Buying Myths

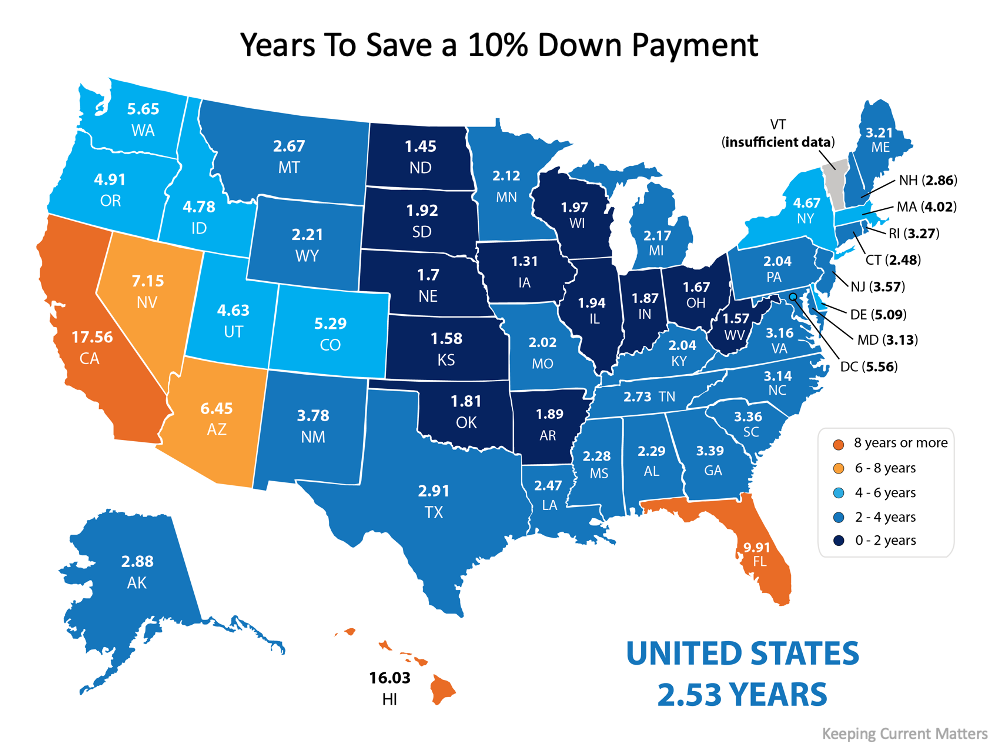

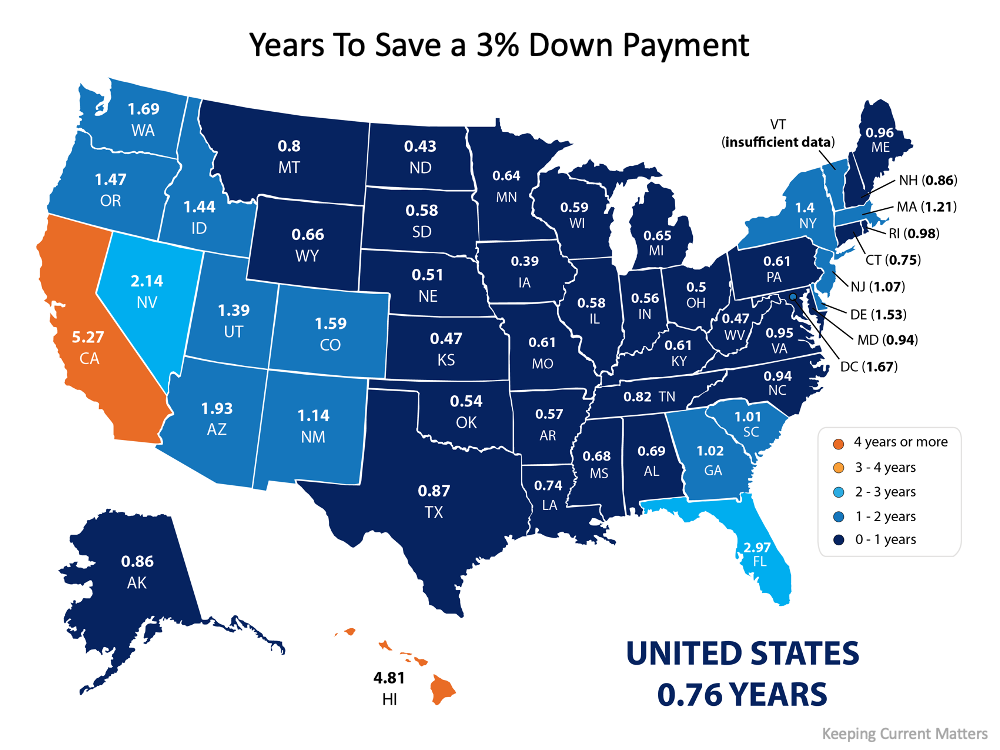

How Much Time Do You Need To Save for a Down Payment?

Buying Myths

Top 5 Reasons To Hire an Agent When Buying a Home [INFOGRAPHIC]

Buying Myths

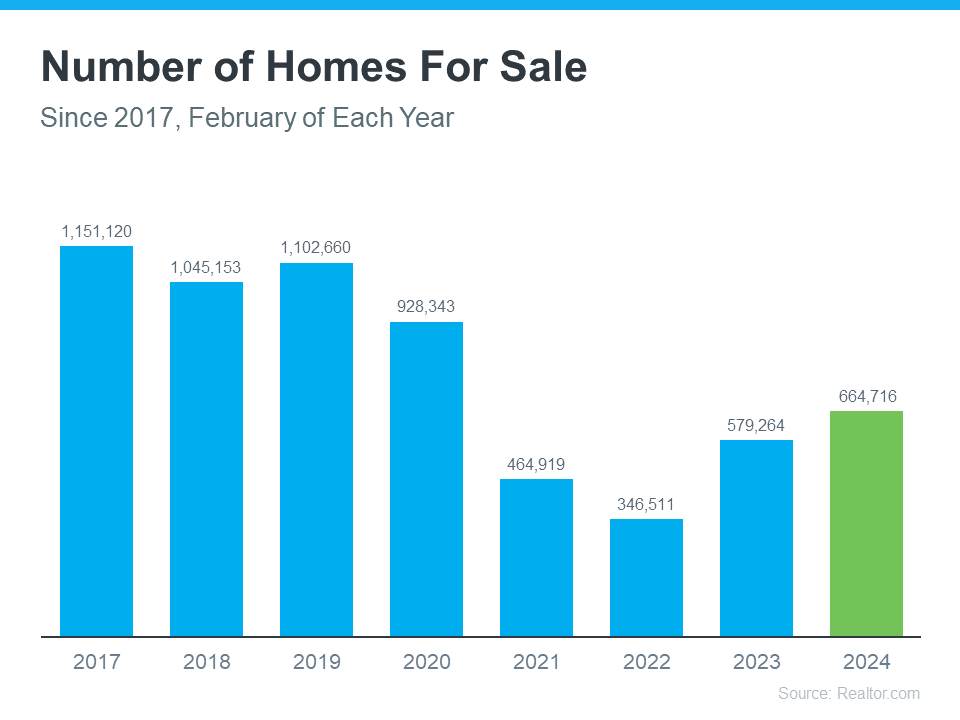

Is It Easier To Find a Home To Buy Now?

Buying Myths

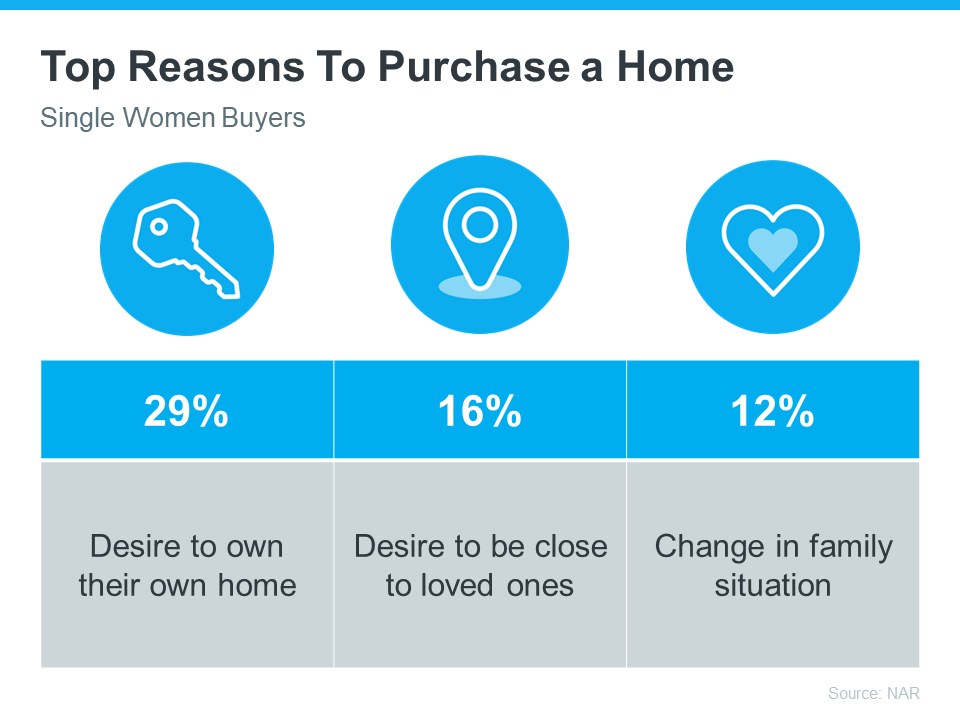

Single Women Are Embracing Homeownership

-

Buying Tips4 weeks ago

Buying Tips4 weeks agoThe Difference Between an Inspection and an Appraisal

-

For Sellers4 weeks ago

For Sellers4 weeks agoWhat To Do When Your House Didn’t Sell

-

Forecasts4 weeks ago

Forecasts4 weeks agoHousing Market Forecast for the 2nd Half of 2024 [INFOGRAPHIC]

-

Buying Tips4 weeks ago

Buying Tips4 weeks agoReal Estate Still Holds the Title of Best Long-Term Investment

-

Equity3 weeks ago

Equity3 weeks agoHomeowners Gained $28K in Equity over the Past Year

-

For Sellers3 weeks ago

For Sellers3 weeks agoWhy Your Asking Price Matters Even More Right Now

-

Agent Value2 weeks ago

Agent Value2 weeks agoThe Price of Perfection: Don’t Wait for the Perfect Home

-

Economy3 weeks ago

Economy3 weeks agoNot a Crash: 3 Graphs That Show How Today’s Inventory Differs from 2008

You must be logged in to post a comment Login