If you’re a homeowner planning to move, you’re probably wondering what the process is going to look like and what you should tackle first:

- Is it better to start by finding your next home?

- Or should you sell your current house before you go out looking?

Ultimately, what’s right for you depends on a lot of factors. And that’s where an agent’s experience can really help make your next step clear.

They know your local market, the latest trends, and what’s working for other homeowners right now. And they’ll be able to make a recommendation based on their expertise and your needs.

But here’s a little bit of a sneak peek. In many cases today, getting your current home on the market first can put you in a better spot. Here’s why that order tends to work best (and how an agent can help).

The Advantages of Selling First

1. You’ll Unlock Your Home Equity

Selling your current home before you try to buy your next one allows you to access the equity you’ve built up – and based on home price appreciation over the past few years, that’s no small number. Data from Cotality (formerly CoreLogic) shows the average homeowner is sitting on $302K in equity today.

And once you sell, you can use that equity to pay for the down payment on your next house (and maybe even more). You could even have enough to buy your next house in cash. That’s a big deal, and it could make your next move a whole lot easier on your wallet.

2. You Won’t Be Juggling Two Mortgages

Trying to buy before you sell means you could wind up holding two mortgages, even if just for a few months. That can get expensive, fast – especially if there are unexpected repairs or delays. Selling first removes that stress and helps you move forward without the financial strain. As Ramsey Solutions says:

“It’s best to sell your old home before buying a new one to avoid unnecessary risks and possible headaches.”

3. You’ll Be in a Stronger Position When You Make an Offer

Sellers love a clean, simple offer. If you’ve already sold your house, you don’t need to make your offer contingent on that sale – and that can help you stand out. Your agent can position your offer to be as strong as possible, so you have the best shot at getting the home you want.

This can be a big advantage in competitive markets where sellers prefer buyers with fewer strings attached.

One Thing To Keep in Mind

But, like with anything in life, there are tradeoffs. As you weigh your options, consider this potential drawback, too:

1. You May Need a Place To Stay (Temporarily)

Once your house sells, you may need a short-term rental or to stay with family until you can move into your next home. Your agent can help you negotiate things like a post-closing occupancy (renting the home from the buyer for a set period) or flexible closing dates to help smooth out that transition as much as possible.

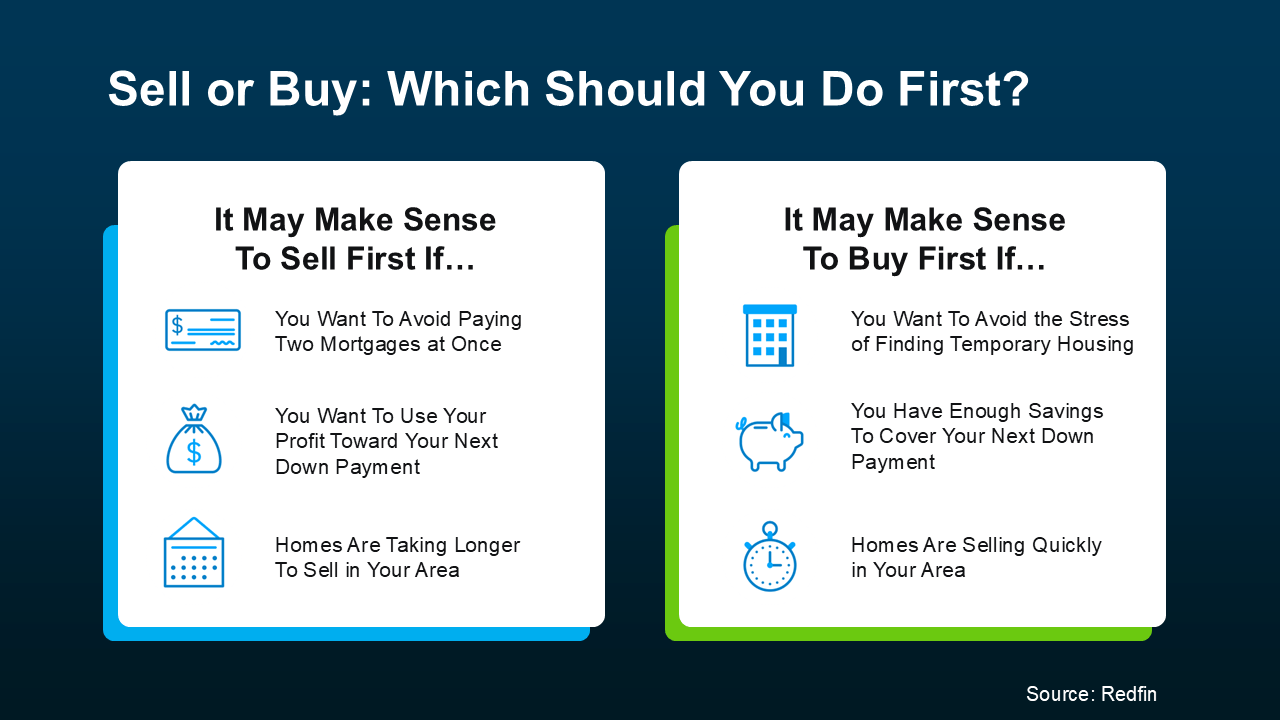

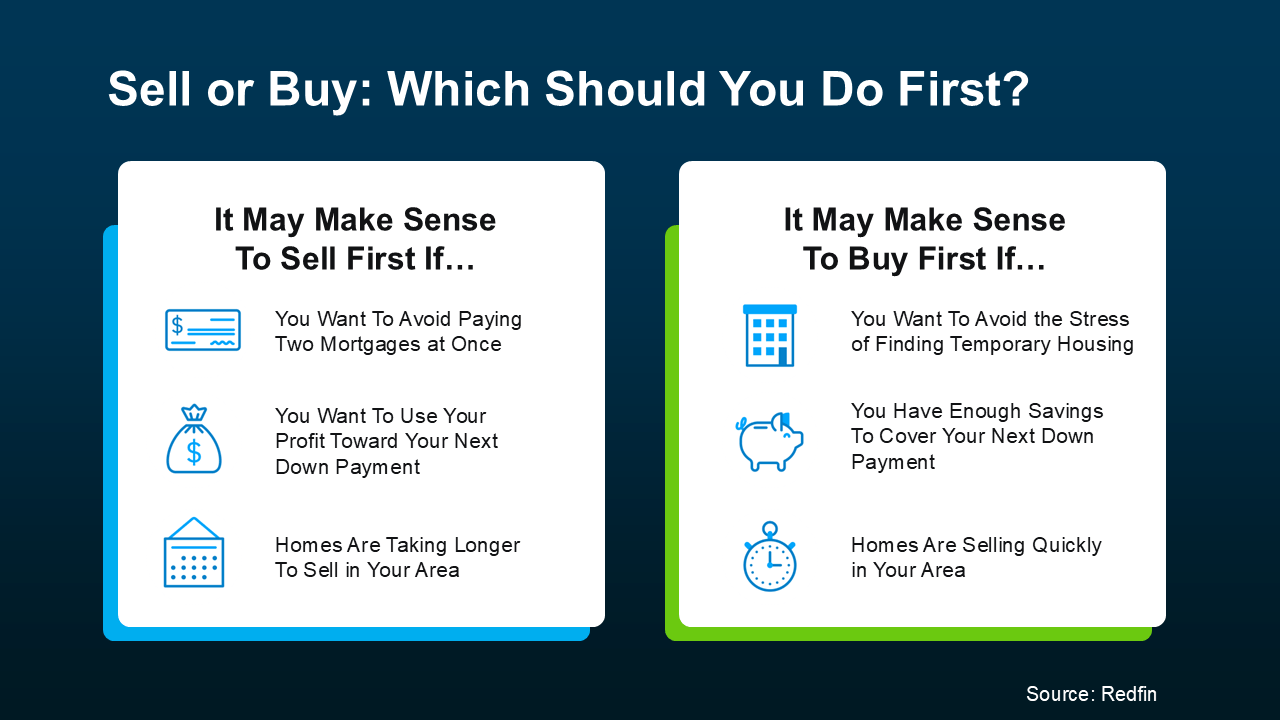

Here’s a simple visual that can help you think through your options (see below):

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

Bottom Line

In many cases, selling first doesn’t just give you clarity, it gives you options. It helps you buy with more confidence, more financial power, and less pressure.

If you’re ready to make a move but not sure where to begin, talk to a local agent. They’ll walk you through your equity, your timing, and your local market so you can decide what’s right for you.

Infographics2 weeks ago

Infographics2 weeks ago

Agent Value4 weeks ago

Agent Value4 weeks ago

For Buyers4 weeks ago

For Buyers4 weeks ago

Downsize4 weeks ago

Downsize4 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

Infographics3 weeks ago

Infographics3 weeks ago

Agent Value3 weeks ago

Agent Value3 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

But the best way to determine what’s best for you and your specific situation? Talk to a trusted local agent.

You must be logged in to post a comment Login