Buying your first home is exciting, but let’s be real – it can also feel overwhelming. It’s a big step, and with that comes plenty of questions. Am I making the right decision? Can I really afford this right now? Will I be able to make ends meet if I have unexpected repairs? What if I lose my job?

Here’s the thing: every first-time homebuyer has these thoughts.

The homebuying process has always been a mix of excitement and nerves, and that’s completely normal. Here’s some information that can give you a bit of perspective, so you don’t have these concerns.

Focus on What You Can Control

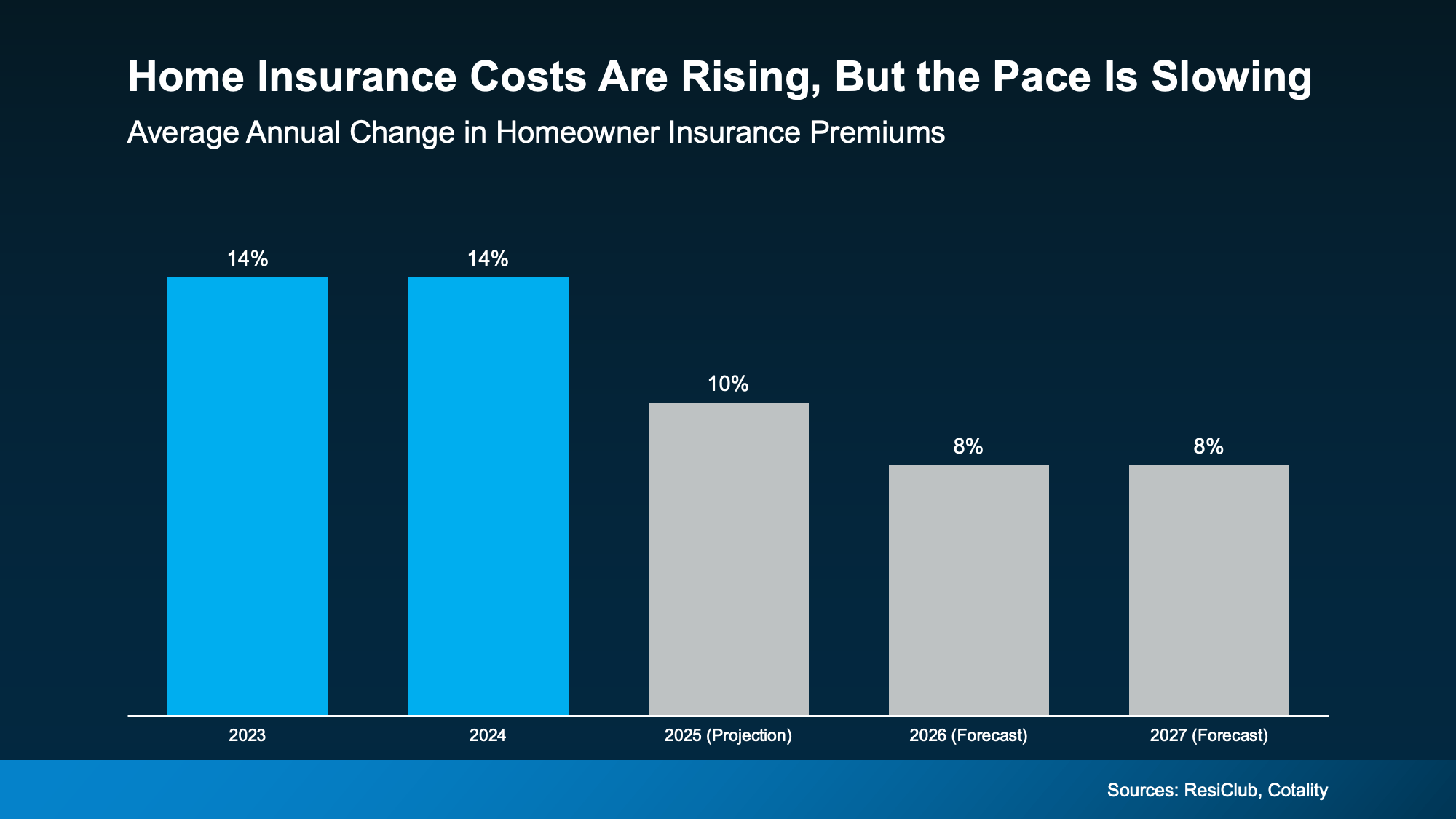

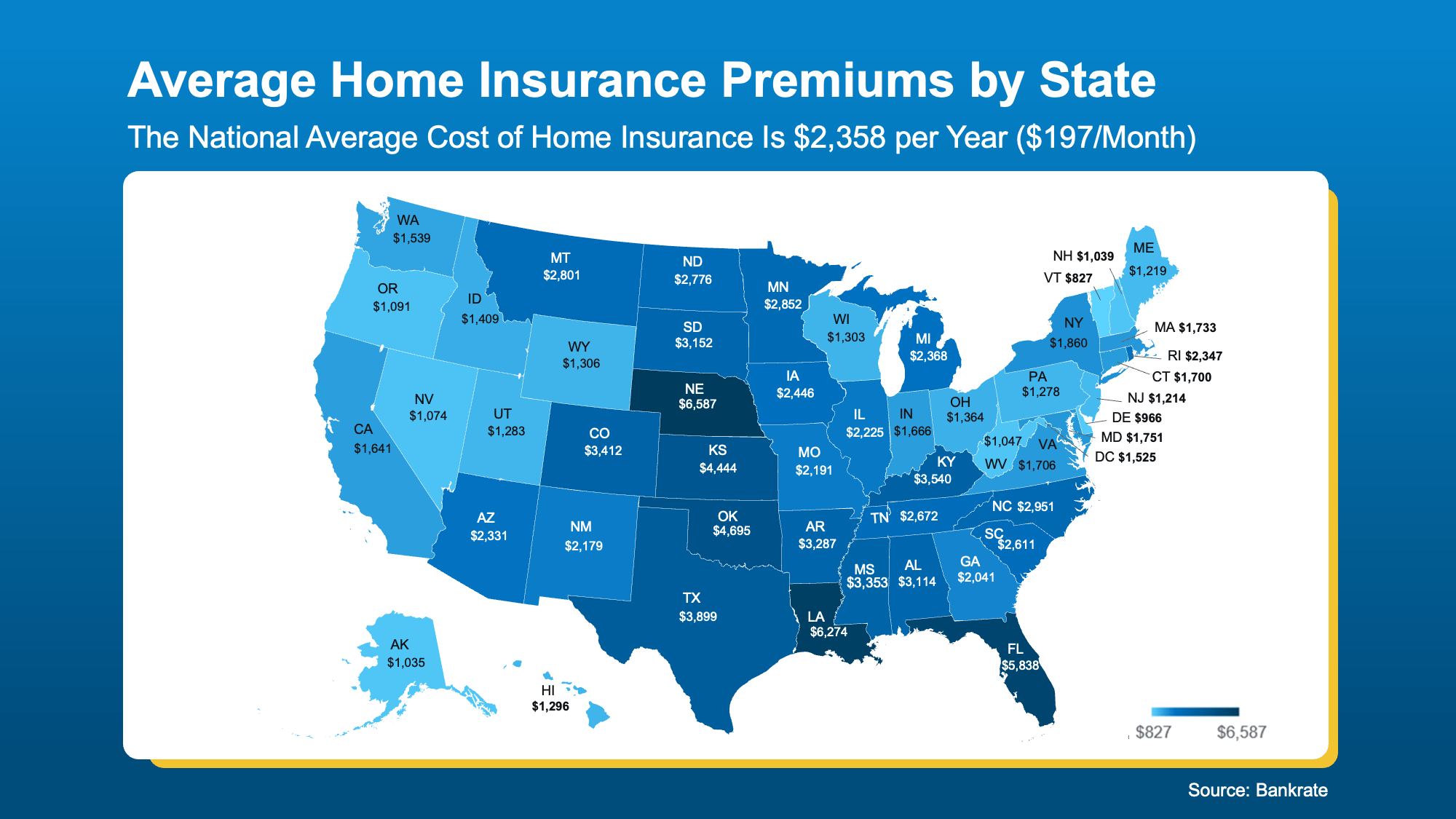

Since homeownership is new to you, you’re probably feeling like it’s hard to know what to budget for. And that can be a bit scary. You’ll have the mortgage, home insurance, and maintenance to think about – maybe even lawn care or homeowner’s association (HOA) fees. It’s easy to let the dollar signs be overwhelming. As Zillow says:

“Buying a house is a big decision, and you might feel confused and indecisive as you assess your current financial situation and try to work through whether or not the timing is right. Making big life choices might come with some self-doubt, but crunching the numbers and thinking about what you want your life to look like will help guide you down the right path.”

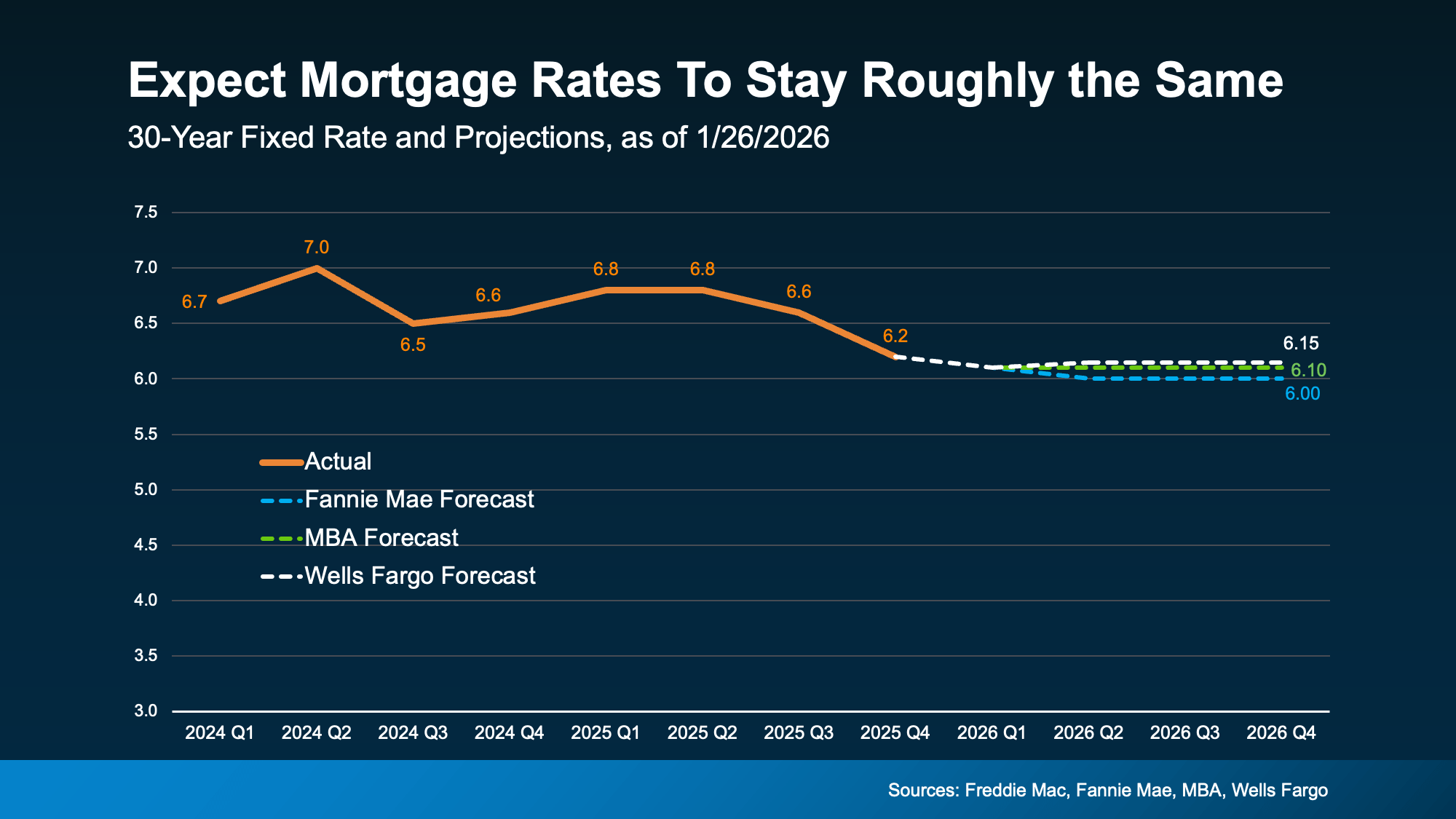

The important thing is to focus on what you can control. By partnering with a local agent and a trusted lender, you can get a clear understanding of what you can borrow for your home loan, what your monthly payment would be, and how your mortgage rate can impact it. And since that payment will likely be your biggest recurring expense, the key is to make sure the number works for you.

Don’t Stress About Repairs

The maintenance and repairs? Those can be a little bit harder to anticipate. But don’t forget you’ll get an inspection during the homebuying process to give you a better look at the condition of your future house. And with your inspection report in hand, you’ll have a good idea of what needs work. This way, you can start saving up so that you’re ready if and when something breaks.

But even then, if this is something that’s still really nagging at you, talk to your agent about asking the seller to throw in a home warranty. Those can cover repairs for some of the bigger systems in the house, like the HVAC, if they break within a specific time frame. While this isn’t a huge expense for the seller, the likelihood of a seller agreeing to one depends on what’s happening in your local market and how competitive it is right now.

It’s Okay To Stretch – Just Not Too Far

And remember, chances are that money will be a little tight – at least at first. And that’s kind of to be expected. A lot of times when someone buys their first home, they cut down on things like shopping and eating out for a while until they get a better idea of how their expenses will shake out in the new home.

But if you’re crunching the numbers and you won’t have enough money left for things like gas, food, etc. – it’s a sign you’d be stretching yourself too far. The last thing you want is to take on a payment that’s too much to handle. But stretching a little? That’s different. That’s normal.

Your Job Will Probably Change – And That’s Okay

And don’t forget, you’ll likely earn more down the road, so that slight stretch now won’t seem so bad as time wears on. As you advance in your career, you’ll probably start to make more money too. So, as your paycheck grows, the payments will get easier. Renting is a short-term option – and it’s one you deserve to get out of. Buying a home is a long-term play.

And just in case you’re worried about what happens if you do lose your job, you should know there are options, like forbearance, designed to help you temporarily pause payments on your home loan due to hardship.

Bottom Line

Buying your first home is a big decision, and it’s okay to feel a little nervous about it. But if you’re financially ready, don’t let fear keep you from moving forward. These emotions are normal, and great agents help their buyers get through them.

What makes you nervous when you think about buying your first home?

Connect with an agent so you have an expert on your side to explain everything along the way.

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Affordability1 week ago

Affordability1 week ago

Equity3 weeks ago

Equity3 weeks ago

Affordability4 weeks ago

Affordability4 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

Equity2 weeks ago

Equity2 weeks ago

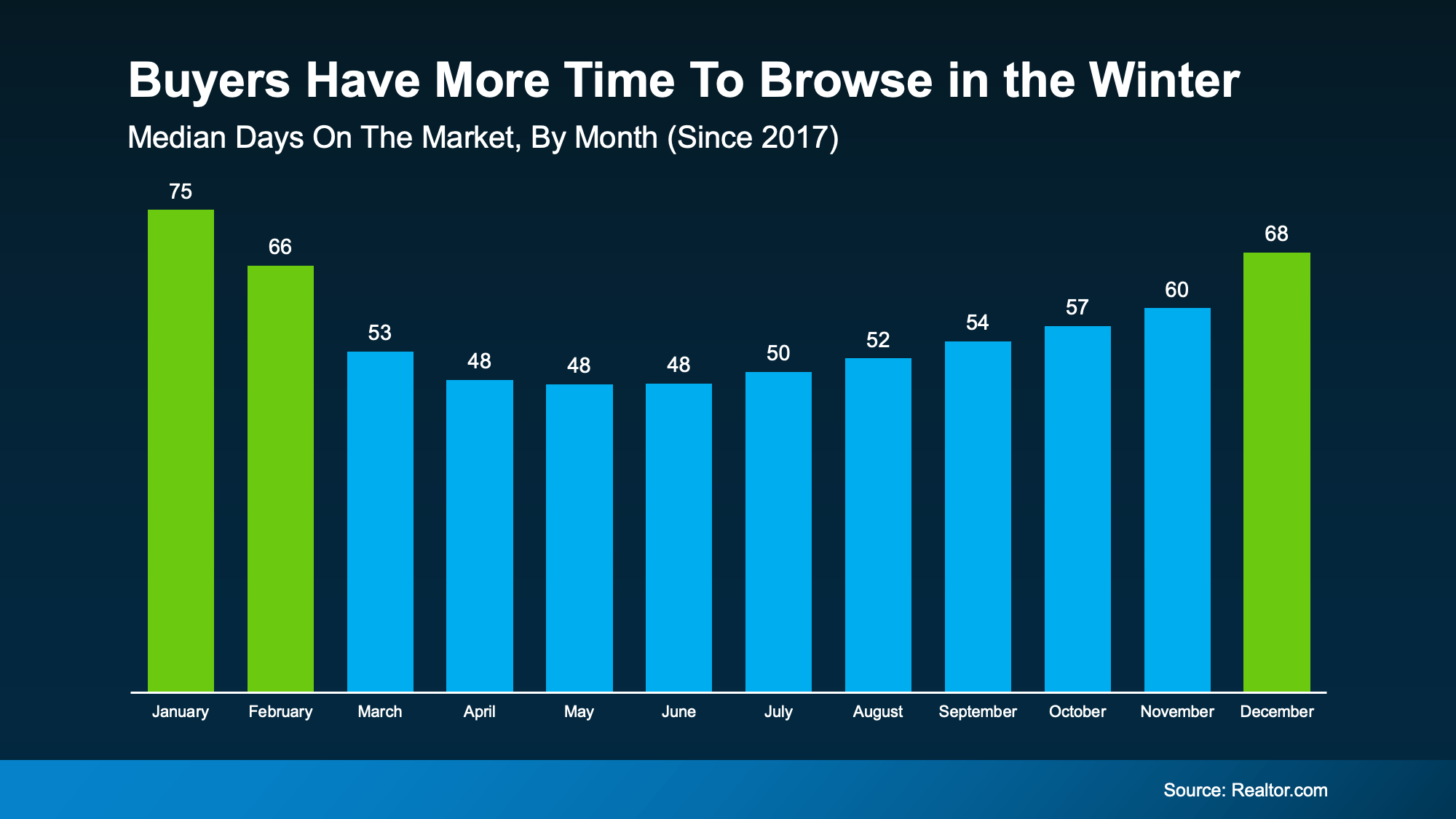

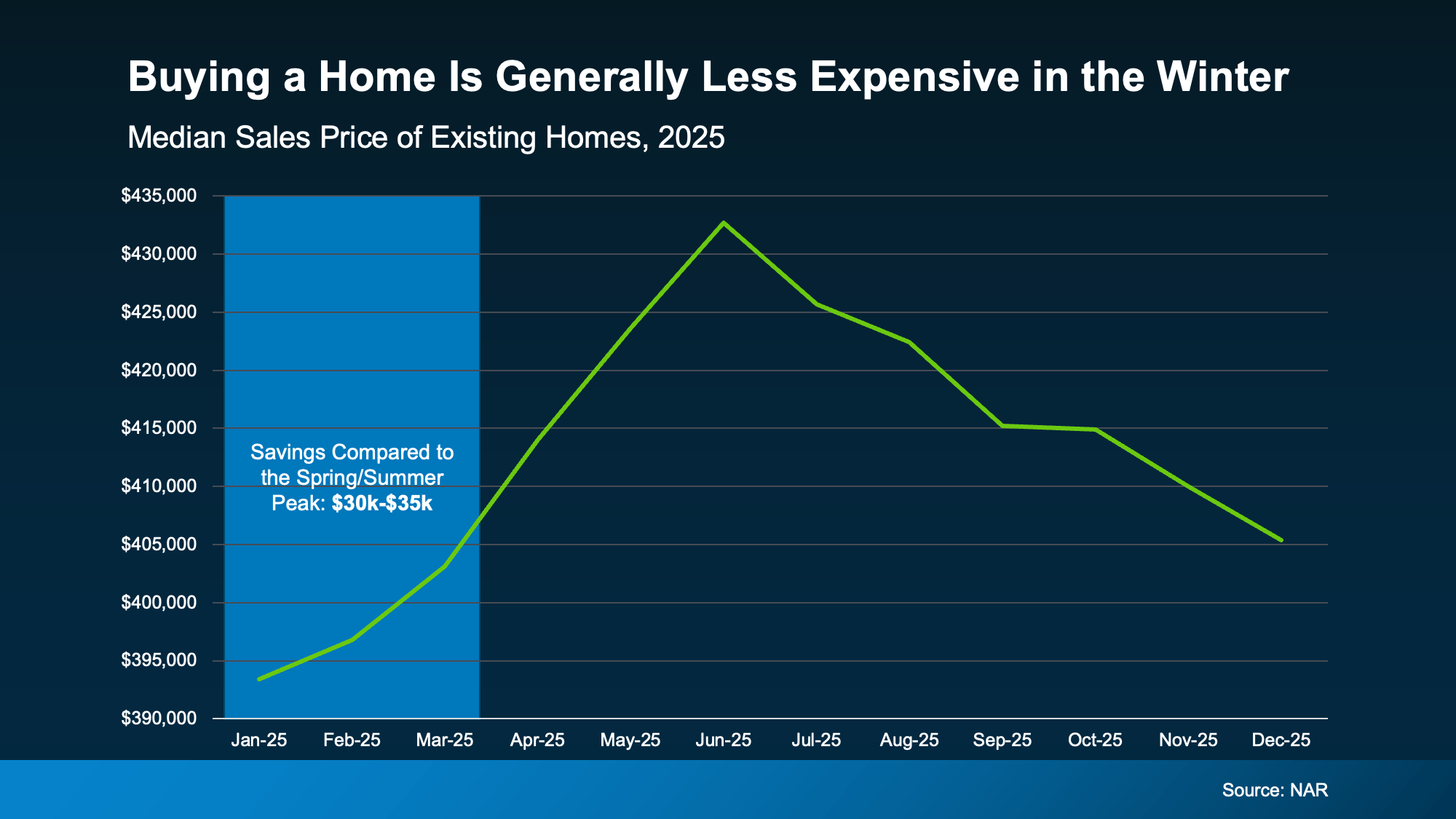

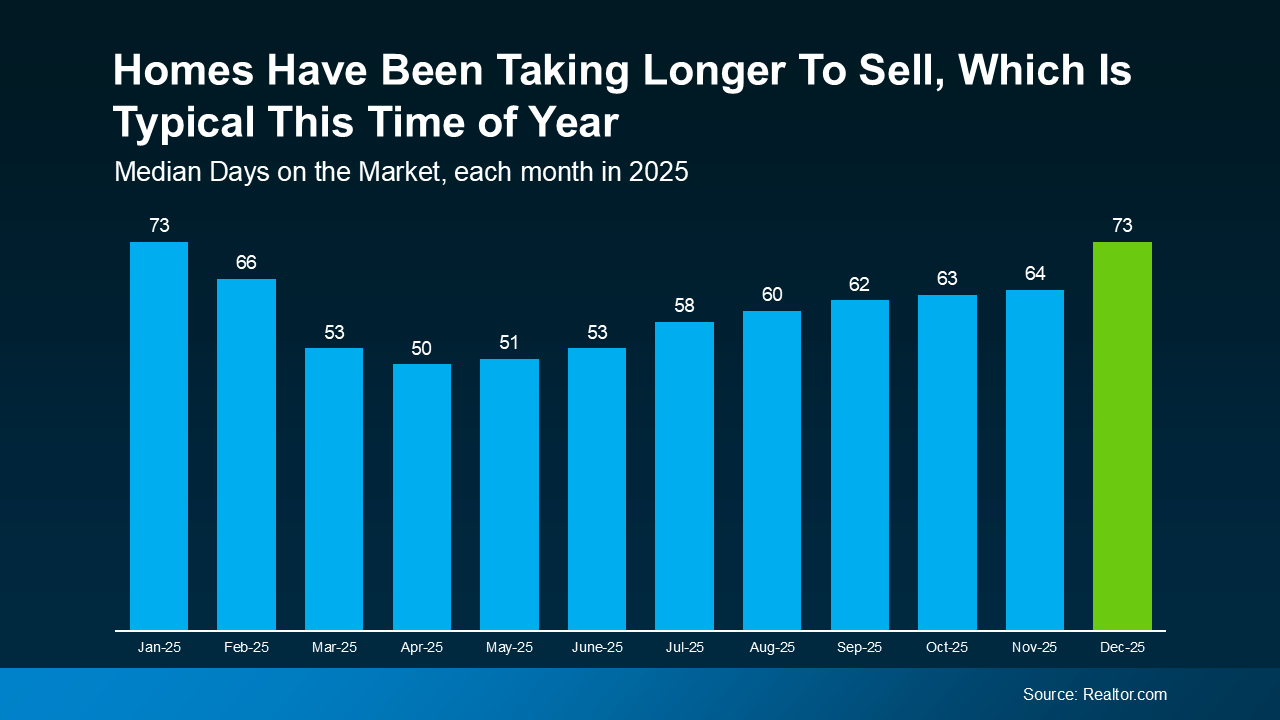

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

So, What Can You Do About It?

So, What Can You Do About It?

You must be logged in to post a comment Login