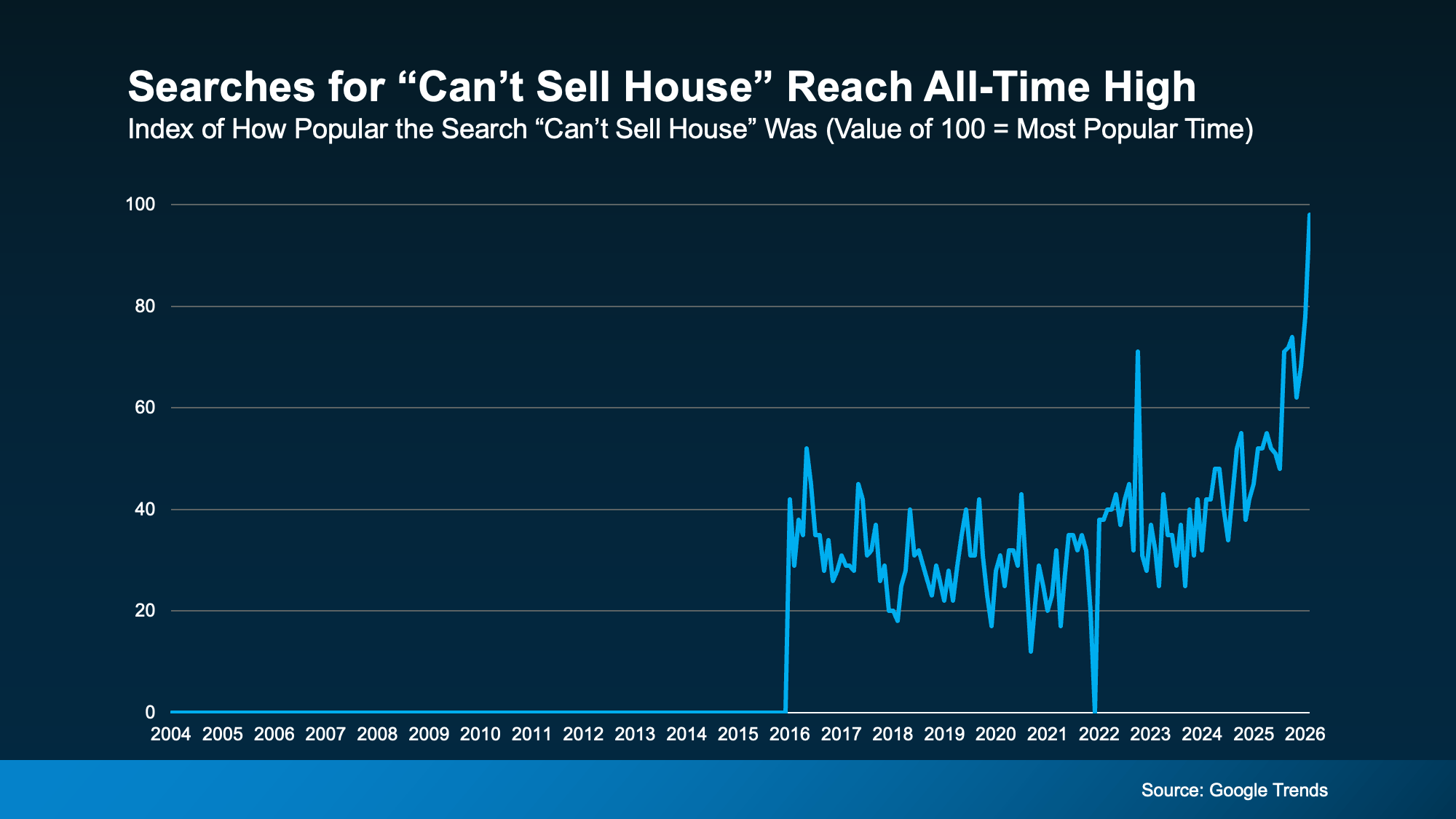

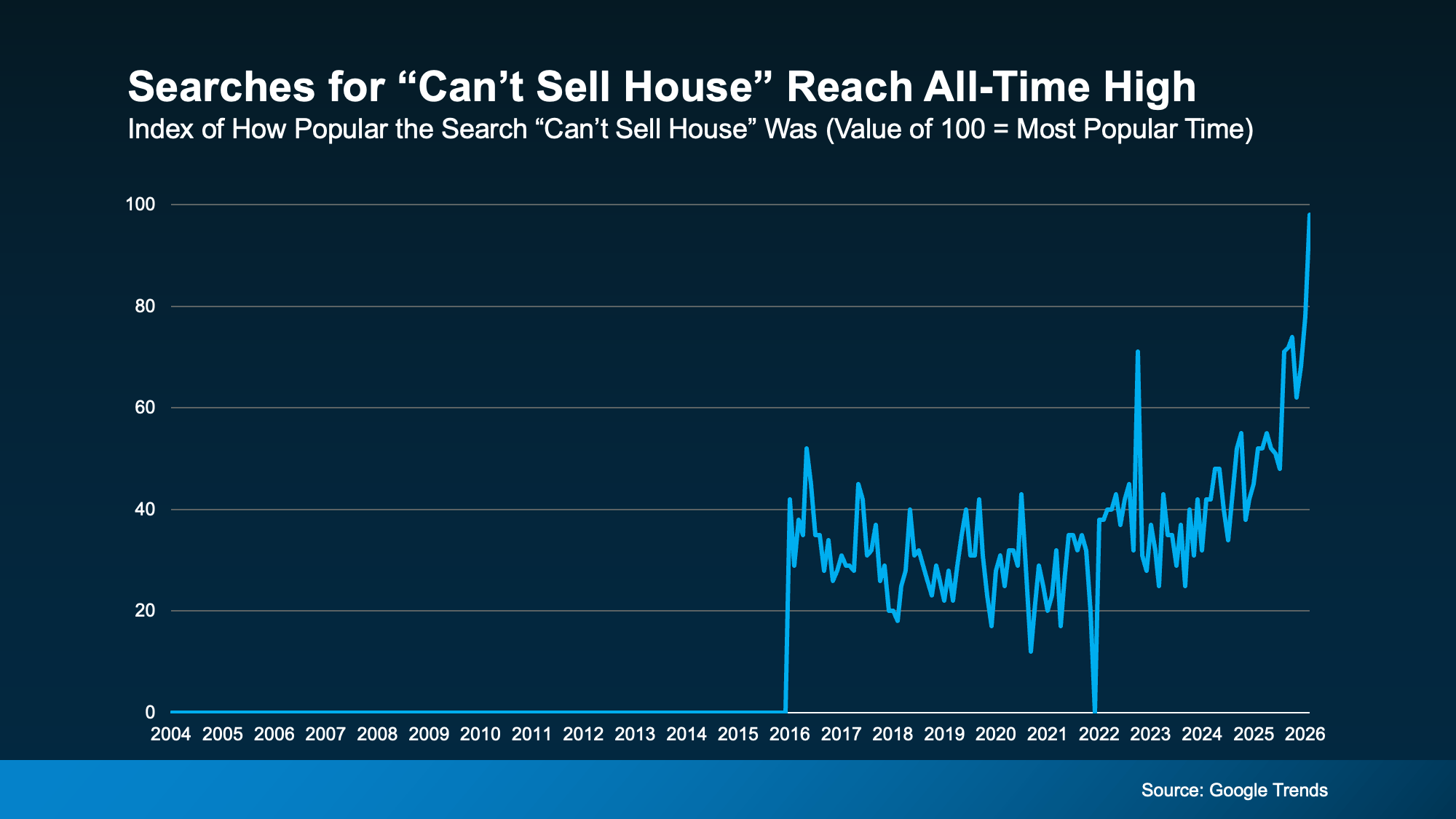

Online searches for “can’t sell house” just hit an all-time high according to Google Trends. So, if your house has been sitting on the market without any bites, you’re not the only one. But it’s also not the end of the road.

Homes are selling every day, so you can turn this around. You just need to take another look at your approach.

If you’re feeling this pain, know this: an online search engine isn’t where you should go for your answers. It’s much better to talk to your agent. Because a search engine doesn’t know your market or your house. But your agent does.

If you’re feeling this pain, know this: an online search engine isn’t where you should go for your answers. It’s much better to talk to your agent. Because a search engine doesn’t know your market or your house. But your agent does.

While a quick search or an AI platform may give you some tips on what to try, only an expert agent can actually diagnosis what’s going on – and how to fix it.

For example, your agent knows most homes that struggle to sell today are usually being held back by one (or more) of these three things.

1. Presentation: Buyers Will Compare Everything

When inventory was tight a few years ago, buyers overlooked imperfections because they had to, or they’d lose out to another bidder. Now? That’s no longer the case.

Today’s buyers scroll through dozens of listings in just minutes. They compare condition, updates, lighting, finishes, layout, and more – all side by side. If your home feels dated, cluttered, or in need of repairs, buyers will notice and it’ll knock your house right off their list of contenders.

This doesn’t mean you need a full renovation. But it does mean first impressions matter again. To compete today, you need curb appeal. Clean spaces. Neutral colors. Professional photos. If there are scuffs on the walls, obvious repairs, or too many outdated features, it could be what’s holding you back.

2. Pricing: If the Price Isn’t Compelling, It’s Not Selling

This is maybe the hardest one to hear, but what your neighbor sold their house for a few years ago isn’t necessarily the same price you’ll get today. As Selma Hepp, Chief Economist at Cotality, says:

“For sellers, the days of pricing aggressively and expecting instant offers are largely over. Homes that are well-priced and well-presented will still sell, but pricing discipline matters more than it did during boom years.”

Buyers are budget-conscious right now. If your home is priced based on outdated expectations instead of current demand, buyers may still look at your house online… but they likely won’t write an offer. Or, they’ll make an offer that you think is too low.

Pricing too high for this market is one of the top things sellers miss the mark on today. And those who aren’t willing to meet the market where it is or entertain offers may feel stuck.

3. Access: If Buyers Can’t See It, They Can’t Buy It

It sounds obvious but limited showing availability can kill your momentum. If your house isn’t easy to see because you’re restricting showings to evenings only, no weekends, or requiring a 24-hour notice, you’re cutting your buyer pool down by more than you may realize.

And the more friction you create, the fewer buyers walk through the door.

In a market where buyers have more options, the last thing you want to do is give them a reason to skip your house. Availability matters because if no one sees it, no one buys it.

Don’t Let Search Results Decide Your Next Step

When your house isn’t selling, it’s tempting to spiral and wonder if it’s the market or if something’s wrong with your house. But instead of searching for answers online, here’s what to do.

Sit down with your agent and ask three honest questions:

- What are buyers looking for in today’s market?

- What feedback are we getting from showings?

- Why do you think my house hasn’t sold yet?

That conversation will bring a lot more clarity than any search engine results.

Bottom Line

If your listing feels stuck, it’s not a sign you shouldn’t sell. It’s the market giving you feedback. And feedback is powerful when you use it.

Start with a real conversation with a real agent about what’s working and what’s not. Your agent will be able to tell you which small adjustments could totally change the momentum. Because in this market, the sellers who adapt are the ones who move.

Affordability2 weeks ago

Affordability2 weeks ago

Equity4 weeks ago

Equity4 weeks ago

For Buyers4 weeks ago

For Buyers4 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

Equity2 weeks ago

Equity2 weeks ago

Agent Value3 weeks ago

Agent Value3 weeks ago

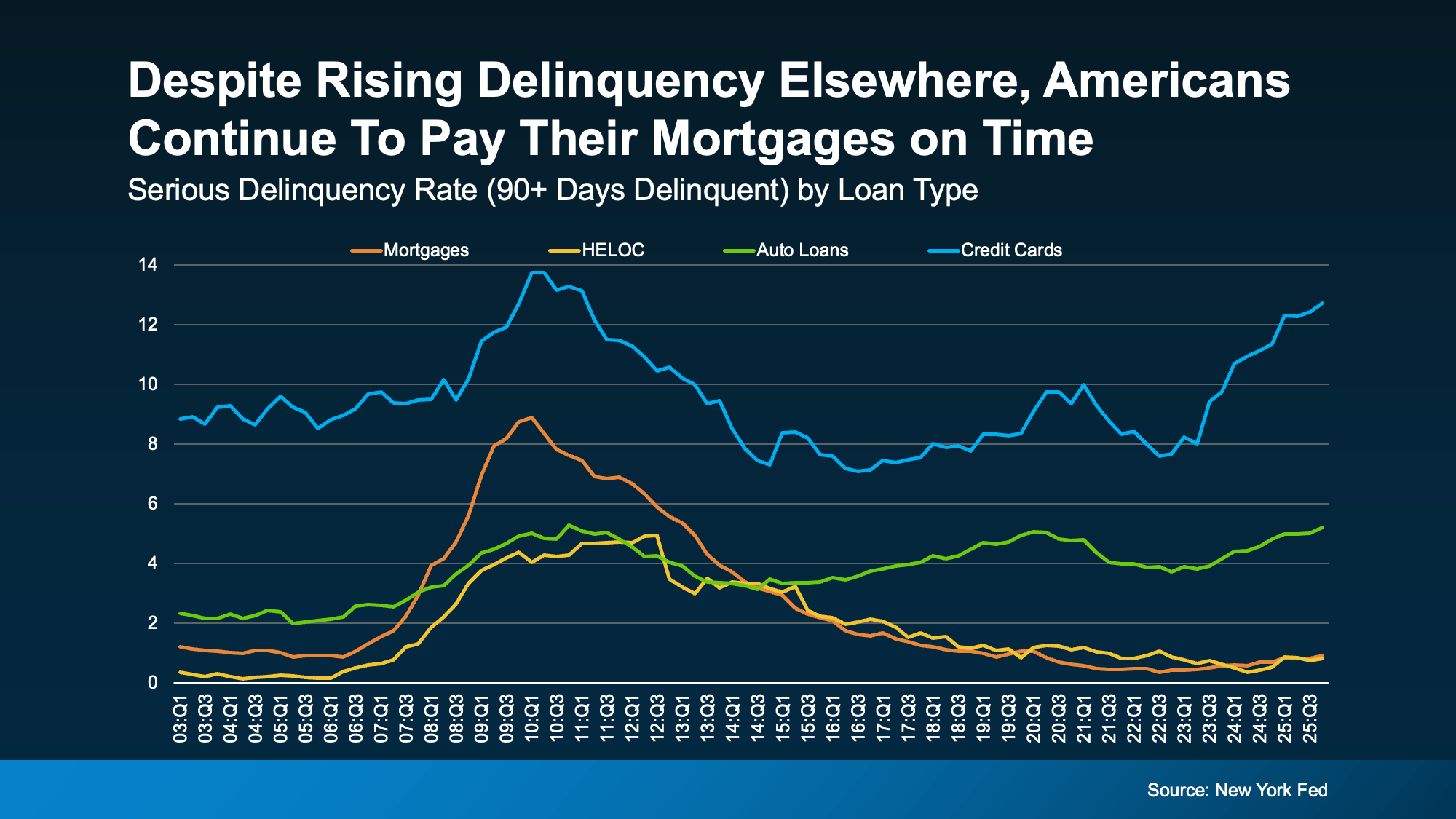

In other words, people may fall behind on other debts, but they fight hard to keep their homes. And, in today’s housing market, they’re also in a strong equity position to do so.

In other words, people may fall behind on other debts, but they fight hard to keep their homes. And, in today’s housing market, they’re also in a strong equity position to do so.

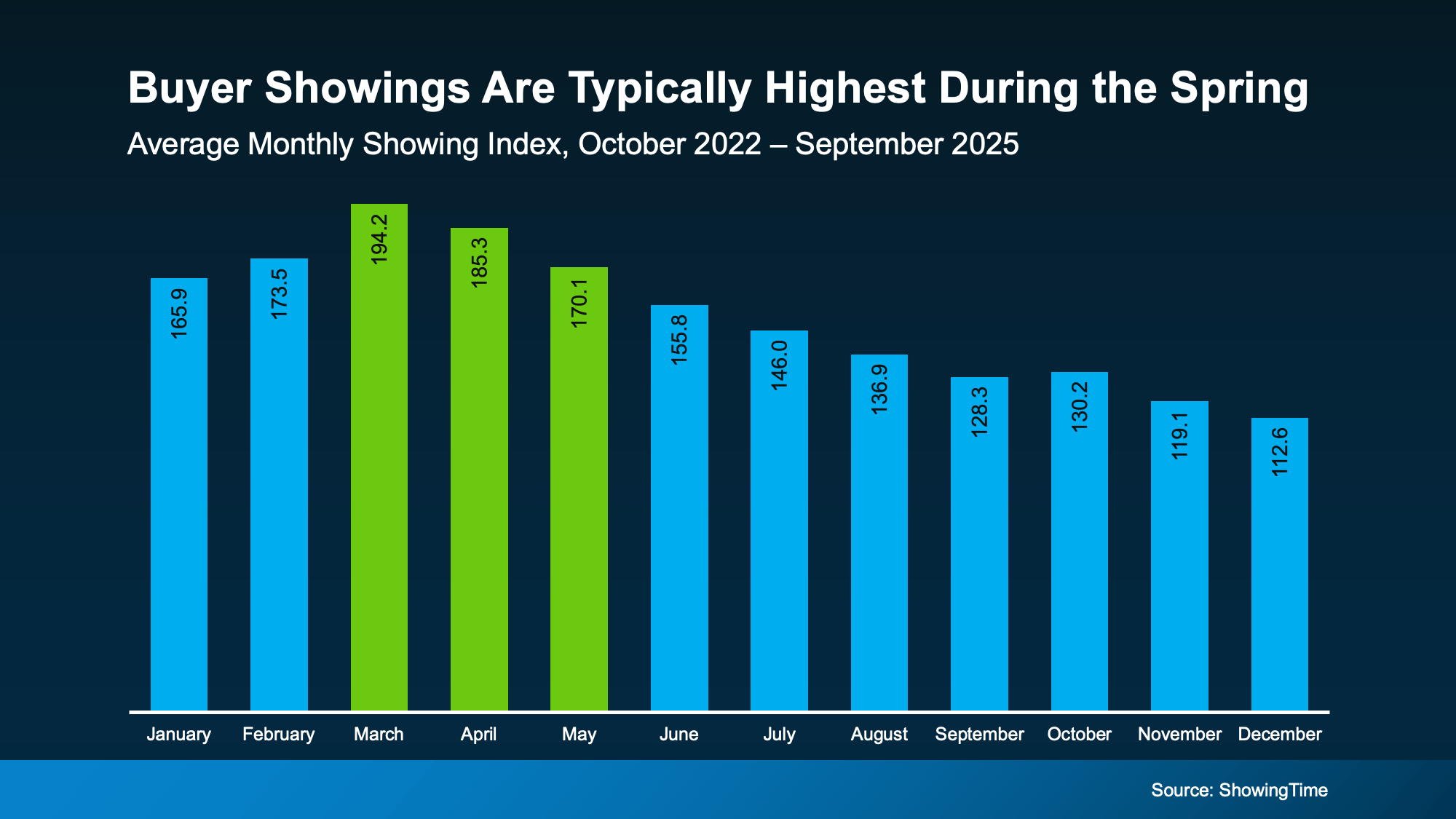

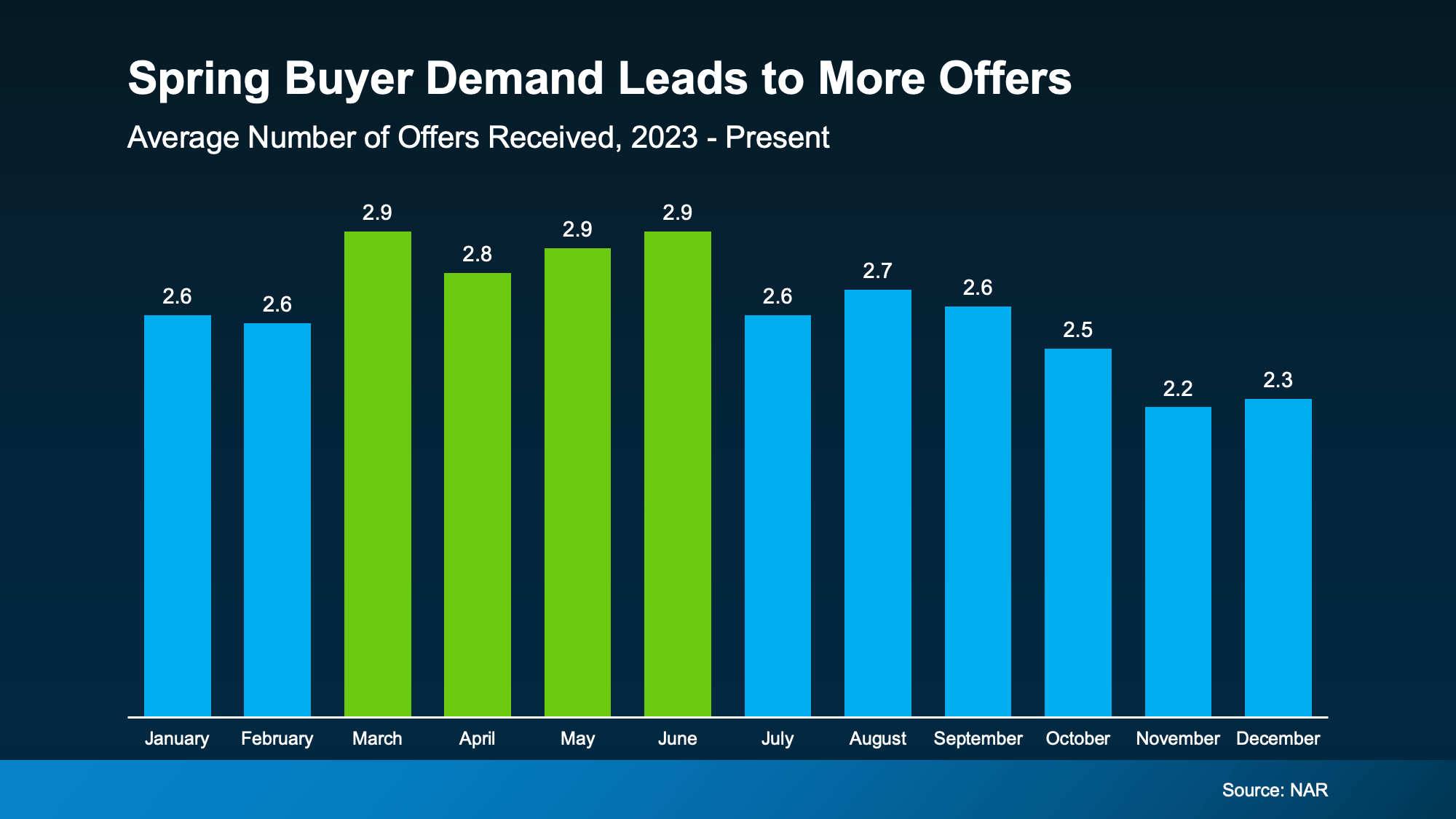

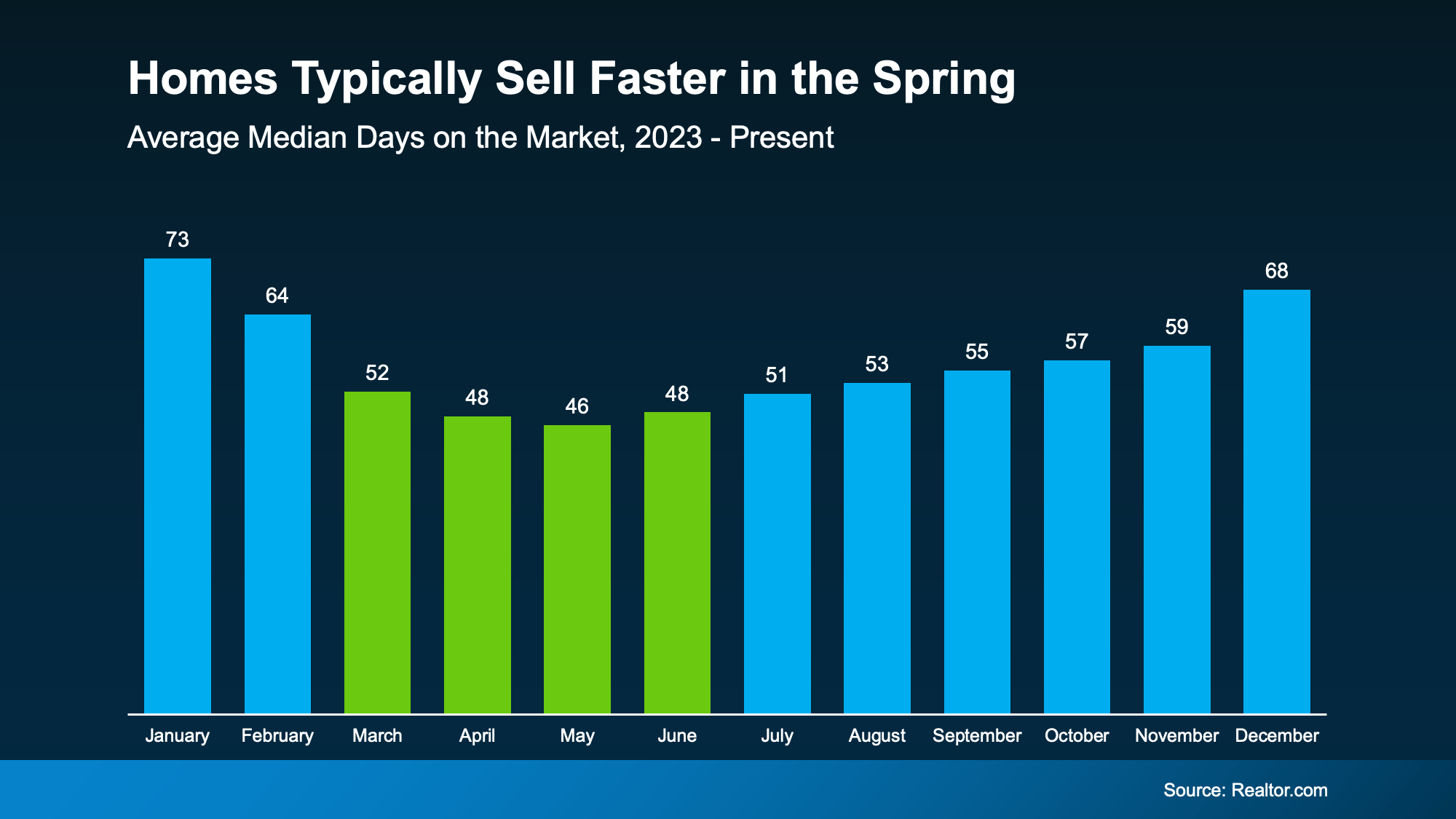

On average, homes sell 20 days faster in the Spring compared to the Winter. That’s almost 3 weeks shaved off your timeline. And that’s a difference you can feel.

On average, homes sell 20 days faster in the Spring compared to the Winter. That’s almost 3 weeks shaved off your timeline. And that’s a difference you can feel.

You must be logged in to post a comment Login