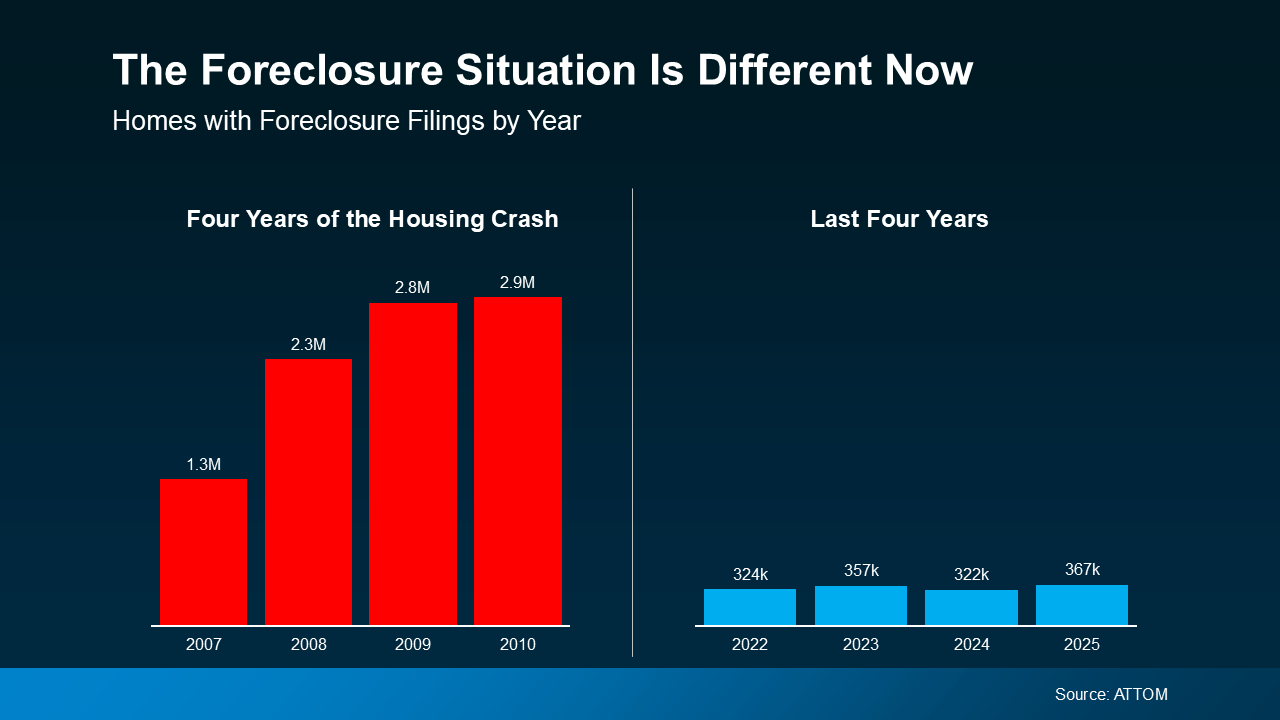

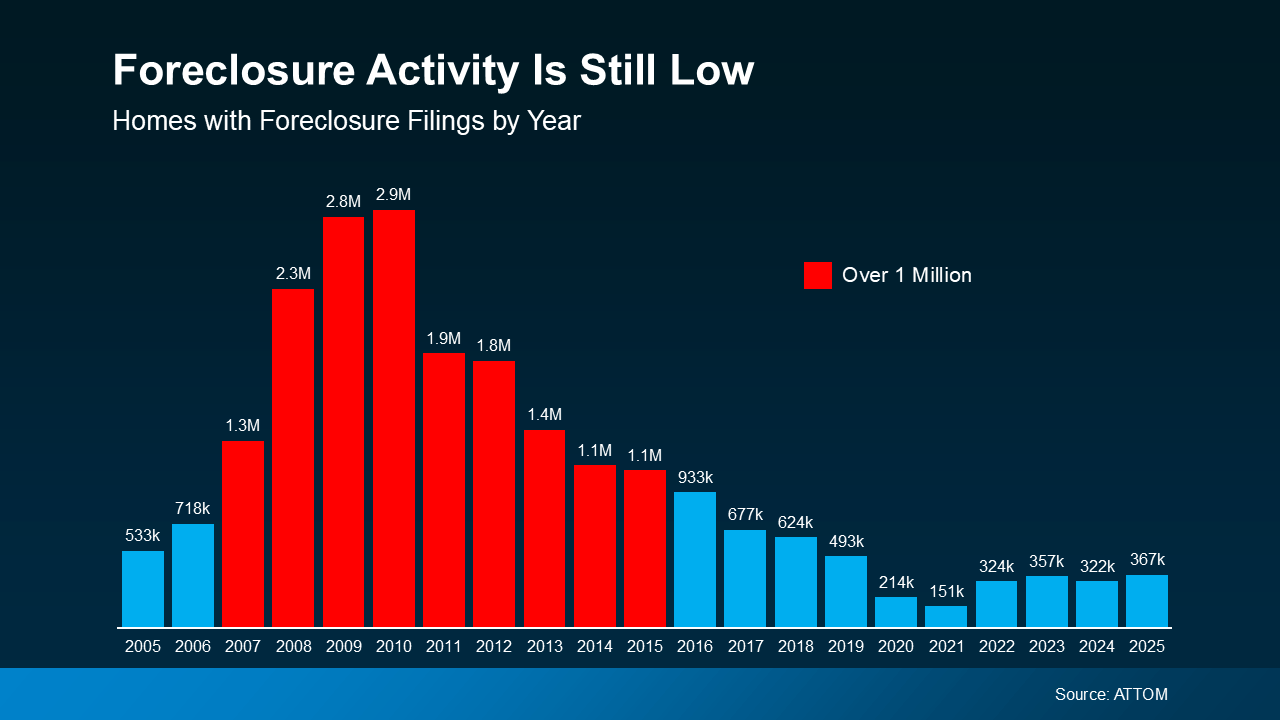

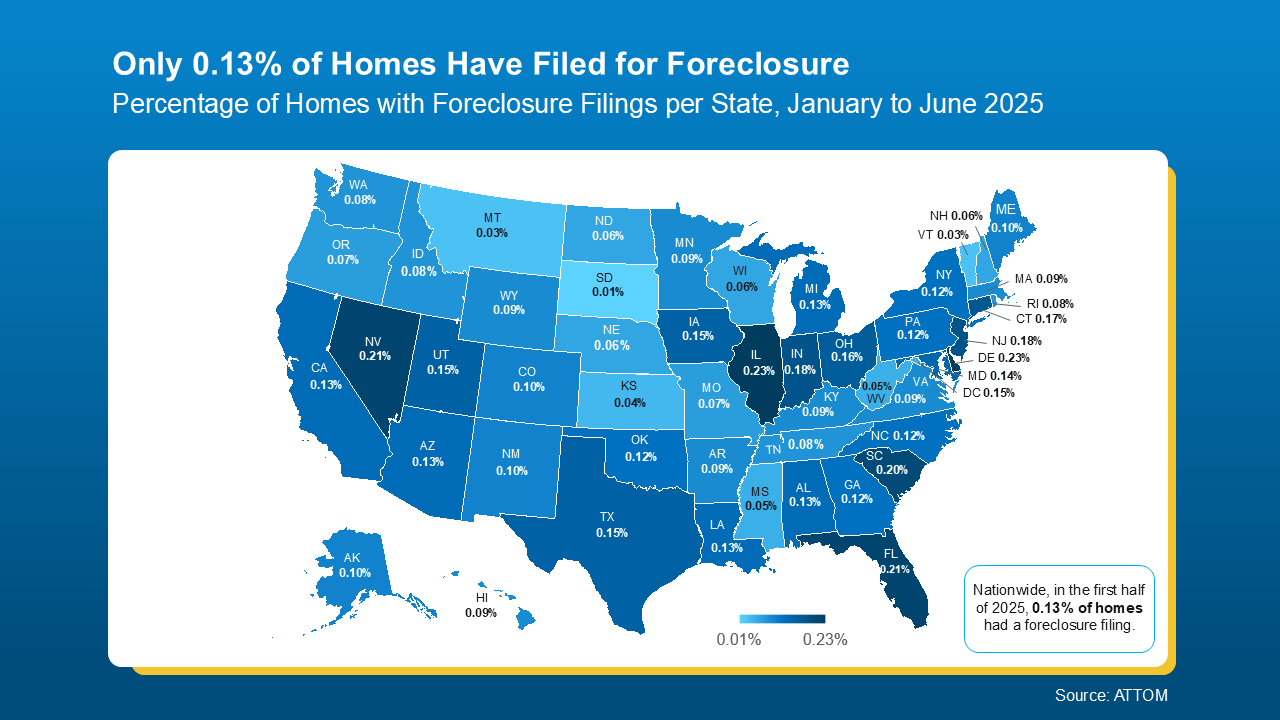

You may be seeing headlines about how foreclosures are rising. And if that makes you nervous that we’re headed for another crash, here’s what you should know.

According to ATTOM, during the housing crash, over nine million people went through some sort of distressed sale (2007-2011). Last year, there were just over 300,000.

So, even with the increase lately, we’re talking about numbers that are dramatically lower. But what does the future hold? Is a wave coming? The short answer is, no.

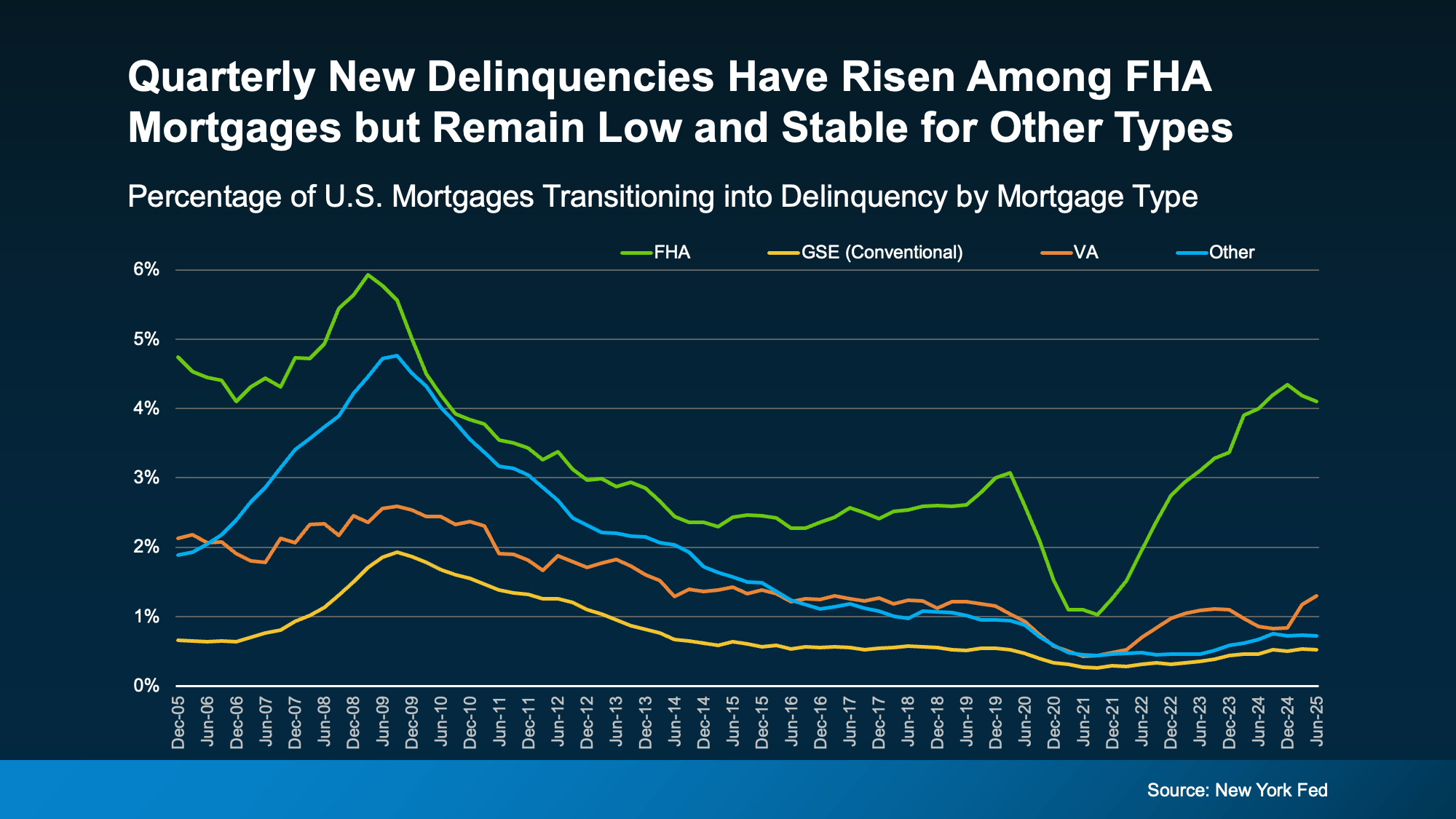

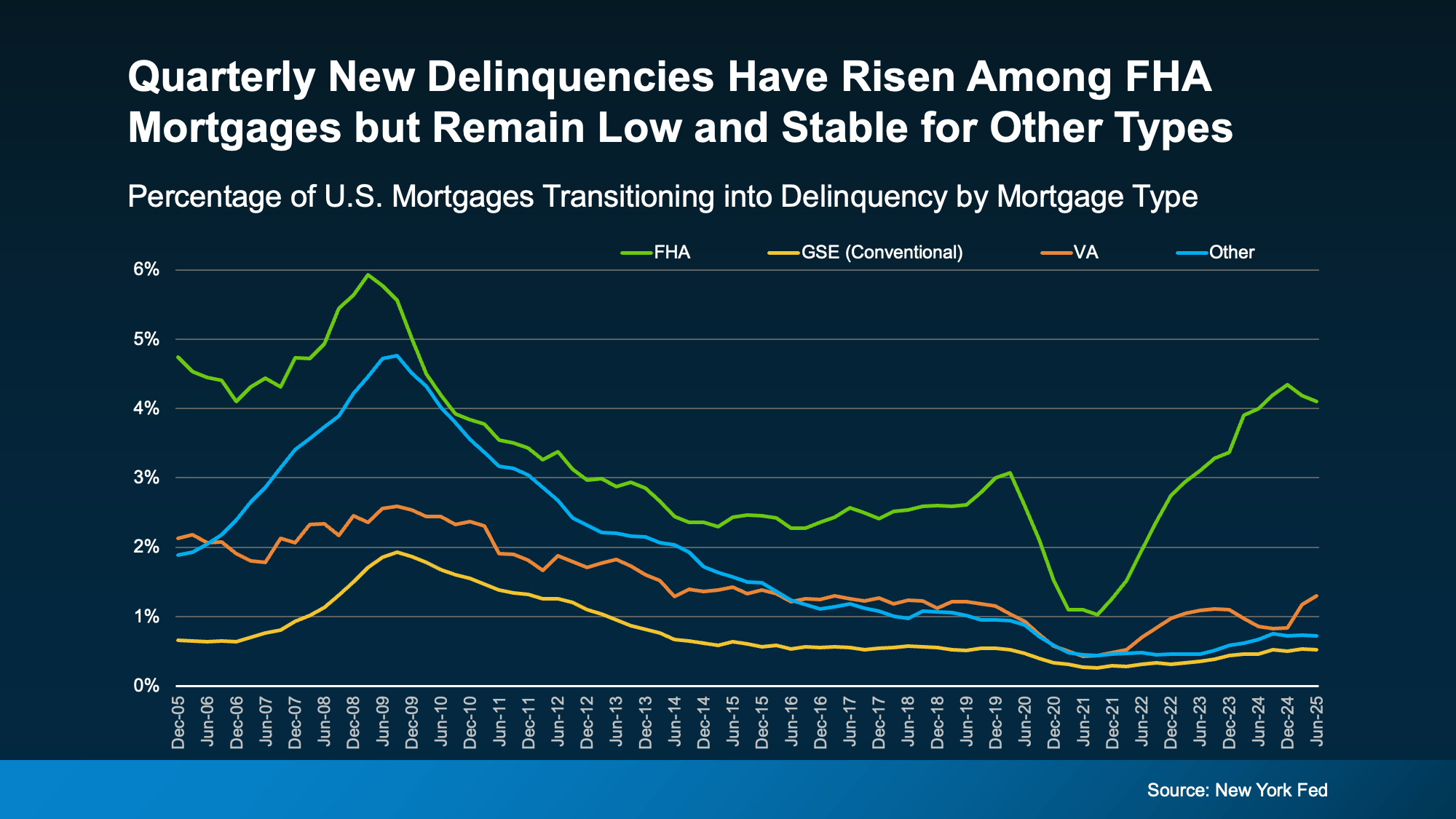

Here’s why. Experts in the industry look at mortgage delinquencies (loans that are more than 30 days past due) as an early sign for potential foreclosures down the line. And the latest data for delinquencies is reassuring about the market overall.

Right now, delinquencies as a whole are consistent with where we ended last year, which means we’re not seeing the kind of increase that would signal widespread trouble.

But there are some key indicators to continue to watch. Marina Walsh, Vice President of Industry Analysis at the Mortgage Bankers Association, explains:

“While overall mortgage delinquencies are relatively flat compared to last year, the composition has changed.”

Right now, borrowers with FHA mortgages currently make up the biggest share of new delinquencies (see graph below):

And here’s why that may be happening. Borrowers with FHA mortgages may be more sensitive to shifts in the economy. And with recession fears, stubborn inflation, employment challenges, and more, it makes sense this segment of the market may be feeling it a bit more. But that doesn’t mean it’s a signal a crash is coming.

And here’s why that may be happening. Borrowers with FHA mortgages may be more sensitive to shifts in the economy. And with recession fears, stubborn inflation, employment challenges, and more, it makes sense this segment of the market may be feeling it a bit more. But that doesn’t mean it’s a signal a crash is coming.

If you look back at the graph, it shows, while there are more FHA loans experiencing hardship than the norm, delinquency rates for other loan types remain low and stable. Back during the crash, delinquency rates were significantly elevated for all 4 categories.

That means the broader mortgage market is on much stronger footing than it was back in 2008. As ResiClub says:

“The recent uptick in mortgage delinquency seems to be concentrated among FHA borrowers, however, mortgage performance remains very solid when viewed in light of the twenty-year history of our data.”

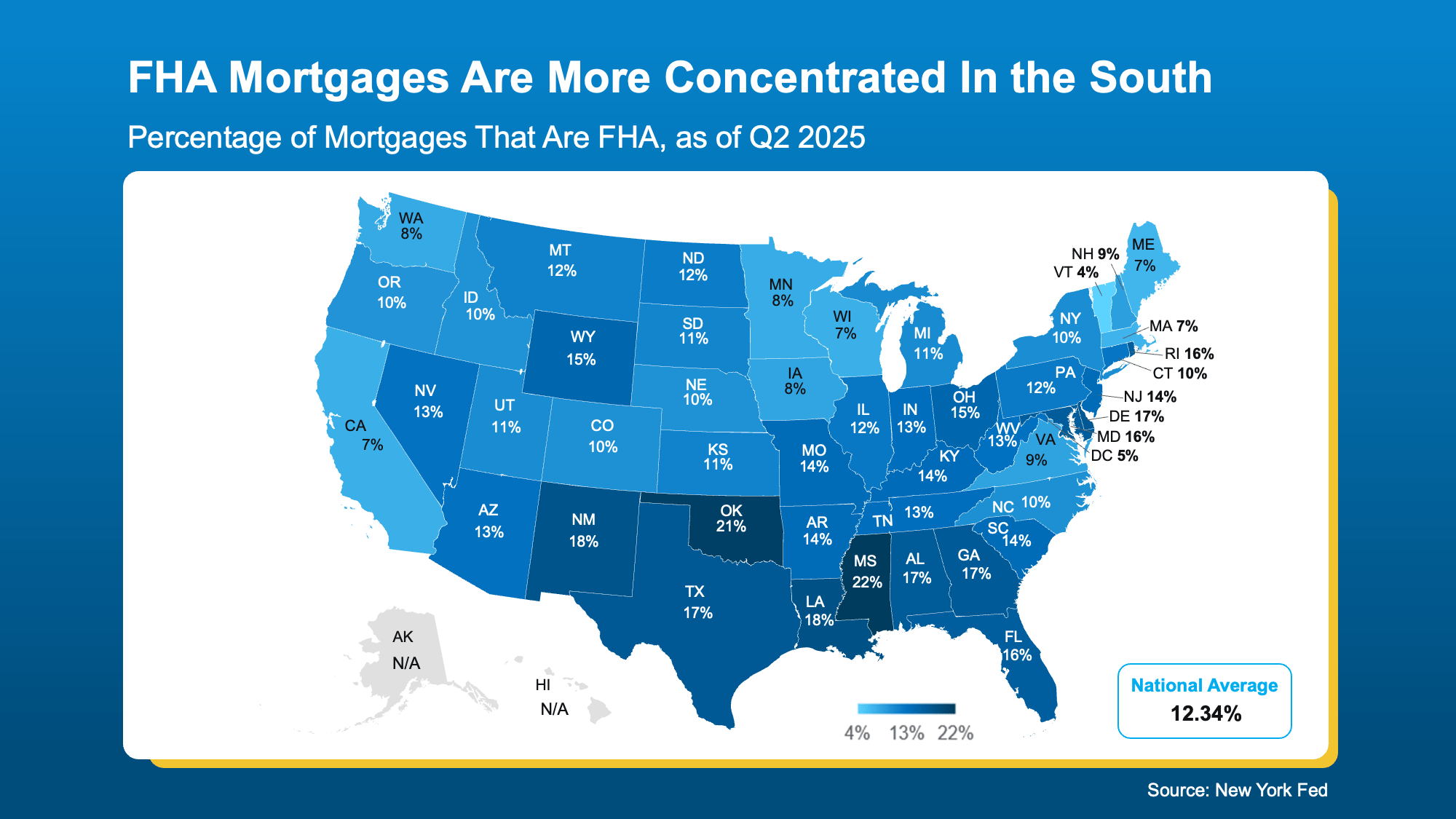

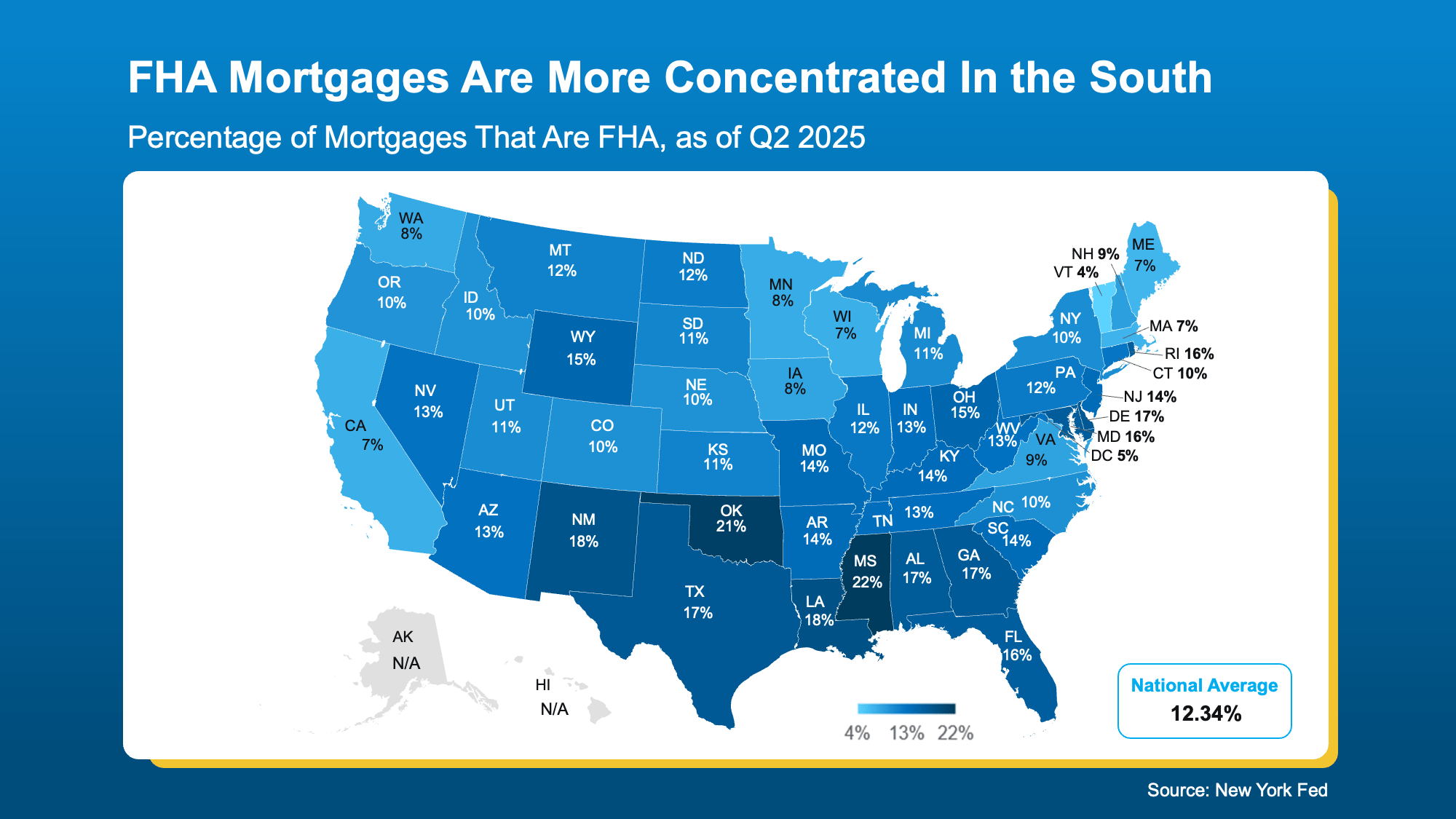

The Region with the Most FHA Loans

Here’s another reason this isn’t a signal of trouble ahead. FHA loans only make up about 12% of all home loans nationwide. But like anything else in housing, local data matters. There are some regions of the country where there are more of this type of loan than others, particularly the South.

The map below does not show how many FHA loans are delinquent. It just shows the overall concentration of FHA loans by state, so you can see which regions have the greatest volume (see map below):

As the Federal Reserve Bank of New York explains:

As the Federal Reserve Bank of New York explains:

“Looking at geographic concentrations of loans, recent data indicate that a higher proportion of mortgage balances are delinquent in many of the southern states . . . we see that higher delinquency rates coincide with a higher share of FHA loans across states.”

Just remember, even the delinquencies rates we’re seeing now aren’t as high as they were in 2008. Again, this is not a signal of a crisis. But it is something experts will monitor in the months ahead.

If You’re Experiencing Financial Hardship

No one wants to see anyone face the challenges of foreclosure. But just know that, if you’re a homeowner struggling with payments, you’re not alone – and you do have options.

The first step is reaching out to your mortgage provider. In many cases, you may be able to set up a repayment plan or explore loan modifications to help you stay on track. And for many homeowners today, you may also have enough equity to sell your house and avoid foreclosure. Odds are, at least some of these delinquencies will go that route since homeowners today have near record amounts of equity in their homes. It may be worth seeing if that could be an option for you too.

Bottom Line

Foreclosures are rising slightly, but they’re nowhere near the levels of 2008. And delinquency trends don’t point to a crash ahead.

This is something industry professionals are going to watch in the days ahead. If you want to stay up to date, connect with an agent or lender so you always have the latest information.

Downsize4 weeks ago

Downsize4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Equity2 weeks ago

Equity2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

You must be logged in to post a comment Login