If you’ve seen headlines or social posts calling for a housing crash, it’s easy to wonder if home values are about to take a hit. But here’s the simple truth.

The data doesn’t point to a crash. It points to slow, continued growth.

And sure, it’s going to vary by local area. Some markets will see prices rise more than others. And some may even see small, short-term declines. But the big picture is: home prices are expected to rise nationally, not fall, over the next 5 years.

The Real Story Is in the Expert Forecasts

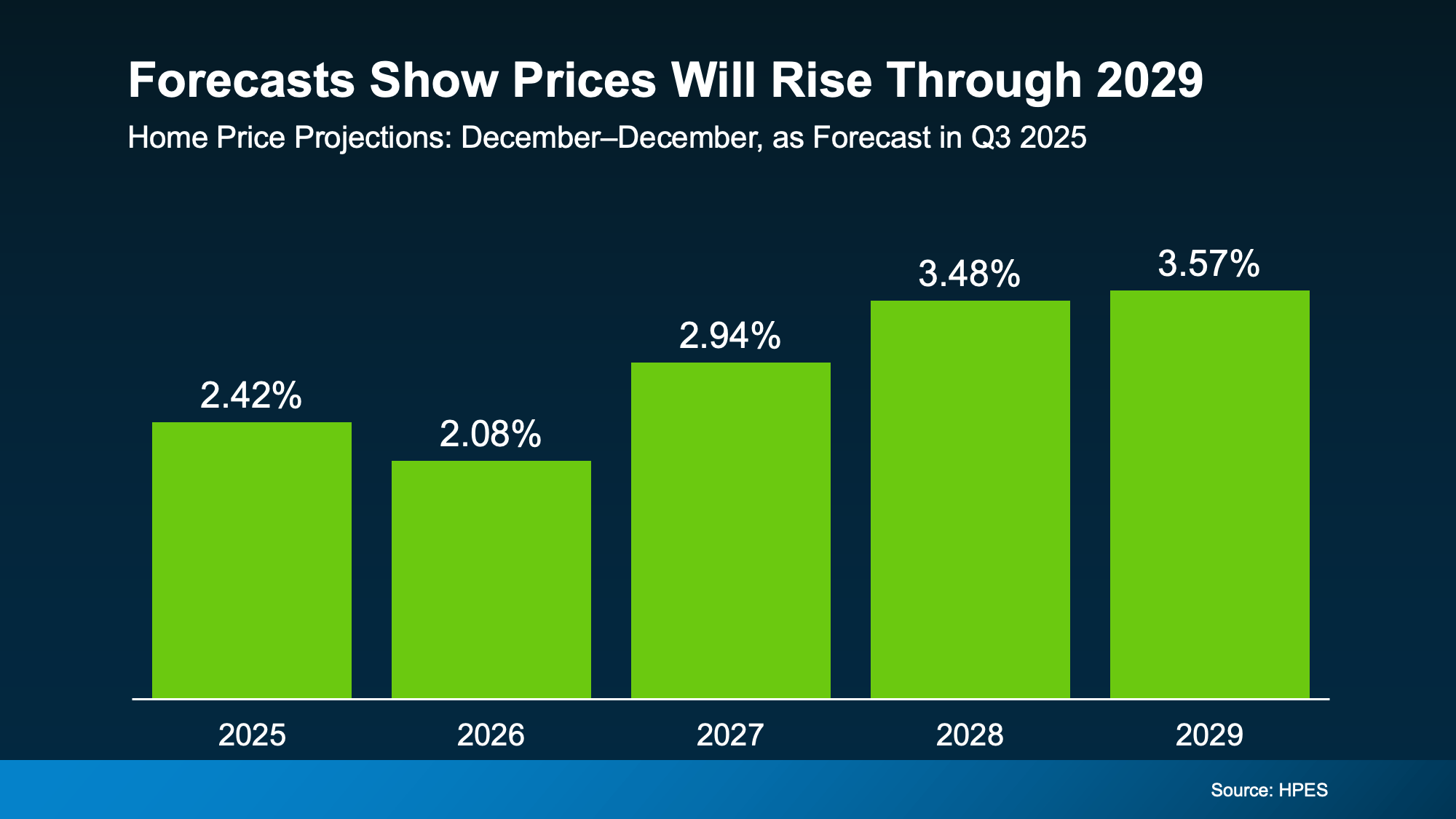

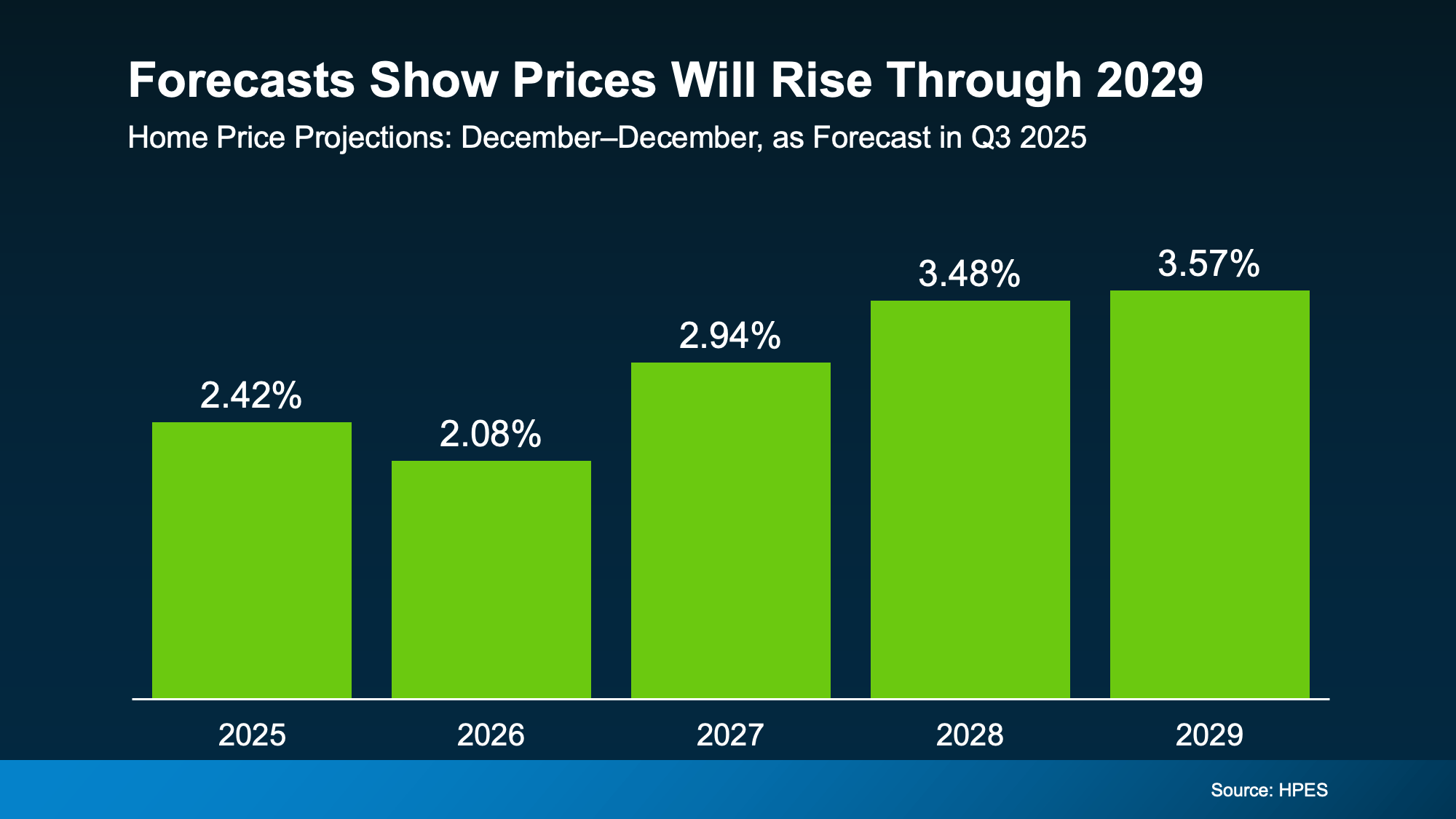

In the Home Price Expectations Survey (HPES) from Fannie Mae, each quarter over 100 leading housing market experts weigh in on where they project home prices will go from here. And in the report that was just released, the experts agree prices are projected to climb nationally through at least 2029 (see graph below):

Here’s how to read this visual. Each bar in that graph shows an increase, not a loss. It’s just that the anticipated pace of that appreciation varies year-to-year.

Here’s how to read this visual. Each bar in that graph shows an increase, not a loss. It’s just that the anticipated pace of that appreciation varies year-to-year.

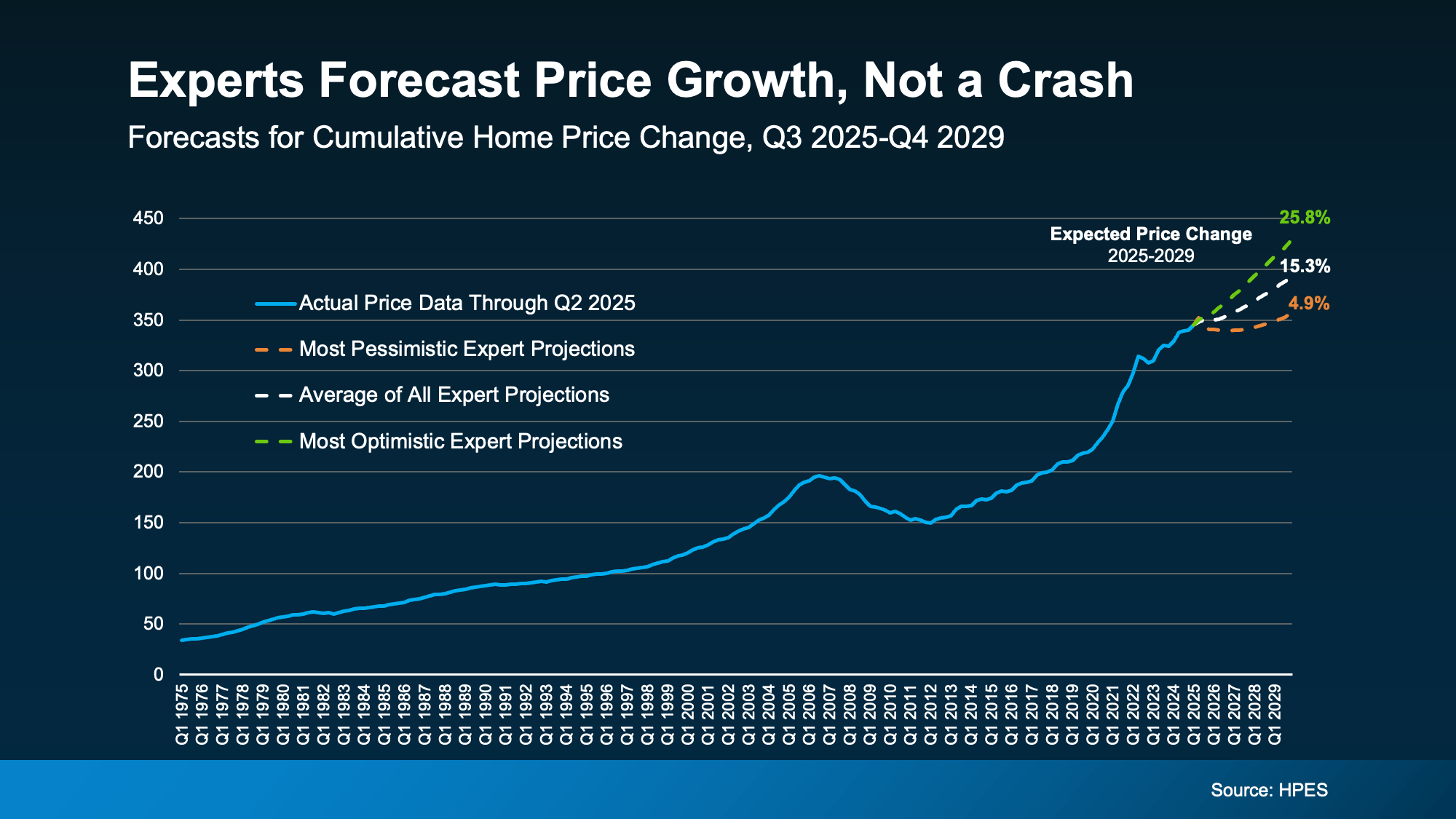

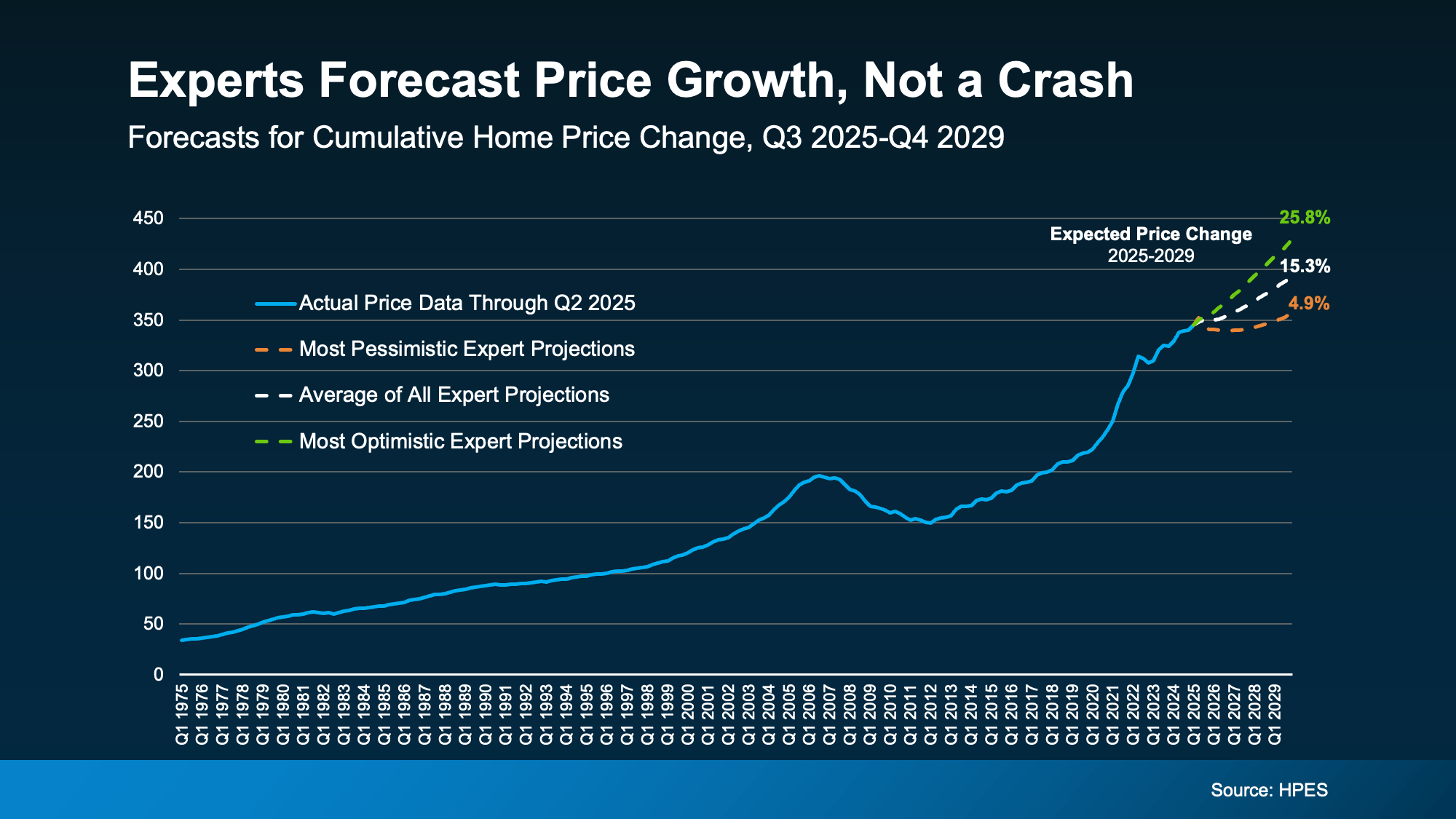

And to further drive this home, let’s look at another view of where prices are and where they’re expected to go. In this version, the expert forecasts are broken into 3 categories: the overall average, the most optimistic projections, and the most pessimistic projections (see chart below):

Notice how even the most pessimistic forecasters say we’ll see prices rise by almost 5% over the next few years.

Notice how even the most pessimistic forecasters say we’ll see prices rise by almost 5% over the next few years.

- Overall, prices are expected to rise about 15% from now through the end of 2029.

- The optimists say we’ll beat that and see a roughly 26% increase.

- And even the pessimists anticipate prices will go up by 5% during that period.

What sticks out the most? None of these groups who study the market are forecasting a crash, or even a decline, over the next 5 years.

How This Compares to “Normal” for the Market

Now, focus back on the first graph. The projections call for 2-3.5% price increases in each of the next five years. For context, the average rate of appreciation for the last 25 years was closer to 4-5% annually.

So, while that’s slightly below the historical average, it’s much more sustainable and typical than where the market was in 2020, 2021, and 2022.

Back then, prices rose too much, too fast based on record-low supply and record-high demand. Some places even saw prices climb by 15-20%.

So, while it may feel like prices are stalling compared to those pandemic-era surges, what’s really happening is that the market is finally finding balance again.

Why Prices Aren’t Expected To Crash

A lot of the chatter about home prices today is based on that rapid rise and the old saying that what goes up, must come down. But historically, that’s not really true. Home prices almost always rise.

And the main reason we’re not heading for a repeat of 2008 is simple: supply and demand.

Even though affordability challenges have made it harder for some people to buy over the past few years, there still aren’t enough homes for everyone who wants one. And that ongoing shortage is keeping upward pressure on prices nationally.

That’s why experts across the board can confidently agree: we’re not headed for a price collapse, but for steady, long-term appreciation.

And just in case it’s the economy that’s got you worried, remember this. Over the past 50 years, there have been plenty of economic events that have impacted the market. And one thing that’s consistently been true throughout time is the housing market always recovers. And we’re coming through that turn right now and going into a recovery.

Bottom Line

If you’ve been waiting to buy or sell because you’re worried about a crash, it’s time to look at the data – not the headlines.

The question isn’t if home prices will rise, it’s by how much.

Connect with an agent who can show you what’s happening in your local market and what these forecasts mean for your next move.

Affordability4 weeks ago

Affordability4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Equity3 weeks ago

Equity3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Affordability1 week ago

Affordability1 week ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

2. How Many Jobs the Economy Is Adding

2. How Many Jobs the Economy Is Adding

You must be logged in to post a comment Login