First Time Home Buyers

The Difference in Net Worth Between Homeowners and Renters Is Widening

First Time Home Buyers

Don’t Let Your Student Loans Delay Your Homeownership Plans

Buying Myths

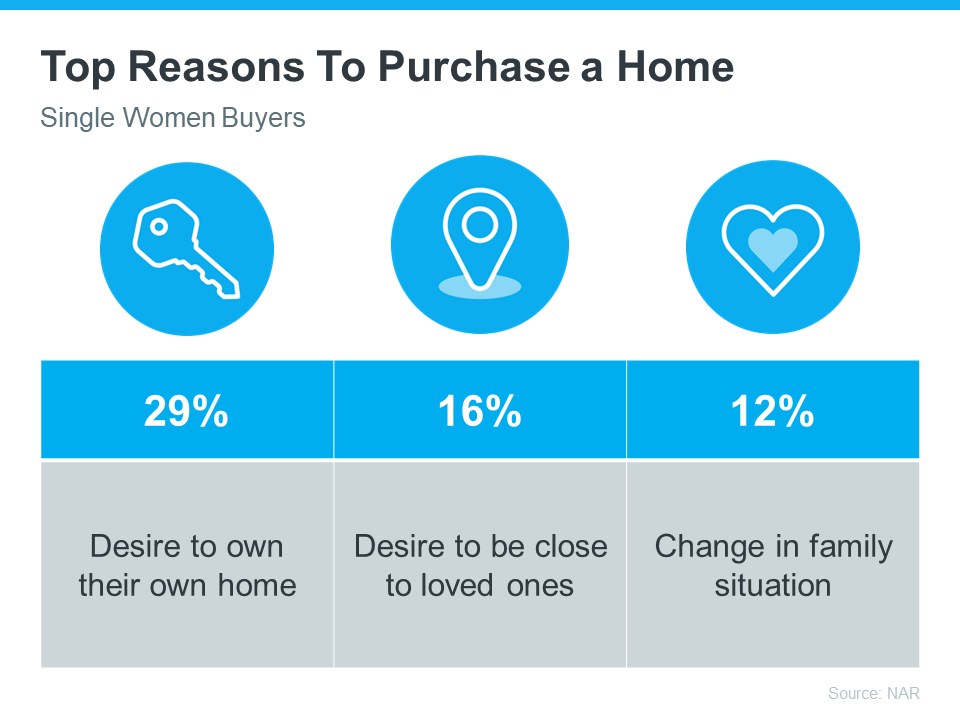

Single Women Are Embracing Homeownership

First Time Home Buyers

3 Helpful Tips for First-Time Homebuyers [INFOGRAPHIC]

-

Infographics3 weeks ago

Infographics3 weeks agoWhy Your Home’s Asking Price Matters More Today

-

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks agoWhy Homeownership Is Going To Be Worth It

-

Economy3 weeks ago

Economy3 weeks agoThink It’s Better To Wait for a Recession Before You Move? Think Again.

-

Buying Tips4 weeks ago

Buying Tips4 weeks ago3 Reasons To Buy a Home This Summer

-

For Sellers3 weeks ago

For Sellers3 weeks agoWhat Every Homeowner Needs To Know In Today’s Shifting Market

-

Affordability3 weeks ago

Affordability3 weeks agoMulti-Generational Homebuying Hit a Record High – Here’s Why

-

For Sellers2 weeks ago

For Sellers2 weeks agoThink No One’s Buying Homes Right Now? Think Again.

-

Infographics2 weeks ago

Infographics2 weeks agoTop 5 Reasons To Hire a Real Estate Agent When You Sell

You must be logged in to post a comment Login