Selling your home might be on your mind, but the current mortgage rates may be giving you pause. Many homeowners are hesitant to sell and potentially take on a higher mortgage rate for their next home. If this dilemma has you concerned, it’s important to understand that while interest rates are currently elevated, so is your home equity. Here’s what you need to know.

What Exactly Is Home Equity and How Does It Grow?

Home equity is the share of your home that you’ve paid off and fully own. It’s the difference between your home’s current market value and the remaining balance on your mortgage. As your home appreciates in value over time and you make mortgage payments that reduce the principal amount owed, your equity stake steadily increases.

In simpler terms, equity is essentially how much your home is worth now, minus the outstanding mortgage balance.

How Much Equity Do Homeowners Currently Possess?

Surprisingly, homeowners have been accumulating equity at a faster pace than they might realize. To put things into perspective, CoreLogic reports that the typical U.S. homeowner now boasts approximately $290,000 in equity. This significant growth can be attributed to the substantial increase in home prices over the past few years. Although the market is showing signs of stabilization, demand for homes still outpaces supply, which is contributing to another round of price hikes.

According to data from the Federal Housing Finance Agency (FHFA), the Census, and property data provider ATTOM, nearly 68.7% of homeowners either have fully paid off their mortgages or have achieved at least 50% equity in their homes.

How Your Equity Can Alleviate Affordability Concerns

Given the current challenges related to affordability, your equity can play a pivotal role when you’re contemplating a move. After selling your current residence, you can leverage the equity you’ve accumulated to facilitate the purchase of your next home. Here’s how it can work to your advantage:

1. Become an All-Cash Buyer: If you’ve been in your current home for an extended period, you may have accumulated enough equity to purchase a new house without the need for a loan. In such a scenario, you can sidestep borrowing money and the associated concerns about fluctuating mortgage rates. The National Association of Realtors (NAR) highlights that these all-cash buyers are happily avoiding the challenges posed by higher mortgage interest rates.

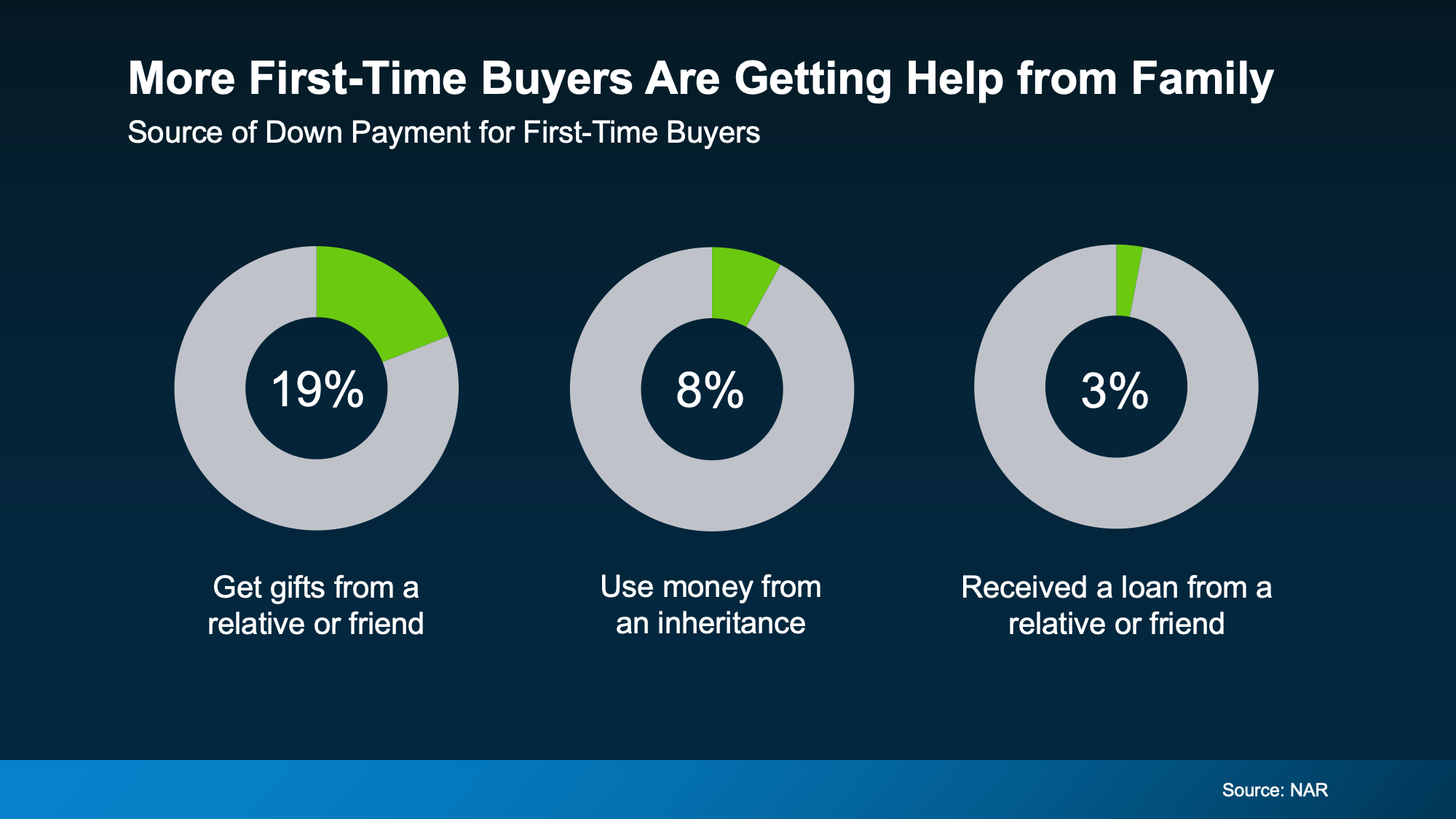

2. Increase Your Down Payment: Your equity can be employed as a substantial down payment on your next home. It could even be substantial enough to allow you to make a larger down payment, reducing the amount you need to borrow and potentially mitigating concerns about today’s interest rates. According to Experian, a larger down payment can lower your principal loan amount and, consequently, your loan-to-value ratio, which may result in more favorable interest rate offers from lenders.

In Conclusion

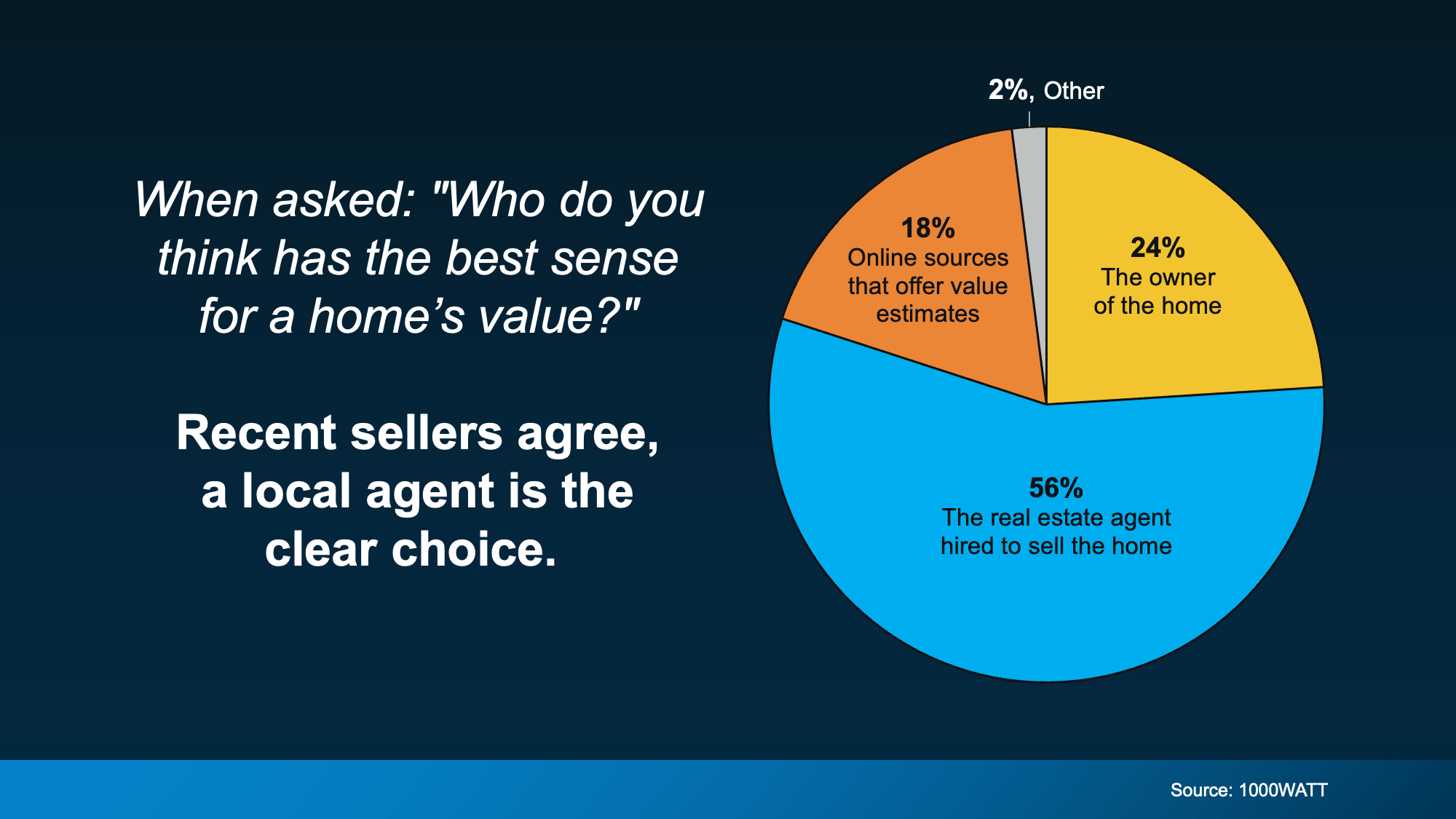

When considering a move, the equity you’ve accrued can be a game-changer, particularly in the current housing market landscape. To determine the exact amount of equity you have in your current home and explore how it can be used to facilitate your next home purchase, it’s advisable to reach out to a trusted real estate agent.

Affordability4 weeks ago

Affordability4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Buying Tips4 weeks ago

Affordability3 weeks ago

Affordability3 weeks ago

Equity3 weeks ago

Equity3 weeks ago

For Buyers3 weeks ago

For Buyers3 weeks ago

For Buyers2 weeks ago

For Buyers2 weeks ago

For Sellers2 weeks ago

For Sellers2 weeks ago

This Is About Opportunity, Not Obligation

This Is About Opportunity, Not Obligation

You must be logged in to post a comment Login