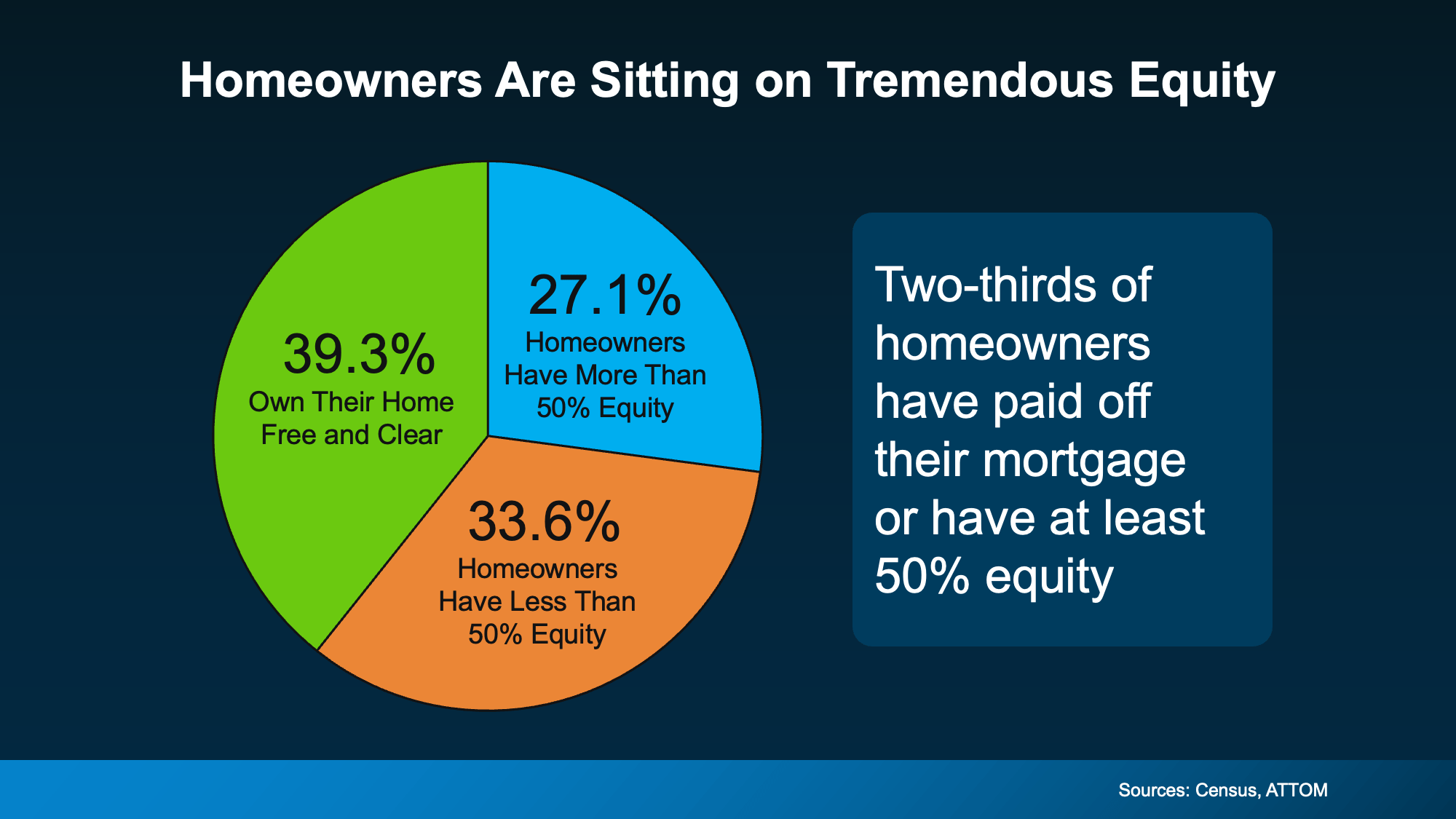

The level of equity homeowners have is at an all-time high. According to the U.S. Census, over 38% of owner-occupied homes are owned free and clear, meaning they don’t have a mortgage. Those with a mortgage are seeing their equity skyrocket too. Every time real estate values increase, homeowners get a dollar-for-dollar gain in their home equity.

According to the first-quarter 2021 U.S. Home Equity Report from ATTOM Data Solutions:

“17.8 million residential properties in the United States were considered equity-rich, meaning that the combined estimated amount of loans secured by those properties was 50 percent or less of their estimated market value.

The count of equity-rich properties in the first quarter of 2021 represented 31.9 percent, or about one in three, of the 55.8 million mortgaged homes in the United States. That was up from 30.2 percent in the fourth quarter of 2020, 28.3 percent in the third quarter and 26.5 percent in the first quarter of 2020.”

This surge in home equity has given most homeowners the opportunity to use that equity in one of two ways:

- Refinance to cash out some of the equity or lower their current payment

- Move to a home that better fits their current needs

Let’s break down the possibilities.

1. Refinance

An abundance of equity and record-low mortgage rates can make refinancing a home very easy. Some homeowners choose to refinance so they can lower their payments. Others convert a portion of the equity to cash while keeping their monthly payment the same.

There are many homeowners who could take advantage of lower rates and higher levels of equity, but they haven’t yet. According to an Economic & Housing Research Note from earlier this month, there were over five million homeowners with a loan funded by Freddie Mac who would benefit by refinancing their loan. As of January 2021, there were:

- 452,122 loans with an average mortgage rate of 6.17%

- 1,027,834 loans with an average mortgage rate of 4.39%

- 3,687,780 loans with an average mortgage rate of 4.21%

With mortgage rates currently hovering around 3%, any of these homeowners would benefit from refinancing. They could lower their payments by hundreds of dollars per month or cash out large sums of equity while keeping their monthly payment the same.

Example:

If a homeowner has a $200,000 fixed-rate mortgage with a 6% interest rate and refinances that loan to a 3% interest rate, their monthly mortgage payment (principal and interest) will go from $1,199 per month to $843 per month – a savings of $356 a month, or $4,272 each year.

On the other hand, if they keep their mortgage payment the same, they could cash out a significant amount of their equity.

2. Move into your dream home

The past year prompted many households to redefine what a dream home really means, and it’s something different to everyone. Those who have a high mortgage rate could use their equity as a down payment and perhaps buy their next home without significantly raising their mortgage payment.

Example:

Suppose a person bought a house for $216,000 at the height of the market in 2006. (The median home price in May of 2006). If they put 10% down and took out a mortgage of $194,400 at 6.41% (the average rate in 2006), the monthly mortgage payment (principal and interest) would have been $1,217.

According to the National Association of Realtors (NAR), a typical single-family home has grown in value by approximately $150,000 over the last fifteen years. That means the $216,000 house would be worth about $366,000 today.

After deducting selling expenses, they would be left with about $130,000 ($150,000 minus approximately $20,000 in selling expenses).

A seller could take that equity and use it as a down payment on a new house. Let’s assume they purchased a home for $450,000 (roughly $80,000 more than the value of their current home). If they put the $130,000 down, they could take out a mortgage of $320,000 with a 3% interest rate. The monthly mortgage payment (principal and interest) would be $1,349. Therefore, they could buy a home worth $80,000 more than the one they have today and only spend an extra $132 per month.

Bottom Line

Whether you’re refinancing your house or moving to a new home, your current mortgage rate and your level of equity are crucial in your decision-making process. Look at your mortgage documentation to find out your interest rate, and then let’s connect to determine the potential equity in your home. You may be surprised by the opportunities you have.

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers4 weeks ago

For Sellers4 weeks ago

For Buyers4 weeks ago

For Buyers4 weeks ago

Downsize2 weeks ago

Downsize2 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

First-Time Buyers2 weeks ago

First-Time Buyers2 weeks ago

Affordability1 week ago

Affordability1 week ago

You must be logged in to post a comment Login