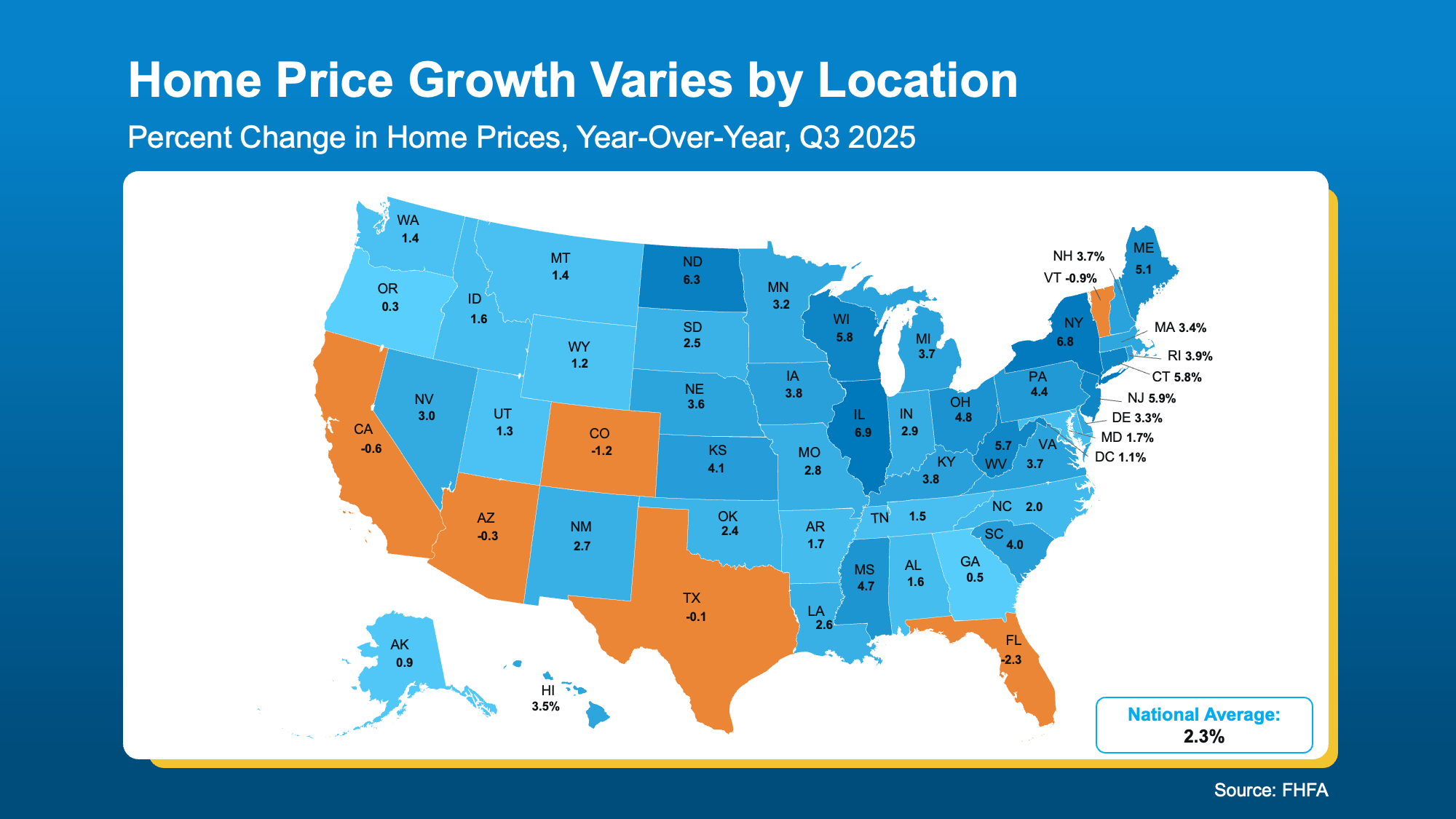

Hearing talk about home prices falling? That may leave you worried about whether your house is losing value. But here’s what you need to know. While some local markets have seen small price dips this year, home prices are not falling nationally. So, don’t let the headlines scare you.

The vast majority of the country is actually seeing prices rise.

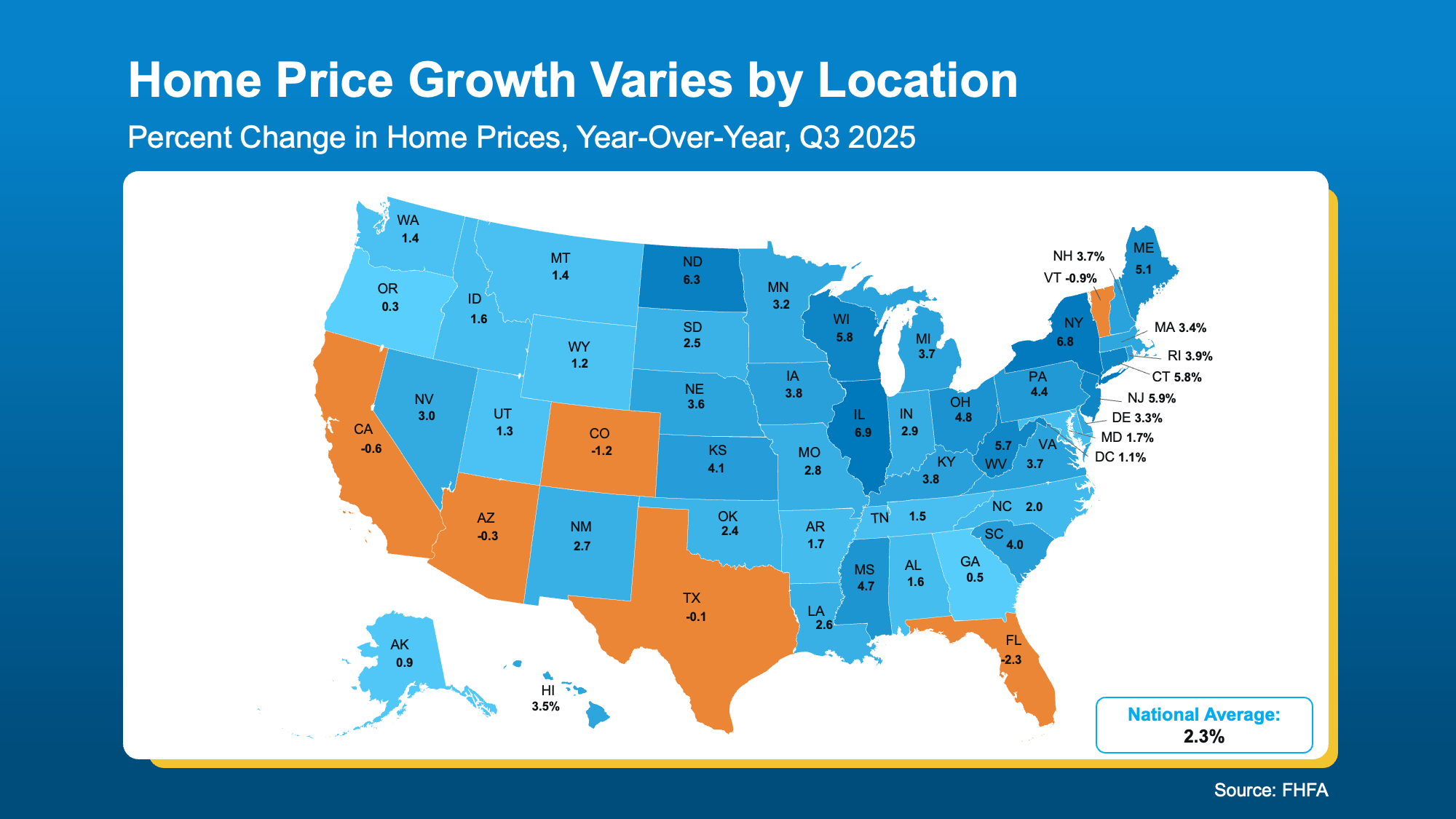

While that may feel surprising after the headlines you’ve seen, the map below uses year-over-year data from the Federal Housing Finance Agency (FHFA) to make that clear:

Let’s break down what this really shows.

Let’s break down what this really shows.

Most states are seeing prices rise (the blue in that map). Not fall. Now, the gains aren’t as big as they’ve been in recent years, but that’s okay. The story is still, prices are growing. And that positive majority is exactly why data from the National Association of Realtors (NAR) shows, nationally, home prices are up 2.1% compared to last year.

But the headlines don’t draw attention to this. They feed on the negative. But even that isn’t as bad as it sounds.

Yes, there are some states where homes have lost value over the past 12 months (the orange in the map above). That’s what all the chatter is drawing attention too. But here’s what the data really says.

The dips aren’t happening everywhere. And in the select states where prices are inching down, it’s slight. The range here is -0.1 to roughly -2%.

And those states are the ones where prices spiked too high, too fast during the pandemic housing boom. There was always going to be a come down period after that. Now, we’re in it. In those places, prices are leveling off. And that’s a sign of normalization, not collapse.

In plain terms: Home prices aren’t crashing. And this isn’t doom and gloom or the sign of broader trouble.

Most Homeowners Still Have Plenty of Value

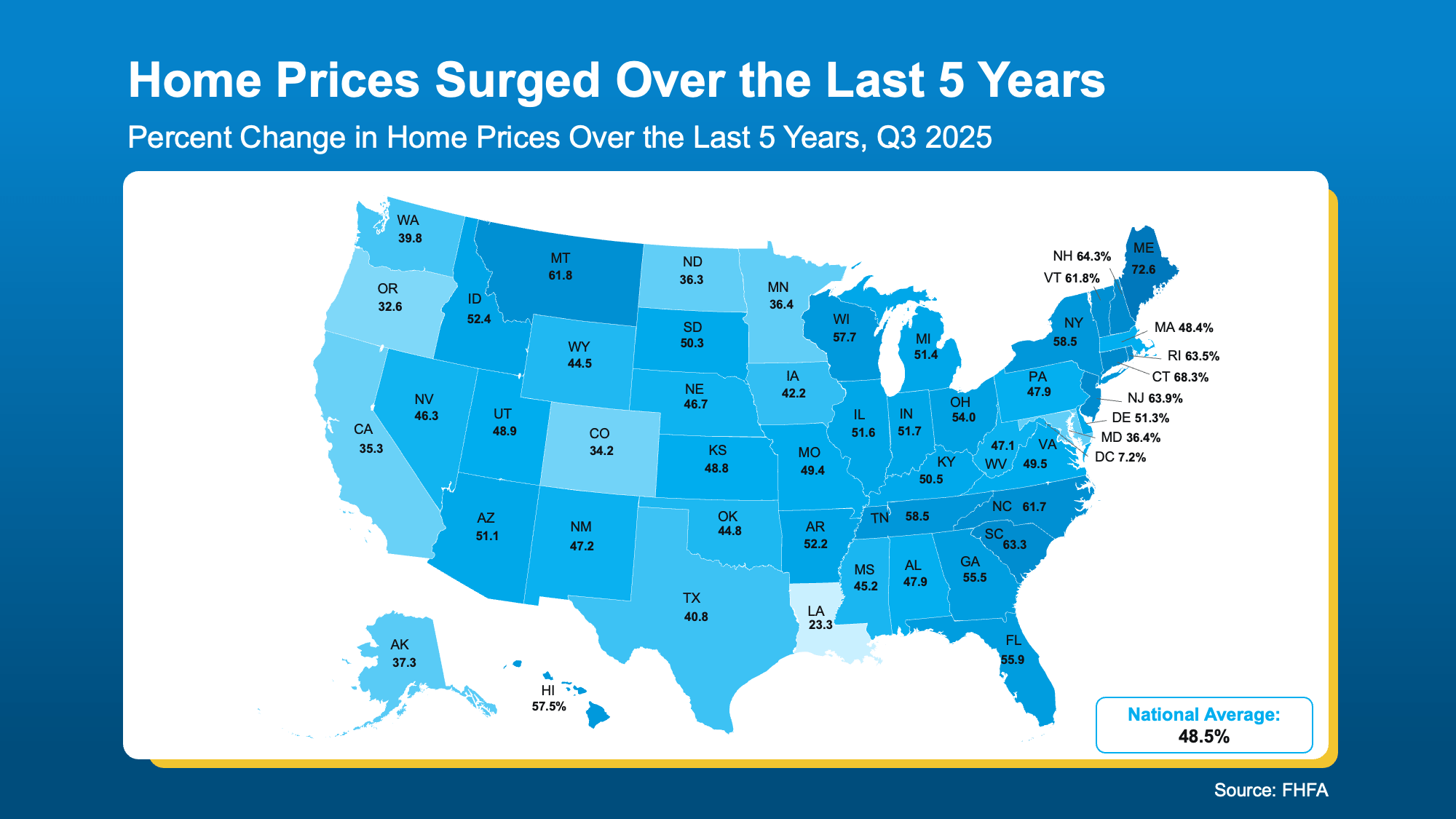

Just to drive that point home, here’s one more thing to reassure you. Even in the few places where prices dipped slightly, most homeowners are still way ahead. Additional context from Zillow helps prove that point:

- Only about 4% of homes are worth less than what the owner originally paid.

- And 96% of homes are still worth more than their homeowners paid for them.

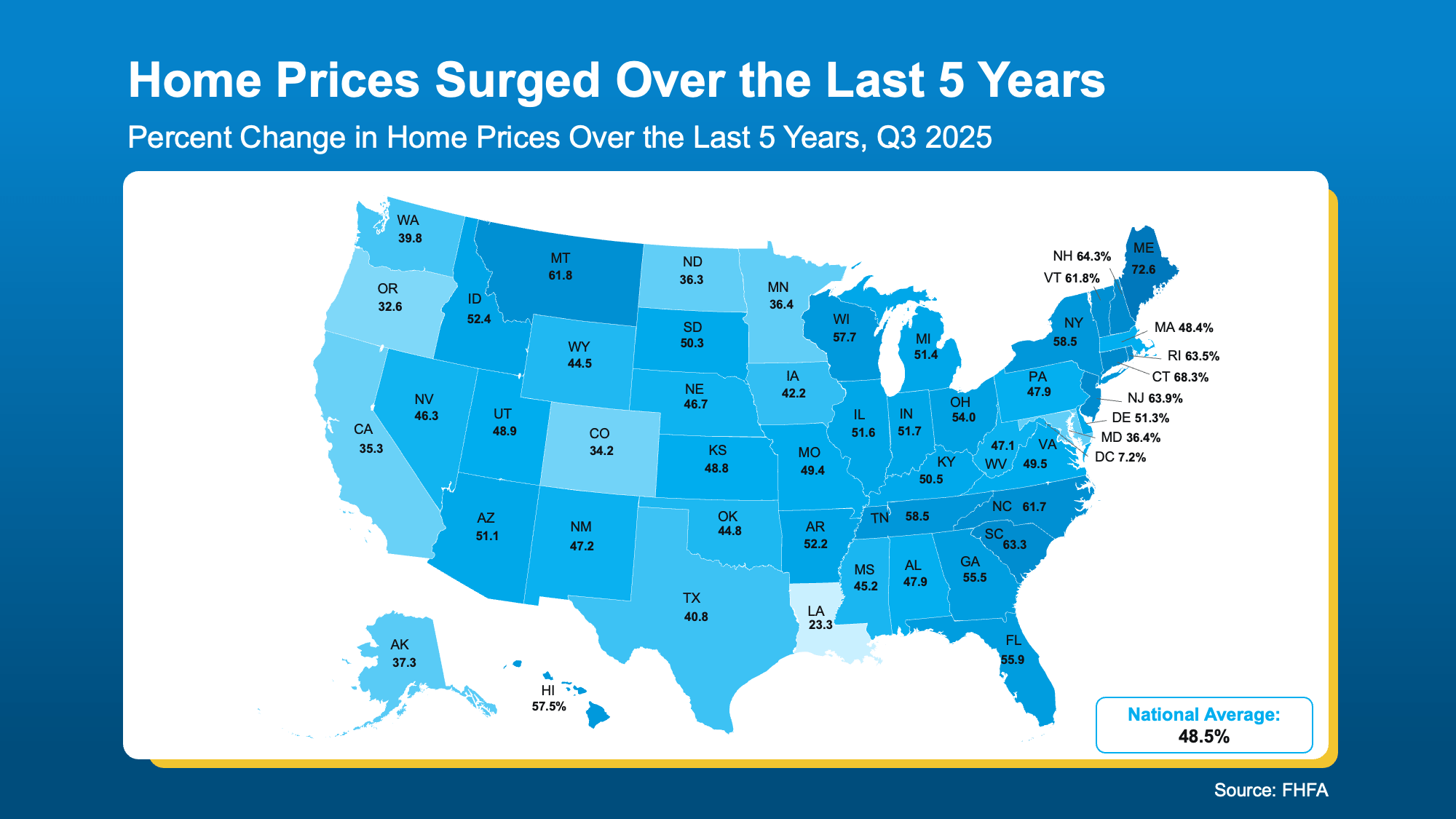

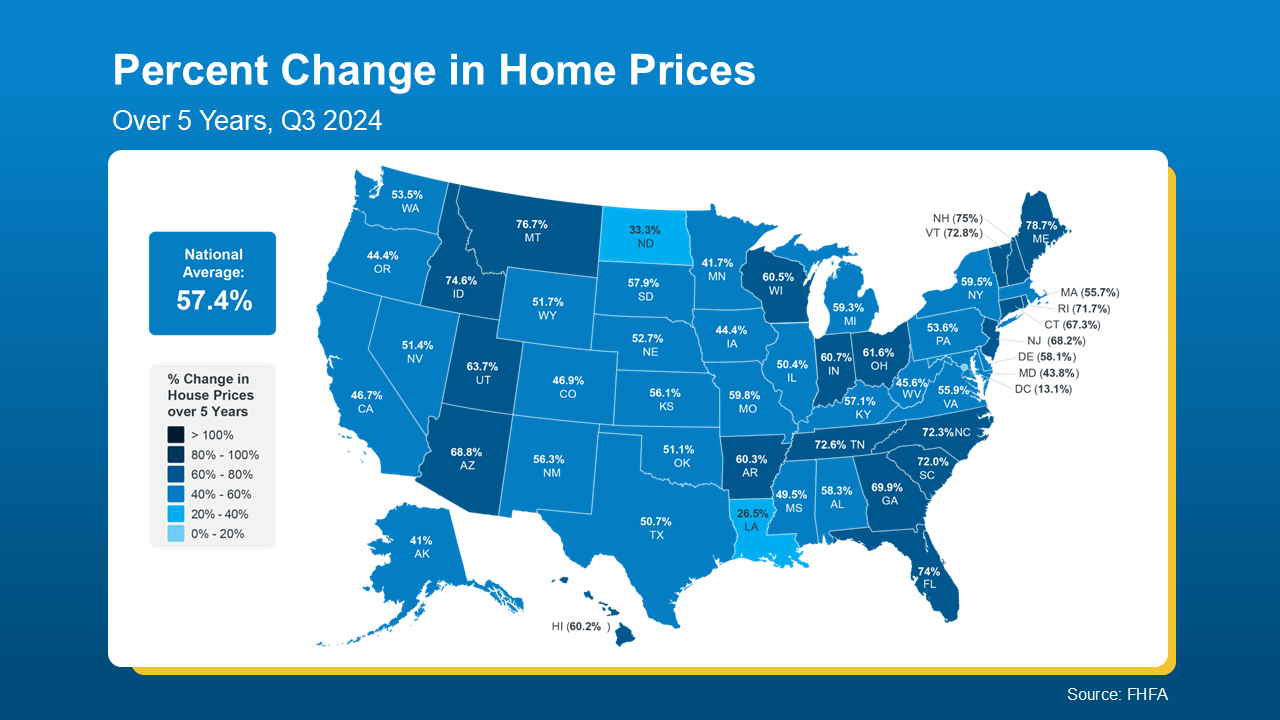

But don’t just take their word for it, see for yourself. When you zoom out and look at how much home prices have grown over the past five years, it’s a lot easier to understand why so many homeowners are still in such great shape.

Nationally, prices are up almost 49% in the last 5 years alone, and just about everywhere saw double-digit price growth in that time frame. That’s why there’s no orange in this map (see below):

The truth is, across the board, homeowners are still sitting on substantial gains. So, the -0.1 to -2% declines some states are seeing now? That’s easily absorbed.

The truth is, across the board, homeowners are still sitting on substantial gains. So, the -0.1 to -2% declines some states are seeing now? That’s easily absorbed.

So, don’t let the headlines scare you. What’s happening with home prices this year varies a lot from one area to the next. But the takeaway is clear: a small dip in some areas doesn’t mean your home’s value is collapsing.

It means select local markets are correcting – and most of the time these are the ones that saw prices rise the most during the pandemic. You’re probably still in great shape.

Bottom Line

If you’re hearing talk about price drops or crashes, a closer look at the data can help put things in perspective. That’s only happening in some markets. Most of the nation is still seeing prices rise.

And for the vast majority of homeowners, the long-term gains far outweigh any recent softening.

If you want help understanding what’s happening in your local market, connect with a local real estate agent.

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

For Buyers4 weeks ago

For Buyers4 weeks ago

For Sale by Owner4 weeks ago

For Sale by Owner4 weeks ago

Downsize2 weeks ago

Downsize2 weeks ago

Buying Tips2 weeks ago

Buying Tips2 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

First-Time Buyers2 weeks ago

First-Time Buyers2 weeks ago

You must be logged in to post a comment Login