Life can feel a bit unpredictable these days. What’s happening with inflation? The economy? The housing market? But in the middle of all that uncertainty, there’s one thing a lot of people still crave – a place to call their own.

Because when everything else feels up in the air, home can be the thing that grounds you. As the experts at 1000WATT put it:

“Homeownership isn’t primarily financial anymore. . . Across all demographics, emotional and lifestyle factors consistently outrank wealth-building as motivators.”

Here’s what owning a home can mean for you, especially right now.

Freedom To Make It Yours

When you’re a homeowner, you don’t need to ask permission to paint a wall, hang a gallery of your favorite art, or redo the floors. You have the freedom to create a space that reflects who you are, all the way from the light fixtures to the paint colors.

Pro Tip: Just be mindful about exterior changes, if you buy a home in a community that has a homeowner’s association (HOA). There may be some approvals you’d need to get for select outdoor changes.

More Privacy, More Peace

Owning your home can give you a sense of peace you didn’t even realize you were missing. It’s a comfortable place where you feel secure and can relax, enjoy your privacy, and unwind after a long day.

Room To Grow

Whether it’s starting a family, setting up a home office for your new career, or finally building that home gym in the garage so you can hit your fitness goals, owning gives you the space to live life on your terms.

A Stronger Sense of Community

When you own, you’re not just passing through, you’re putting down roots. That often leads to stronger ties with your community, more connection to your neighborhood, and a deeper feeling of belonging where you live. That’s very different from the temporary nature of renting.

A Feeling of Accomplishment

There’s something powerful about getting the keys and walking into your own front door for the first time. It’s more than pride, it’s personal satisfaction. A quiet and meaningful sense of “I did this.”

Sure, it’s not always easy for first-time homebuyers right now. The market today requires patience, strategy, and sometimes a little creative problem-solving. But it’s still worth it. As Realtor.com says:

“Buying a home is a major commitment, but it’s also incredibly rewarding.”

When you get those keys in your hand, when you realize this place is where your life gets to unfold, it clicks. The stress, the waiting, the planning – all of it led you home.

Bottom Line

There are a lot of things out of your control right now. But building a life in a space that’s truly yours? That’s still possible with the right strategy and expert help. Talk to a local agent about how to make it happen.

What would it mean for you to finally have a place to call your own?

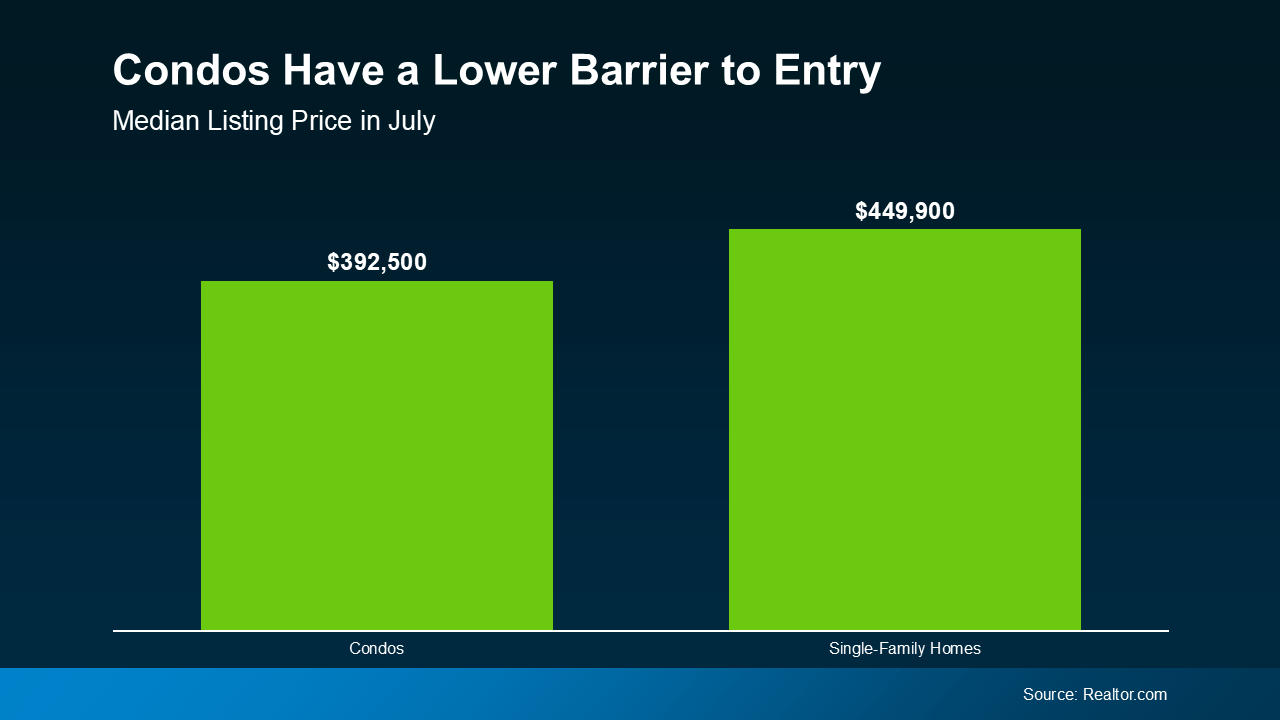

Affordability4 weeks ago

Affordability4 weeks ago

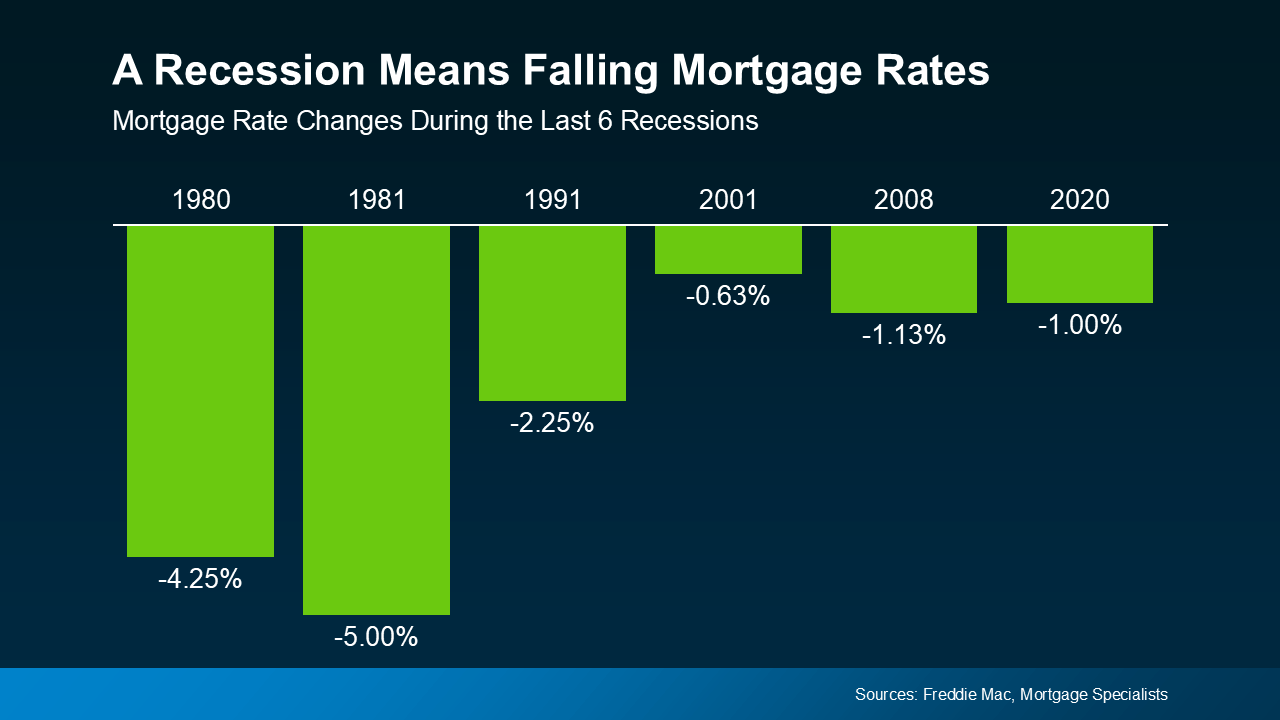

Economy4 weeks ago

Economy4 weeks ago

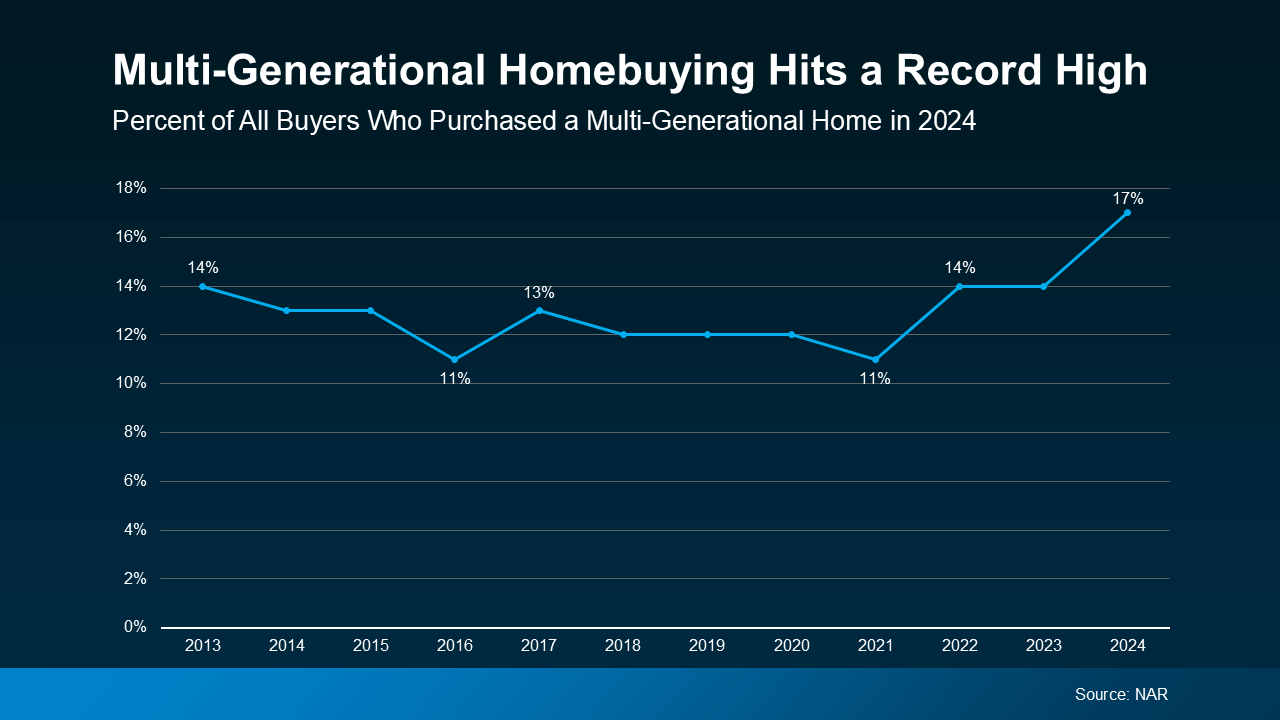

Infographics6 days ago

Infographics6 days ago

Infographics3 weeks ago

Infographics3 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Agent Value4 weeks ago

Agent Value4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

First-Time Buyers3 weeks ago

First-Time Buyers3 weeks ago

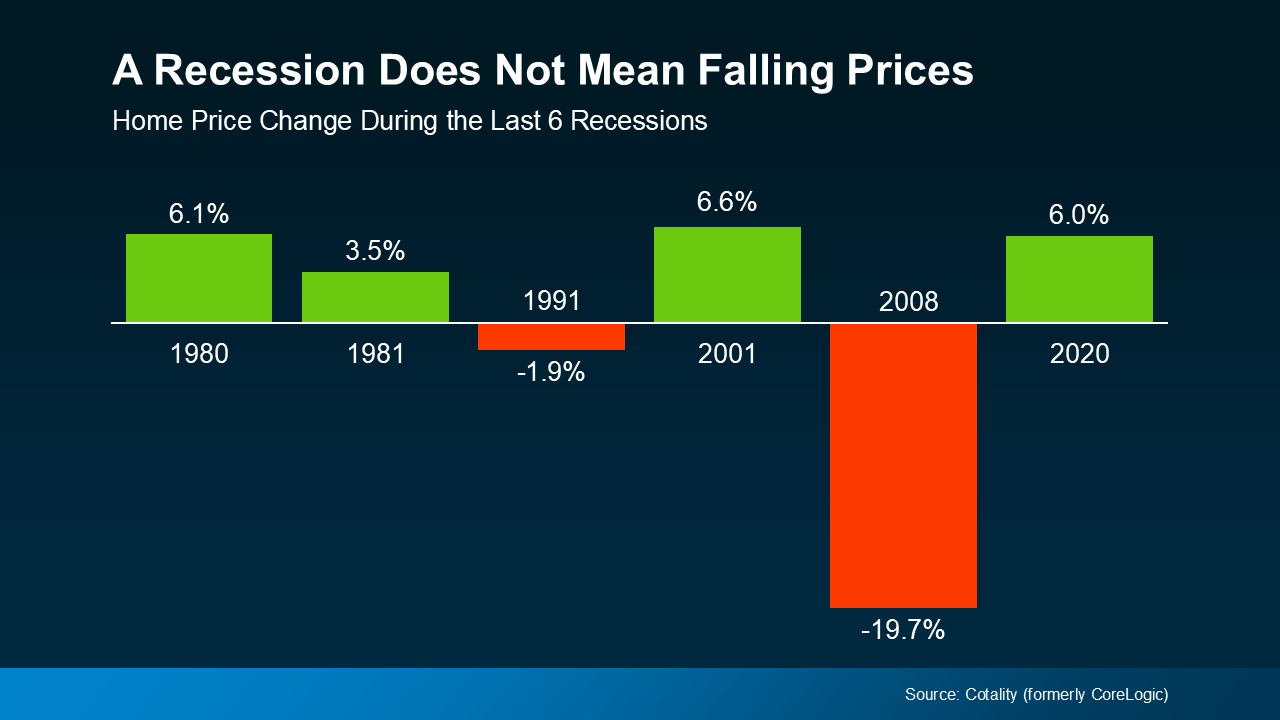

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing

So, while many people think that if a recession hits, home prices will fall like they did in 2008, that was an exception, not the rule. It was the only time the market saw such a steep drop in prices. And it hasn’t happened since, mainly because there’s still a long-standing

You must be logged in to post a comment Login