Over the past few years, affordability has been the biggest challenge for homebuyers. Between rapidly rising home prices and higher mortgage rates, many have felt stuck between a rock and a hard place.

But, something pretty encouraging is happening. While affordability is still tight, mortgage rates have shown signs of stabilizing in recent months. And that may finally make it a bit easier to plan your move.

Mortgage Rates Have Stabilized – For Now

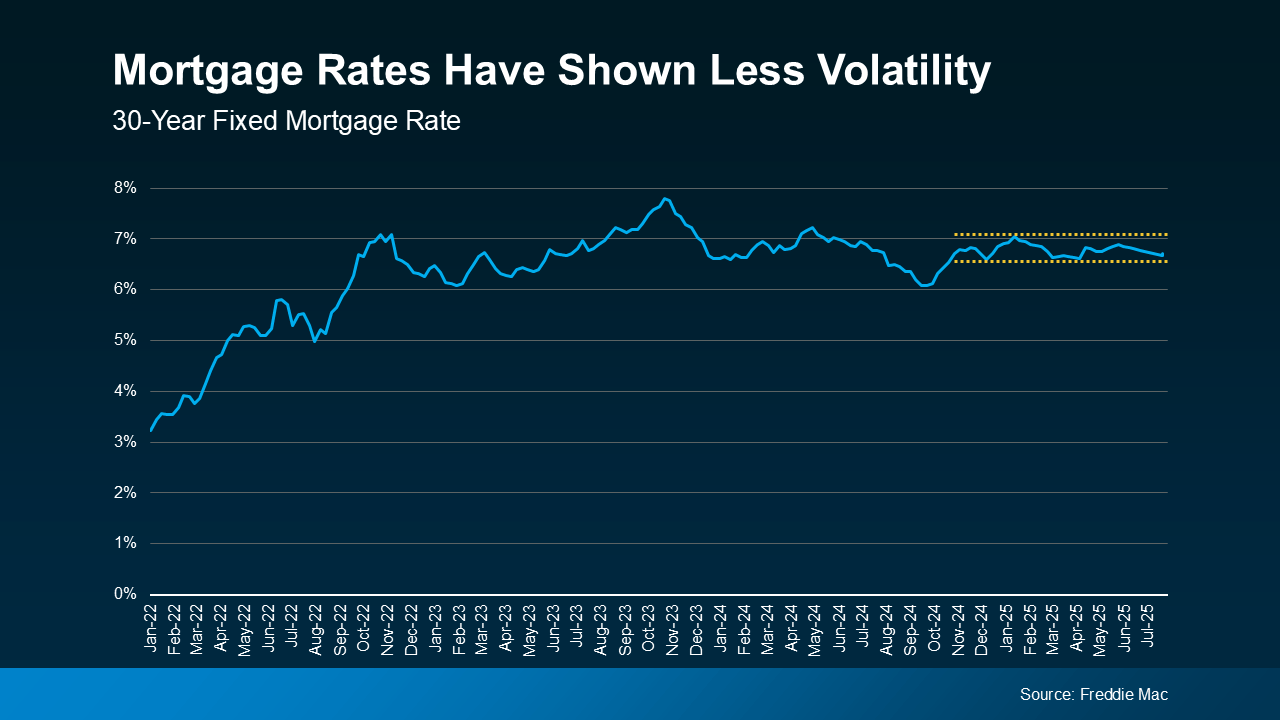

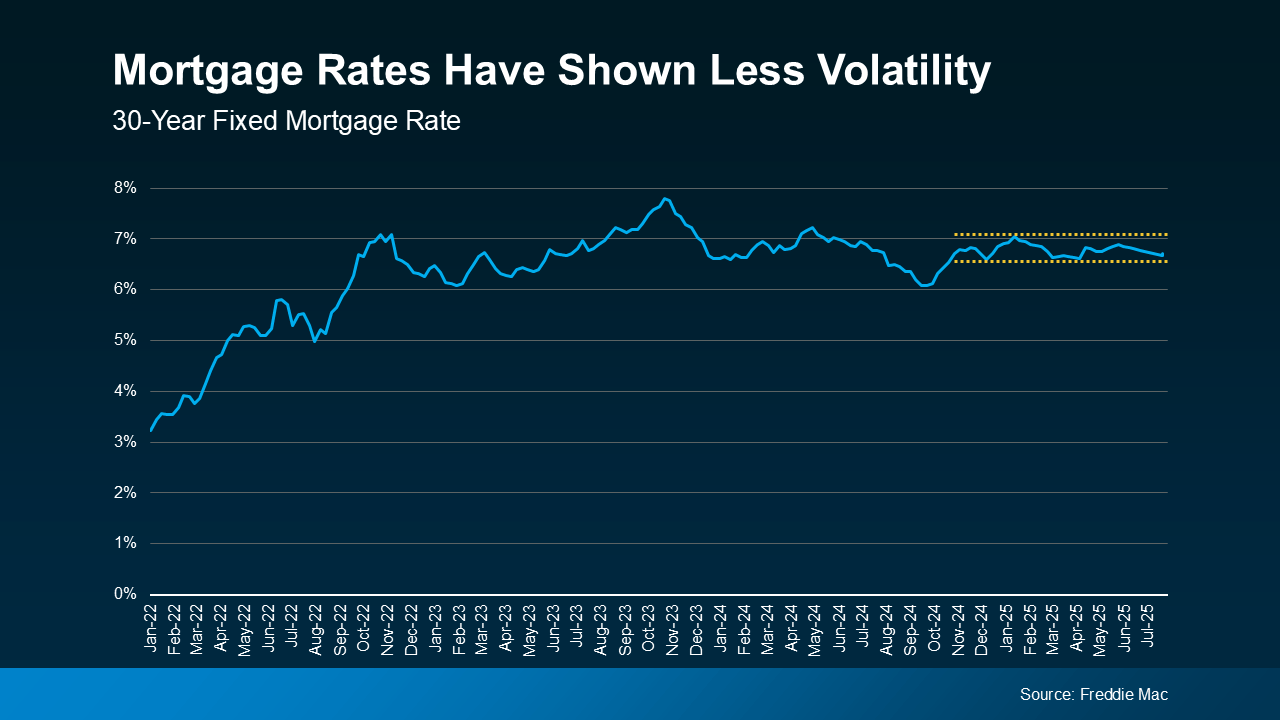

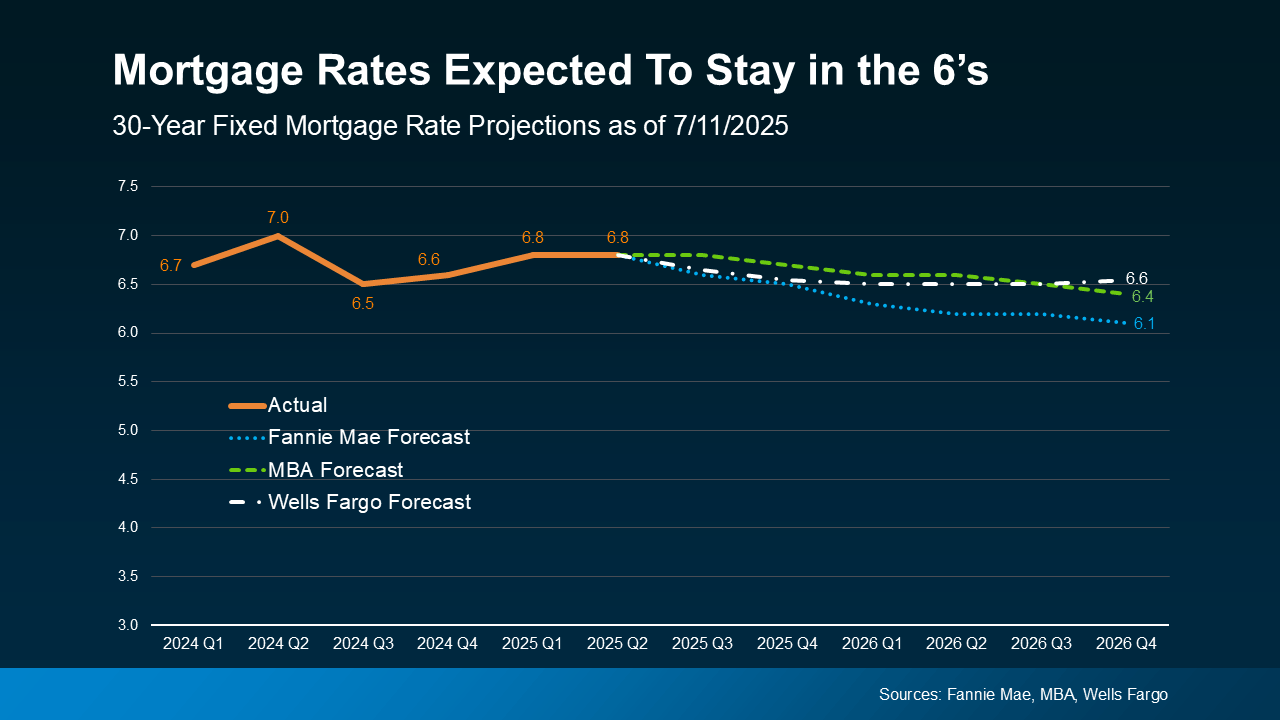

Over the past year, mortgage rates have had their share of ups and downs, making it tough for buyers to know what to expect. But recently, rates have started to level out and have settled into a more narrow range (see graph below):

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately. And that’s a bigger deal than you may realize. As HousingWire explains:

As the graph shows, rates have stayed within that half-percentage-point since late last year. Yes, there’s been movement within that range, but wild swings and sudden ups and downs just haven’t been the story lately. And that’s a bigger deal than you may realize. As HousingWire explains:

“Analysts, economists and mortgage professionals are coining this quarter’s activity as one of the most “calm” periods for mortgage rates in recent memory.”

How This Helps Today’s Buyers

Let’s be real. Unpredictability makes it tough to plan ahead. When rates are bouncing around and making big jumps week to week, it’s easy to be intimidated. But with rates staying in a pretty steady range over the past several months, you have a clearer picture of what your potential monthly payment could look like. That makes moving feel less uncertain – and more doable.

So, stop waiting. And start planning. Even though rates may not be where you want them to be right now, they have been much less volatile for quite some time.

Will This Stability Last?

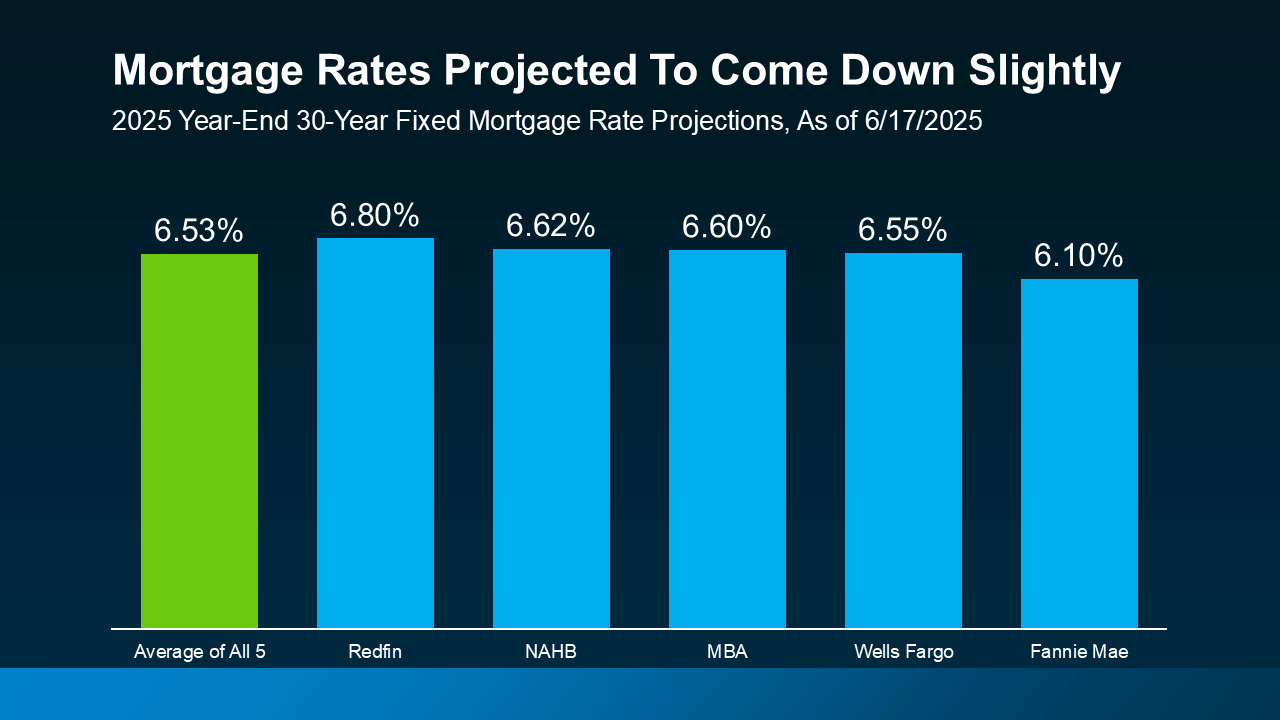

According to the experts, it looks like that stability might hang around for a bit. Rates may come down ever so slightly in the months ahead, but it’ll likely be a slow and mild change. As Danielle Hale, Chief Economist at Realtor.com, says:

“I expect a generally downward trend for rates this year, but at a slow enough pace that it might not be noticeable in any given month.”

So, if you’ve been holding out for the perfect mortgage rate, the best advice is to avoid trying to time the market. It may not look terribly different than the opportunity you already have in front of you. As Jeff Ostrowski, Housing Market Analyst at Bankrate, explains:

“Trying to time mortgage rates is really difficult. There’s no guarantee that rates are going to be any more favorable in three months or six months.”

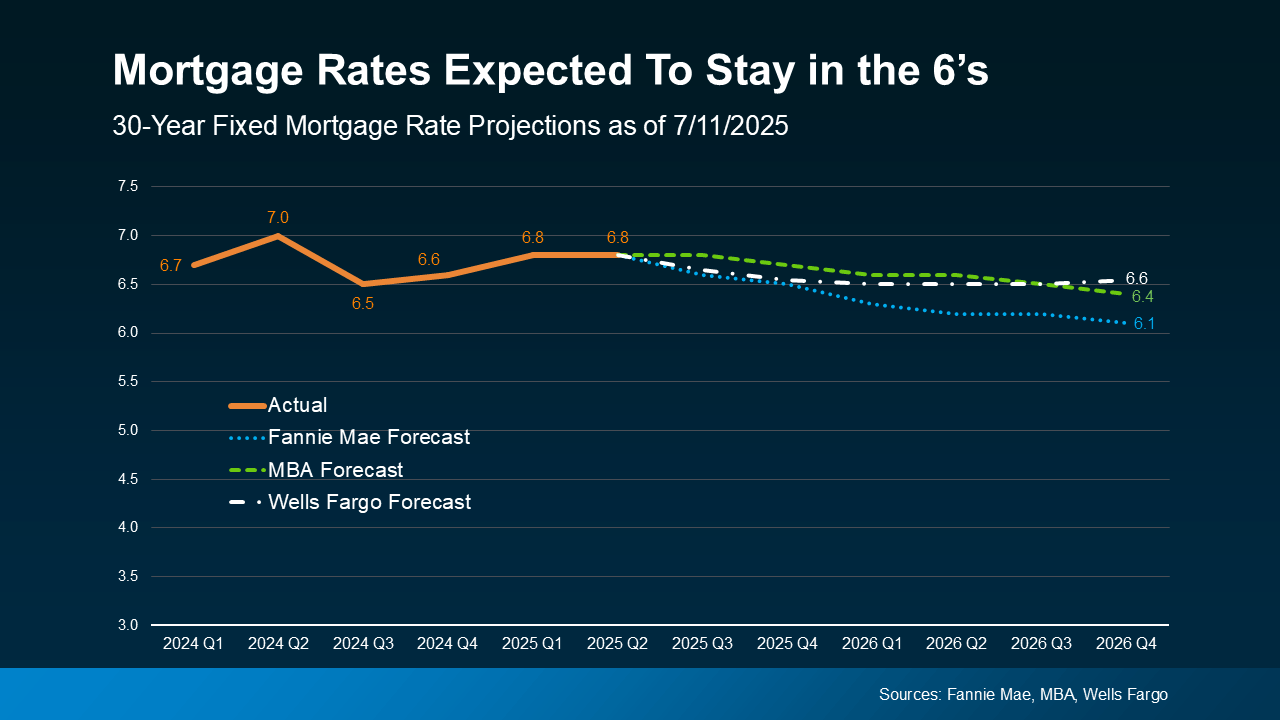

And if we look at the latest expert forecasts that go out a bit further, even those tell much of the same story. Two out of the three projections say rates will still likely be in the mid-6% range by the end of 2026 (see graph below):

This puts today’s buyers in a much better spot. As Sam Khater, Chief Economist at Freddie Mac, explains:

This puts today’s buyers in a much better spot. As Sam Khater, Chief Economist at Freddie Mac, explains:

“Mortgage rates have moved within a narrow range for the past few months . . . Rate stability, improving inventory and slower house price growth are an encouraging combination . . .”

Just remember, mortgage rates are still going to react to changing economic conditions, inflation, and more – and that means they could shift again. But right now, you’ve got more predictability, and that means more opportunity, too.

Bottom Line

While affordability is still a challenge, the market may be offering a bit more stability – and that makes planning your next move a lot easier.

Connect with an agent or a lender if you want to run the numbers and see what a monthly payment would look like in today’s market. That way you can stop waiting and start planning.

Infographics3 weeks ago

Infographics3 weeks ago

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks ago

Economy3 weeks ago

Economy3 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

Equity1 week ago

Equity1 week ago

You must be logged in to post a comment Login