Who doesn’t love a top 10 list? Well, here are two top 10 lists for the housing market this year. But before you take a look, there’s something you should know.

If a move is on your radar for 2026, here’s the most important thing you need to understand upfront: there isn’t one housing market this year – there are many.

Experts agree 2026 is shaping up to be one of the most geographically split housing markets in years. Some areas are tilting in favor of sellers, while others are opening real doors for buyers. Who has the advantage depends almost entirely on where you are. Selma Hepp, Chief Economist at Cotality, puts it this way:

“Looking ahead to 2026, regional differences will remain pronounced, with demand favoring areas that offer both economic opportunity and relative affordability.”

To show just how divided the landscape is, here’s a look at where sellers are expected to have the upper hand, and where first-time buyers may finally find their opening this year.

Where Sellers Are Poised To Win Big in 2026

Zillow identified the following metros as some of the strongest seller markets for 2026, based on buyer demand, pricing momentum, and how quickly homes are expected to sell:

In markets like these, buyers are going to be competing for limited inventory, which gives sellers more leverage.

In markets like these, buyers are going to be competing for limited inventory, which gives sellers more leverage.

Homeowners in seller’s markets this year can expect:

That doesn’t mean every listing is guaranteed success. But it does mean sellers who prepare well and lean on an agent’s expertise should be very happy with their results in 2026.

Markets Where There’s More Opportunity for First-Time Buyers

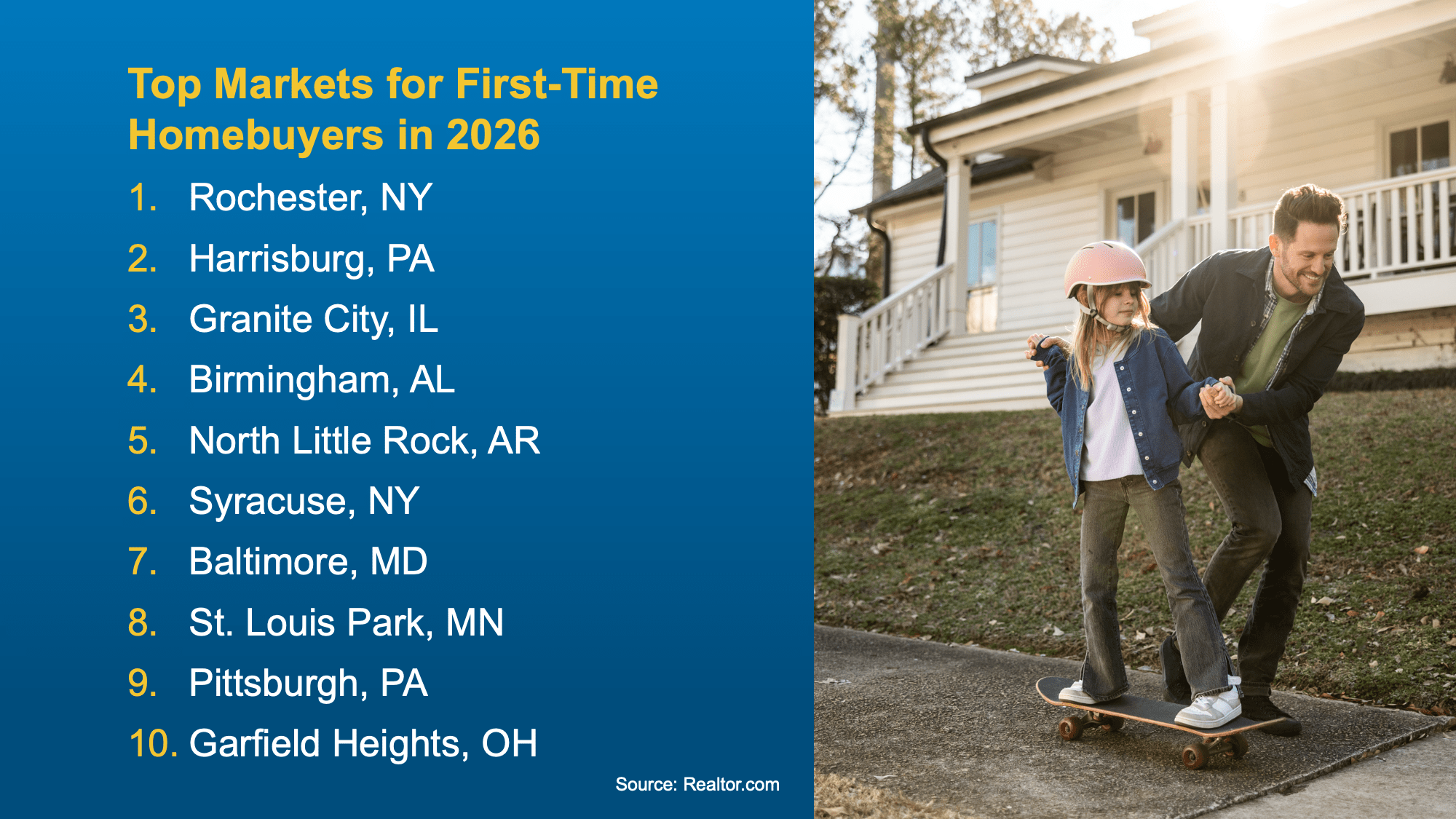

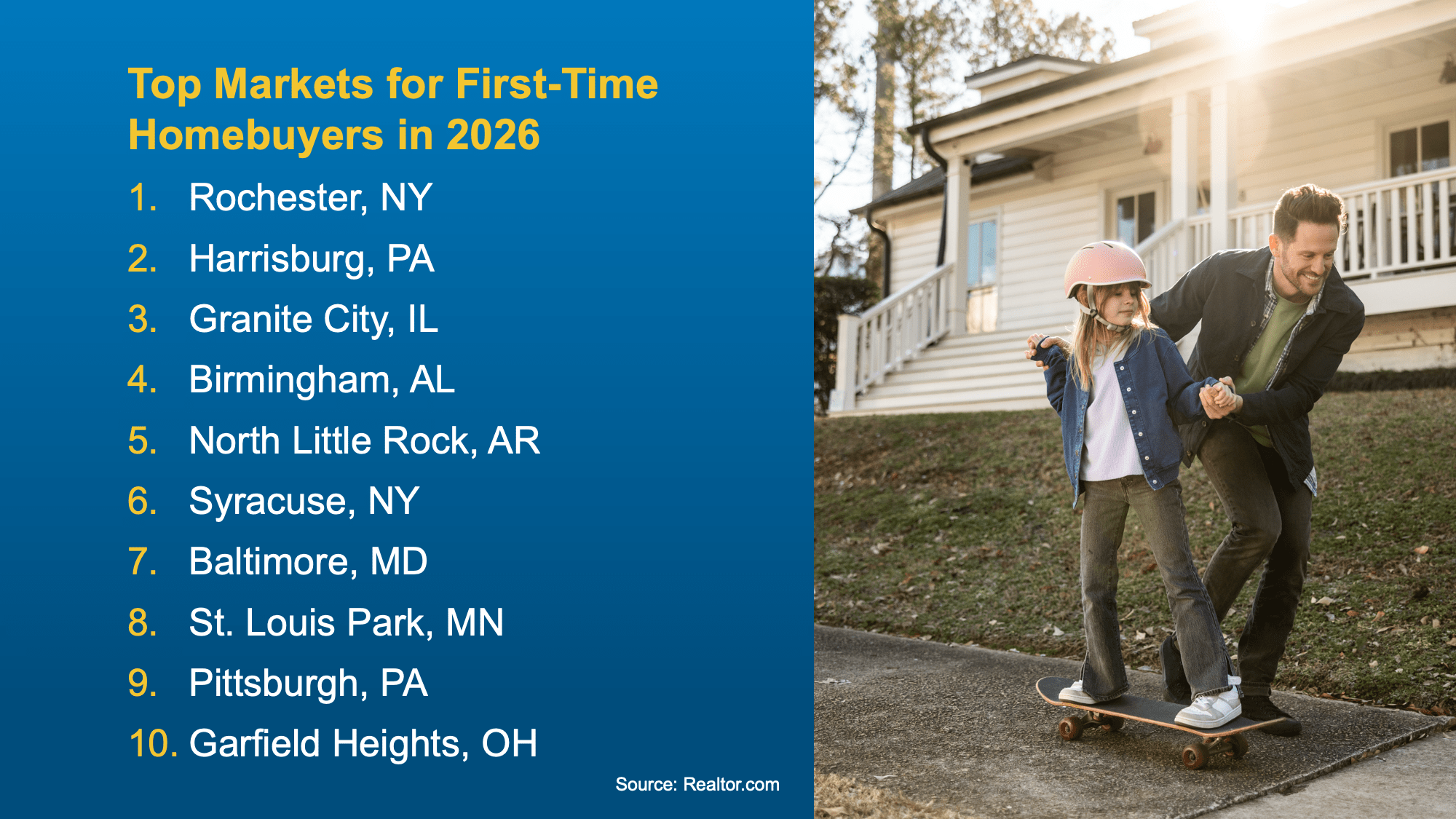

On the flip side, here’s a look at where buyers have the power – in particular, first-time buyers, since they’ve had the hardest time breaking into the market lately. Realtor.com highlights the top metros where first-time buyers are expected to have better opportunities in 2026:

These markets stand out for a mix of:

These markets stand out for a mix of:

-

More affordable home prices

-

Better housing availability

-

Strong local amenities and economic health

For first-time buyers, that combination matters. It’s what could finally turn “someday” into “this could actually work.” In buyer’s markets, they should expect:

What Matters More Than Any Top 10 List

Not seeing your city on the list? Don’t stress. This is just a national snapshot, not a judgment on your local market. The goal here is just to show you how different the market really is depending on where you are.

And remember, you can buy or sell no matter how your local market leans. You just need an agent’s help to figure out the right strategy to get it done. For example:

To find out where your market falls and what you should expect, you’ll want the help of a local expert.

Bottom Line

The housing market in 2026 isn’t one-size-fits-all. It’s a year where local conditions matter more than ever.

Whether your market leans more buyer-friendly or seller-friendly, the right strategy can put you in a strong position. And that’s where a local expert comes in. Connect with a trusted real estate agent today.

Buying Tips4 weeks ago

Buying Tips4 weeks ago

For Sellers4 weeks ago

For Sellers4 weeks ago

First-Time Buyers3 weeks ago

First-Time Buyers3 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

For Sale by Owner3 weeks ago

For Sale by Owner3 weeks ago

So, What Can You Do About It?

So, What Can You Do About It?

You must be logged in to post a comment Login