Sometimes it can feel like everyone has advice when it comes to buying a home. While your friends and loved ones may have your best interests in mind, they may also be missing crucial information about today’s housing market that you need to make your best decision.

Before you decide whether you’re ready to buy a home, you should know how to answer these three questions.

1. What’s Going on with Home Prices?

Home prices are one factor that directly impacts how much it will cost to buy a home and how much you stand to gain as a homeowner when prices appreciate.

The graph below shows just how much experts are forecasting prices to rise this year: Continued price appreciation is great news for existing homeowners but can pose a significant challenge if you wait to buy. Using these forecasts, you can determine just how much waiting could cost you. If prices increase based on the average of all forecasts (12.46%), a median-priced home that cost $350,000 in January of 2021 will cost an additional $43,610 by the end of the year. What does this mean for you? Put simply, with home prices increasing, the longer you wait, the more it could cost you.

Continued price appreciation is great news for existing homeowners but can pose a significant challenge if you wait to buy. Using these forecasts, you can determine just how much waiting could cost you. If prices increase based on the average of all forecasts (12.46%), a median-priced home that cost $350,000 in January of 2021 will cost an additional $43,610 by the end of the year. What does this mean for you? Put simply, with home prices increasing, the longer you wait, the more it could cost you.

2. Are Today’s Low Mortgage Rates Going To Last?

Another significant factor that should inform your decision is mortgage interest rates. Today’s average rates remain close to record-lows. Much like prices, though, experts forecast rates will rise over the coming months, as the chart below shows: Your monthly mortgage payment can be significantly impacted by even the slightest increase in mortgage rates, which makes the overall cost of the home greater over time when you wait.

Your monthly mortgage payment can be significantly impacted by even the slightest increase in mortgage rates, which makes the overall cost of the home greater over time when you wait.

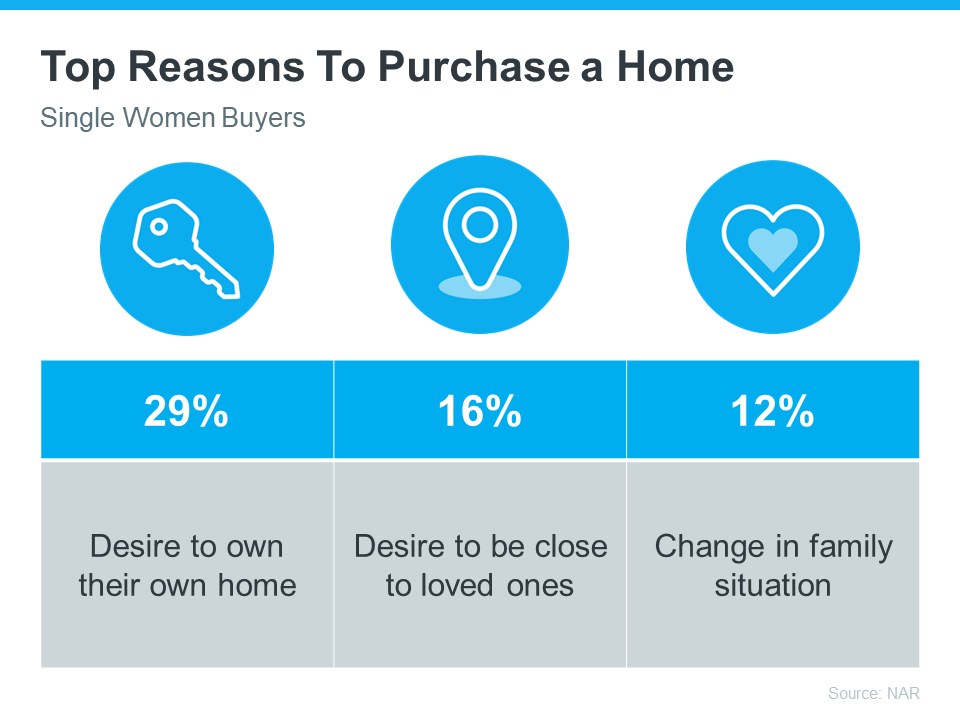

3. Why Is Homeownership Important to You?

The final question is a personal one. Before deciding, you’ll need to understand your motivation to buy a home and why homeownership is an important goal for you. The financial benefits of owning a home are often easier to account for than the many emotional ones.

The 2021 National Homeownership Market Survey shows that six of the nine reasons Americans value homeownership are because of how it impacts them on a personal, aspirational level. The survey says homeownership provides:

- Stability

- Safety

- A Sense of Accomplishment

- A Life Milestone

- A Stake in the Community

- Personal Pride

The National Housing & Financial Capability Survey from NeighborWorks America also highlights the emotional benefits of homeownership: Clearly, there’s a value to homeownership beyond the many great financial opportunities it provides. It gives homeowners a sense of pride, safety, security, and accomplishment – which impacts their lives and how they feel daily.

Clearly, there’s a value to homeownership beyond the many great financial opportunities it provides. It gives homeowners a sense of pride, safety, security, and accomplishment – which impacts their lives and how they feel daily.

Bottom Line

Homeownership is life-changing, and buying a home can positively impact you in so many ways. With any decision this big, it helps to have a trusted advisor by your side each step of the way. If you’re ready to begin your journey toward homeownership, let’s connect to discuss your options and begin your journey.

Buying Tips4 weeks ago

Buying Tips4 weeks ago

For Sellers4 weeks ago

For Sellers4 weeks ago

Forecasts4 weeks ago

Forecasts4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

For Sellers3 weeks ago

For Sellers3 weeks ago

Equity3 weeks ago

Equity3 weeks ago

Agent Value2 weeks ago

Agent Value2 weeks ago

Economy3 weeks ago

Economy3 weeks ago

You must be logged in to post a comment Login