These days, you’re going to want to get your price right when you get ready to sell your house. Honestly, it’s more important than ever. Why? While you may want to list high just to see what happens, that’s a plan that can easily backfire, and it’s going to cost you in today’s market.

And the risk isn’t just missing out on offers, it’s missing out on the move you needed to make in the first place.

The Real Pitfall of Overpricing

Many homeowners remember what their neighbor’s house sold for a few years ago, and they want to chase that same sky-high number. The problem is, that was a different market.

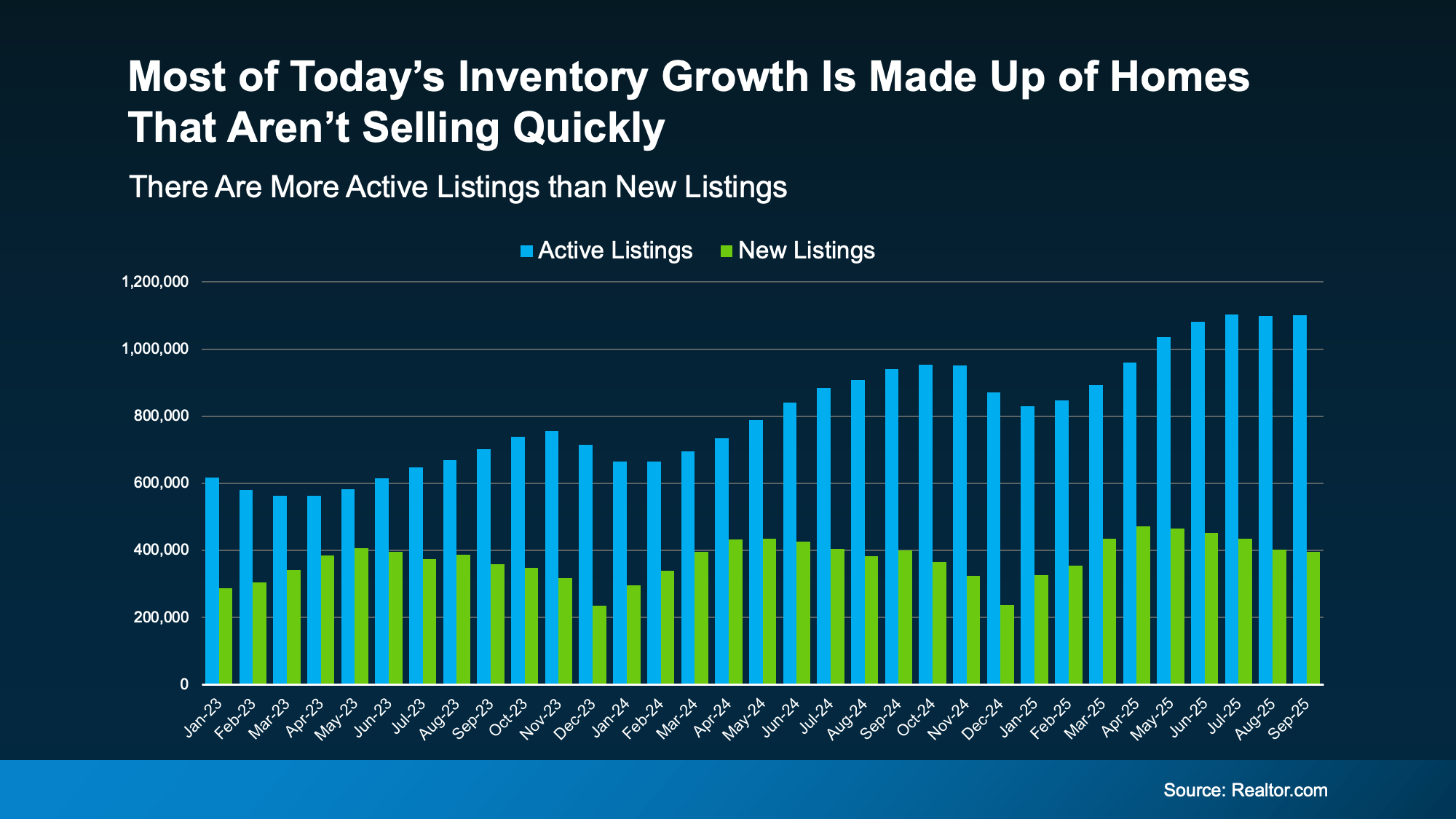

Today, there are more homes for sale. Buyers have more options to choose from. They don’t have to get into bidding wars where they offer way over asking just to compete. Now they can come in at, or even below, list price. And if you’re not open to that, they’ll move on. Lisa Sturtevant, Chief Economist at Bright MLS, explains:

“Buyers will have more leverage in many, but not all, markets. Sellers will need to adjust price expectations to reflect the transitioning market.”

But here’s the good news. You still have one big advantage as a seller. According to the Federal Housing Finance Agency (FHFA), home values went up by a staggering 54% over the last 5 years. So, even if you compromise just a little bit on your sale price today, odds are you’ll still come out way ahead.

The challenge? Most sellers aren’t thinking about it that way. They’re stuck on what a neighbor got months or years ago – and that’s a costly mistake.

Overpricing Can Stall Your Whole Move

Here’s what happens. A seller lists too high. Buyers stay away. No offers come in. The house sits. And suddenly, that seller is facing a tough decision. Do they cut the price? Stick it out? Or give up altogether?

Unfortunately, a late price cut may not be enough. Buyers often see that as a red flag that something’s wrong with the house. That’s why some sellers are opting to just pull their listing off the market entirely.

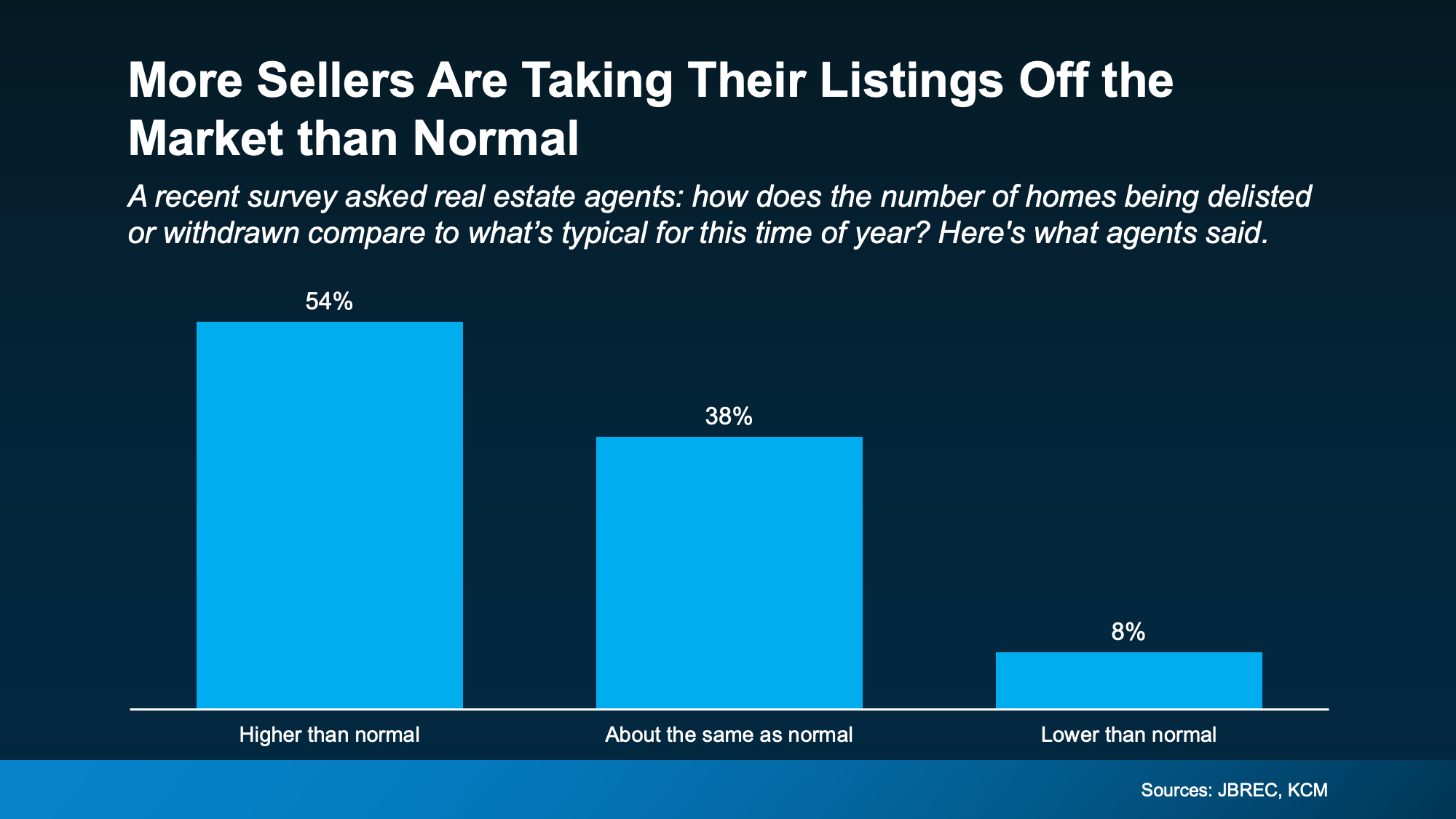

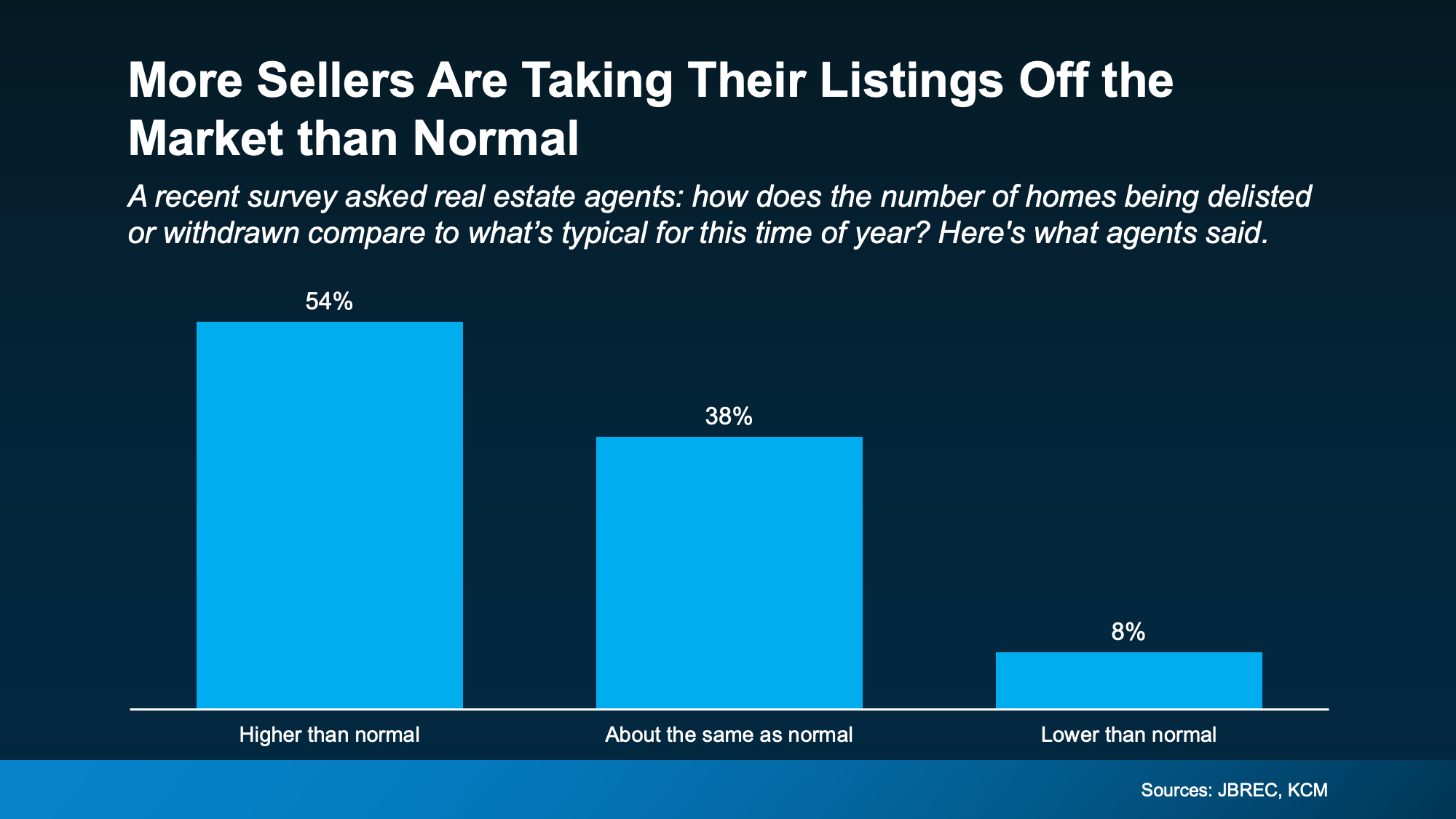

In a recent survey from John Burns Research and Consulting (JBREC) and Keeping Current Matters (KCM) over half of agents (54%) say there are more homes being taken off the market than usual.

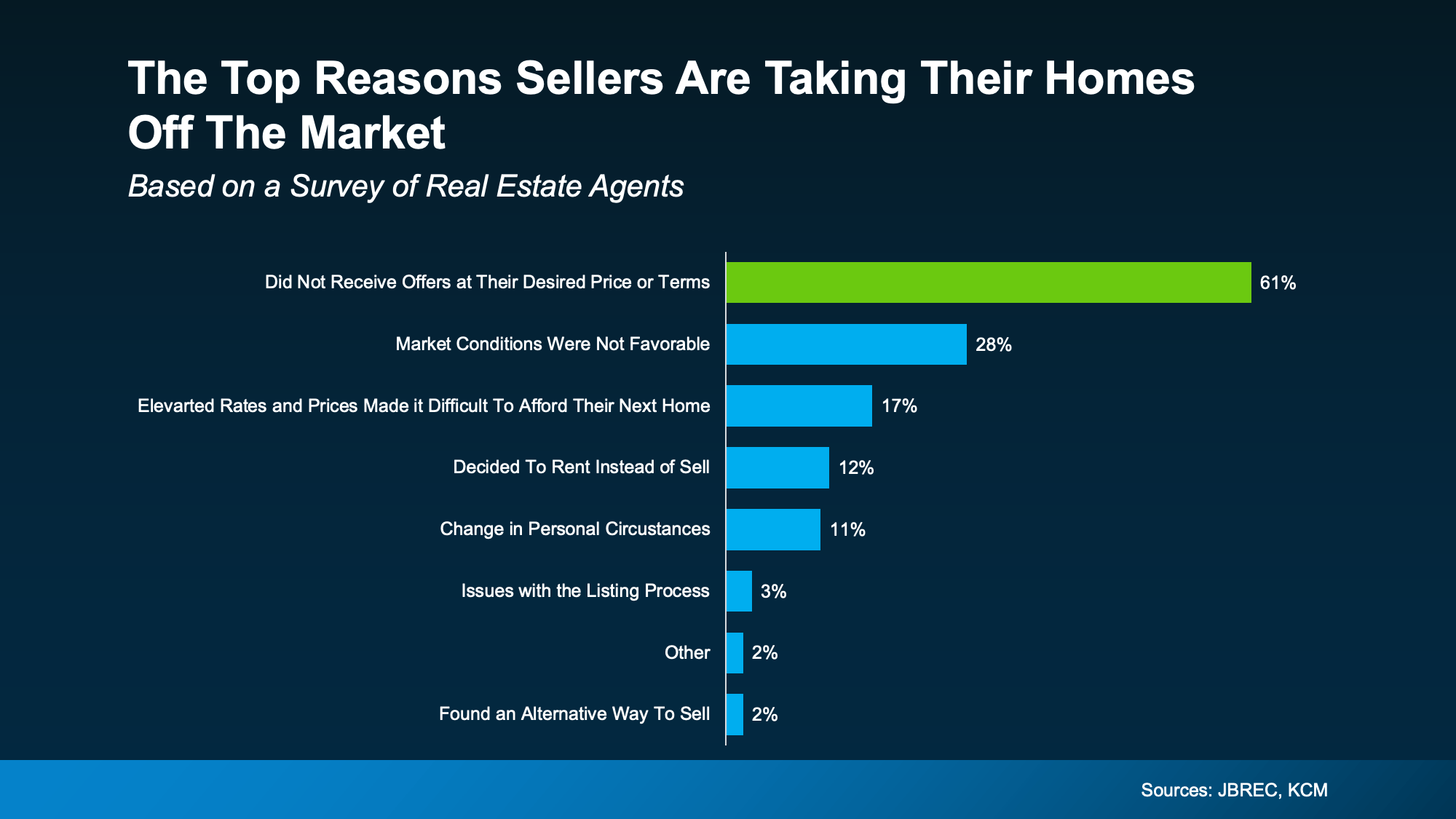

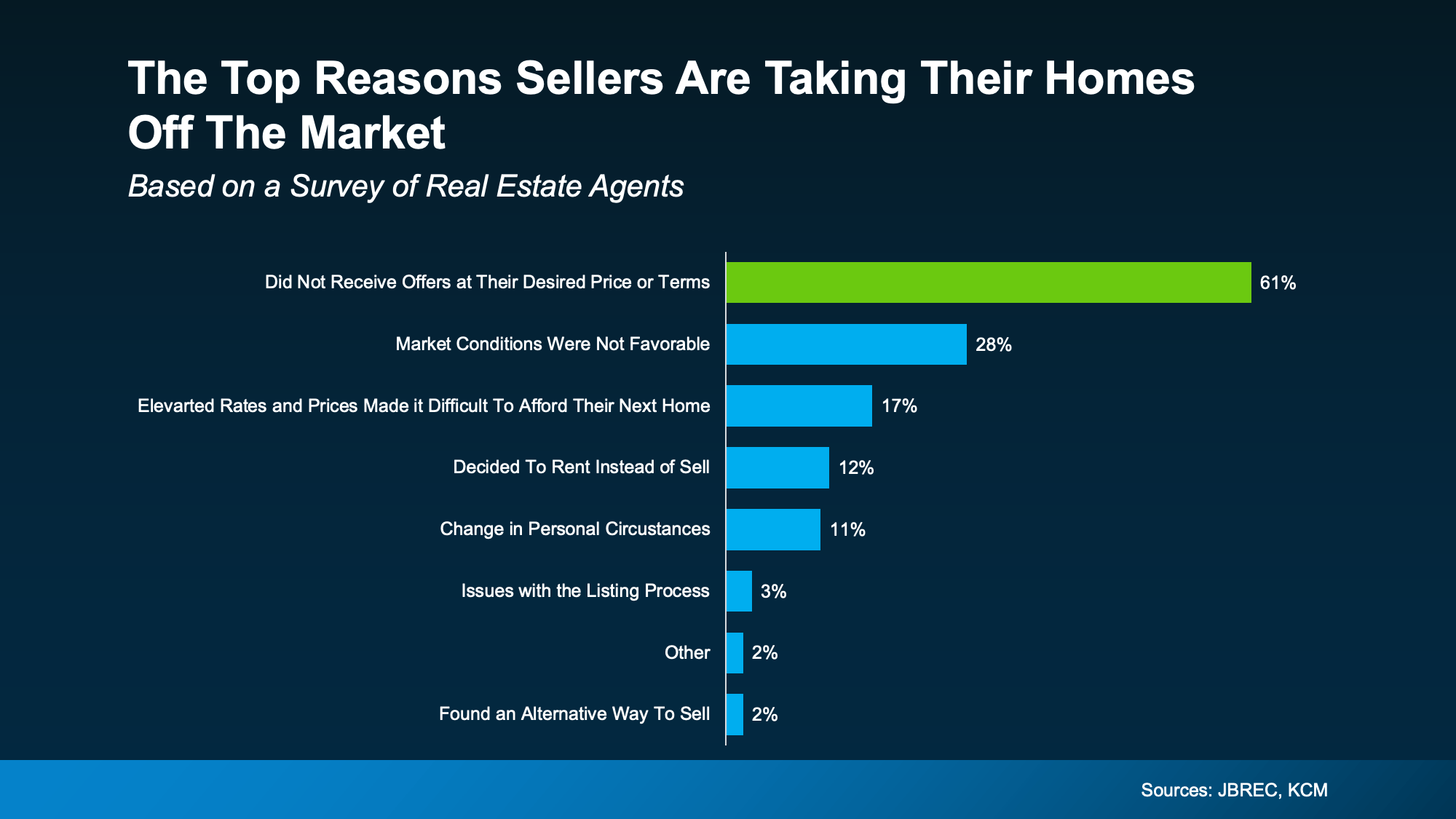

And the top reasons for that? According to the agents, homeowners didn’t get any offers they felt were fair. The survey from JBREC and KCM explains it like this:

And the top reasons for that? According to the agents, homeowners didn’t get any offers they felt were fair. The survey from JBREC and KCM explains it like this:

“Sellers holding onto high price expectations is the leading reason they are delisting their homes.”

BrightMLS data backs this up:

BrightMLS data backs this up:

“. . . sellers are delisting after having their home on the market and finding they are not getting the price they hoped for.”

It’s more proof pricing too high does more than turn buyers away, it puts your whole move at risk. Because if no one looks at your home or makes an offer, how are you going to sell it?

The Secret To Making Your Move Happen

If you’re selling to relocate for a job, need more space for your growing family, or have to be closer to your relatives as they age, you can’t afford to get stuck. You need a pricing strategy that helps you move forward – and that starts with the right agent.

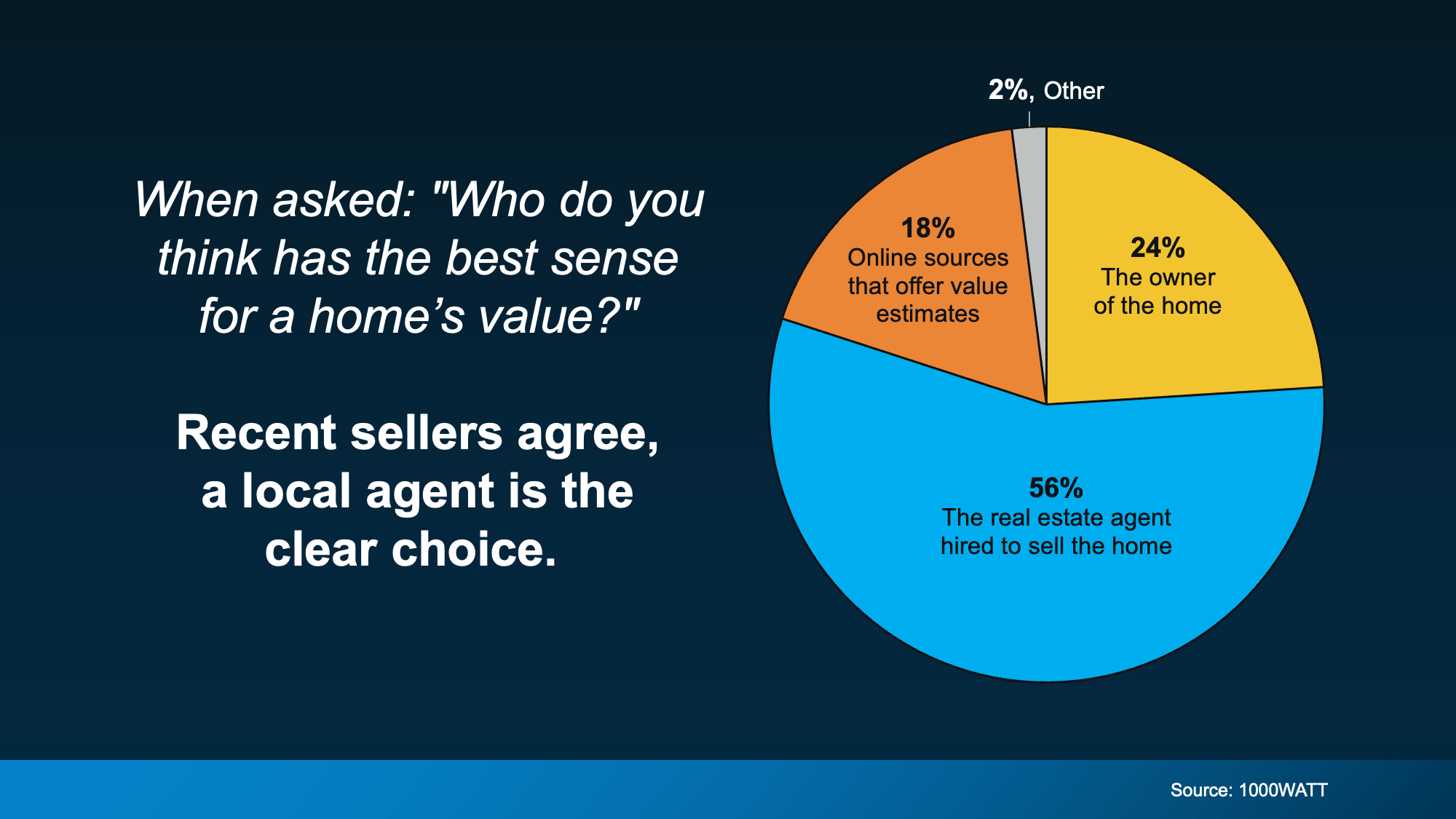

The sellers who are winning right now are the ones working with experienced local agents who know the current market and aren’t afraid to have honest conversations about price.

And it’s paying off. In the right price range and condition, homes are still selling fast, sometimes even with multiple offers.

Bottom Line

Pricing your house for today’s market isn’t just about getting it sold. It’s about making sure your move doesn’t stall before it starts.

Talk to an agent about what buyers are really paying right now in your area, and how to price your home to match.

Affordability4 weeks ago

Affordability4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Equity3 weeks ago

Equity3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Affordability1 week ago

Affordability1 week ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

BrightMLS

BrightMLS

You must be logged in to post a comment Login