First Time Home Buyers

6 Foundational Benefits of Homeownership Today

First Time Home Buyers

Don’t Let Your Student Loans Delay Your Homeownership Plans

Buying Myths

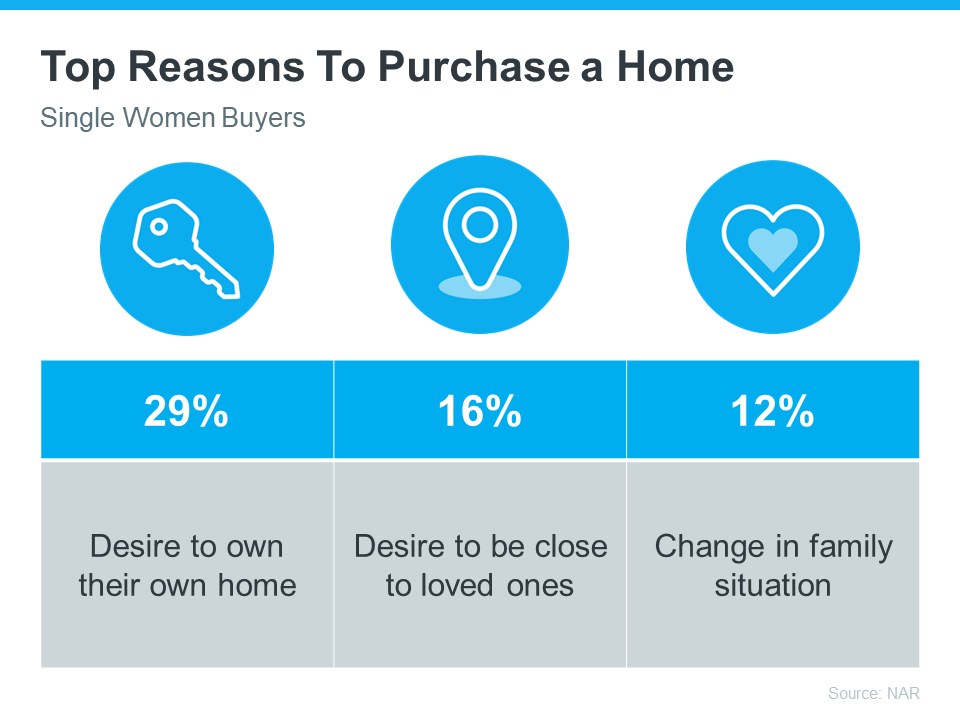

Single Women Are Embracing Homeownership

First Time Home Buyers

3 Helpful Tips for First-Time Homebuyers [INFOGRAPHIC]

-

Infographics2 weeks ago

Infographics2 weeks agoWhy Your Home’s Asking Price Matters More Today

-

Infographics4 weeks ago

Infographics4 weeks agoThe Big Difference Between a Homeowner’s and a Renter’s Net Worth

-

Affordability4 weeks ago

Affordability4 weeks agoBuying Your First Home? FHA Loans Can Help

-

Agent Value3 weeks ago

Agent Value3 weeks agoYour House Didn’t Sell. Here’s What To Do Now.

-

For Buyers4 weeks ago

For Buyers4 weeks agoIs Inventory Getting Back To Normal?

-

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks agoThe Five-Year Rule for Home Price Perspective

-

Downsize3 weeks ago

Downsize3 weeks agoYou May Have Enough Equity To Downsize and Buy Your Next House in Cash

-

For Sellers3 weeks ago

For Sellers3 weeks agoWhy More Sellers Are Choosing To Move, Even with Today’s Rates

You must be logged in to post a comment Login