Do you think a brand-new home means a bigger price tag? Think again.

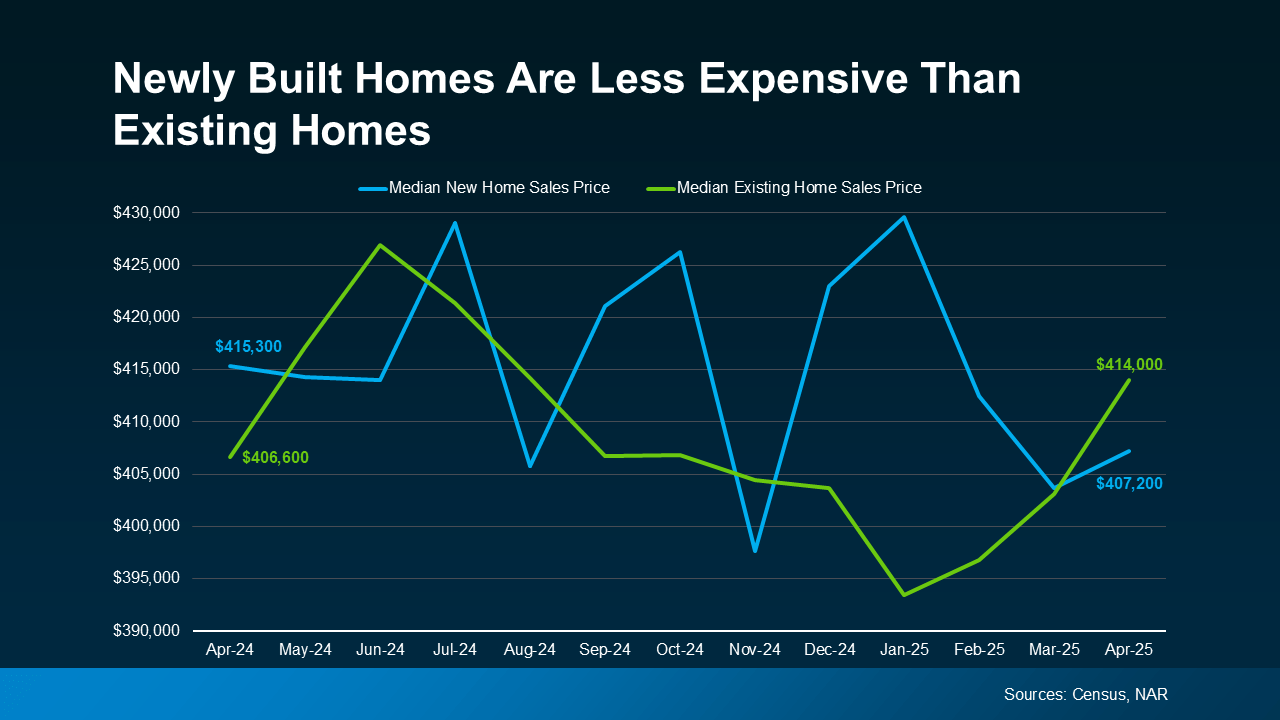

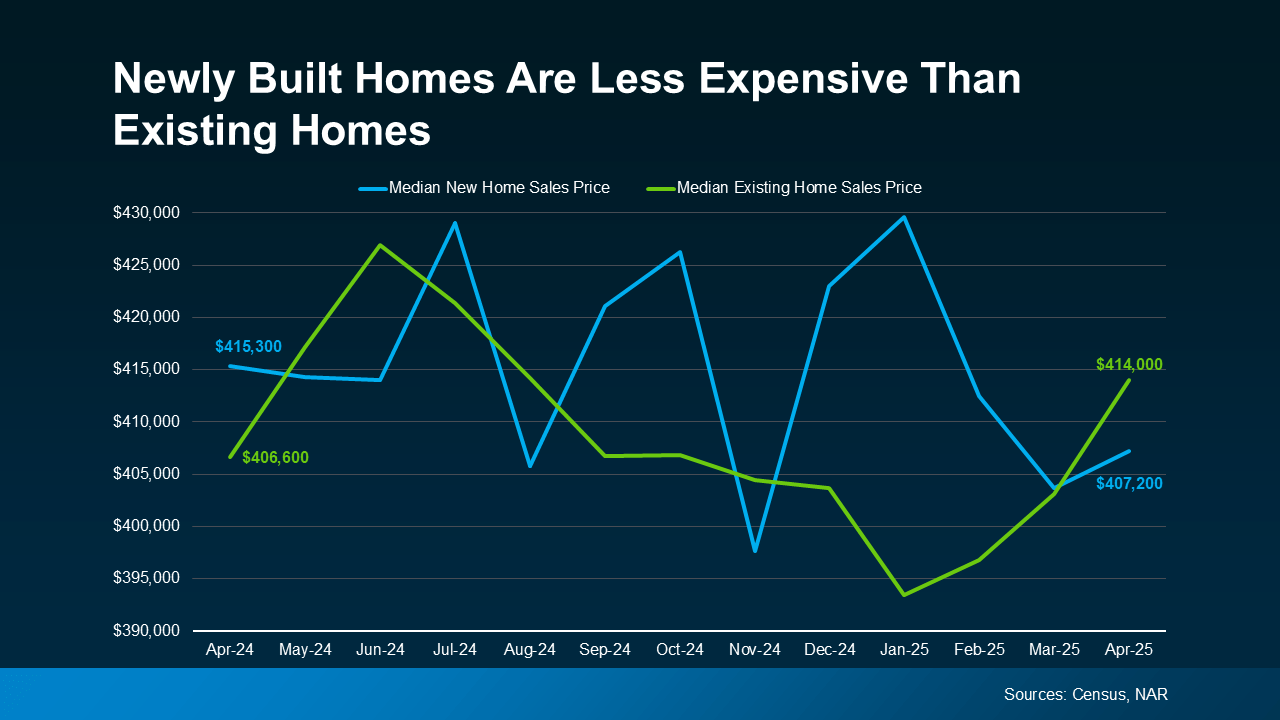

Right now, something unique is happening in the housing market. According to the Census and the National Association of Realtors (NAR), the median price of newly built homes is actually lower than the median price for existing homes (ones that have already been lived in):

You read that right. That brand new, never-been-lived-in house may cost less than the one built 20 years ago in a neighborhood just down the street. So, if you wrote off a new build because you assumed they’d be financially out of reach, here’s what you should know. You could be missing out on some of the best options in today’s housing market.

You read that right. That brand new, never-been-lived-in house may cost less than the one built 20 years ago in a neighborhood just down the street. So, if you wrote off a new build because you assumed they’d be financially out of reach, here’s what you should know. You could be missing out on some of the best options in today’s housing market.

Why Are Newly Built Homes Less Expensive Right Now?

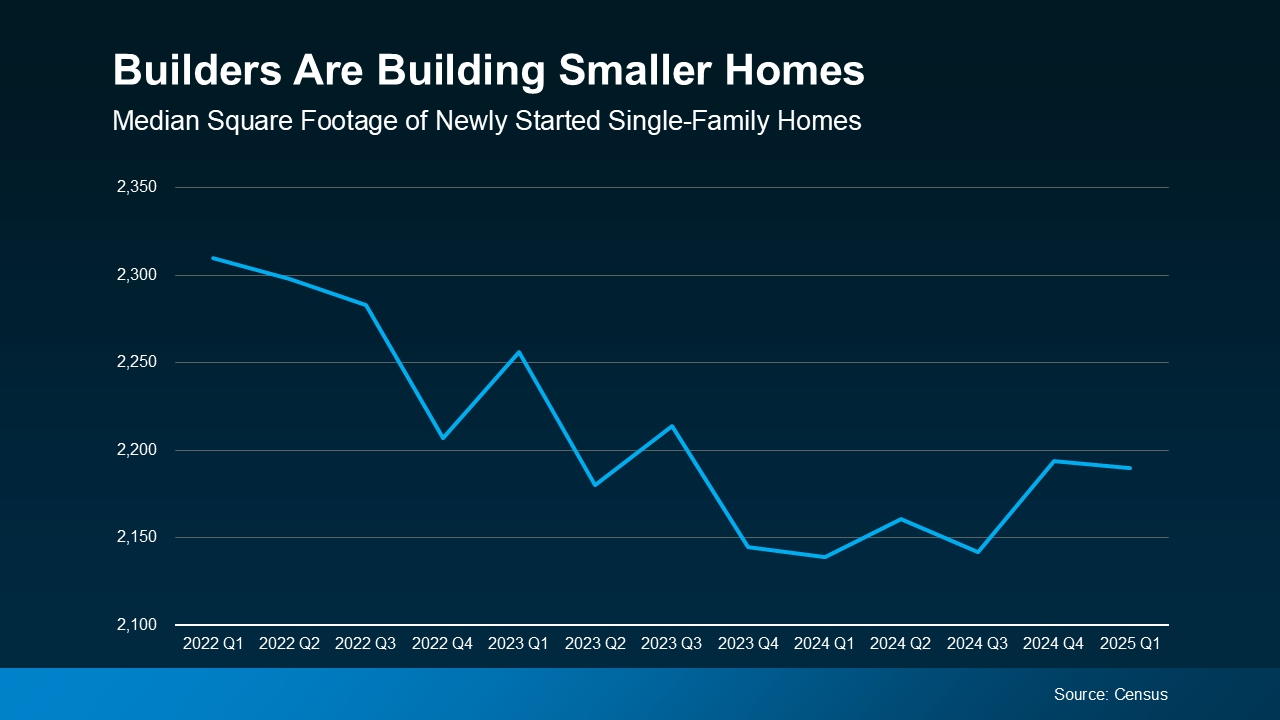

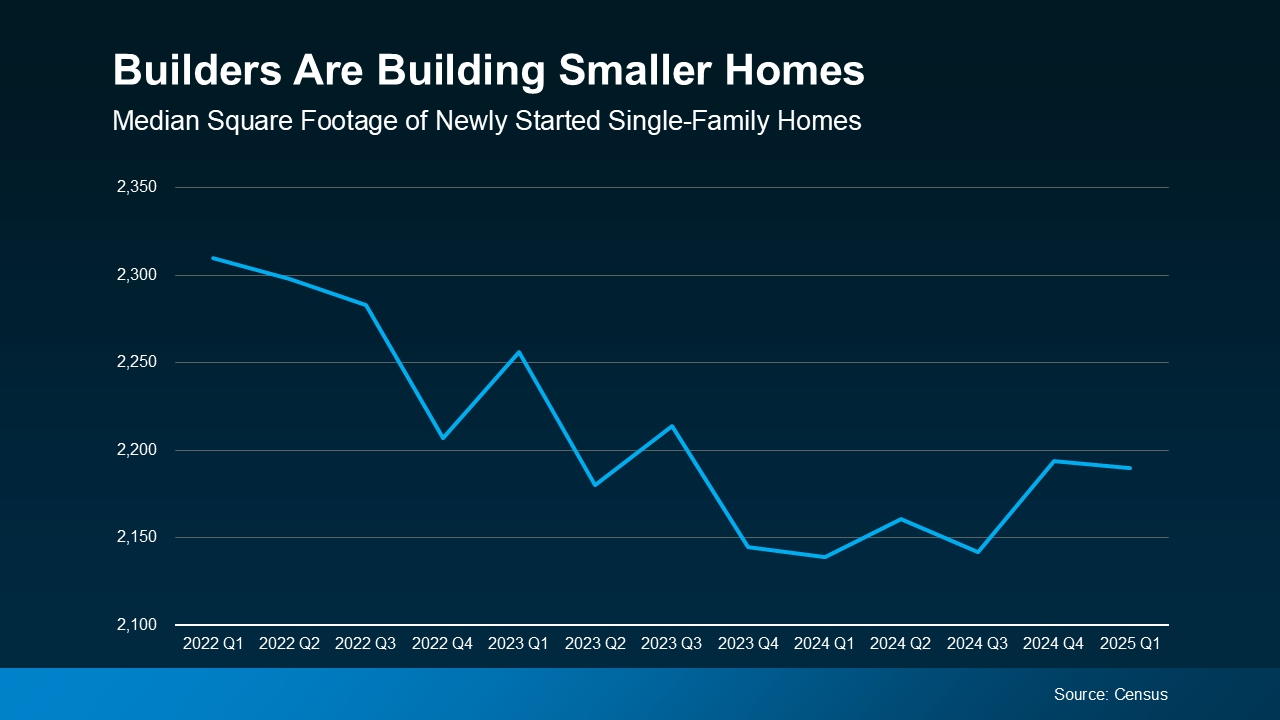

1. Builders Are Building Smaller Homes

Builders know that buyers are struggling with affordability today. So, instead of building big houses that may not sell, they’re building smaller ones that will. According to the Census, the average size of a newly built single-family home has dropped considerably over the past few years (see graph below):

And as size goes down, the price often does too. Smaller homes use fewer materials, which makes them less expensive to build. That helps builders keep prices lower so more people can afford them.

And as size goes down, the price often does too. Smaller homes use fewer materials, which makes them less expensive to build. That helps builders keep prices lower so more people can afford them.

2. Builders Are Offering Price Cuts and Incentives

In May, according to the National Association of Home Builders (NAHB), 34% of builders lowered their prices, with an average price drop of 5%. That’s because they want to be sure they’re selling the inventory they have before they build more.

On top of that, 61% of builders also offered sales incentives – like helping with closing costs or buying down your mortgage rate. These are all ways builders are making their homes more affordable, so these homes sell in today’s market.

Your Next Step? Ask Your Agent What’s Available Near You

If you’re trying to buy a home right now, be sure to talk to your agent to find out what builders are doing in and around your area. They can find new home communities, as well as builders who are offering incentives or discounts, and hidden gems you might not uncover on your own.

Plus, buying a newly built home often means there are different steps in the process than if you purchase a home that’s been lived in before. That’s why it’s so important to have your own agent who can explain the fine print. You want a pro in your corner to advocate for you, negotiate on your behalf, and make sure your best interests come first.

Bottom Line

You could get a home that’s brand new, with modern features, at a price that’s even lower than some older homes. Talk with a local real estate agent about what you’re looking for and see if a newly built home is the right fit for you.

If buying a home is on your to-do list, what would stop you from exploring newly built options?

Affordability4 weeks ago

Affordability4 weeks ago

Infographics1 week ago

Infographics1 week ago

Economy4 weeks ago

Economy4 weeks ago

Infographics4 weeks ago

Infographics4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Agent Value4 weeks ago

Agent Value4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

First-Time Buyers3 weeks ago

First-Time Buyers3 weeks ago

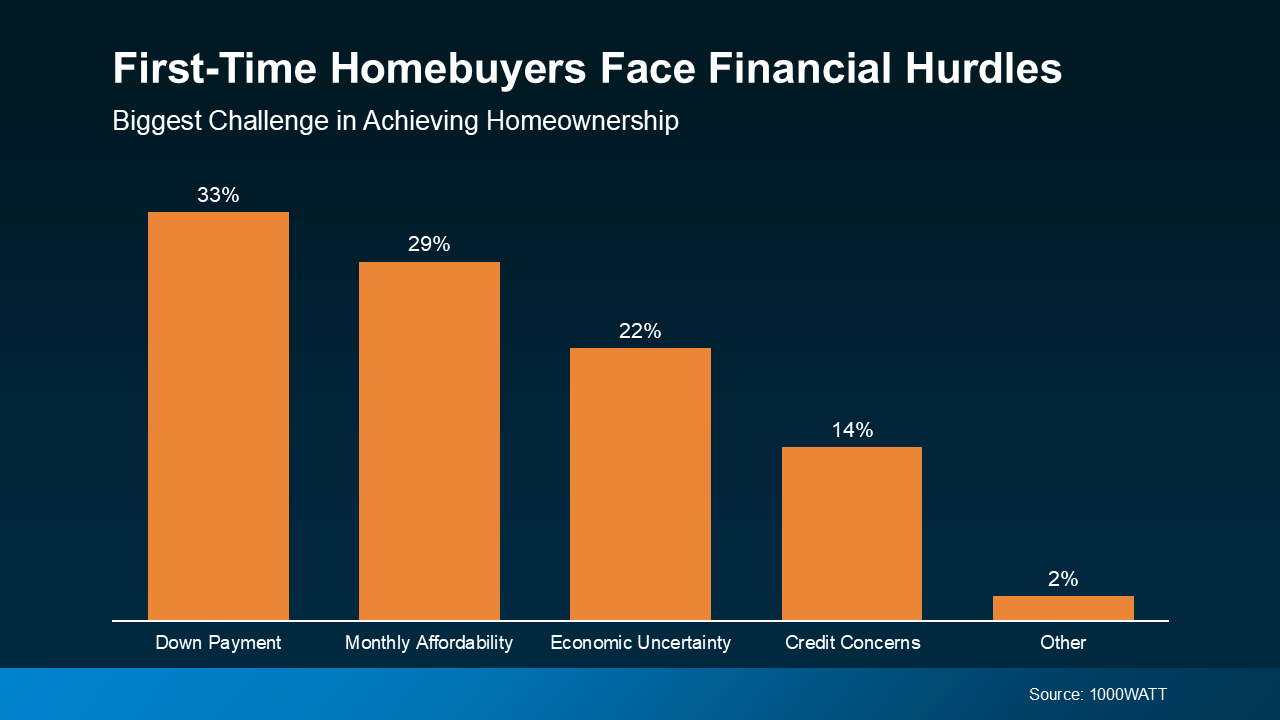

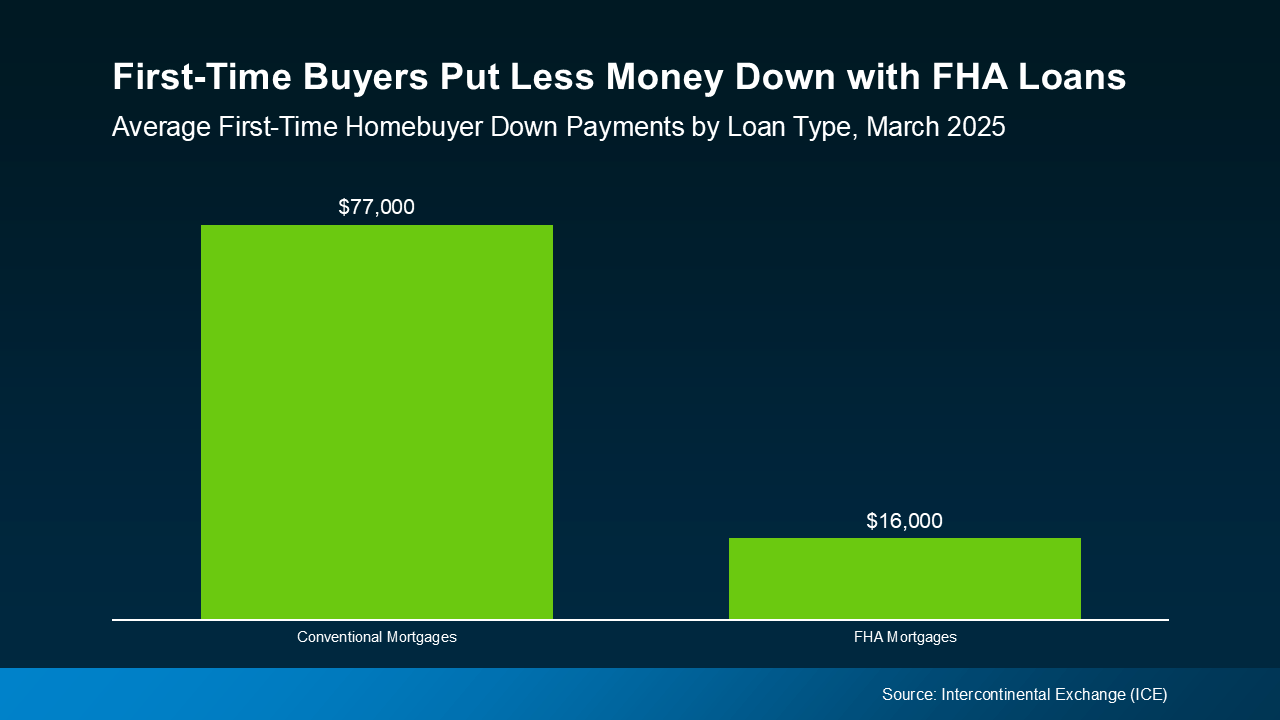

That’s Where FHA Loans Come In

That’s Where FHA Loans Come In Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

Essentially, buyers who use an FHA loan may not have to come up with as much cash up front. But the perks don’t stop there. You may also be able to pay less monthly, too.

You must be logged in to post a comment Login