Renting can feel like the easier choice right now. There’s no big down payment. No dealing with surprise repairs. And no long-term commitment.

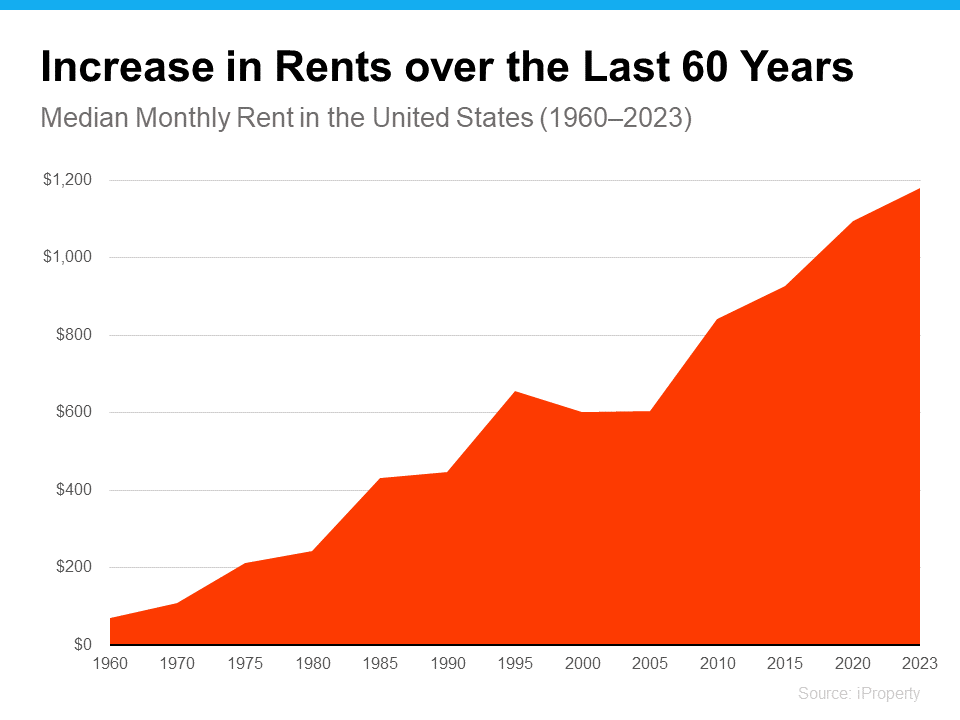

But then your rent goes up again. And again. And suddenly the thing that seemed flexible starts looking… expensive, especially considering you’re not building any equity. And once that happens, it’s easy to feel a little trapped in the cycle.

That’s because there’s so much chatter today about how buying a home isn’t affordable. But the truth is, the math may work out better than you’d expect based on what’s changed recently.

Buying Is More Affordable Than Renting in Many Areas

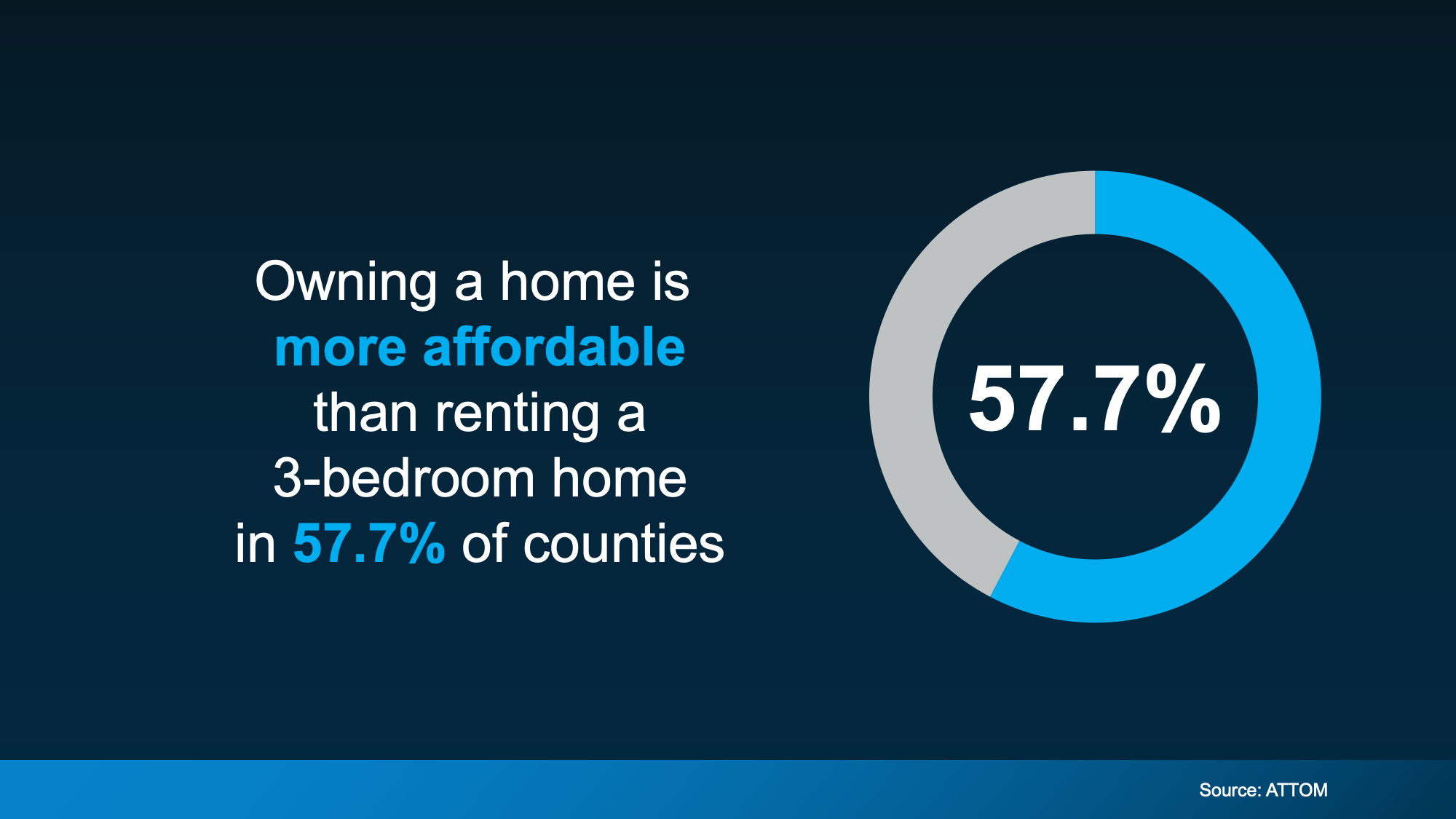

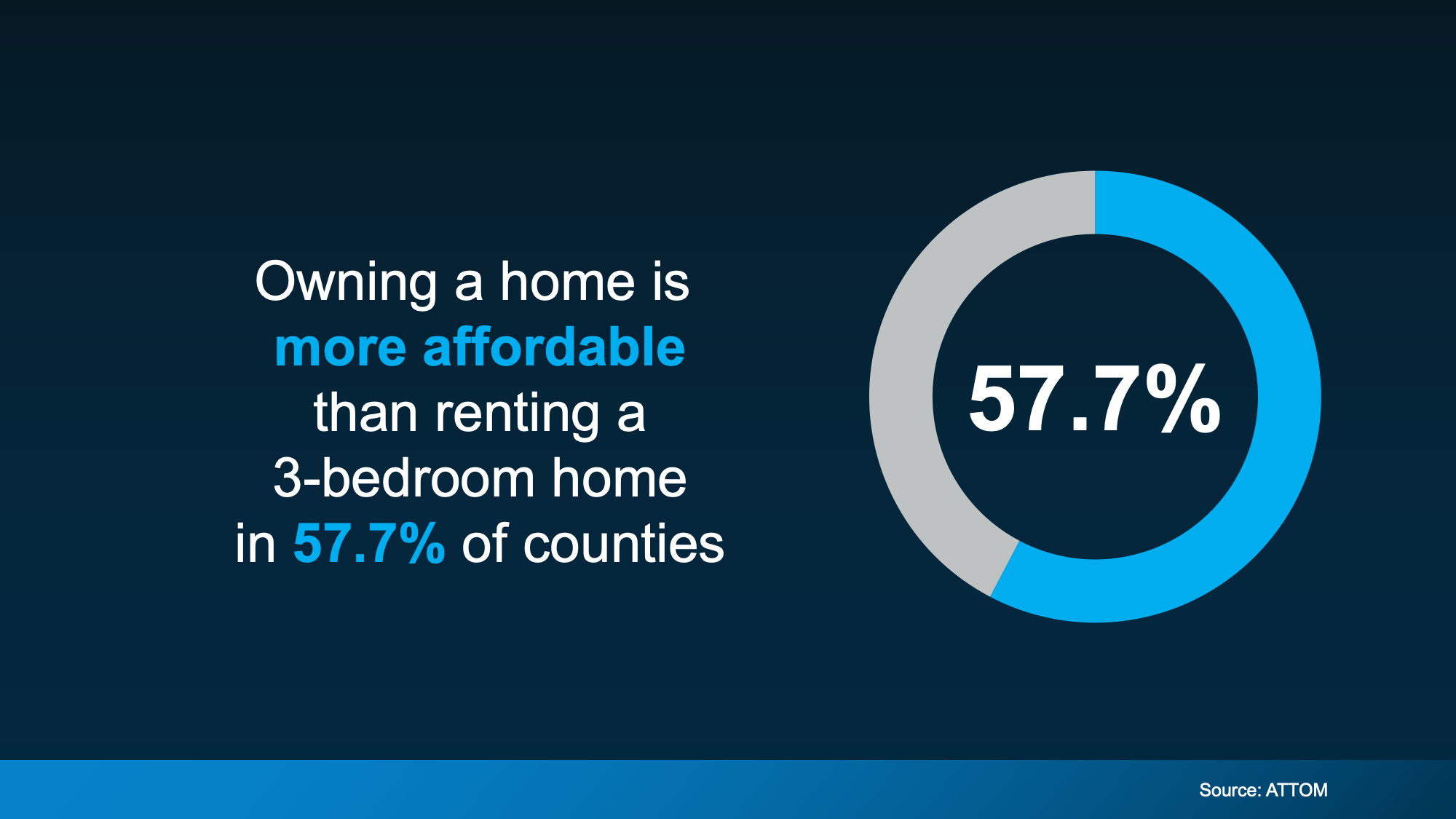

In a lot of places today, owning a home actually costs less each month than renting a 3-bedroom home. And recent data from ATTOM shows that’s true in nearly 58% of counties across the U.S. (see chart below).

And that’s after you factor in things like insurance and typical maintenance costs.

In other words, even though it may feel like a bit of a shock, the numbers show rent often stretches monthly budgets more than owning does. That’s thanks to slower home price growth, more homes for sale, and monthly mortgage payments starting to ease as rates come down.

In other words, even though it may feel like a bit of a shock, the numbers show rent often stretches monthly budgets more than owning does. That’s thanks to slower home price growth, more homes for sale, and monthly mortgage payments starting to ease as rates come down.

Affordability Still Varies by Region

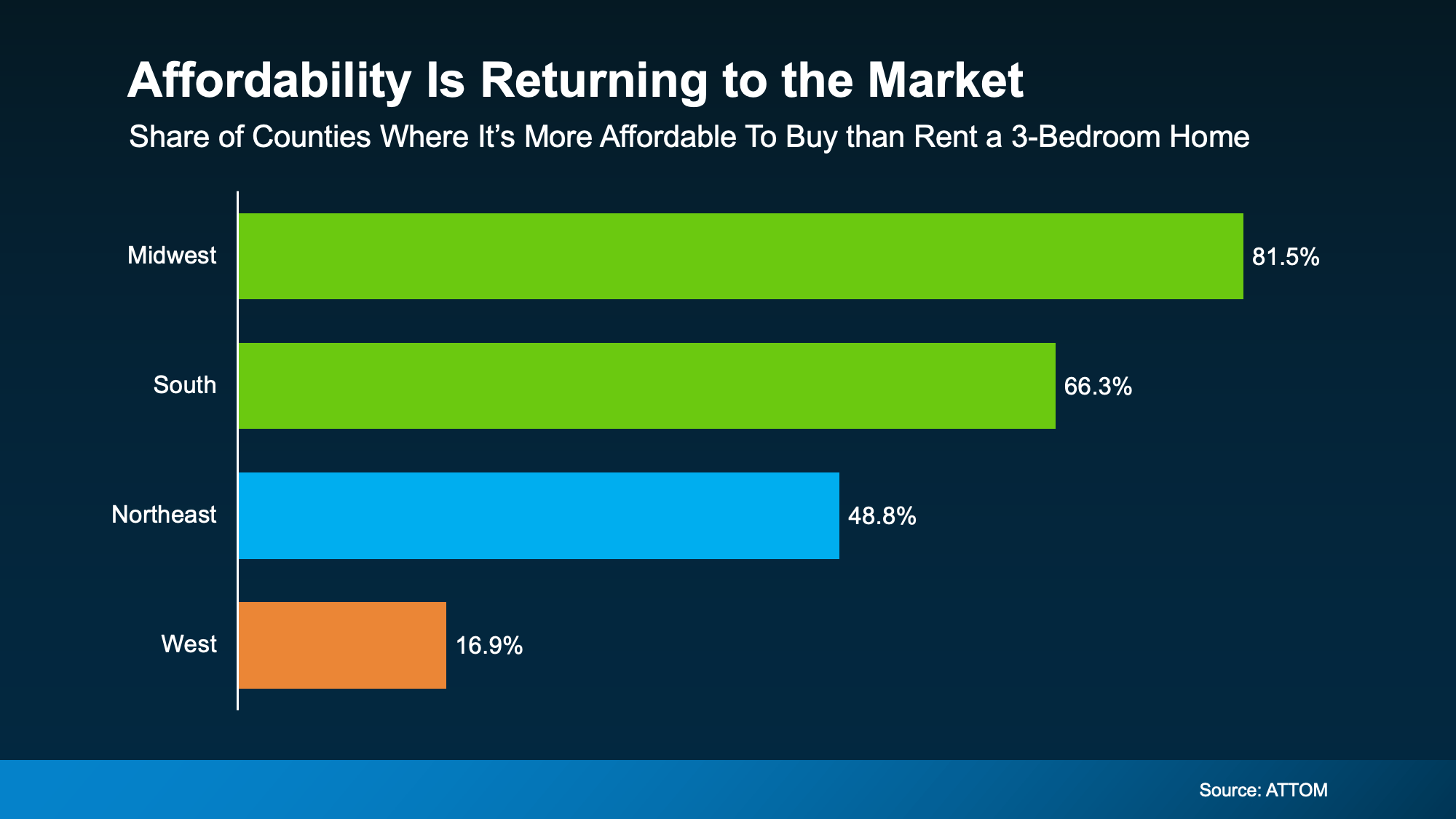

Now, even though nationally the balance has shifted, that doesn’t mean buying is more affordable in every market or for every renter.

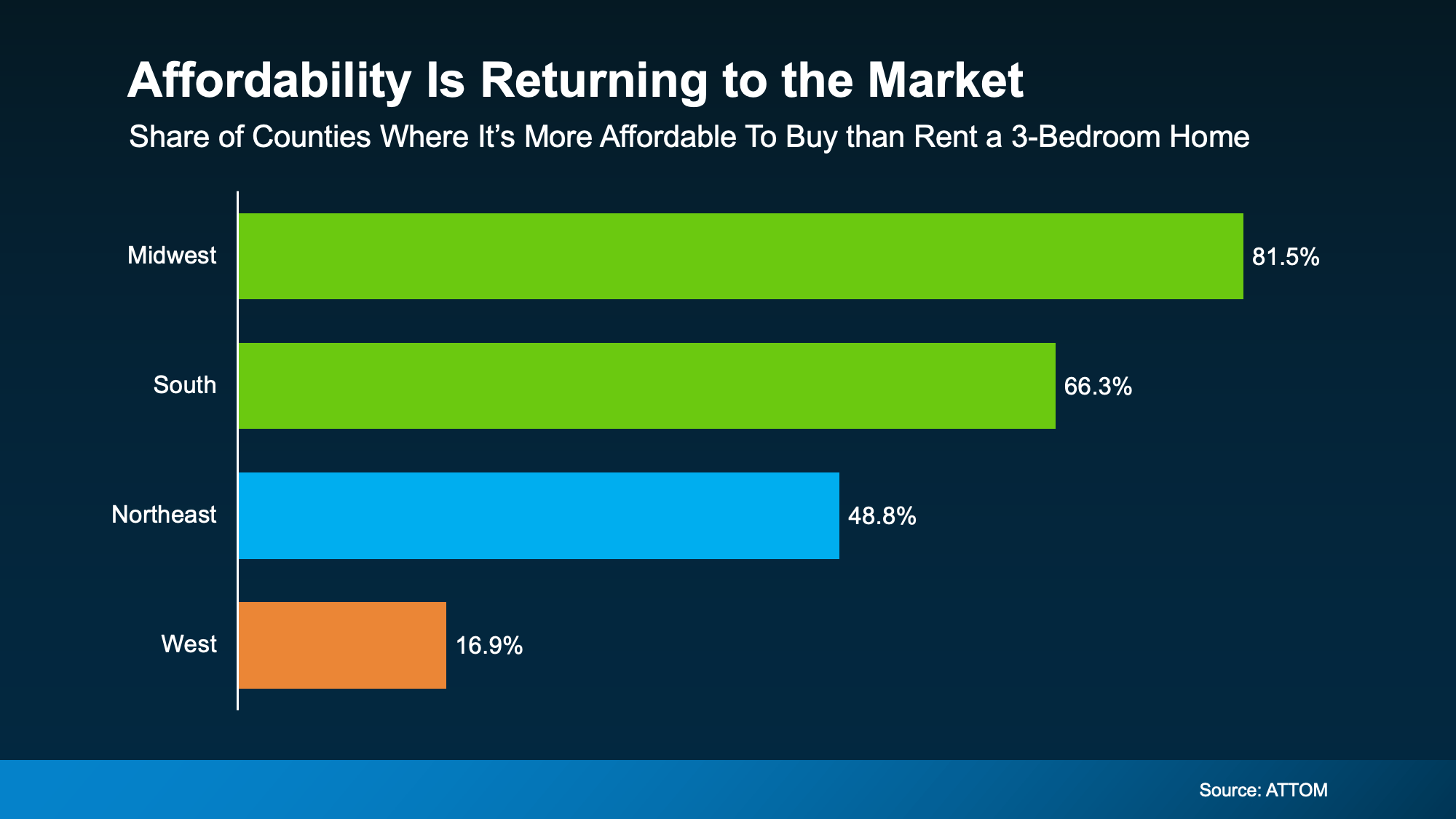

While buying is more affordable than renting in nearly 58% of counties nationwide, that share looks different depending on your region (see graph below):

The biggest improvement is happening in the Midwest and South. But if you’re living in the West, things could still feel tight.

The takeaway? How affordable buying is really depends on where you live. And the only way to know how this plays out where you live is to look at the numbers locally.

So, What’s Still Holding Buyers Back?

Maybe you’re nodding along so far but thinking, “Okay, but I still can’t afford the upfront costs.” If that’s your reaction, you’re not the only one.

For many renters, the biggest hurdle isn’t the monthly payment alone. It’s the down payment, too.

But you’re not out of options. Here’s the part most people don’t hear enough about: there are thousands of down payment assistance programs available across the country, and many buyers qualify without realizing it.

And the average benefit? Roughly $18,000.

That kind of support can help cover part of your down payment or closing costs, which means you may not need to save nearly as much as you think to get started.

When you combine that with monthly payments that may work better than expected, especially as rates continue to ease and prices cool, buying may feel far more realistic than it looks at first glance.

Bottom Line

The point isn’t that everyone should rush out and buy a home tomorrow.

It’s that renting isn’t always the more affordable option people assume it is – and buying may be more realistic than it feels once you look at the full picture.

If you’re renting and feeling stuck in the “someday” loop, it might be worth a simple conversation with a local real estate agent or lender. Just a chance to see what’s possible and whether it makes sense for you.

Affordability1 week ago

Affordability1 week ago

Equity3 weeks ago

Equity3 weeks ago

Affordability4 weeks ago

Affordability4 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

Equity2 weeks ago

Equity2 weeks ago

Agent Value2 weeks ago

Agent Value2 weeks ago

You must be logged in to post a comment Login