At some point, a house that once felt perfect just… doesn’t anymore.

Maybe you need more space.

Maybe working from home turned your dining room into a permanent office.

Maybe the layout just doesn’t match how you live now.

If your current house is starting to feel like it’s holding you back instead of supporting your life, it’s natural to think about making a move. But that brings up the next big question: once you sell, where do you go?

For a growing number of buyers, the answer is something brand new.

New Construction Is a More Popular Choice Lately

According to the National Association of Realtors (NAR), more people are buying new homes than they have in years. The latest annual data available shows 16% of homes purchased were newly built.

At first glance you may not see why that’s a big deal. But that’s actually the highest share of new home purchases in almost two decades.

Why More Buyers Are Choosing a Brand-New Construction

For many buyers, especially move-up buyers, new construction isn’t just about aesthetics. It’s about lifestyle, convenience, and peace of mind.

1. Everything Is Brand New

You’re not inheriting someone else’s projects. No wondering how old the roof is. No budgeting for a new HVAC right after move-in. No big surprises when the previous owners patch job fails. For move-up buyers who’ve been dumping money into updating their current house, that’s a win.

2. You Can Customize Before Move In

If you choose a home that’s still under construction, you could have the chance to pick the flooring, counters, cabinets, hardware, lighting, and so much more. That level of personalization can be a draw for move-up buyers like you, because it allows you to hand pick the fit and finishes you’ve been wanting for so long.

3. A Home Designed for How People Live Today

Most new construction homes are built to current building standards and buyer preferences, which means you could see built-in smart home features, better energy efficiency (which can lower utility bills), and even more modern floor plans and features. And if your layout just isn’t working for you anymore, you may find exactly what you need now in a new home.

4. Neighborhood Amenities

New developments often include shared community spaces like walking trails, parks, playgrounds, or even pools and gyms. For families and active households, that’s a big bonus to have that just a few steps out of their front door.

5. Builder Incentives

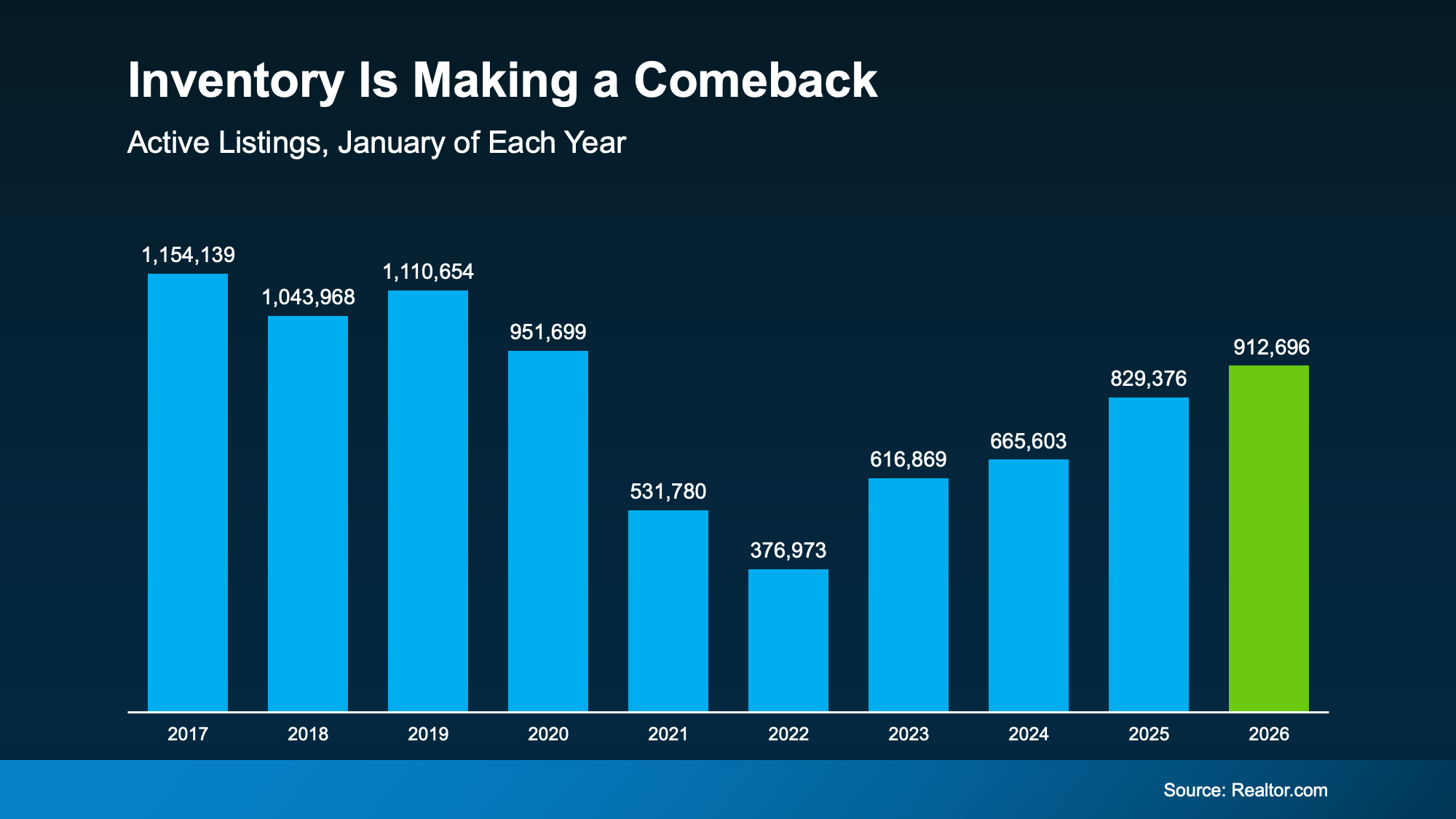

Not to mention, since there are more new homes on the market than the norm, builders are motivated to sell what they have. So, you may find they’re more willing to negotiate than you’d expect on things like price, upgrades, and more.

Bottom Line

If your current house isn’t meeting your needs anymore, don’t assume your only choice is an existing home. New construction is becoming a real contender, especially for move-up buyers who want space, features, and a home that works for how they live now.

Curious whether new construction might be a fit for you? Talk to a local real estate agent.

Affordability4 weeks ago

Affordability4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Equity3 weeks ago

Equity3 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

Affordability6 days ago

Affordability6 days ago

For Buyers2 weeks ago

For Buyers2 weeks ago

You must be logged in to post a comment Login