Ten million Americans lost their jobs over the last two weeks. The next announced unemployment rate on May 8th is expected to be in the double digits. Because the health crisis brought the economy to a screeching halt, many are feeling a personal financial crisis. James Bullard, President of the Federal Reserve Bank of St. Louis, explained that the government is trying to find ways to assist those who have lost their jobs and the companies which were forced to close (think: your neighborhood restaurant). In a recent interview he said:

“This is a planned, organized partial shutdown of the U.S. economy in the second quarter. The overall goal is to keep everyone, households and businesses, whole.”

That’s promising, but we’re still uncertain as to when the recently unemployed will be able to return to work.

Another concern: how badly will the U.S. economy be damaged if people can’t buy homes?

A new concern is whether the high number of unemployed Americans will cause the residential real estate market to crash, putting a greater strain on the economy and leading to even more job losses. The housing industry is a major piece of the overall economy in this country.

Chris Herbert, Managing Director of the Joint Center for Housing Studies of Harvard University, in a post titled Responding to the Covid-19 Pandemic, addressed the toll this crisis will have on our nation, explaining:

“Housing is a foundational element of every person’s well-being. And with nearly a fifth of US gross domestic product rooted in housing-related expenditures, it is also critical to the well-being of our broader economy.”

How has the unemployment rate affected home sales in the past?

It’s logical to think there would be a direct correlation between the unemployment rate and home sales: as the unemployment rate went up, home sales would go down, and when the unemployment rate went down, home sales would go up.

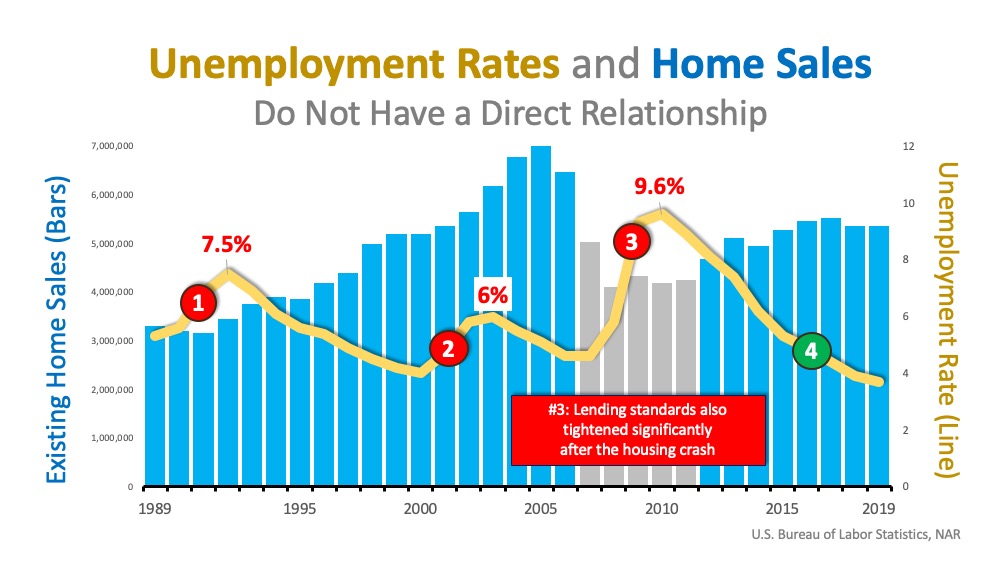

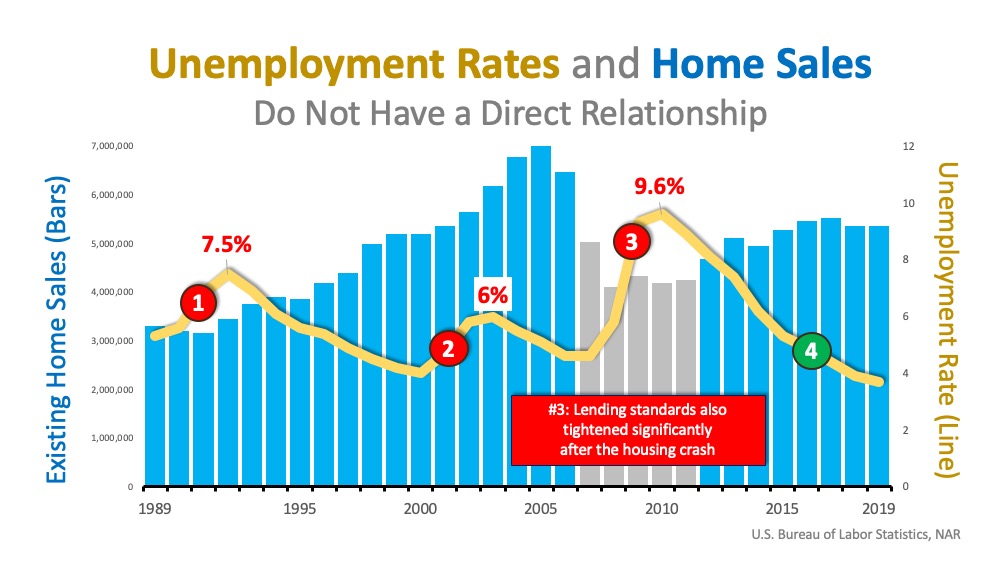

However, research reviewing the last thirty years doesn’t show that direct relationship, as noted in the graph below. The blue and grey bars represent home sales, while the yellow line is the unemployment rate. Take a look at numbers 1 through 4:

- The unemployment rate was rising between 1992-1993, yet home sales increased.

- The unemployment rate was rising between 2001-2003, and home sales increased.

- The unemployment rate was rising between 2007-2010, and home sales significantly decreased.

- The unemployment rate was falling continuously between 2015-2019, and home sales remained relatively flat.

The impact of the unemployment rate on home sales doesn’t seem to be as strong as we may have thought.

Isn’t this time different?

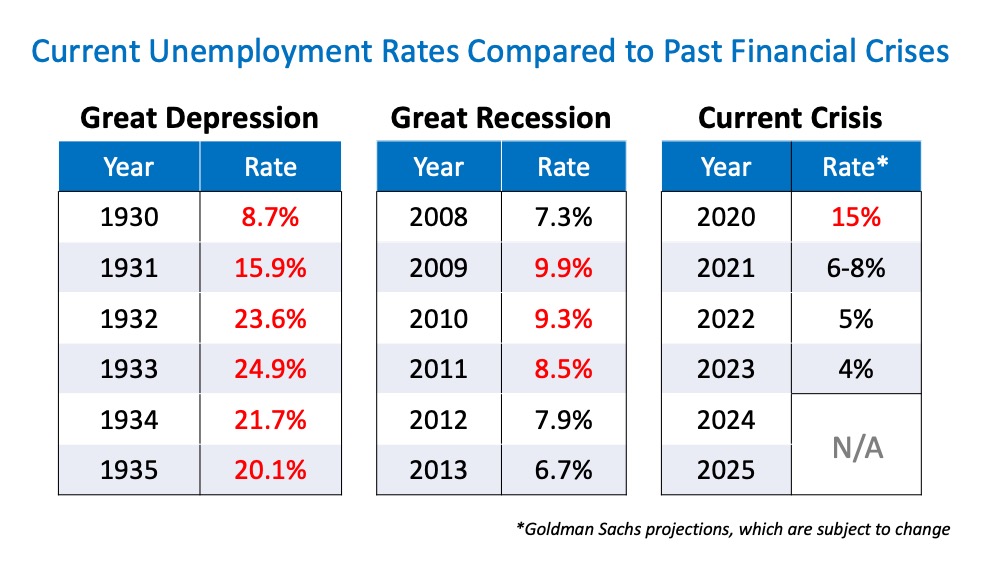

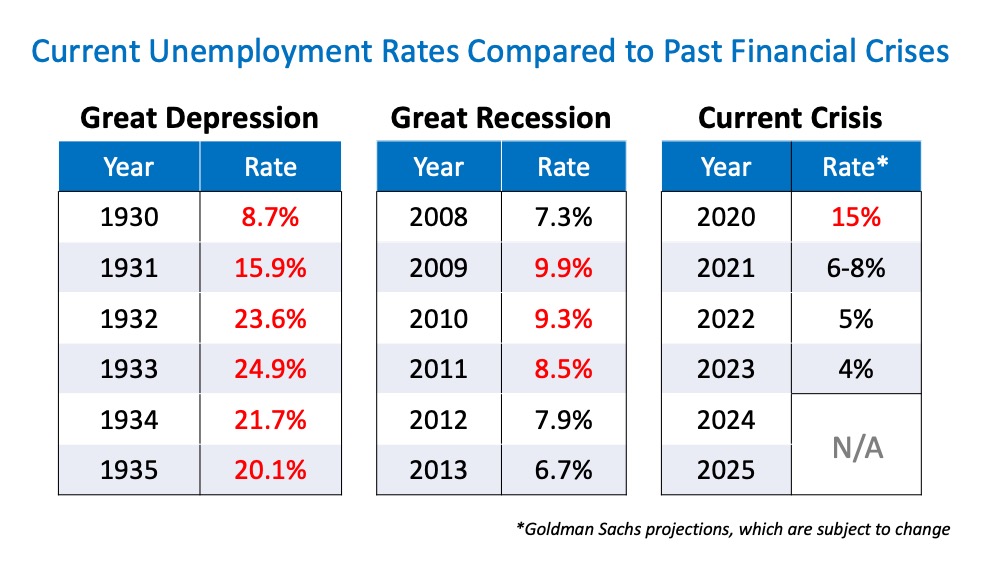

Yes. There is no doubt the country hasn’t seen job losses this quickly in almost one hundred years. How bad could it get? Goldman Sachs projects the unemployment rate to be 15% in the third quarter of 2020, flattening to single digits by the fourth quarter of this year, and then just over 6% percent by the fourth quarter of 2021. Not ideal for the housing industry, but manageable.

How does this compare to the other financial crises?

Some believe this is going to be reminiscent of The Great Depression. From the standpoint of unemployment rates alone (the only thing this article addresses), it does not compare. Here are the unemployment rates during the Great Depression, the Great Recession, and the projected rates moving forward:

Bottom Line

We’ve given you the facts as we know them. The housing market will have challenges this year. However, with the help being given to those who have lost their jobs and the fact that we’re looking at a quick recovery for the economy after we address the health problem, the housing industry should be fine in the long term. Stay safe.

Infographics2 weeks ago

Infographics2 weeks ago

Infographics4 weeks ago

Infographics4 weeks ago

Affordability4 weeks ago

Affordability4 weeks ago

For Buyers4 weeks ago

For Buyers4 weeks ago

Agent Value3 weeks ago

Agent Value3 weeks ago

First-Time Buyers4 weeks ago

First-Time Buyers4 weeks ago

Downsize3 weeks ago

Downsize3 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

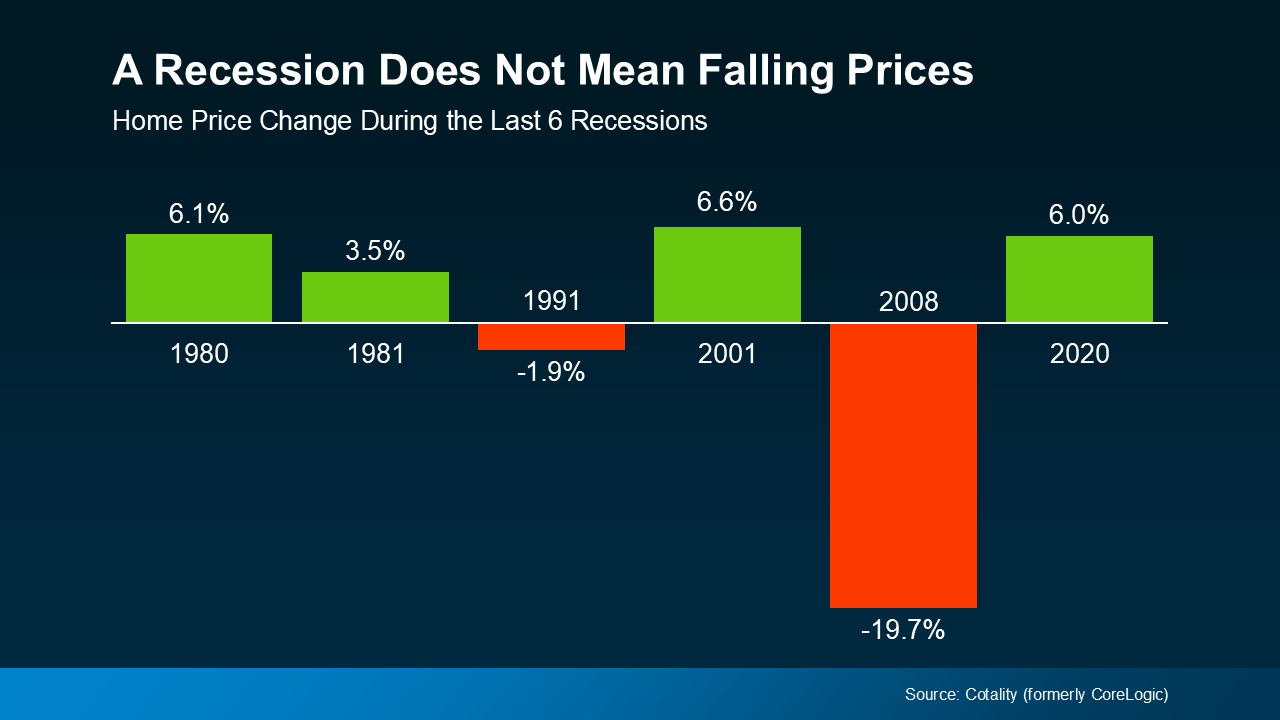

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing

You must be logged in to post a comment Login