Buying Myths

Is a 20% Down Payment Really Necessary To Purchase a Home?

Buying Myths

Top 5 Reasons To Hire an Agent When Buying a Home [INFOGRAPHIC]

Buying Myths

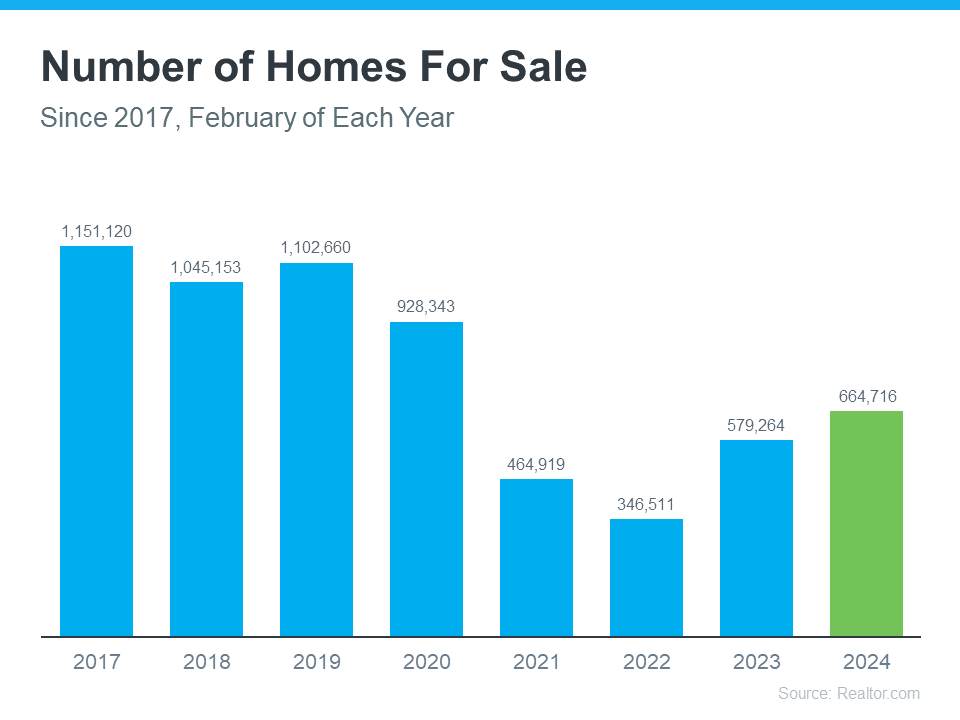

Is It Easier To Find a Home To Buy Now?

Buying Myths

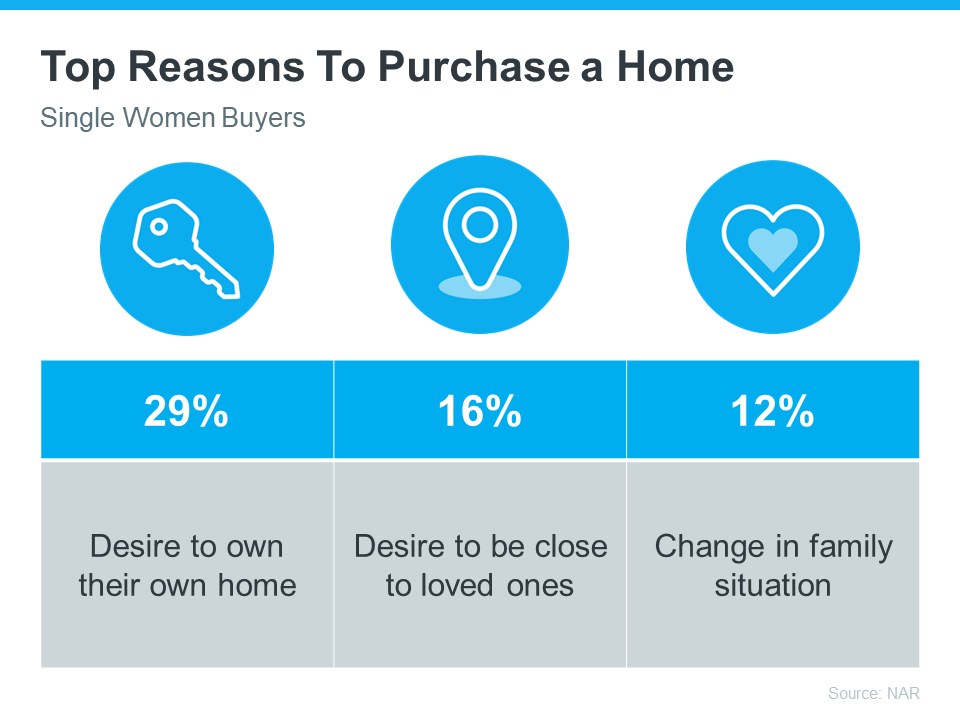

Single Women Are Embracing Homeownership

-

Infographics3 weeks ago

Infographics3 weeks agoWhy Your Home’s Asking Price Matters More Today

-

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks agoWhy Homeownership Is Going To Be Worth It

-

Economy3 weeks ago

Economy3 weeks agoThink It’s Better To Wait for a Recession Before You Move? Think Again.

-

Buying Tips4 weeks ago

Buying Tips4 weeks ago3 Reasons To Buy a Home This Summer

-

For Sellers3 weeks ago

For Sellers3 weeks agoWhat Every Homeowner Needs To Know In Today’s Shifting Market

-

Affordability3 weeks ago

Affordability3 weeks agoMulti-Generational Homebuying Hit a Record High – Here’s Why

-

For Sellers2 weeks ago

For Sellers2 weeks agoThink No One’s Buying Homes Right Now? Think Again.

-

Infographics2 weeks ago

Infographics2 weeks agoTop 5 Reasons To Hire a Real Estate Agent When You Sell

You must be logged in to post a comment Login