There’s no arguing this past year has been difficult for homebuyers. And if you’re someone who has started the process of searching for a home, maybe you put your search on hold because the challenges in today’s market felt like too much to tackle. You’re not alone in that. A Bright MLS study found some of the top reasons buyers paused their search in late 2023 and early 2024 were:

- They couldn’t find anything in their price range

- They didn’t have any successful offers or had difficulty competing

- They couldn’t find the right home

If any of these sound like why you stopped looking, here’s what you need to know. The housing market is in a transition in the second half of 2024. Here are four reasons why this may be your chance to jump back in.

1. The Supply of Homes for Sale Is Growing

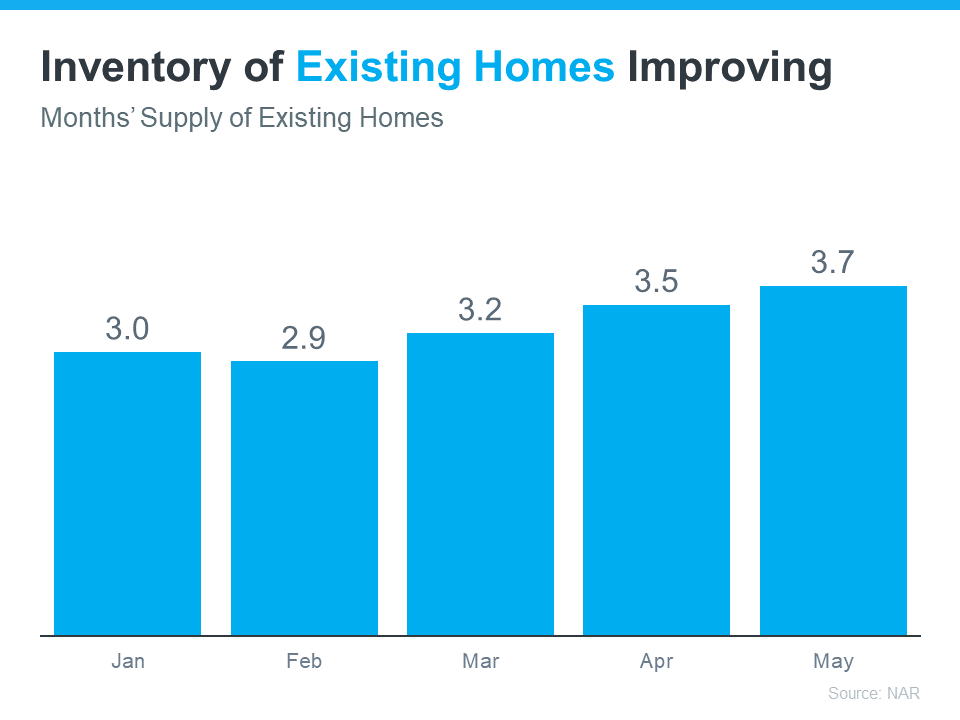

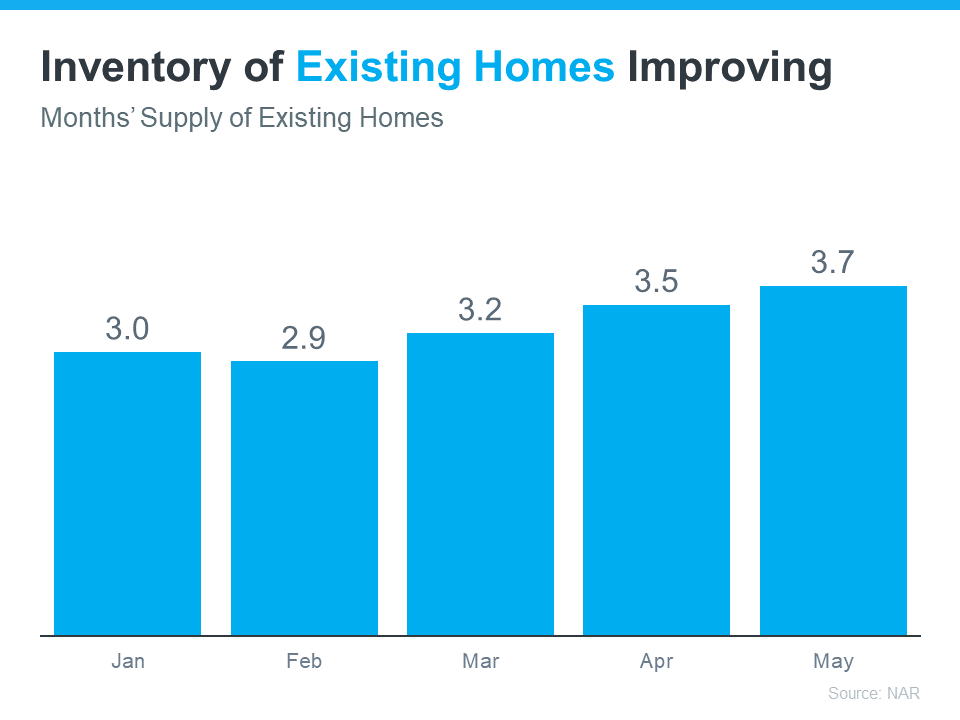

One of the most significant shifts in the market this year is how the months’ supply of homes for sale has increased. If you look at data from the National Association of Realtors (NAR), you’ll see how inventory has grown throughout 2024 (see graph below):

This graph shows the months’ supply of existing homes – homes that were previously lived in by another homeowner. The upward trend this year is clear.

This increase means you have a better chance of finding a home that suits your needs and preferences. And if the biggest reason you put off your home search was difficulty finding the right home, this is a big relief.

2. There’s More New Home Construction

And if you still don’t see an existing home you like, another big opportunity lies in the rise of new home construction. Builders have worked to increase the supply of newly built homes this year. And they’ve turned their attention to crafting smaller, more affordable homes based on what’s most needed in today’s market. This helps address the long-standing issue of housing undersupply throughout the country, and those smaller homes also offset some of the affordability challenges you’re feeling today.

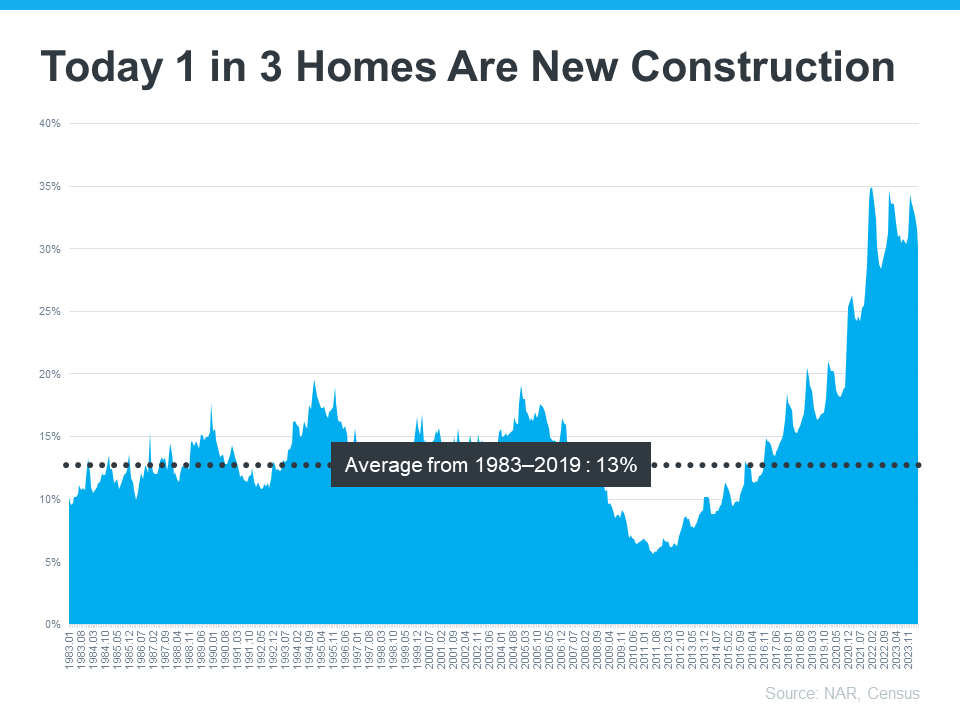

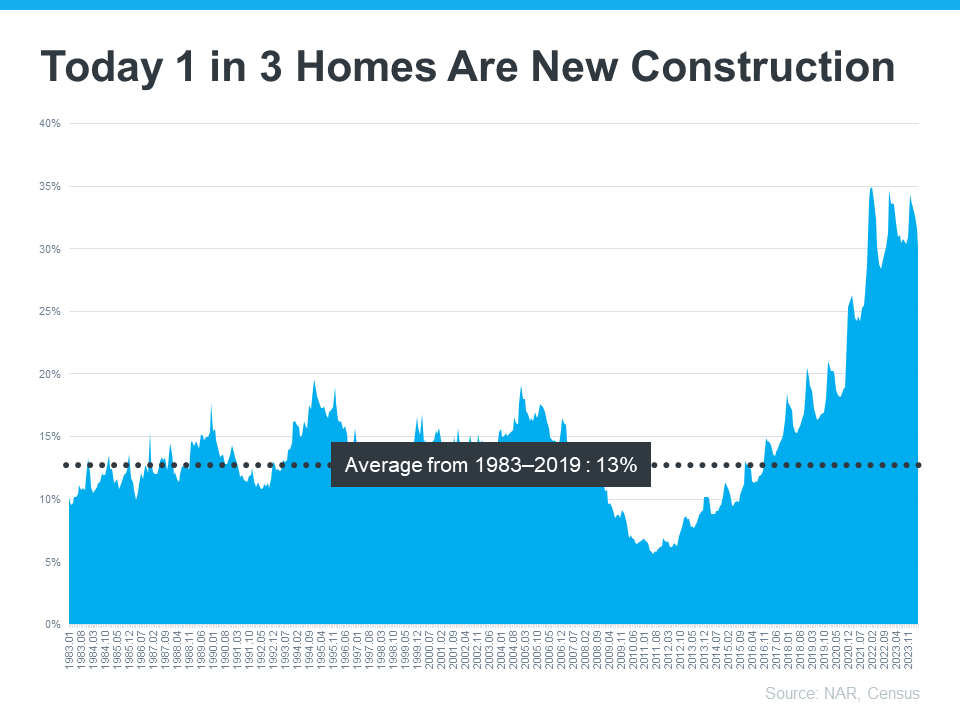

According to data from the Census and NAR, one in three homes on the market is a newly built home (see graph below):

This means, that if you didn’t previously look at newly built homes as part of your search, you may have been cutting your pool of options by a third. Not to mention, some builders are also offering incentives like buying down mortgage rates to make it easier for buyers to get a home that fits their budget.

So, consider talking to your agent about what builders have to offer in your area. Your agent’s expertise on builder reputations, contracts, and more will help you weigh your options.

3. Less Buyer Competition

Mortgage rates are still hovering around 7%, so buyer demand isn’t as fierce as it once was. And when you combine that with more housing supply, you have a better chance of avoiding an intense bidding war. Danielle Hale, Chief Economist at Realtor.com, highlights the positive trend for the latter half of 2024, saying:

“Home shoppers who persist could see better conditions in the second half of the year, which tends to be somewhat less competitive seasonally, and might be even more so since inventory is likely to reach five-year highs.”

This creates a unique opportunity for you to find a home you want to buy with less stress and at a potentially better price.

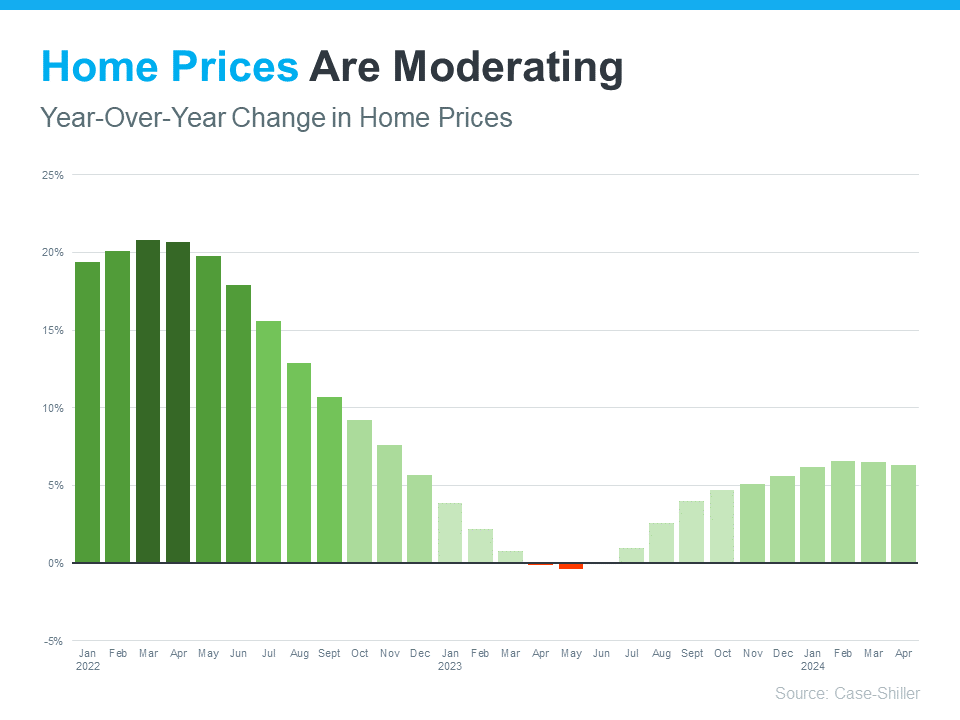

4. Home Prices Are Moderating

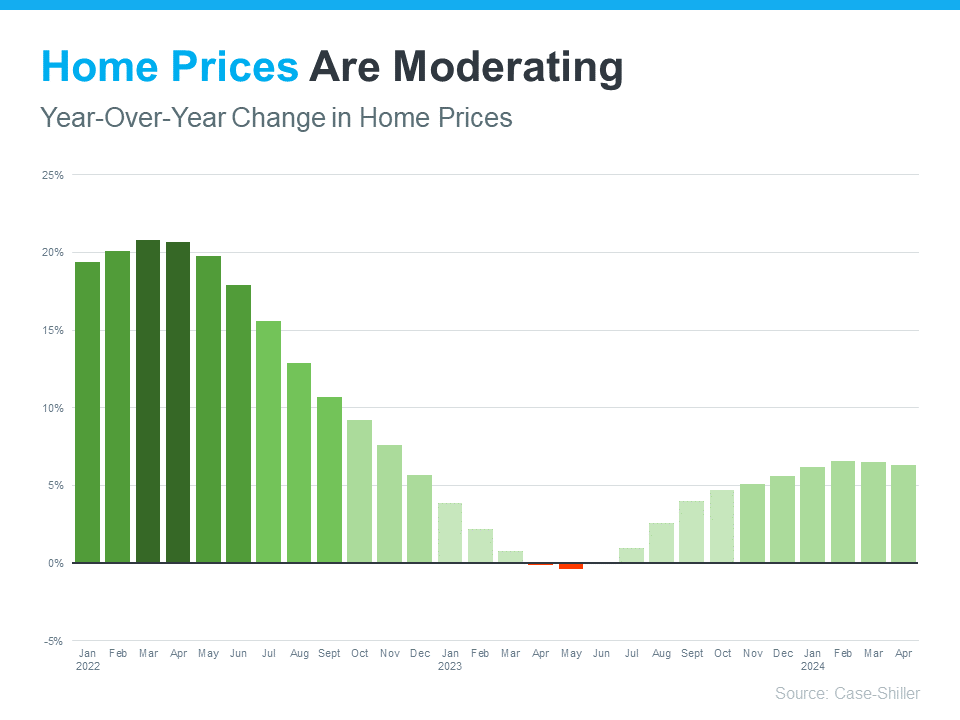

Speaking of prices, home prices are also showing signs of moderation – and that’s a welcome shift after the rapid appreciation seen in recent years (see graph below):

This moderation is mostly due to supply and demand. Supply is growing and demand is easing, so prices aren’t rising as fast. But make no mistake, that doesn’t mean prices are falling – they’re just rising at a more normal pace. You can see this in the graph. The bars are still showing prices increasing, just not as dramatic as it was before.

The average forecast for home price appreciation in 2024 is for positive growth around 3% to 5%, which is more in line with historical norms. That moderation means that you are less likely to face the steep price increases we saw a few years ago.

The Opportunity in Front of You

If you’re ready and able to buy, you may find that the second half of 2024 is a bit easier to navigate. There are still challenges, but some of the biggest hurdles you’ve faced are getting better as time wears on.

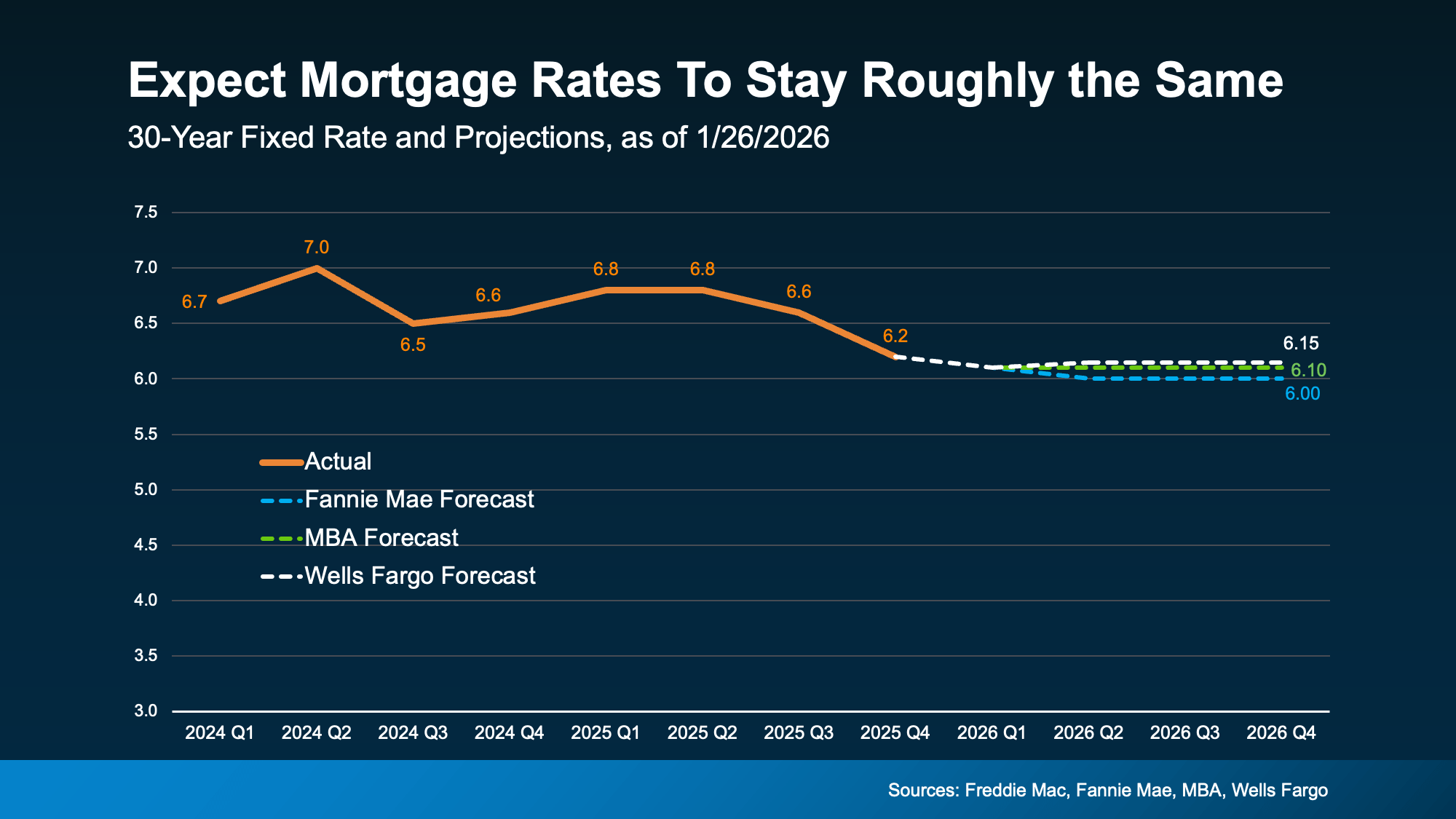

On the other hand, you could choose to wait. But if you do, here’s the risk you run. As more buyers recognize the shift in the market, competition will grow again. On a similar note, if mortgage rates do come down (as forecasts say), more buyers will flood back into the market. So, making a move now helps you take advantage of the current market conditions and get ahead of those other buyers.

Bottom Line

If you’ve put your dream of homeownership on hold, the second half of 2024 may be your chance to jump back in. Connect with a real estate agent to talk more about the opportunities you have in today’s market.

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

For Buyers4 weeks ago

For Buyers4 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

For Sale by Owner3 weeks ago

For Sale by Owner3 weeks ago

Buying Tips2 weeks ago

Buying Tips2 weeks ago

Affordability2 weeks ago

Affordability2 weeks ago

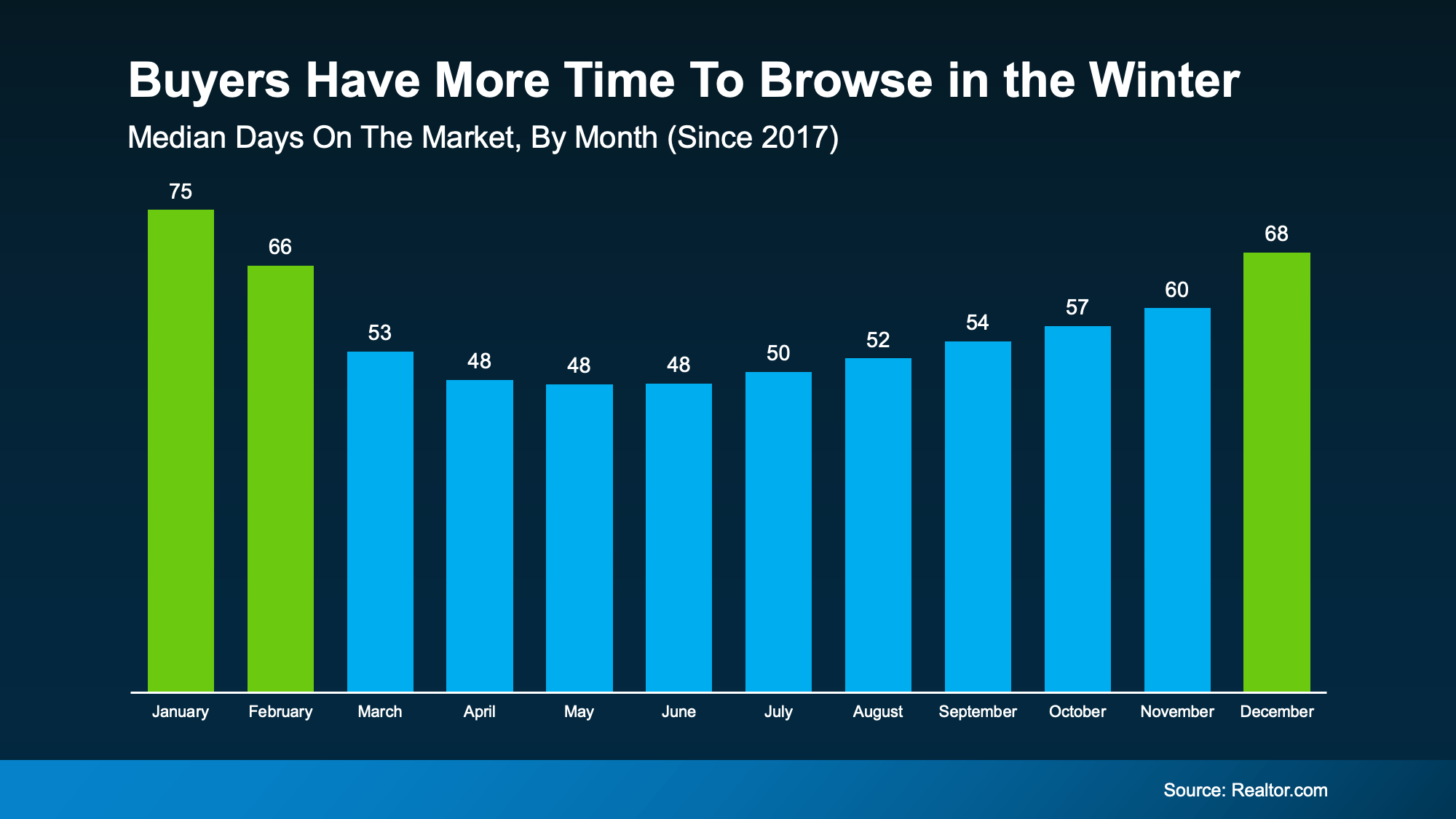

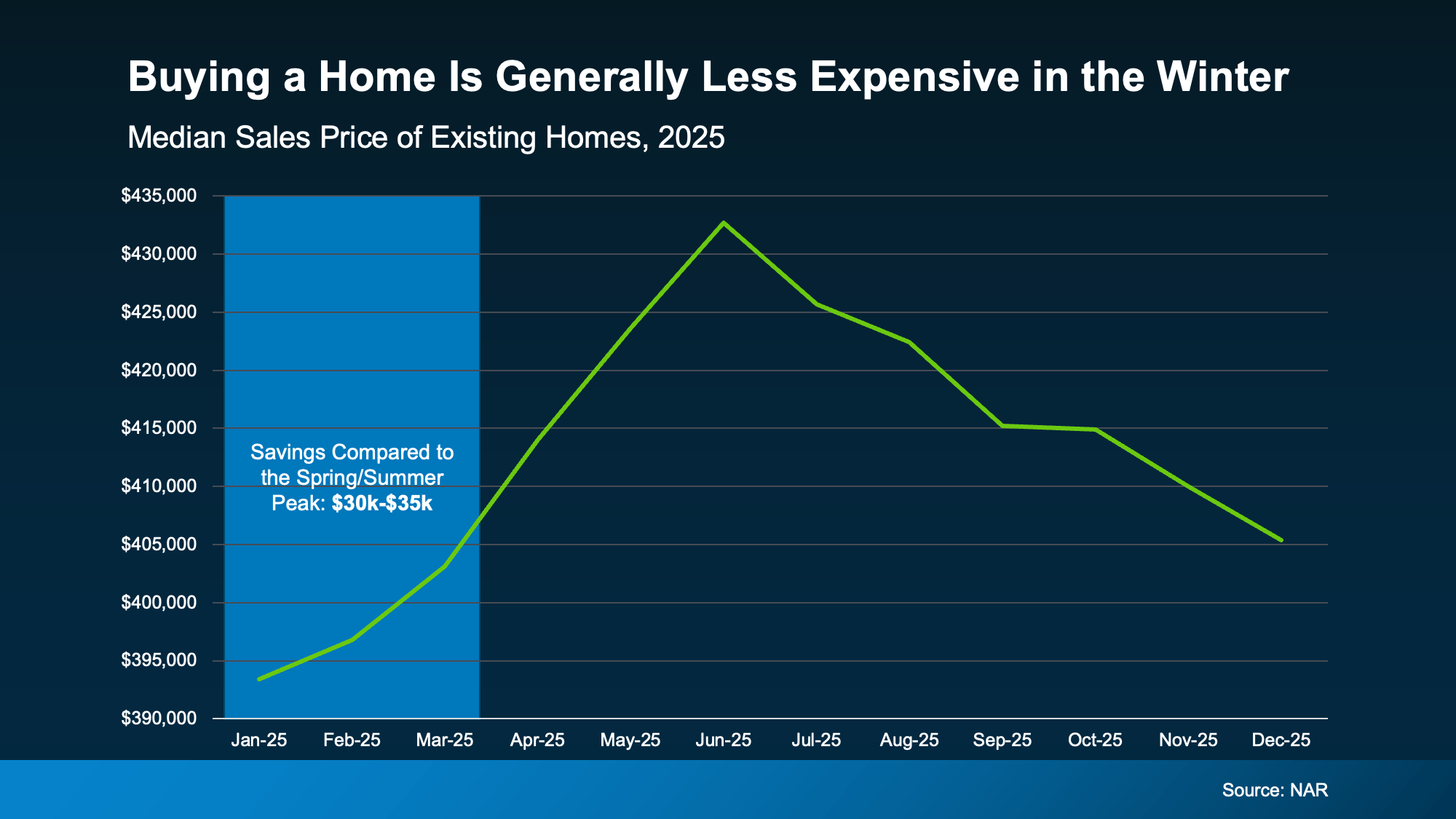

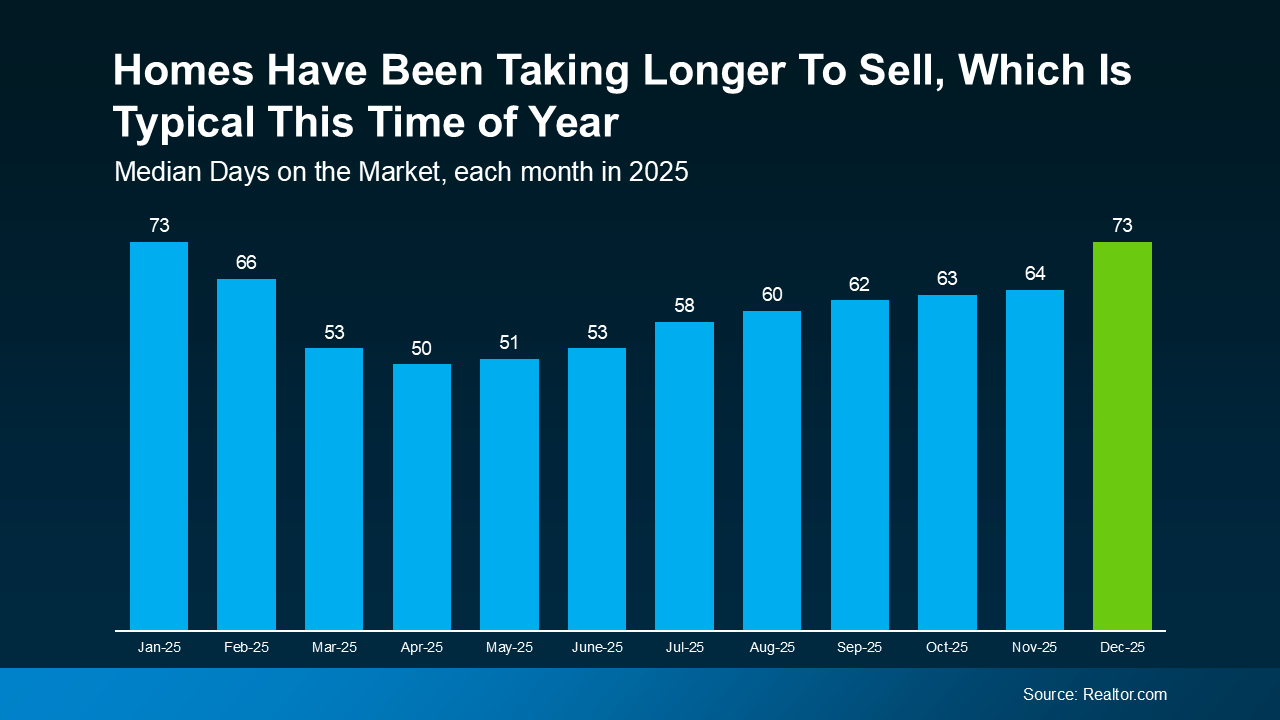

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

So, What Can You Do About It?

So, What Can You Do About It?

You must be logged in to post a comment Login