Wondering what to expect from the housing market in 2026? You’re not the only one. For the past few years, affordability has been the biggest barrier standing between most people and their next move. And a lot of buyers and sellers have been holding their breath waiting for things to get better. The good news? It’s finally happening.

In 2025, affordability was the best it’s been in 3 years. And experts agree the momentum will keep going in 2026. And that’s based on their analysis of the key factors shaping the housing market in the year ahead: mortgage rates, inventory, and home prices.

Lower Mortgage Rates Are Already Here

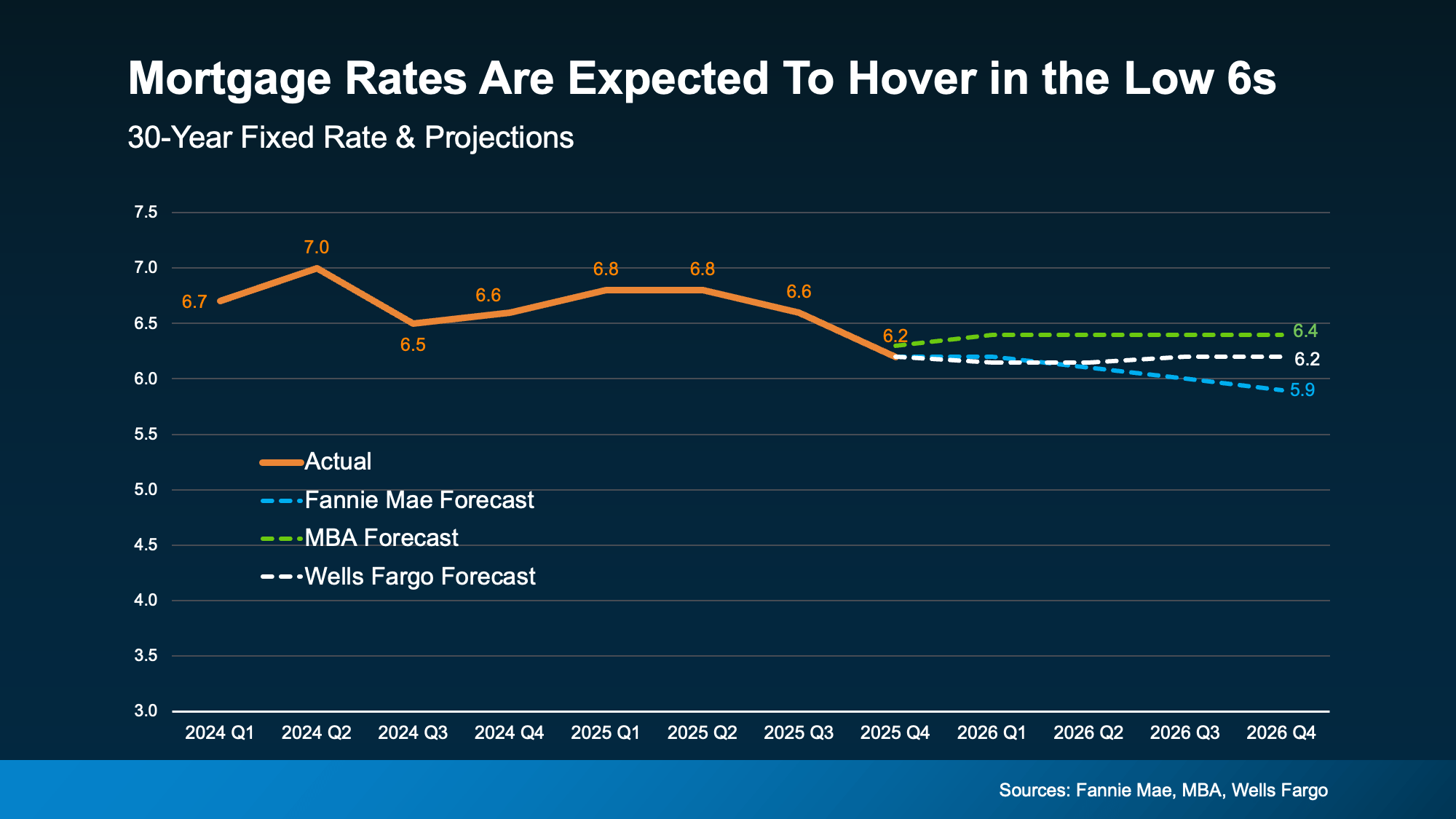

Mortgage rates have already come down from their peak. By some counts, they dropped by almost a full percentage point over the course of the last year. And that’s a big deal, even if it doesn’t sound like it. But how low will they go? And should you wait for them to come down more? Here’s your answer.

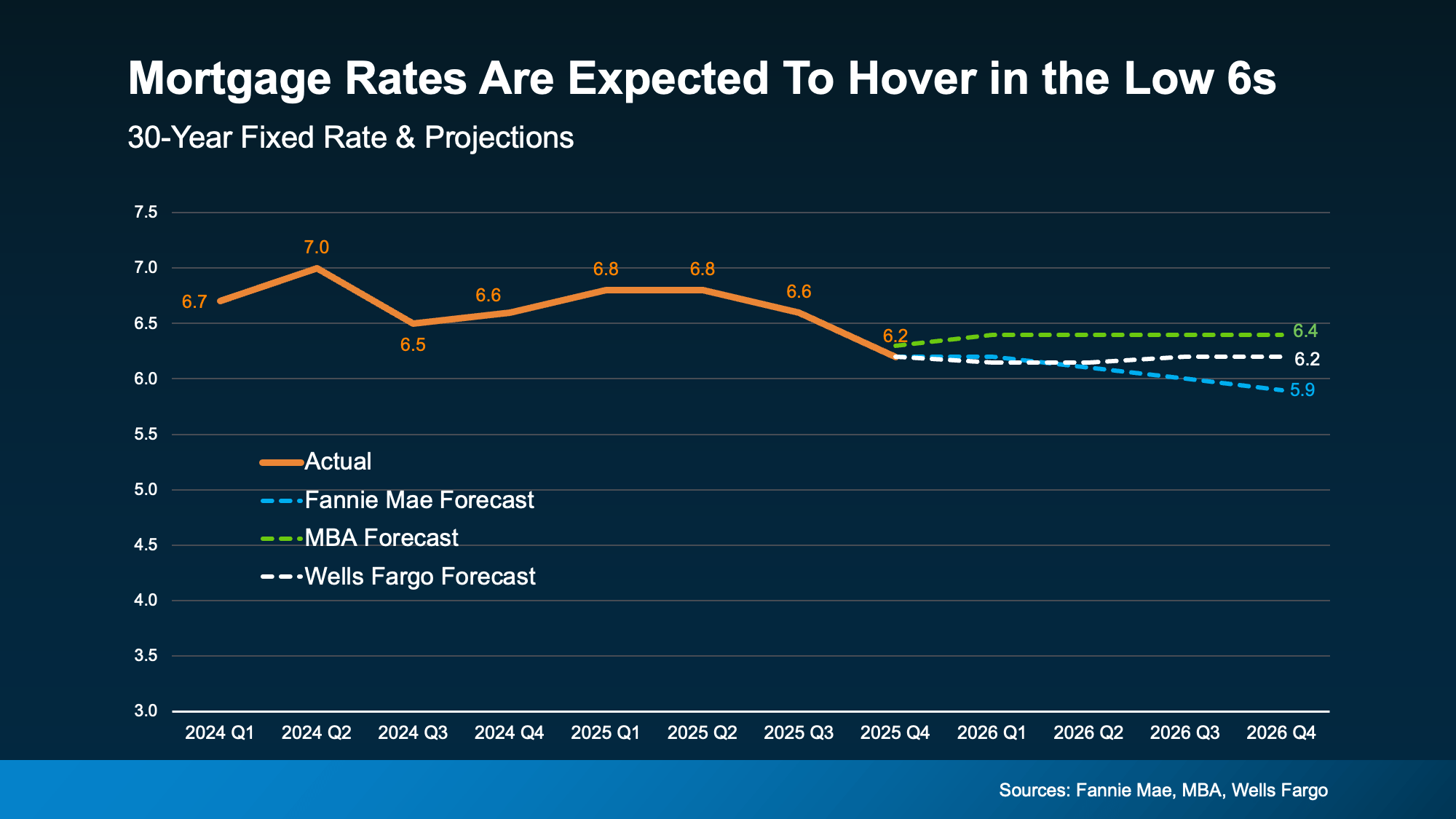

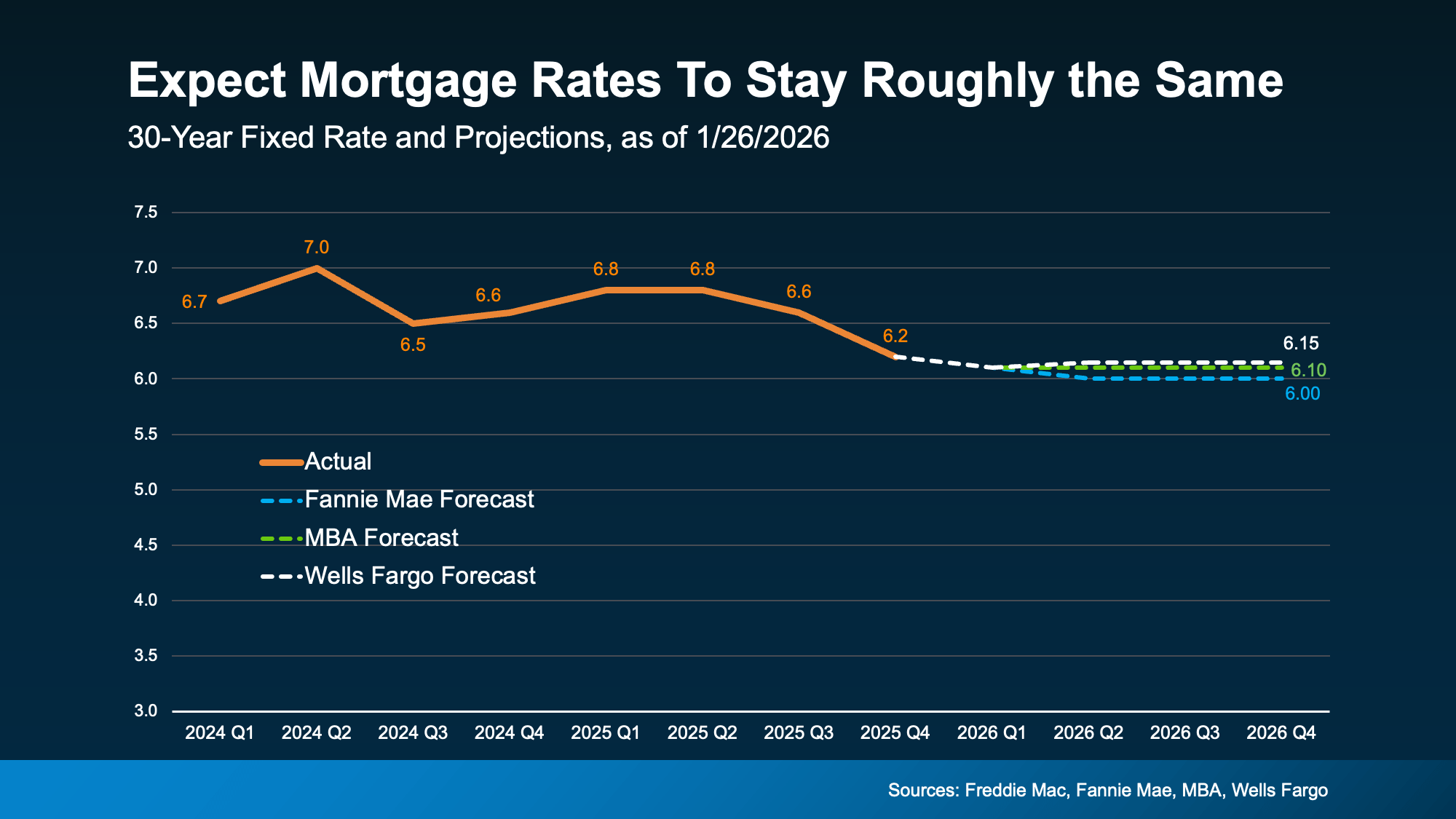

Forecasts suggest they’ll stay pretty much where they are now and hover in the low 6% range throughout 2026 (see graph below):

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

Where they go from here really depends on what happens with the economy, the job market, and any changes in monetary policy the Fed makes in the year ahead. The important thing is, they’re already lower than they were just one year ago and that’s ideal if you’re planning a 2026 move.

- For buyers: A lower rate reduces monthly payments and increases buying power. And, that combo helps more people qualify for homes that previously felt just out of reach.

- For sellers: It may be time to accept that rates in the 6s are the new normal. And if you need to move, it’s doable, especially with your equity.

Even More Options Are on the Way

In 2025, the number of homes for sale improved by about 15%. As inventory rose, buyers regained things they hadn’t had in years: options, time to consider those options, and negotiating leverage. That helped restore more balance to the housing market.

Not to mention, the inventory gains are a big piece of what’s helped price growth slow down – which in turn improves affordability.

While the inventory gains this year aren’t expected to be as steep, experts at Realtor.com say the supply of homes for sale should grow by another 8.9% this year.

- For buyers: That means even more choice and more negotiating power.

- For sellers: Pricing your house right will be essential to draw in buyers.

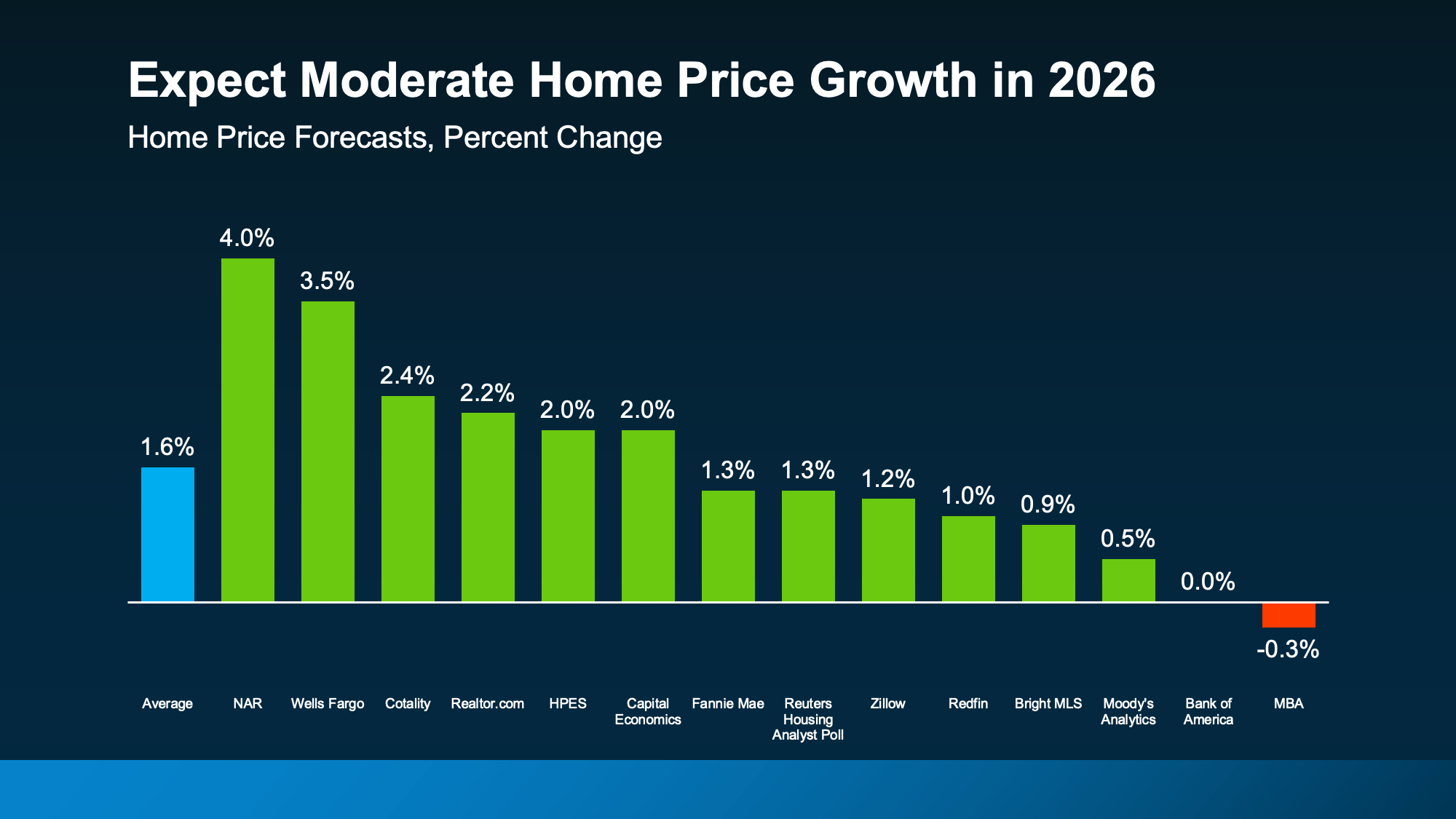

Home Price Growth Is Slowing to a More Sustainable Pace

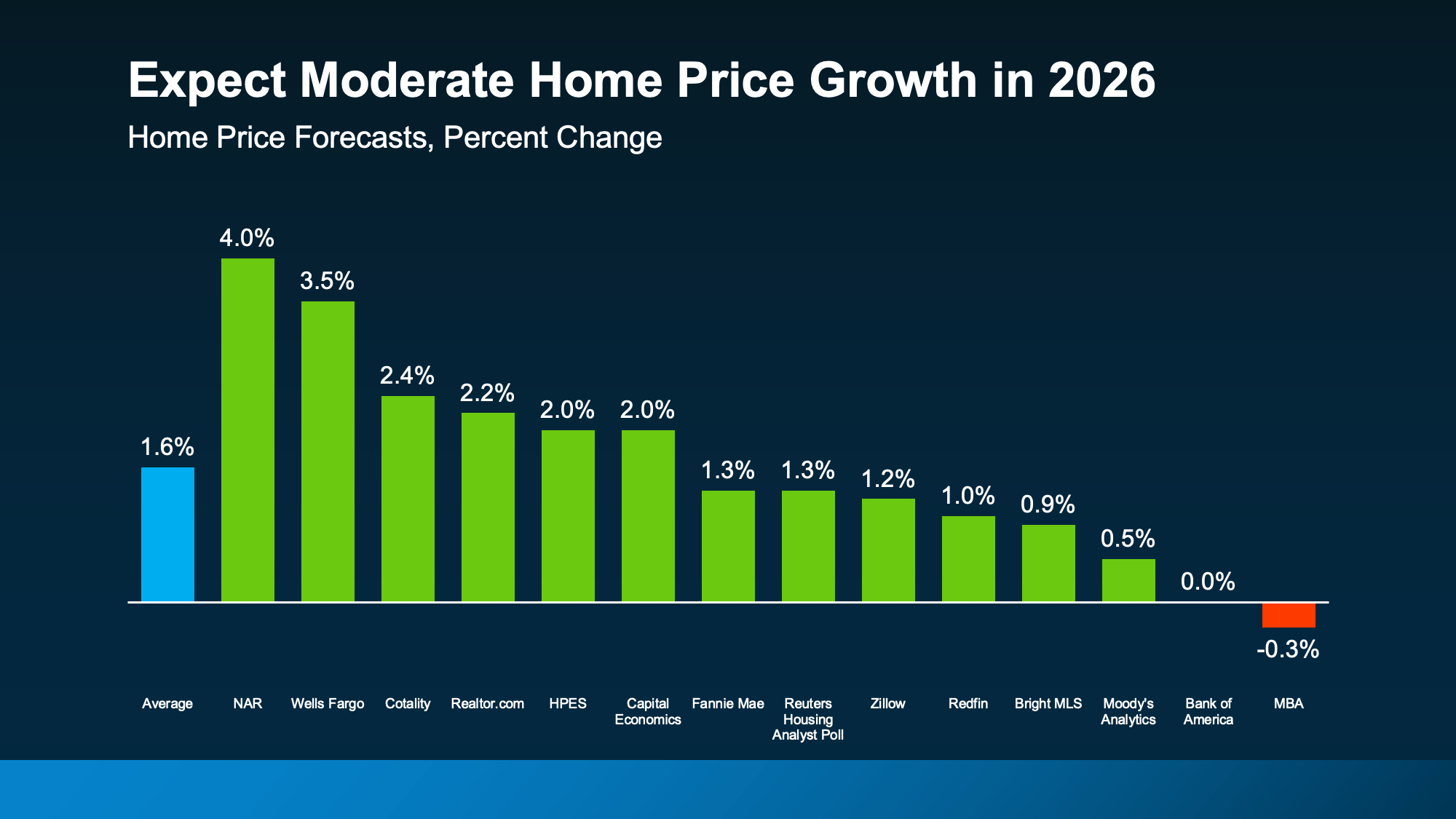

With more homes for sale, there isn’t as much upward pressure on prices right now. And we’ve seen that shake out over the past year. Even so, the overwhelming majority of experts say, nationally, prices will continue rising in the year ahead – just at a slower pace. On average, they say prices will rise by 1.6% in 2026 (see graph below):

And that’s reassuring if you’ve been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

And that’s reassuring if you’ve been fed content on social media saying prices are going to come crashing down. But here’s what you need to remember most about this. It’s going to vary a lot by area.

So, lean on a local agent for the latest on what’s happening where you are. Some markets will see prices rise more than this. Others may see prices come down slightly. It really all depends on conditions in your local market

But overall, prices will continue to rise at the national level. And that’s good for the market as a whole. As Realtor.com explains:

“For homebuyers and sellers, the shift signals a more balanced market—one where price growth steadies, rate relief offers breathing room, and negotiating power tilts subtly toward buyers.”

- For buyers: Expect more moderate price growth, not the sudden and intense spikes just a few short years ago. That gives you fewer surprises and more predictability, which makes budgeting a whole lot easier.

- For sellers: This slower price growth restores balance without putting your equity at risk. And that’s a win.

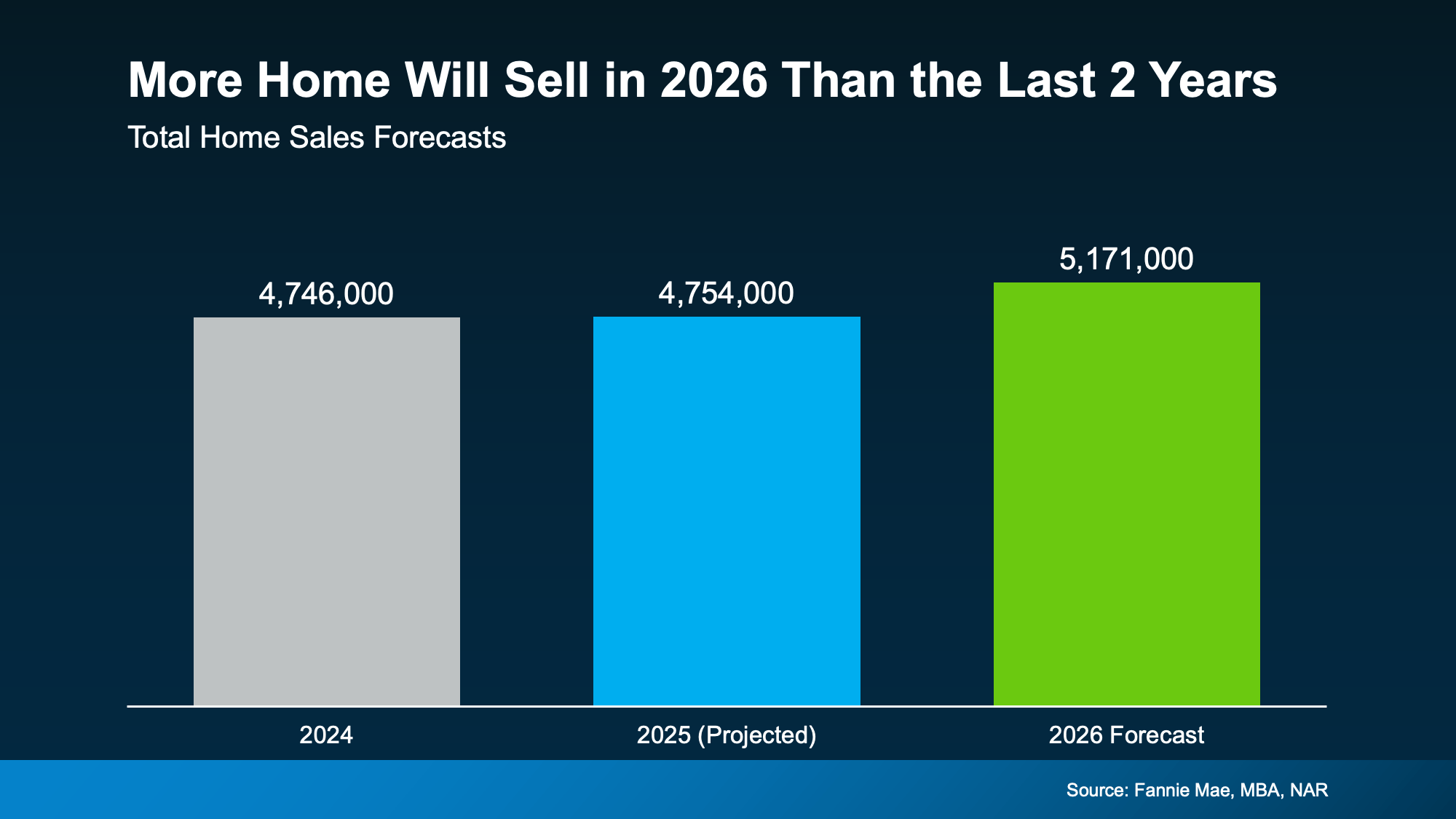

More Homes Will Sell

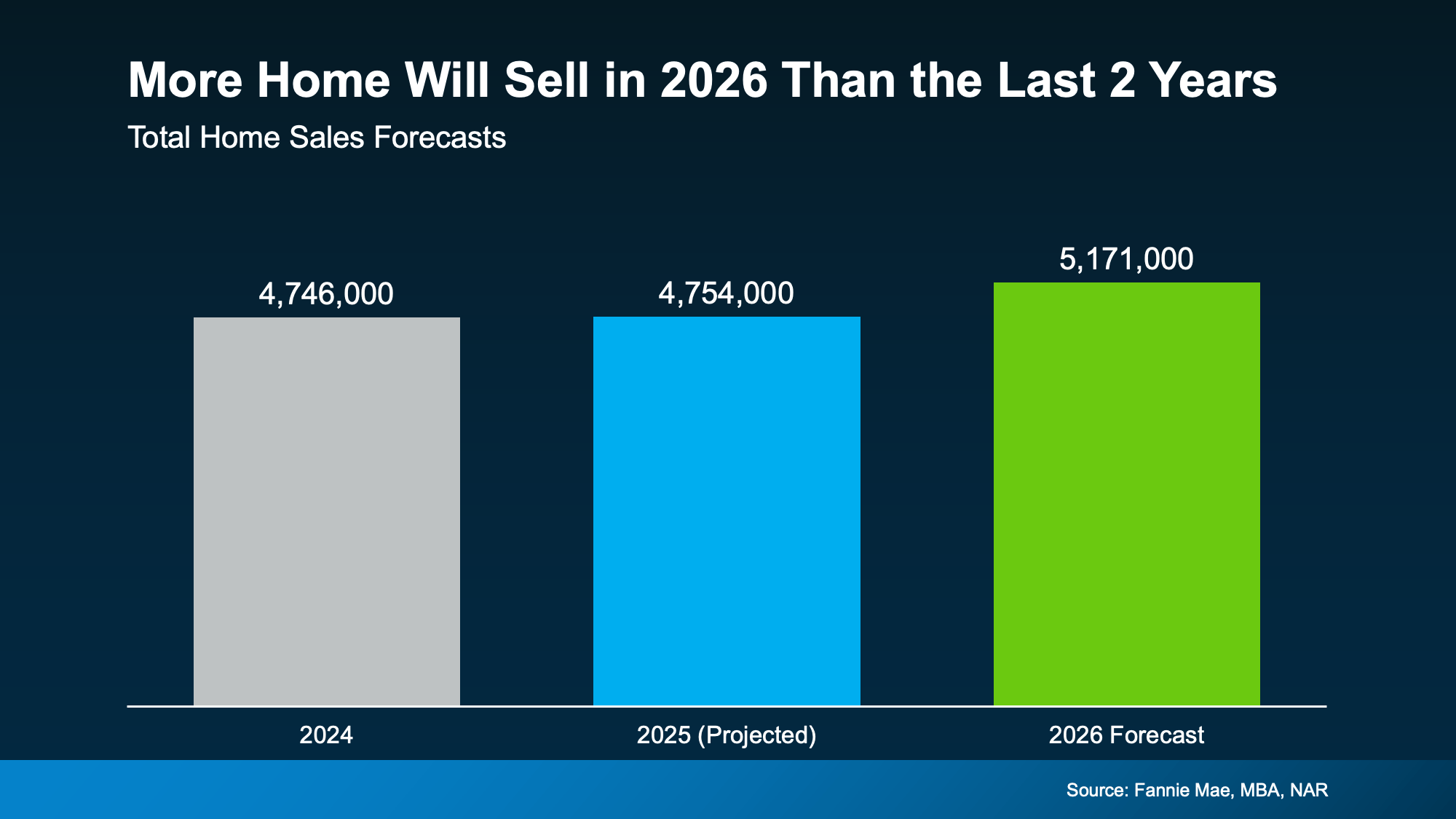

All of this adds up to a better affordability equation in 2026. And that’s exactly why experts are saying we should see more homes sell (and more people buy) this year.

As Mischa Fisher, Chief Economist at Zillow, says:

As Mischa Fisher, Chief Economist at Zillow, says:

“Buyers are benefiting from more inventory and improved affordability, while sellers are seeing price stability and more consistent demand. Each group should have a bit more breathing room in 2026.”

The bottom line is, more people are finally going to be able to make their move this year. So, the question is: will you be one of them? The market is giving you an opportunity you haven’t had in a while. Maybe it’s time to take advantage of it.

Bottom Line

Affordability won’t change suddenly overnight. But, with several key trends working together, it should slowly and steadily improve in the months ahead.

That’s exactly why, in 2026, you should see a market with more balance, more predictability, and more breathing room than you’ve had in years.

Want more information about the opportunities unlocking in your local market? Connect with a real estate agent today.

Downsize4 weeks ago

Downsize4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Buying Tips3 weeks ago

Buying Tips3 weeks ago

Equity2 weeks ago

Equity2 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

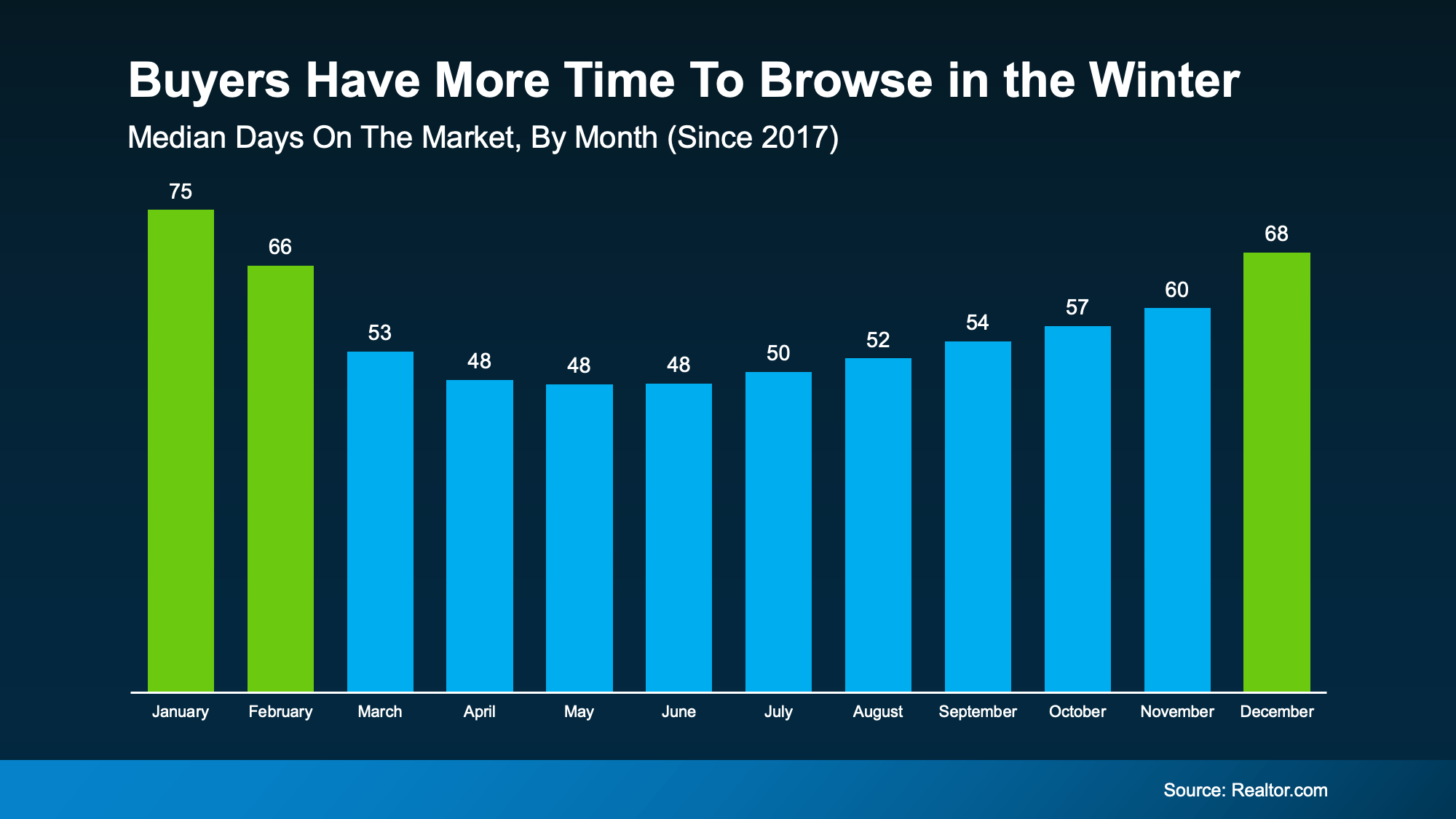

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

Homes sell faster in the spring, and slower in the winter. And that can be a worthwhile perk for buyers who want to get ahead before their decisions start to feel rushed.

You must be logged in to post a comment Login