First Time Home Buyers

3 Benefits to Buying Your Dream Home This Year

First Time Home Buyers

Don’t Let Your Student Loans Delay Your Homeownership Plans

Buying Myths

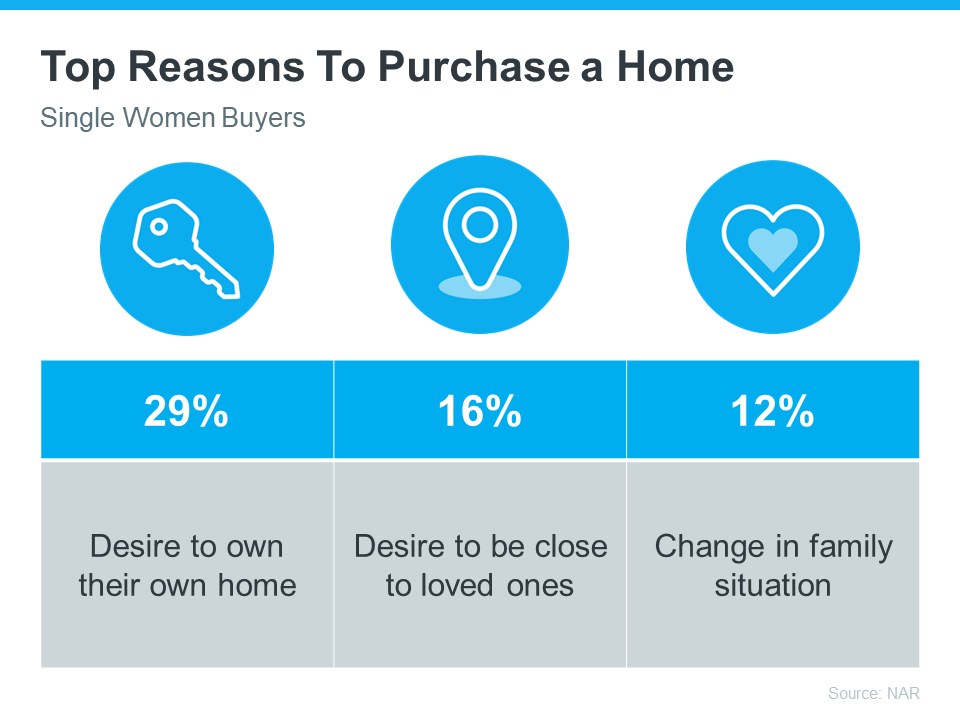

Single Women Are Embracing Homeownership

First Time Home Buyers

3 Helpful Tips for First-Time Homebuyers [INFOGRAPHIC]

-

Infographics2 weeks ago

Infographics2 weeks agoWhy Your Home’s Asking Price Matters More Today

-

Agent Value4 weeks ago

Agent Value4 weeks agoYour House Didn’t Sell. Here’s What To Do Now.

-

For Buyers4 weeks ago

For Buyers4 weeks agoIs Inventory Getting Back To Normal?

-

Downsize4 weeks ago

Downsize4 weeks agoYou May Have Enough Equity To Downsize and Buy Your Next House in Cash

-

For Sellers3 weeks ago

For Sellers3 weeks agoWhy More Sellers Are Choosing To Move, Even with Today’s Rates

-

Infographics3 weeks ago

Infographics3 weeks agoWhat You Really Need To Know About Down Payments

-

Agent Value4 weeks ago

Agent Value4 weeks agoWhy Most Sellers Hire Real Estate Agents Today

-

Buying Tips3 weeks ago

Buying Tips3 weeks ago3 Reasons To Buy a Home This Summer

You must be logged in to post a comment Login