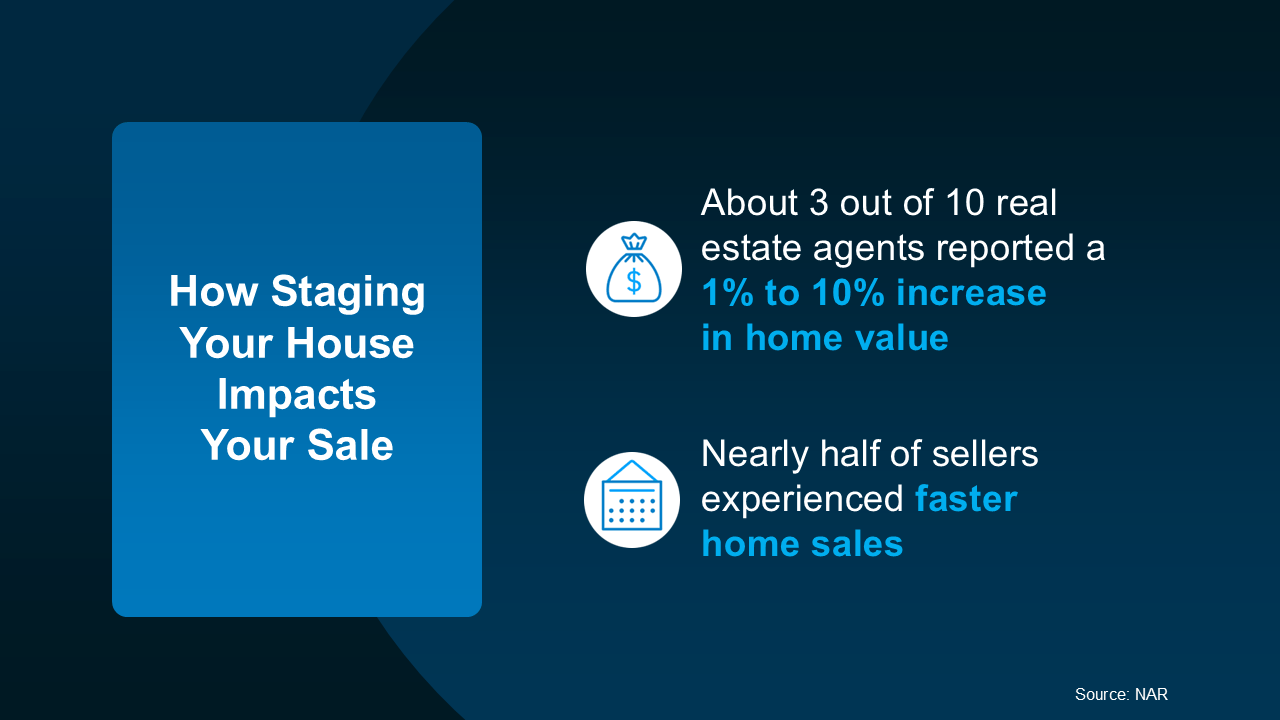

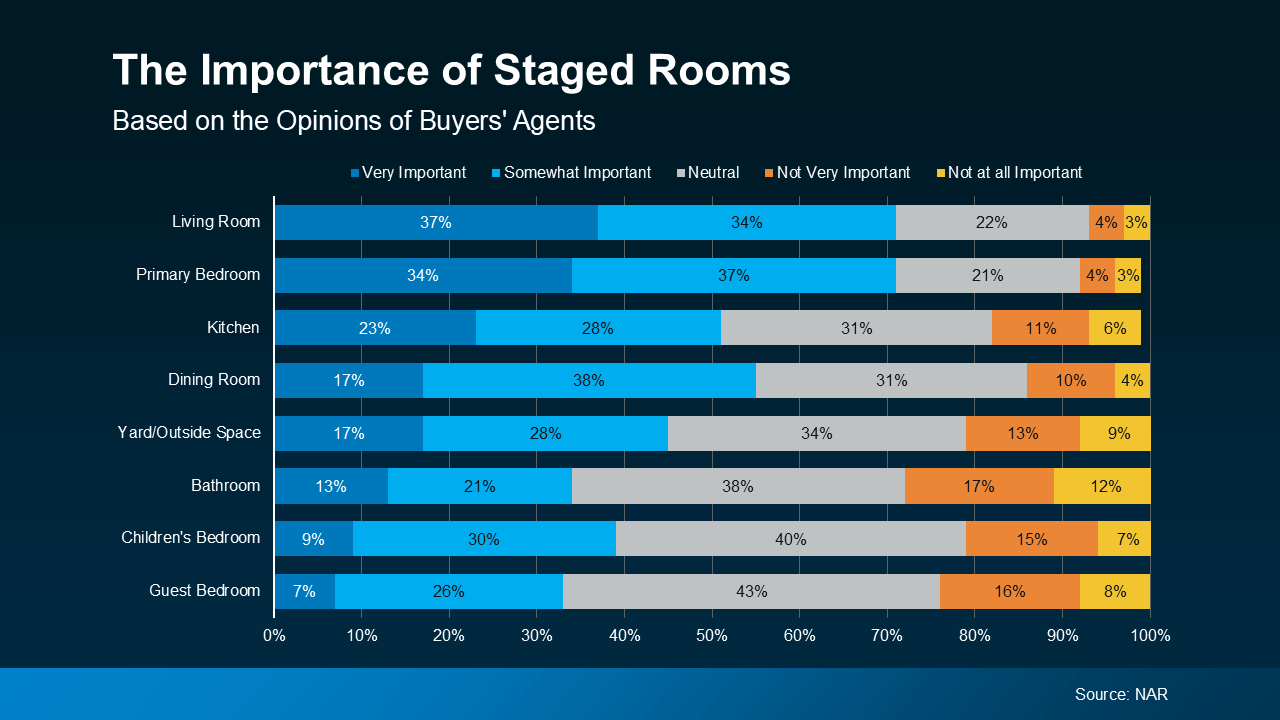

You only get one shot at a first impression. If the listing photos didn’t pop, the house wasn’t staged well, or it wasn’t updated, most buyers will skip over it without ever scheduling a showing. And even if buyers did show up, small things like scuffed walls, outdated light fixtures, or a wobbly doorknob can turn them away.

What we need to do now: Let’s walk through your house with fresh eyes to see if there are any areas that may have been sticking points inside and out. Sometimes taking down old drapery, some light staging, or even a fresh coat of paint can completely change how a buyer feels about the home.

3. It Didn’t Get the Right Exposure

If your home didn’t sell, chances are it wasn’t getting the visibility it deserved. Generic flyers and a few online photos aren’t enough anymore. Today’s top agents are using highly targeted digital marketing, social media strategies, custom video content, and more to get your listing in front of the right buyers at the right time.

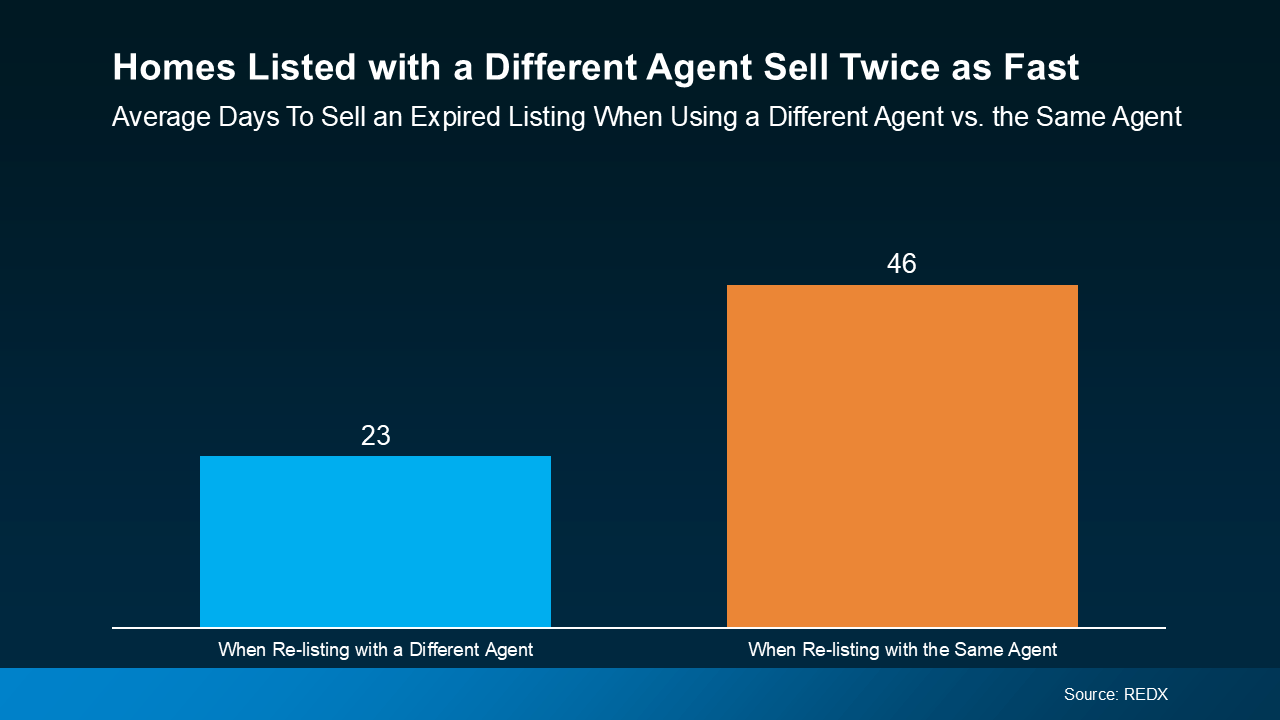

What we need to do now: We have to do more than just put your house online and hope it sells. Together, we can come up with a real plan to maximize its exposure. With the right pricing, staging, and marketing, your house will sell quickly. Here’s a real-world example (see graph below):

4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate

In this market, sellers who aren’t open to negotiating on things like closing costs, inspection repairs, or other concessions are often left behind. And if your last agent didn’t set that expectation with you, that’s a real shame.

What we need to do now: Be willing to meet buyers where they are. The goal is to get the deal done – and sometimes that means getting creative to help buyers cross the finish line. Home values have increased by over 55% over the last five years, so you likely have enough wiggle room to offer some perks without sacrificing your bottom line.

Bottom Line

If your house didn’t sell and your listing has expired, you don’t need to give up. You just need a better plan. And maybe, a better partner.

Over 70% of homeowners who switch agents sell their house the second time. That’s not a coincidence. That’s strategy.

If you’re ready for a proven approach, talk to a local agent so you know what to do differently – and why doing different things actually works. It’s time to get your move back on track.

Infographics3 weeks ago

Infographics3 weeks ago

Agent Value4 weeks ago

Agent Value4 weeks ago

Downsize4 weeks ago

Downsize4 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

Infographics4 weeks ago

Infographics4 weeks ago

Agent Value4 weeks ago

Agent Value4 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

First-Time Buyers3 weeks ago

First-Time Buyers3 weeks ago

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better.

REDX data also shows that only 1 in 3 homeowners with expired listings actually make that change. That means most sellers either give up or repeat the same mistakes, so they get the same disappointing outcome. You deserve better. 4. You Weren’t Willing To Negotiate

4. You Weren’t Willing To Negotiate

You must be logged in to post a comment Login